Eighteen months of interest rate hikes add more than 800,000 to number of people at risk of mortgage stress

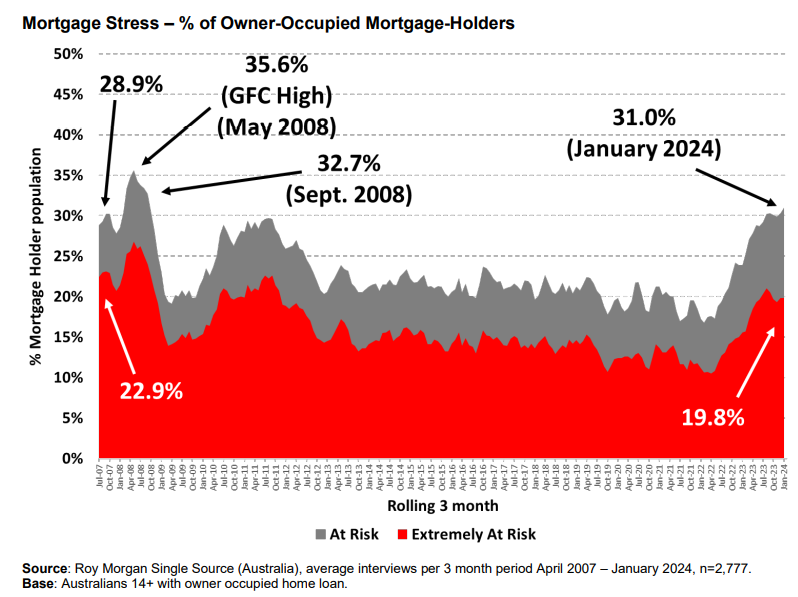

Over 1.6 million mortgage holders in Australia, constituting 31% of the total, faced potential mortgage stress in the three-month period leading up to January, new findings from independent research firm Roy Morgan have revealed.

This figure in January sets a new record for the number of mortgage holders deemed at risk of mortgage stress, surpassing previous highs of over 1.56 million recorded in August and September 2023.

Despite reaching a new peak, the current percentage of mortgage holders at risk remains below the historical high of 35.6% observed during the mid-2008 global financial crisis, attributed to the expansion of the Australian mortgage market.

According to Michele Levine (pictured), chief executive at Roy Morgan, mortgage stress escalated in December and January following the RBA’s rate hike in November, marking the first instance where the number of mortgage holders at risk surpassed 1.6 million.

Since May 2022, when the Reserve Bank of Australia (RBA) initiated a series of interest rate hikes, the count of Australians at risk of mortgage stress has soared by 802,000. The current official interest rate stands at 4.35%, marking the highest level since December 2011.

The number of mortgage holders considered ‘extremely at risk’ has climbed to 994,000, accounting for 19.8% of the total. This is a significant increase from the 10-year average of 14.3%.

Roy Morgan’s projections suggest that if the RBA further increases interest rates by 0.25% to 4.6% in March, the proportion of mortgage holders at risk could rise to 31.3%, affecting 1.625 million individuals — an increase of 16,000 from January. By April, the figure is expected to reach 31.6%, or 1,638,000 mortgage holders, marking a rise of 29,000 from January.

“The latest figures for January show that when considering the data on mortgage stress, it is always important to appreciate interest rates are only one of the variables that determines whether a mortgage holder is considered ‘at risk’ of mortgage stress,” Levine said.

“The variable that has the largest impact on whether a borrower falls into the ‘at risk’ category is related to household income – which is directly related to employment. The employment market in Australia has been exceptionally strong over the last year and this has underpinned rising household incomes which have played a part in reducing overall mortgage stress in January.

“However, rising interest rates since May 2022 have caused a large increase in the number of mortgage holders considered ‘at risk’. If there is a reacceleration in inflation over the months ahead, that results in further interest rate increases in 2024, levels of mortgage stress are set to increase further to new record highs.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.