Economy expected to grow over 2025 and 2026

NAB’s economic growth projections remain largely unchanged, with growth expected to stay below trend this year but improve to around 2.25% over the next two years.

The latest Forward View, a report by NAB’s economics team, also anticipates the unemployment rate to rise to approximately 4.5% by the end of 2024 and maintain that level through 2025. This increase is attributed to a cooling in labour demand amid robust population growth, rather than a decline in employment.

“In terms of the recent data flow, we see growth as having remained soft in Q2,” said Alan Oster (pictured above), group chief economist at NAB. “ABS retail sales data and our internal transactions data suggest another quarterly decline in real retail sales. “Our Monthly Business Survey measure of business conditions also points to a further loss of momentum – falling further below average in June.”

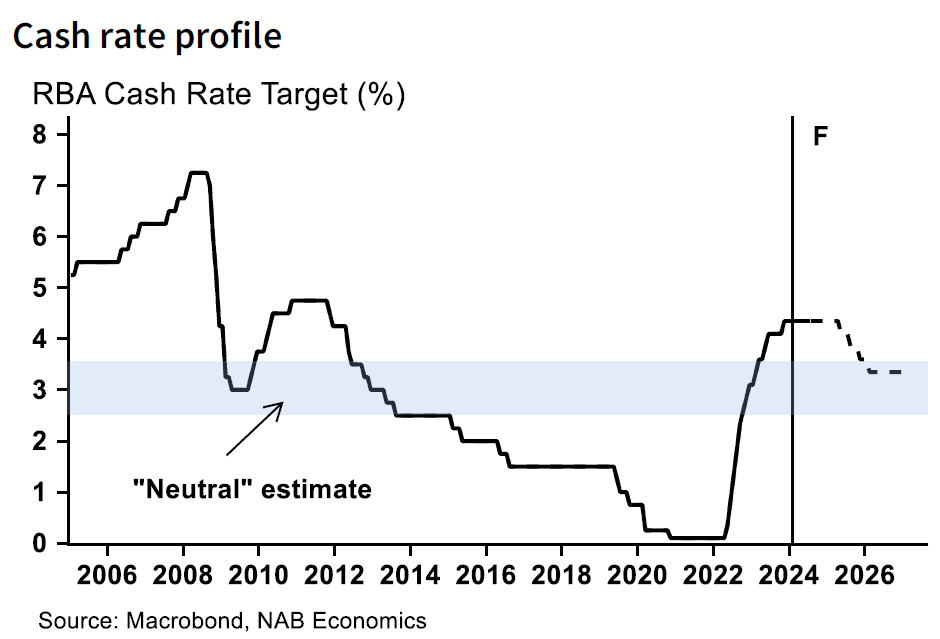

NAB’s latest forecasts also indicate a revised timeline for the Reserve Bank of Australia’s (RBA) first interest rate cut. The anticipated cut is now expected in May 2025, with a projected reduction of 125 basis points over the following year.

“We acknowledge the upside risks to rates in the near-term, but we ultimately see the RBA maintaining its strategy of trying to hold onto labour market gains,” Oster said. “That sees the need to remain on hold for longer.”

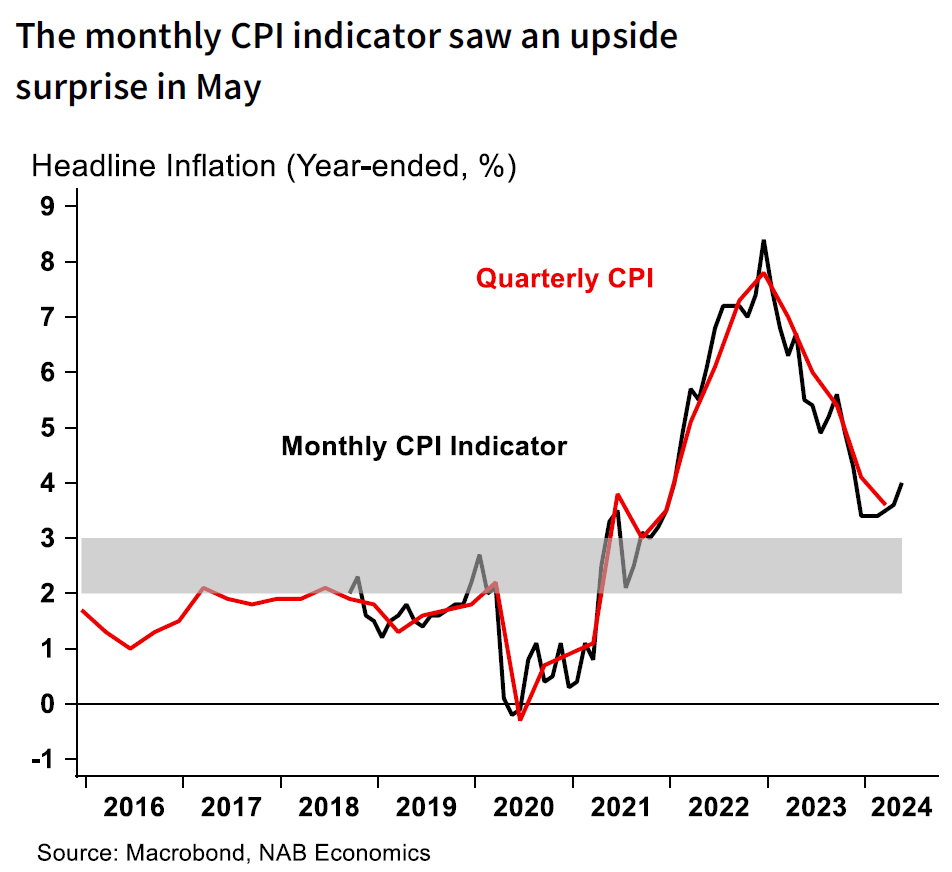

For inflation, the NAB forecast for Q2 has been adjusted to 1% quarter-on-quarter (4% year-on-year) for the trimmed mean and 1% quarter-on-quarter (3.8% year-on-year) for the headline. The adjustment suggests underlying inflation will reach 3.7% year-on-year by the end of the year.

“Inflation has remained higher than we (and the RBA) expected, although the market services components of the monthly CPI indicator – though still high – show a clearer easing trend,” Oster said. “Overall inflation remains important and has shown little further moderation in H1 2024.”

The labour market also continues to show signs of easing, with forward indicators softening. However, job vacancies remain elevated, indicating ongoing resilience in the near term.

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.