Banks eye arrears and customer impacts

The official cash rate increased by 25-basis points on Tuesday, defying economists’ predictions of another outsized 50-basis point rise.

Marking the sixth consecutive rise this year, the wholesale cash rate now sits at 2.60%. The interest rate on exchange settlement balances has also increased by 25-basis points, to 2.50%.

Ahead of the October announcement, big four banks ANZ and NAB forecast a fifth 50-basis point increase.

But the RBA has changed tack, governor Philip Lowe having already hinted that the pace of official cash rate hikes would slow. At some point, it would be appropriate “to slow the rate of increase”, Lowe told the House of Representatives Standing Committee on Economics in September.

Annual inflation stood at 6.1% in the June quarter, the preliminary inflation figure released by ABS in September showing the monthly CPI indicator rose 6.8% in the year to August.

As is the case in most countries, inflation in Australia “is too high”, Lowe said on Tuesday. The RBA’s forecast for inflation did not stray from the 7.75% previously forecast over 2022, moderating towards 4% next year, dropping back to 3% in 2024.

Acknowledging that the official cash rate had increased “substantially in a short period of time”, in Tuesday’s statement, Lowe said the Board had decided on a 25-basis point increase in October, as it continued to assess the inflation outlook and economic growth in Australia.

“Today’s further increase in interest rates will help achieve a more sustainable balance of demand and supply in the Australian economy. This is necessary to bring inflation back down,” Lowe said.

Unemployment, currently 3.5% was around the lowest in almost half a decade, Lowe said. The Australian economy continues to grow strongly and national income is being boosted by “a record level of the terms of trade”.

Further increases to interest rates are not ruled out, Lowe saying the Board expects to increase interest rates further over the period ahead.

Read next: Are borrowers in for more interest rate pain?

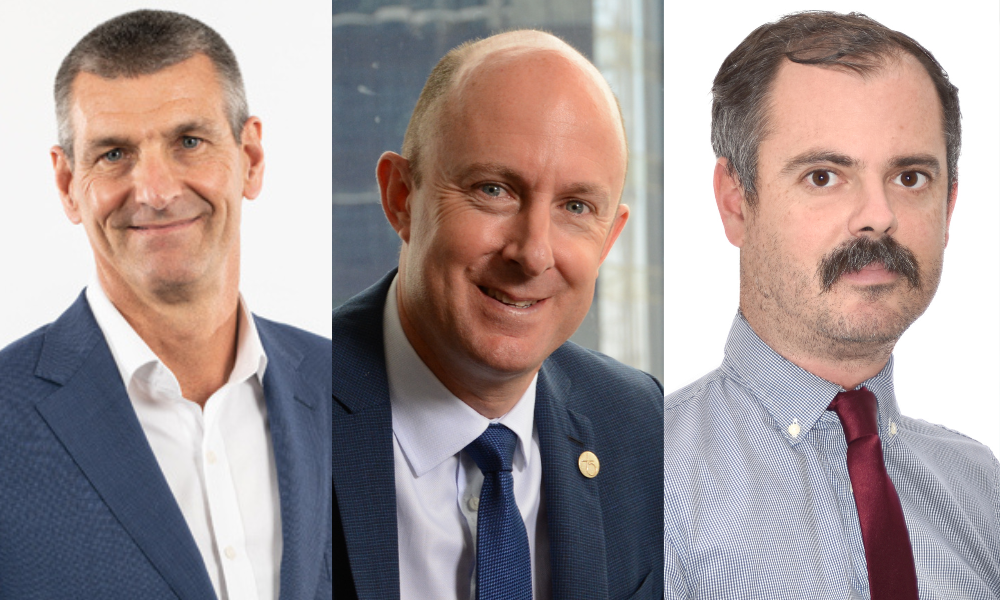

Commenting on the October cash rate announcement, Auswide Bank managing director Martin Barrett (pictured above left) said while interest rates were still materially below average, the speed of the current rate hike cycle, which now includes 250-basis points of interest rate hikes, had caught many consumers off guard.

Monetary policy has been referred to as a blunt instrument: it applies to all industries, sectors, and states equally, and can also have unwanted side effects, such as slower growth and higher unemployment. But it’s the main tool available to solve a “complex inflation issue”, which Barrett said was compounded by geopolitical tensions and supply chain issues, making it more difficult to target through interest rate rises alone.

As of June 30, Auswide Bank customer arrears remained at a historic low, representing 0.18% of its loan book. Despite 250 basis points of cash rate rises this year, Barrett said arrears and hardship requests were currently at very low levels, with little evidence of any material customer difficulty.

“This is likely due to full employment, advance payments/setoff balances and serviceability requirements, [which when] interest rates were at their lowest point, serviceability was assessed at over 5%,” Barrett said.

“If interest rates were to rise by another 1% [or more] in a short time frame, then industry-wide, we could start to see some pressure build, particularly in the higher LVR and top of cycle (property price) segment.”

Mortgage brokers will be aware of clients for whom repayment capacity is tight, Barrett said. He suggested brokers continue to work with banks and lenders to explore options around loan structure, loan term and cost, considering short and medium-term implications.

As a significant tranche of fixed-term borrowers approach the end of their loan term, Barrett said Auswide Bank allowed fixed rate borrowers additional flexibility, such as the ability to increase their repayments, make one-off payments, and operate an offset account.

“Simply having salary go into an offset account against [the] loan, can, over the life of the loan, make a meaningful difference to interest charged and thus, the loan term,” Barrett said.

“We encourage our customers and brokers to contact us as early as possible if difficulties are or are likely to be experienced. It’s in the best interests of all to work on options together.”

Given the multitude of economic factors currently at-play, Beyond Bank general manager customer experience Nick May (pictured above centre) acknowledged the likely difficulties in keeping up with and adapting to change.

For mortgage borrowers on fixed rates, the impact of the official cash rate rises would take time to filter through to repayments, whereas those on variable rates are already adjusting their spending, he said.

Beyond Bank customer arrears have remained stable, May said. Borrowers have typically adjusted their spending habits, and those who have repaid more than the minimum amount have found their prepayment levels have slowed.

“It is still very early in the rate increase cycle, and we will continue to keep a close eye on the impacts on our customers and how we can help them adjust with both their repayments and spending habits,” May said.

May acknowledged that Beyond Bank’s broker partners already work closely with their clients, informing them of the changing interest rate environment. Brokers’ continued support and education would help borrowers budget for the current rate rises and guide borrowing in accordance with their desired lifestyle.

Beyond Bank is supporting customers with mortgages rolling off lower fixed rates.

“We believe an important part of being a lender is to have a deeper relationship than just the home loan. We proactively engage with customers by undertaking ‘banking reviews’ to ensure their goals and household budgets are all in order,” May said.

Along with banking reviews, the bank also conducts annual ‘home loan check-ins’ to ensure customer needs are met, he said.

“Beyond Bank [also] recently launched [a] personal financial management (PFM) tool that allows customers to budget and keep track of their spending patterns and habits as well as set goals for the future,” May said.

According to the Fitch Ratings mortgage market index – Australia (the Dinkum RMBS Index), due to record-low unemployment, 30-plus day arrears fell 7-basis points between the first and second quarters of 2022, to 0.82%.

Ahead of the RBA’s cash rate decision for October, Fitch Ratings director, structured finance Tim Groombridge (pictured above right) told MPA that if rates rose by more than 0.25%, the total increase (from May to October) would be over 2.5% - the interest rate buffer on which borrowers were assessed from 2019 to 2021.

Read next: When will house prices find their floor?