Corelogic/RP Data Senior Data Analyst Cameron Kusher explains yesterday’s Australian Prudential Authority’s ADI Property Exposures report

Corelogic/RP Data Senior Data Analyst Cameron Kusher explains yesterday’s Australian Prudential Authority’s ADI Property Exposures report

The Australian Prudential Regulation Authority (APRA) released their quarterly Authorised Deposit-taking Institution (ADI) Property Exposures data for September 2014 earlier today. The data always provides a valuable insight into current and historic mortgage lending by domestic ADIs and this quarter’s release was no different.

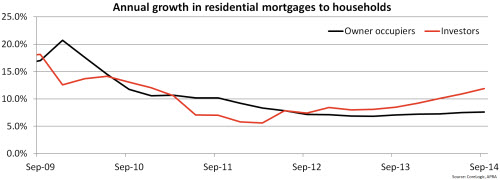

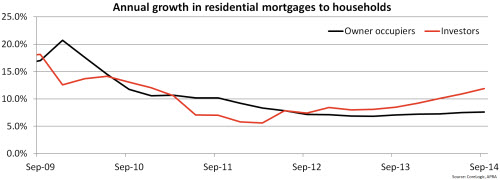

Based on the value of all outstanding mortgages by households to Australian ADI’s, there was $825.0 billion outstanding to owner occupiers (66.0% of all housing loans) at the end of September 2014 and $425.4 billion to investors (34.0%). Over the 12 months to September 2014, the total value of outstanding mortgages to owner occupiers has increased by 7.6% compared to an 11.9% rise in outstanding credit to investors. This represents the greatest annual increase in owner occupier lending since June 2012 and the greatest rise in investor lending since December 2010. Much like other data received more regularly, the chart indicates that there is significantly more momentum in the investor lending space than that for owner occupiers where growth is more moderate.

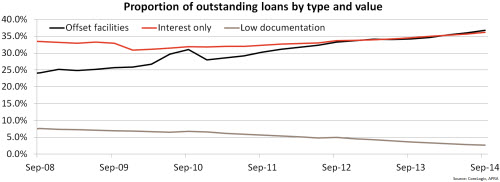

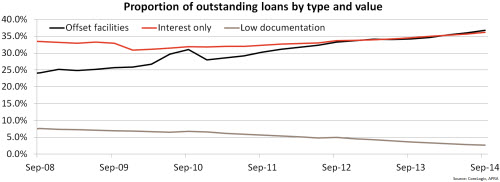

At the end of September 2014, a record high 36.8% of loans outstanding had an offset facility, up from 34.2% a year earlier. Also a record high was the 36.8% of all outstanding mortgages which were interest-only, up from 34.6% a year earlier. Just 0.2% of all outstanding mortgages were reverse mortgages and 2.7% were low documentation which was down from 3.6% a year earlier and at a record low proportion. Other non-standard loans accounted for just 0.1% of all outstanding mortgages. It seems that more and more mortgagees are accessing offset accounts in order to reduce the interest payable on their mortgages and maximise repayments of the principal while interest rates are so low. The data also indicates that a high proportion of lenders are accessing interest-only mortgages which seems somewhat counterintuitive at a time when interest rates are so low.

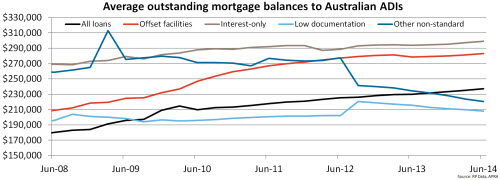

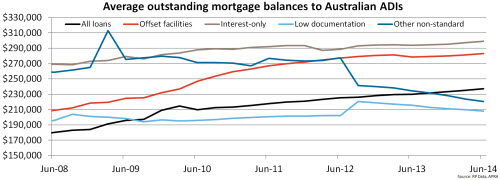

The average balance on all outstanding mortgages at the end of September 2014 was $238,700. The average balance has increased by 3.0% over the past year. Loans with an offset facility ($284,600) and interest-only mortgages ($308,400) have much higher average outstanding loan balances. It is interesting to note that the annual growth in average outstanding loan balances has been much more moderate for mortgages with an offset and interest-only mortgages at 2.0% and 2.1% respectively. Encouragingly, the data also indicates that outstanding balances are reducing for low documentation and other non-standard loans as they become less common. Over the past year the average balance has fallen by -3.1% for low-documentation loans and by -6.5% for other non-standard loans. With mortgage rates low and fewer of these loan types being written it seems those that have these types of loans are continuing to pay down these mortgages.

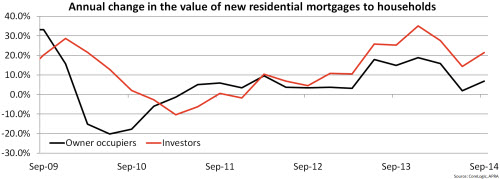

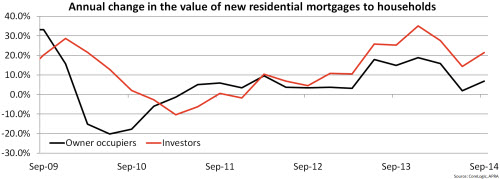

Turning the focus to new loans written over the September quarter, 62.6% of the total value of new lending was to owner occupiers and 37.4% was to investors. The proportion of new lending to investors has fallen from a record high of 37.9% in the June 2014 quarter. Based on this data it suggests that growth in demand for both owner occupier and investment lending may have peaked. Although after having trended lower over the previous two quarters, the annual change in new owner occupier and investment lending bounced in September, recorded at 6.9% and 21.4% respectively.

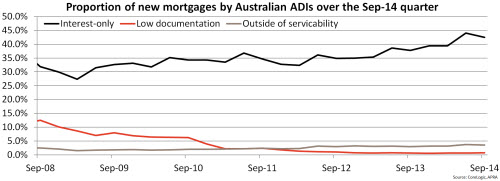

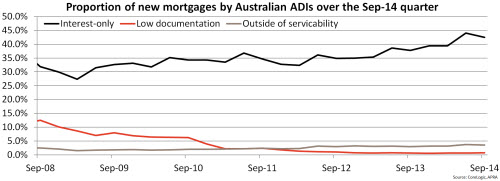

Over the September 2014 quarter, 0.7% of new loans approved were low-documentation, 42.5% were interest-only, 0.1% were other non-standard loans, 43.2% were third party originated loans and 3.5% were loans approved outside of serviceability. The 42.5% of new loans which were interest only was down from a record high of 44.0% over the previous quarter. The data also seems to reflect the slowing of growth in investment demand, remember that interest only loans tend to be (but not always) reflective of lending for investment purposes. The ADIs seem to be increasing the usage of their broker channels with the 43.2% of loans originated by third parties the highest proportion since June 2008. With 3.5% of new mortgages approved outside of serviceability over the September 2014 quarter, this was down from a record high 3.7% over the previous quarter.

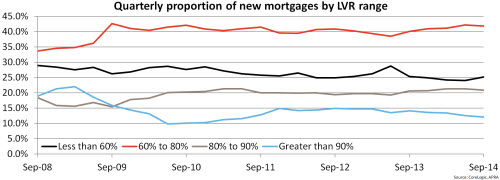

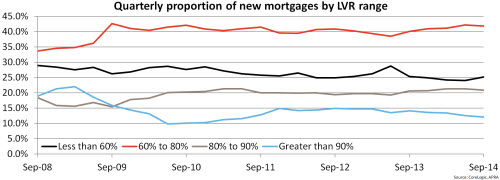

Looking at the loan to value ratios (LVR) of loans written over the September 2014 quarter, 25.2% of new loans had an LVR of less than 60%, 41.8% of loans had an LVR of between 60% and 80%, 20.9% had an LVR of between 80% and 90% and 12.1% had an LVR of 90% or more. The 12.5% of new loans with an LVR of more than 90% is the lowest proportion since June 2011. The 25.2% of mortgages with an LVR lower than 60% was the highest proportion in a year. This falling proportion of loans above 90% LVR suggests there are proportionally less high-risk mortgages being written.

The data indicates that overall interest-only lending is continuing to rise however, new lending of this type has eased of late. Investment lending remains high and continues to ramp-up however, the rate of growth in new lending to investors does appear to have slowed. Keep in mind that the December data will probably tell us much more given it encapsulates more of the spring selling season. Furthermore, after the RBA flagged that they and other regulators are looking at ways to cool investor exuberance with an announcement expected in December we may actually see a run on investor lending over the coming quarter.

It is of course important to remember that although investment lending has ramped up sharply over the past year, there is little to suggest that lending to investors is more risky than lending to owner occupiers. Bill Evans provided some insight into Westpac’s investment lending late last week. He noted:

• Compared to owner–occupier applicants, investment applicants are older (75% over 35 years); have higher incomes and higher credit scores.

• 65% of investment loan customers are ahead on their repayments and 90+ days delinquencies are 0.37% compared to 0.47% for the full housing portfolio.

• Westpac has an interest rate buffer approach to lending linking loan approvals to serviceability at a rate at least 180 basis points above the standard mortgage rate (5%).

• All investment loans are full recourse and specific policies apply to holiday apartments and single industry towns.

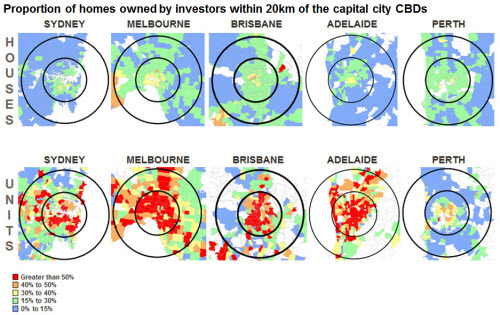

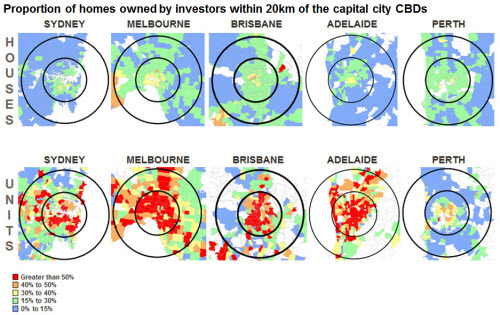

Our concern about the high level of investment lending remains over the fact that investors are targeting the residential property asset class because of its superior returns. While these returns remain superior demand is likely to persist. The concern then arises when other investment classes start to show superior returns will these owners exit the residential property class or remain in it for the long-term? As the above chart shows, investor activity is heavily concentrated within the capital city inner-city unit market. Were many investors to exit the market at a similar time in search of superior returns that could have some serious repercussions for the inner city unit market and potentially the wider housing market too.

___

Cameron Kusher: why would deflating Australia's greatest assets be a good thing?

MPA's house prices news analysis

Healthy report for mortgage market

The Australian Prudential Regulation Authority (APRA) released their quarterly Authorised Deposit-taking Institution (ADI) Property Exposures data for September 2014 earlier today. The data always provides a valuable insight into current and historic mortgage lending by domestic ADIs and this quarter’s release was no different.

Based on the value of all outstanding mortgages by households to Australian ADI’s, there was $825.0 billion outstanding to owner occupiers (66.0% of all housing loans) at the end of September 2014 and $425.4 billion to investors (34.0%). Over the 12 months to September 2014, the total value of outstanding mortgages to owner occupiers has increased by 7.6% compared to an 11.9% rise in outstanding credit to investors. This represents the greatest annual increase in owner occupier lending since June 2012 and the greatest rise in investor lending since December 2010. Much like other data received more regularly, the chart indicates that there is significantly more momentum in the investor lending space than that for owner occupiers where growth is more moderate.

At the end of September 2014, a record high 36.8% of loans outstanding had an offset facility, up from 34.2% a year earlier. Also a record high was the 36.8% of all outstanding mortgages which were interest-only, up from 34.6% a year earlier. Just 0.2% of all outstanding mortgages were reverse mortgages and 2.7% were low documentation which was down from 3.6% a year earlier and at a record low proportion. Other non-standard loans accounted for just 0.1% of all outstanding mortgages. It seems that more and more mortgagees are accessing offset accounts in order to reduce the interest payable on their mortgages and maximise repayments of the principal while interest rates are so low. The data also indicates that a high proportion of lenders are accessing interest-only mortgages which seems somewhat counterintuitive at a time when interest rates are so low.

The average balance on all outstanding mortgages at the end of September 2014 was $238,700. The average balance has increased by 3.0% over the past year. Loans with an offset facility ($284,600) and interest-only mortgages ($308,400) have much higher average outstanding loan balances. It is interesting to note that the annual growth in average outstanding loan balances has been much more moderate for mortgages with an offset and interest-only mortgages at 2.0% and 2.1% respectively. Encouragingly, the data also indicates that outstanding balances are reducing for low documentation and other non-standard loans as they become less common. Over the past year the average balance has fallen by -3.1% for low-documentation loans and by -6.5% for other non-standard loans. With mortgage rates low and fewer of these loan types being written it seems those that have these types of loans are continuing to pay down these mortgages.

Turning the focus to new loans written over the September quarter, 62.6% of the total value of new lending was to owner occupiers and 37.4% was to investors. The proportion of new lending to investors has fallen from a record high of 37.9% in the June 2014 quarter. Based on this data it suggests that growth in demand for both owner occupier and investment lending may have peaked. Although after having trended lower over the previous two quarters, the annual change in new owner occupier and investment lending bounced in September, recorded at 6.9% and 21.4% respectively.

Over the September 2014 quarter, 0.7% of new loans approved were low-documentation, 42.5% were interest-only, 0.1% were other non-standard loans, 43.2% were third party originated loans and 3.5% were loans approved outside of serviceability. The 42.5% of new loans which were interest only was down from a record high of 44.0% over the previous quarter. The data also seems to reflect the slowing of growth in investment demand, remember that interest only loans tend to be (but not always) reflective of lending for investment purposes. The ADIs seem to be increasing the usage of their broker channels with the 43.2% of loans originated by third parties the highest proportion since June 2008. With 3.5% of new mortgages approved outside of serviceability over the September 2014 quarter, this was down from a record high 3.7% over the previous quarter.

Looking at the loan to value ratios (LVR) of loans written over the September 2014 quarter, 25.2% of new loans had an LVR of less than 60%, 41.8% of loans had an LVR of between 60% and 80%, 20.9% had an LVR of between 80% and 90% and 12.1% had an LVR of 90% or more. The 12.5% of new loans with an LVR of more than 90% is the lowest proportion since June 2011. The 25.2% of mortgages with an LVR lower than 60% was the highest proportion in a year. This falling proportion of loans above 90% LVR suggests there are proportionally less high-risk mortgages being written.

The data indicates that overall interest-only lending is continuing to rise however, new lending of this type has eased of late. Investment lending remains high and continues to ramp-up however, the rate of growth in new lending to investors does appear to have slowed. Keep in mind that the December data will probably tell us much more given it encapsulates more of the spring selling season. Furthermore, after the RBA flagged that they and other regulators are looking at ways to cool investor exuberance with an announcement expected in December we may actually see a run on investor lending over the coming quarter.

It is of course important to remember that although investment lending has ramped up sharply over the past year, there is little to suggest that lending to investors is more risky than lending to owner occupiers. Bill Evans provided some insight into Westpac’s investment lending late last week. He noted:

• Compared to owner–occupier applicants, investment applicants are older (75% over 35 years); have higher incomes and higher credit scores.

• 65% of investment loan customers are ahead on their repayments and 90+ days delinquencies are 0.37% compared to 0.47% for the full housing portfolio.

• Westpac has an interest rate buffer approach to lending linking loan approvals to serviceability at a rate at least 180 basis points above the standard mortgage rate (5%).

• All investment loans are full recourse and specific policies apply to holiday apartments and single industry towns.

Our concern about the high level of investment lending remains over the fact that investors are targeting the residential property asset class because of its superior returns. While these returns remain superior demand is likely to persist. The concern then arises when other investment classes start to show superior returns will these owners exit the residential property class or remain in it for the long-term? As the above chart shows, investor activity is heavily concentrated within the capital city inner-city unit market. Were many investors to exit the market at a similar time in search of superior returns that could have some serious repercussions for the inner city unit market and potentially the wider housing market too.

___

You may also find interesting:

Cameron Kusher: why would deflating Australia's greatest assets be a good thing?MPA's house prices news analysis

Healthy report for mortgage market