It's the last of the big four to do so

NAB has raised its fixed rates for owner-occupiers and investors by up to 0.3 percentage points, following similar moves from CBA, Westpac, and ANZ in the last 10 days.

“NAB is the last big four bank to shut the door on fixed rates starting with a ‘5’,” said Sally Tindall (pictured below), RateCity.com.au research director.

The rate change means all four big banks no longer have any fixed rate under 6%.

RateCity.com.au showed in the table below the changes to NAB’s lowest fixed rates:

Fixed rates continue to rise across the board, with 77 lenders lifting at least one fixed rate in the last month – that equates to 68% of lenders in the RateCity.com.au database.

“Pressure on profit margins is likely to be the key motivator behind these fixed rates increases,” Tindall said. “Conveniently, a lack of interest in fixing from borrowers gives the banks the ability to hike these rates without any significant consequence.

“These higher rates aren’t washing with borrowers who are about to come off their fixed rate and looking to reassess their options. For the small proportion of borrowers opting to re-fix, they’d do well to look beyond the big four banks.”

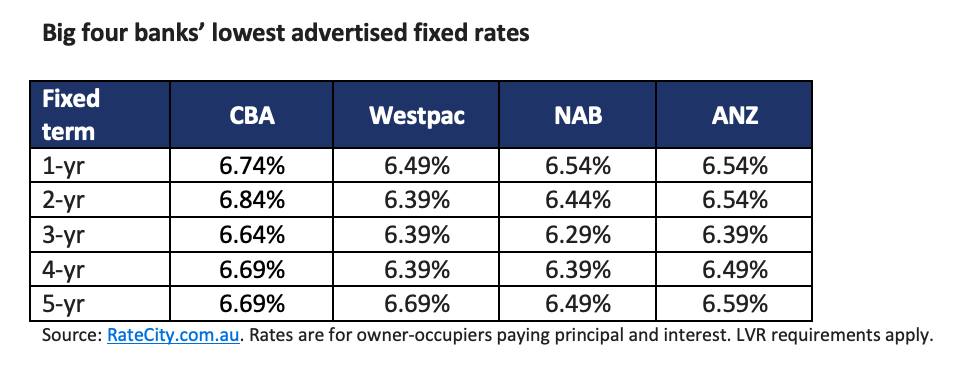

See in the table below the big four banks’ lowest advertised fixed rates, according to RateCity.com.au:

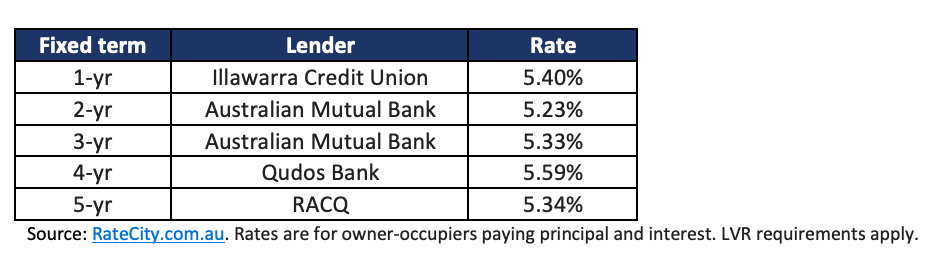

And in the table below are the lowest fixed rates on RateCity.com.au:

Use the comment section below to tell us how you felt about this.