As the pandemic moves on, SMEs continue to look for finance. So, how can brokers best serve their clients during this difficult time? MPA speaks to three leading figures in the non-bank space to find out more

This year is drawing to a close, and SMEs have found themselves battered and bruised by wider world events. While there’s no question that many have been able to successfully pivot their business models and benefit in spite of the pandemic, there are many more who have had their plans derailed and faced tremendous setbacks.

The uncertainty is grim, particularly given the uneven way that the pandemic has affected different parts of the country, let alone the world. How sustainable are these changes? Will businesses find themselves pivoting too far, only to be hamstrung once things return to some semblance of ‘normal’? There’s no clear answer, and in truth there likely won’t be for some time. But the wheels of industry must keep turning, and businesses must grind on.

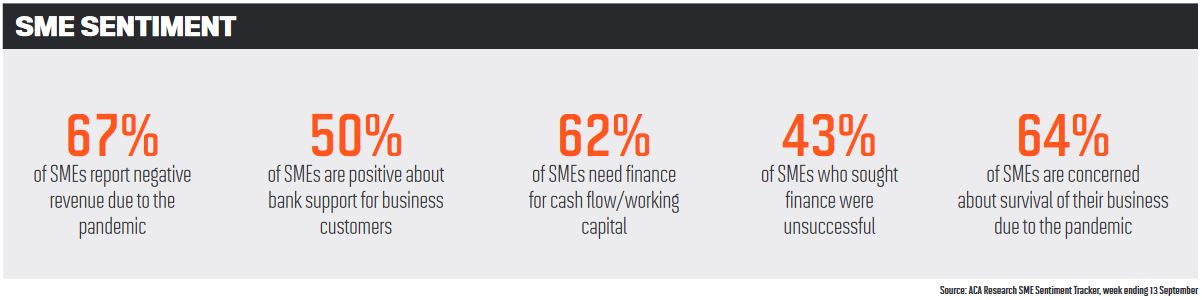

Amid this upheaval is the very real need for SMEs to secure finance. There’s been a predictably mixed response from lenders across the spectrum. Ever since the GFC in 2008 the big banks have tended to take a more conservative approach to their lending criteria, and it’s not unreasonable to assume that the events of 2020 will push them further in that direction. But that doesn’t mean there aren’t opportunities to be had.Brokers will have more opportunities to demonstrate their value to clients as lending criteria shift and become more labyrinthine. Similarly, non-banks have the potential to demonstrate their value to borrowers and brokers alike by providing finance to those who have had their lives disrupted by the pandemic.

“A well-placed broker will be one who not only offers the best financial solution for the client but also the best hassle-free solution” Peter Vala, Thinktank

“The need to work remotely has placed never-before-seen pressure on businesses, with some being able to adjust and many – particularly those in retail, hospitality and tourism – having to close their doors,” says Vala. “Hopefully it’s a temporary measure, but there’s no question it’s changed how SMEs operate.”

Managing cash flow in the face of these challenges has been the number one priority to protect businesses, Vala says. There’s been a heavy focus on negotiating lease and creditor terms, making employee arrange-ments and accessing government subsidies.

“While some SMEs have struggled during the COVID-19 challenges, others have thrived,” Vala says.

“Those experiencing financial difficulties have turned to their lending partners to restructure their funding arrangements and/or seek relief in managing their financial commitments. This has required trust and understanding for all involved – the client, the broker and the lender.”

“In fact, it’s the opposite,” Vala says. “This has provided greater flexibility in lending capability, allowing business to still acquire commercial and residential property, as well as release equity for working capital and expansion of business activities.”

Tas Tzimos, head of sales at Moula, says there have been changes in demand, depending on the industry. Sectors have not been equally impacted and, accordingly, the sorts of services required are undergoing a shift. One of the biggest challenges for SMEs this year, Tzimos points out, is the overall uncertainty of how things will play out.

“For example, we’ve seen less demand from sectors hardest hit by the pandemic, including accommodation and food services, arts and recreation, and education and training,” he says. “At the same time, we’ve seen greater demand from other sectors, including wholesale trade and financial and insurance services.

“Another key challenge has been maintaining cash flow. It’s always one of the biggest challenges for SMEs but has become more pronounced for some sectors.”

Tzimos sees it as an opportunity for brokers to shine, highlighting both their services and the benefits of non-bank lenders, while also expanding their reach to new clients in the process.

“Although it’s a challenging environment for many SMEs, we expect to see increased demand for alternative business finance solutions,” says Tzimos.

“Brokers who become familiar with business lending and take the time to learn about their clients’ needs will be well placed to reduce risk through diversification and grow their businesses.”

Dean Koutsoumidis, managing director of Equity-One, is philosophical about the shift in conditions. For a Melbourne-based office, the cancellation of the F1 Grand Prix was a significant moment, he notes, and initially there was some uncertainty about what was waiting ahead – but by April these concerns had started to fall away, and enquiry activity from borrowers started to “bubble away” again.

“Borrowers’ needs haven’t actually changed per se,” Koutsoumidis says. “They still need a competitive non-bank alternative for when the banks aren’t willing to dance. Our focus is primarily on commercial borrowers seeking a smart, fast solution, so although I don’t want to minimise the di culties that people are facing, a lot of the day-to-day remains very similar for us.”

Koutsoumidis also notes that while on one level borrowing from the banks and other major ADIs has become challenging, there is also more competition in the non-bank space, which has resulted in the costs of borrowing coming down.

“This is good news for borrowers,” says Koutsoumidis. “The challenge for borrowers is ensuring their LVR covenants stay intact, but if that can be ticked off, then borrowers can feel confident that there are choices for them out there. There is no question that the number of property transactions has been affected by COVID-19, so lenders have to keep their offerings as sharp as possible to continue being relevant.”

“There were elements of that scheme which mandated borrowers into repayment schedules with six months repayment-free,” says Tzimos. “While this would have been welcomed by some, we’ve found that a one-size-fits-all approach to lending doesn’t make sense. Business lending requires a holistic approach to looking at a business’s needs and tailoring the funding accordingly.”

Vala is a staunch supporter of the government support initiatives, describing them as “critical” to helping the economy and businesses to keep turning.

“This assistance, combined with efforts of brokers and lenders to reduce loan and lease pressures, has enabled many businesses to maintain enough cash flow to cover expenditure,” Vala says. “These arrangements will need to continue in some form once restrictions ease to enable the SME industry to recover sufficiently.”

Koutsoumidis expresses a certain degree of scepticism around the initiatives, while conceding that they have yielded some benefits. In a situation as unprecedented as this one – “Who would have thought we’d be facing these sorts of challenges back at this time last year?” he says – he is keenly aware that sometimes there isn’t a perfect solution to cover all possible outcomes. It’s best to work with the tools available.

“Although it’s a challenging environment for many SMEs, we expect to see increased demand for alternative business finance solutions” Tas Tzimos, Moula

“Love them or hate them, the government subsidies, grants and supplements have helped stave off the economic consequences,” says Koutsoumidis.

“Some may feel that they may have made things worse by deferring the inevitable consequences. I see it as a little bit akin to a good dose of antibiotics that aren’t quite needed. You’re happy when you get it and will deal with the problems later on. But with that said, I believe that business needs to charge on to assist with our recovery, so in that regard all the support offered will undoubtedly help.”

All three non-banks agree that brokers have an important role to play in the recovery process; after all, they have become an increasingly important part of the loan landscape over the last decade or so. They also play a key part in raising awareness of the important role of non-banks in offering finance to SMEs that might not otherwise have access to it.

Tzimos notes that in the three and a half years leading up to September 2019, the value of commercial loans settled by mortgage brokers through aggregators in Australia almost doubled, reaching a record high of $43.1bn.

“It’s likely this trend will continue into the future,” says Tzimos. “Our BDMs work closely with brokers to help them understand the business finance options available to their clients and how we can assist them. We’ve also been running webinars that help brokers understand trends in business finance and how to benefit from them.”

“Brokers play a crucial role in the servicing of the commercial and retail loan markets in Australia” Dean Koutsoumidis, Equity-One

“Some lenders have seen a tightening of credit policies, whilst others are beginning to relax and provide slightly more flexibility,” he says.

“A well-placed broker will be one who not only offers the best financial solution for the client but also the best hassle-free solution where transactions can be approved and settled with the least amount of inconvenience to the borrower.”

But what about brokers who are working with SMEs for the first time? What sorts of things do they need to consider before entering the playing field?

“Ongoing cash flow is one of, if not the most important factor for any SME,” says Vala. “So, establishing the current cash flow and financial position of the client is the broker’s first priority. Remember, there is a difference between sales, profit and cash. It’s cash derived from sustainable cash flow that repays loans and other financial commitments.”

Another factor, Vala explains, is that there’s more than one way to prove an applicant’s loan serviceability.

“Be mindful of alternative income verification methods for non-full-doc loans,” he says. “For example, BAS may not be the best method of verification to indicate a client’s current earnings, particularly when you consider that the last couple of quarters of trade may have been subdued and not reflect true earnings.”

Tzimos says more people are looking for a single solution that bundles their multiple financial needs together. Most mortgage brokers will already have clients with business lending needs they can assist with.

“You probably don’t need to start by looking for totally new customers,” says Tzimos. “Stay in touch with existing ones and check in to see if they have business finance needs.”

However, he does caution that business lending is not the same as mortgage lending and can often be more nuanced. Business lending, Tzimos explains, is usually tied to a growth opportunity, and finding the right product or solution is about truly understanding a business’s needs and making sure the finance will help them achieve that growth.

“It’s not only about the interest rate. More often than not it’s about ensuring the right outcome to meet the business’s needs,” says Tzimos. “Sometimes this means that speed is a key factor, and sometimes it’s about flexibility, and working with a lender to tailor the finance to the situation.”

“Good relationships are never more important than in tough times,” he says. “Form good relationships with trusted partners. With respect to the lenders they deal with, don’t worry about leaning on their BDMs too much to extract enough knowledge and information to achieve a good outcome for your clients. After all, it’s what lenders are there to do, so feel good about working closely with them to the benefit of your client and your respective businesses.”

There’s no question that uncertainty still lies ahead. But there’s hope too. Though it might be too early to call it a full-blown ‘recovery’, it’s clear that there is resilience among both the broking and lending sectors. With the right tools and support in place, mortgage brokers can be well primed to make their mark on the space.