Impacts of the November increase still apparent, expert says

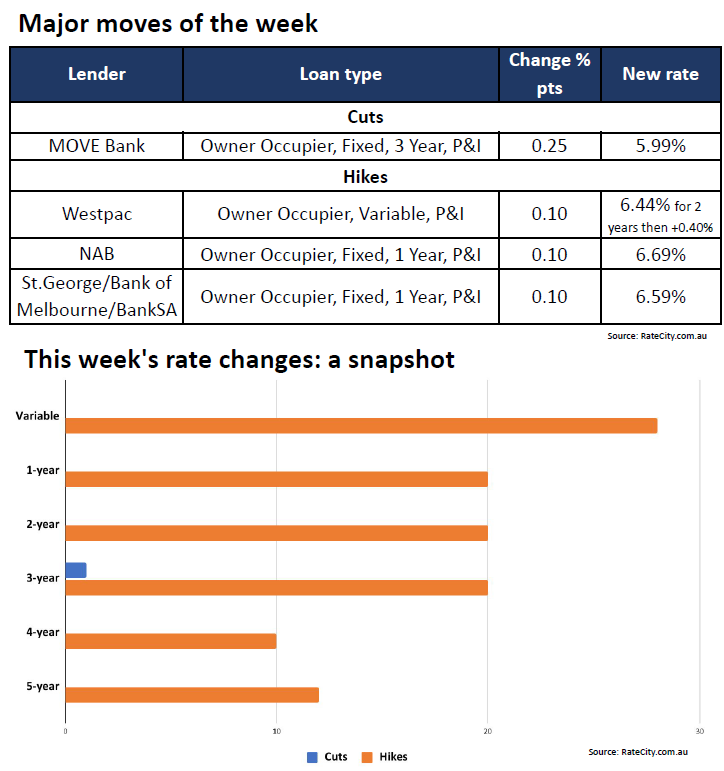

In its latest weekly interest rate wrap-up, RateCity.com.au has reported that the period from Nov. 22-28 has seen a flurry of hikes, with major banks NAB and Westpac taking the lead.

NAB has raised nearly all fixed-rate loan terms by up to 0.25 percentage points for both owner-occupiers and investors, while Westpac increased fixed rates by up to 20 ppt across most loan terms. Westpac also lifted its basic variable rate by 0.1 ppt for new customers, on top of its recent Reserve Bank hike.

“We’re still seeing the tail end of hikes from the RBA increase in early November,” said Sally Tindall (pictured above), RateCity.com.au research director.

While most lenders have followed suit with hikes, MOVE Bank stood out as the only entity to implement a cut, reducing its three-year fixed rate for owner-occupiers paying principal and interest by 25 ppt.

See table below for the major rate adjustments last week, and the graph for a snapshot of the week’s variable rate changes.

To compare with the previous week’s rate changes, click here.

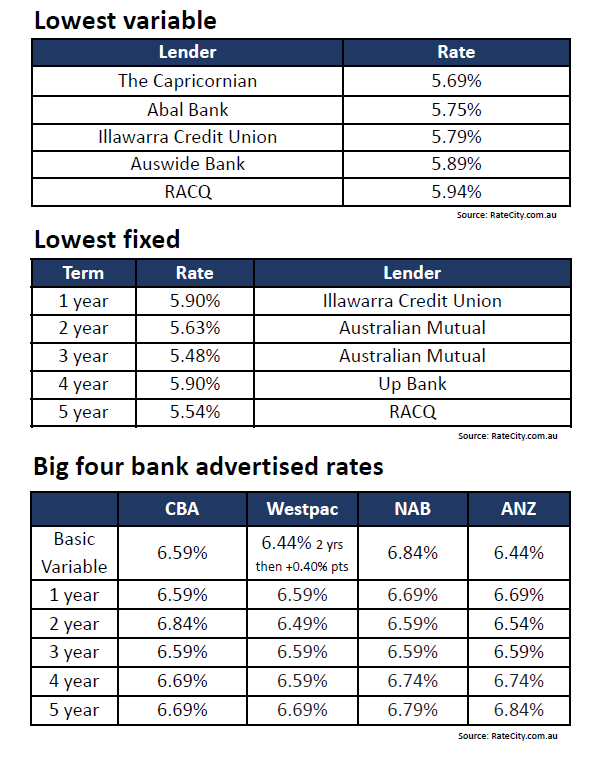

Current rates on offer

See the tables below for the lowest fixed, variable rates available, as well as the big banks’ advertised rates, following last week’s rate changes.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.