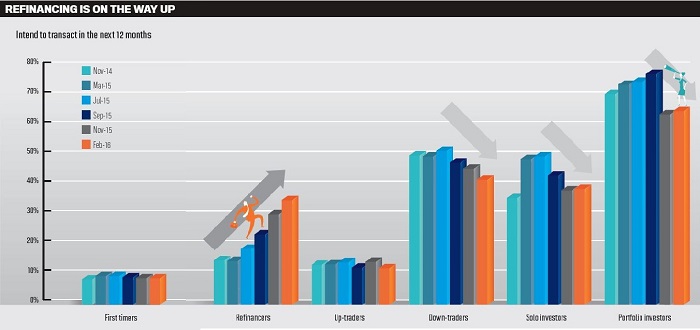

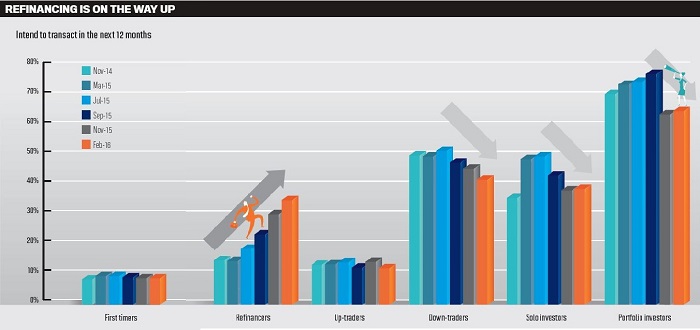

Refinancing is overtaking investors as the driving force behind the market and putting brokers in the driving seat

Banks will need to turn their focus from investors to owner-occupied refinancers, claims a new report by JP Morgan and Digital Finance Analytics (DFA), released in March.

Credit growth will continue to be “relatively strong” for the next 12-18 months, the report notes, as house price appreciation drives refinancing. “The major banks will need to capture the refinancing tailwind by targeting the right customers through the right channels,” explained JP Morgan banking analyst Scott Manning. The right channel being brokers, as approximately 75% of refinancers expect to use brokers.

Brokers also have a role in initiating the refinancing process, the report found, and those banks that are prioritising brokers instead of branches will gain from the refinancing shift. “That’s acting as a potential business case for other banks,” noted Manning. “I think you’ll see a continuation of branch-reducing.”

Whilst two-thirds of refinanced loans went to other lenders, these have generally been major banks. Responding to a question from MPA, DFA principal Martin North explained that the non-majors weren’t benefit ting disproportionately. “I would have expected there’d be a greater fl ow, but it’s a relatively small amount,” said North. “There’s a lot of churn between majors and some to non-banks.”

WHO IS REFINANCING?

Comparing refinancing rates among borrower groups (ie exclusive professionals/wealthy seniors) in 2013 and 2015, DFA made some interesting observations.

Young growing families are now the most likely group to refinance. More than 60% of this group intend to do so within the next 12 months. They are followed by the suburban mainstream (just under 50%).

The battling urban group are also increasingly looking to refinance, with nearly 30% intending to in the next 12 months. The least likely group to refinance are rural families, with less than five per cent intending to and this figure continues to fall.

The report also noted that seniors would be the most sensitive to interest rate rises, followed by young affluent borrowers and exclusive professionals.

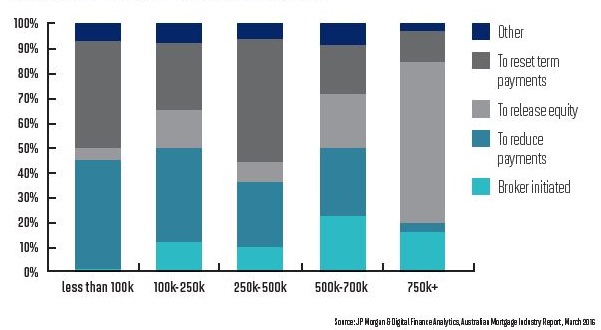

THE REASONS PEOPLE REFINANCE

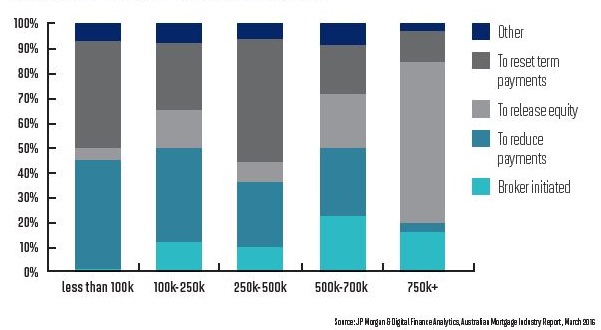

DFA investigated why borrowers with different sized loans were choosing to refinance, and found that “the main driver of refinancing activity appears to be to reset mortgage terms”. However, for $750k+ loans, mortgage terms – and brokers – appear to be less important.

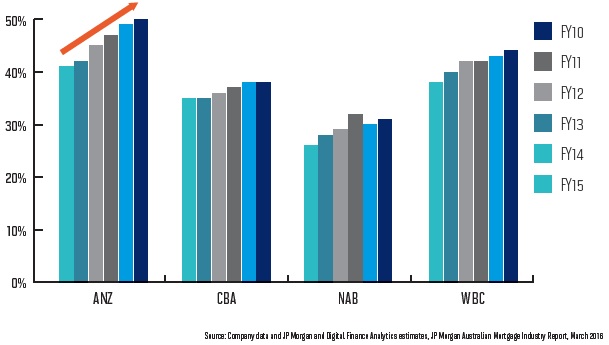

WHY BANKS SHOULD EMBRACE BROKERS

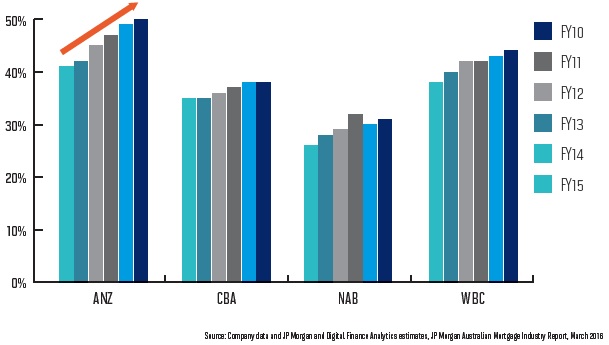

JP Morgan banking analyst Scott Manning argues that the report shows “banks need to stay engaged with their broker channels”, as approximately 75% of refi nancers use a broker. The report explains that “ANZ’s overweight presence in broker places it in a strong position to capture refinancing activity”.

WHAT’S STOPPING INVESTORS?

DFA looked into the reasons for investors deciding not to transact. The usual barriers are still important, such as investors who have recently bought a property, or those who feel prices are too high, but regulation and the fact it is increasingly diffi cult to get funding are also important. DFA principal Martin North claims that “9-10% of investors cannot get the fi nancing they want”.

Credit growth will continue to be “relatively strong” for the next 12-18 months, the report notes, as house price appreciation drives refinancing. “The major banks will need to capture the refinancing tailwind by targeting the right customers through the right channels,” explained JP Morgan banking analyst Scott Manning. The right channel being brokers, as approximately 75% of refinancers expect to use brokers.

Brokers also have a role in initiating the refinancing process, the report found, and those banks that are prioritising brokers instead of branches will gain from the refinancing shift. “That’s acting as a potential business case for other banks,” noted Manning. “I think you’ll see a continuation of branch-reducing.”

Whilst two-thirds of refinanced loans went to other lenders, these have generally been major banks. Responding to a question from MPA, DFA principal Martin North explained that the non-majors weren’t benefit ting disproportionately. “I would have expected there’d be a greater fl ow, but it’s a relatively small amount,” said North. “There’s a lot of churn between majors and some to non-banks.”

WHO IS REFINANCING?

Comparing refinancing rates among borrower groups (ie exclusive professionals/wealthy seniors) in 2013 and 2015, DFA made some interesting observations.

Young growing families are now the most likely group to refinance. More than 60% of this group intend to do so within the next 12 months. They are followed by the suburban mainstream (just under 50%).

The battling urban group are also increasingly looking to refinance, with nearly 30% intending to in the next 12 months. The least likely group to refinance are rural families, with less than five per cent intending to and this figure continues to fall.

The report also noted that seniors would be the most sensitive to interest rate rises, followed by young affluent borrowers and exclusive professionals.

THE REASONS PEOPLE REFINANCE

DFA investigated why borrowers with different sized loans were choosing to refinance, and found that “the main driver of refinancing activity appears to be to reset mortgage terms”. However, for $750k+ loans, mortgage terms – and brokers – appear to be less important.

WHY BANKS SHOULD EMBRACE BROKERS

JP Morgan banking analyst Scott Manning argues that the report shows “banks need to stay engaged with their broker channels”, as approximately 75% of refi nancers use a broker. The report explains that “ANZ’s overweight presence in broker places it in a strong position to capture refinancing activity”.

WHAT’S STOPPING INVESTORS?

DFA looked into the reasons for investors deciding not to transact. The usual barriers are still important, such as investors who have recently bought a property, or those who feel prices are too high, but regulation and the fact it is increasingly diffi cult to get funding are also important. DFA principal Martin North claims that “9-10% of investors cannot get the fi nancing they want”.