It is expected to ease in the months ahead after the Stage 3 tax cuts

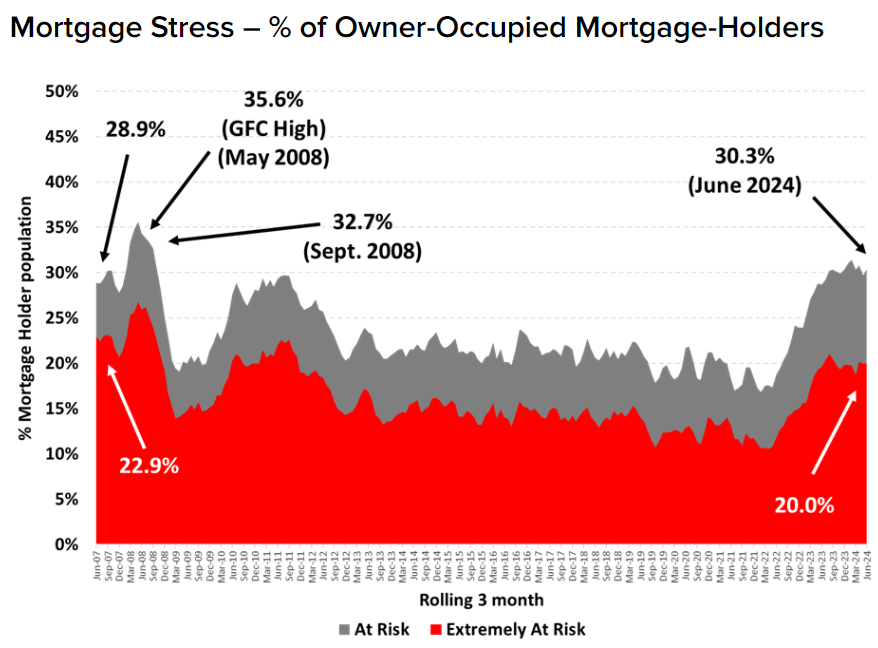

Nearly a third of mortgage holders – or about 1.6 million – were at risk of mortgage stress in the three months to June 2024, new research from Roy Morgan has revealed.

The number registered an increase of 88,000 from the previous month but remains below the record highs reached earlier this year.

The Reserve Bank of Australia (RBA) left interest rates unchanged during their June board meeting. There is no RBA board meeting to decide on interest rates in July.

The proportion of mortgage holders at risk is expected to decline further in the coming months following the introduction of Stage 3 tax cuts for Australian income earners from the first week of July.

The record high of 35.6% of mortgage holders in mortgage stress was recorded in mid-2008. However, due to population growth and an increase in the number of mortgages since the Global Financial Crisis, more Australians are now at risk of mortgage stress.

Since May 2022, when the RBA began increasing interest rates, the number of Australians at risk of mortgage stress has risen by 795,000. Official interest rates are now at 4.35%, the highest since December 2011.

Over 1 million or 20% of mortgage holders are now considered extremely at risk, significantly above the 10-year average of 14.5%.

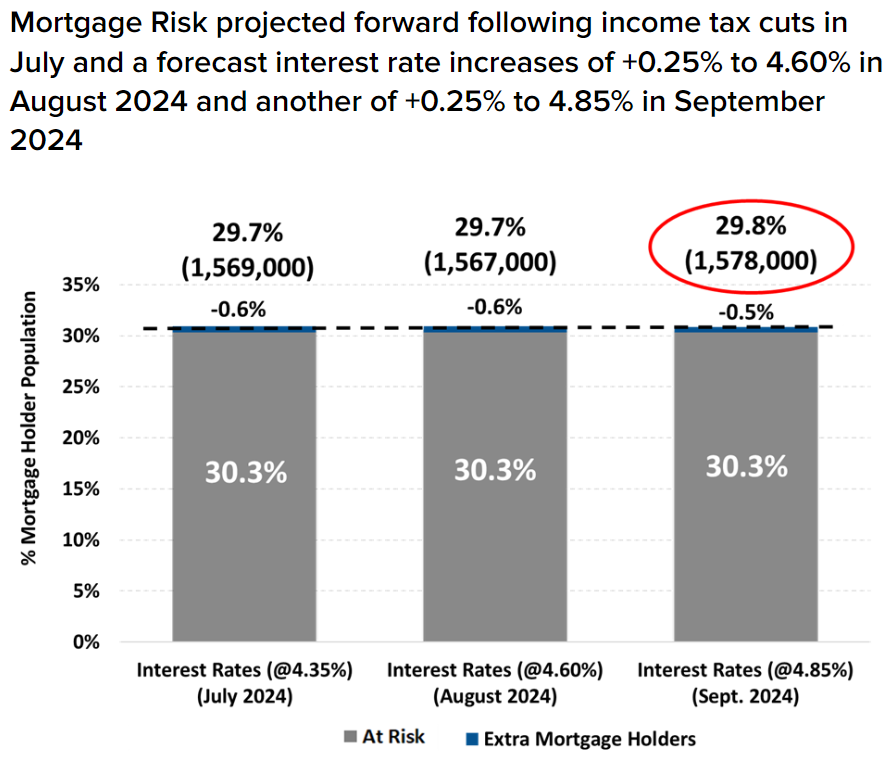

Roy Morgan has modelled the impact of potential RBA interest rate increases of 0.25% in August and September 2024. The forecast takes into account the Stage 3 income tax cuts, which began in early July and have boosted the take-home incomes of many Australians.

In August, the number of mortgage holders at risk is forecast to fall by 35,000 to 1.57 million (29.7%). In September, if the RBA raises interest rates again, the number is expected to rise slightly to 1.58 million (29.8%).

Mortgage holders are considered at risk if their mortgage repayments exceed a certain percentage of household income. They are extremely at risk if the interest-only payments surpass a specific proportion of household income.

Unemployment is a key factor impacting income and mortgage stress. Roy Morgan’s latest estimates show over one in six Australian workers are either unemployed or underemployed, totalling 2.7 million (17.3% of the workforce). Despite a decrease in unemployment, which is now at 8.3%, the greatest impact on an individual’s ability to pay their mortgage is whether they lose their job or main source of income.

“The latest figures for mortgage stress show that when considering the data, it is important to appreciate that interest rates are only one of the variables that determines whether a mortgage holder is considered ‘at risk’ of mortgage stress,” said Michele Levine (pictured above), chief executive of Roy Morgan.

“The Stage 3 income tax cuts are delivering significant financial relief, and a boost to take-home pay, for millions of Australian taxpayers – including many mortgage holders. As these figures show, the variable with the largest impact on whether a borrower falls into the ‘at risk’ category is related to household income – which is directly related to employment.

“The employment market has been strong over the last year, and this has provided support to household incomes which have helped to moderate levels of mortgage stress since the highs of early 2024.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.