How can brokers better aid SMEs in securing finance, especially as it becomes harder to come by?

How can brokers better aid SMEs in securing finance, especially as it becomes harder to come by?

When the average person conjures up the image of a business, they tend to think of a large corporate entity. But that would be ignoring an important sector in the middle. Of the 2.24 million actively trading businesses in Australia, around 1.9 million are estimated to be small businesses. Only 3% of Australian businesses have 20 or more employees, which just goes to show that size doesn’t connote scale of importance to the economy.

It’s therefore a significant market for lenders and brokers. Data from the Australian Bankers’ Association suggests that about half of small businesses in Australia use a business loan facility other than a credit card. According to a background report on small business loans prepared for the royal commission, in December 2015 bank loans to small businesses totalled a staggering $261bn. This doesn’t even account for nonbank services, which suggests that the final total is likely to be significantly higher. Brokers have a important role to play in aiding SMEs and self-employed borrowers, particularly when it comes to securing premises for their businesses.

MPA spoke to some of the top providers in Australia – and an aggregator that is leading the way in diversification – to find out about the current state of the market and the opportunities for the future.

Q: How is your business developing and pushing the boundaries of small business lending, and helping brokers seize the opportunities in this sector?

When it comes to the opportunities in the SME space, there are a lot of reasons why brokers should branch out and assist this booming market. But purely from a perks perspective, these clients often stick with their brokers for longer than typical homeloan- only customers.

“The relationship between a broker and SME client typically runs deeper, as the lending is generally more solutions-based, requiring the broker to have a solid understanding of their client’s ongoing cash flow requirements as well as the industry in which they operate. This creates greater loyalty among SME clients,” says FAST CEO Brendan Wright.

Also, in many cases where a customer is self-employed, their home lending and business lending become closely linked, leading to higher broker retention rates.

Diversifying into small business lending has worked for FAST’s brokers. In 2018, the aggregator’s brokers settled over $7bn in business and asset finance loans. Now, more than a third of all business loans originated by the third party channel in Australia have come through FAST brokers.

Royden D’Vaz, head of sales and marketing at Bluestone, describes self-employed people as the “engine room of the Australian economy”. But if any engine is going to go, it needs gas.

That’s why the non-bank lender has products that provide newly formed SMEs with the injection of cash they need to get o the ground during those critical early stages of development.

Rather than waiting for 24 months before they have a full tax return, Bluestone uses the applicant’s bank statements and BAS to verify their income. It also accepts accountants’ letters.

“Our ‘Business Easy’ product is unique and caters for self-employed borrowers starting up a business, enabling them to borrow funds with an ABN just three months old,” D’Vaz says.

The lender also offers a product that’s suitable for businesses that have had their ABN for 12 months and are looking to expand and grow.

“We recognise that business owners often struggle to access mortgages because of the extra level of income proof they have to provide compared to their PAYG counterparts, so we do our best to offer a variety of ways they can meet income verification requirements.”

When it comes to pushing boundaries, OnDeck has checked that one off the list. As one of the pioneers of the global fintech movement, it identified that there would be a major credit gap for SMEs looking to borrow from mainstream lenders over a decade ago. And it believed the answer was to deliver funding via the internet.

Since arriving on Australia’s shores in 2015, the online small business lender has been busy forging partnerships with the likes of MYOB and Credit Suisse, while also focusing on developing customer-centric and innovative products for the benefit of small businesses, says Michael Burke, head of sales at OnDeck.

But one big difference it champions is its thinking about the broker-client relationship.

“OnDeck believes the broker has total ownership of the customer relationship and that its role is one of support of that relationship and collaboration with the broker in a way that is fair, transparent and accessible,” he says.

Pepper

Over at Pepper Money, it’s exciting times for Australia CEO Mario Rehayem, who tells MPA that the non-bank recently launched a commercial real estate product for a market that’s long been “heavily underserviced”.

The new product, which will provide funding from $150,000 to $5m, will initially begin as a pilot project for the largest commercial writers. Once the lender receives their feedback, it will make any changes necessary and then offer it to its larger network.

There is a large customer base that has been rejected or not been able to successfully acquire commercial real estate in the past due to the lack of risk appetite from many banks for that type of product, he says.

With this in mind, Rehayem hopes to enable more brokers to offer a commercial real estate product in the future, using the same skill set they’ve honed by writing residential mortgages every day.

“Brokers have been asking us when we’re going to take to this space, because they believe the industry is starved of product and the service to match.”

John Mohnacheff, group sales manager at Liberty, feels that the lender’s unique understanding of risk and its partnerships with fintechs like Moula enable it to find more ways to say yes to customers while also servicing a broader section of the market.

“To help brokers embrace commercial lending, we have built an entire division dedicated to the sector,” Mohnache says.

“Our BDMs, underwriters and settlements team can all help brokers to help more clients. We have structured ourselves to support brokers in every way so they can concentrate on finding solutions to help self-employed and business owners reach their next milestone.”

Q: What are some of the biggest challenges facing self-employed and SME borrowers at the moment?

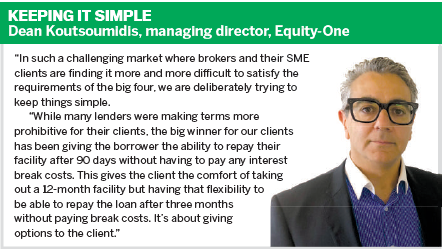

Access to credit has been and continues to be a real issue for SMEs, according to Equity-One managing director Dean Koutsoumidis.

Earlier in the year, the lender dealt with a borrower who had historically enjoyed a good relationship with one of the big four but was now confronted with difficulties in getting finance. The client was trying to purchase a quality property and had a respectable deposit and ample capacity to service the loan, yet his banker of 17 years was unable to assist.

“This is where we try to be as relevant as possible, to really try and provide a solution for brokers and their clients,” Koutsoumidis says. “Scenarios like these are the reason we are a relevant option for commercial borrowers requiring an alternative to their traditional funding sources.”

And he believes these sorts of scenarios are just the “tip of the iceberg”.

Challenges around finance for SMEs are often linked to a lack of equity, says Chris Thomas, general manager of NAB commercial brokers.

“Accessing finance remains a key challenge, particularly for smaller and micro businesses that often don’t have property, or other major assets, to secure against,” he says.

Accordingly, NAB brokers can help these customers through NAB QuickBiz for Broker, which provides end customers with access to an unsecured facility, often as part of a broader financing relationship with that customer.

It’s this solution that Yellow Brick Road Carlton franchise owner Aleksandar Naumoski turned to when he found many of his SME clients coming to him for working capital. He started looking into unsecured-lending options and found the QuickBiz product to be transparent, customer-friendly and simple to use.

“One of our clients was very surprised at how quickly we were able to turn around their online approval. Customers are often expecting a long, drawn-out process, and when we are able to get an approval in 48 hours they are very surprised and happy with the result,” Naumoski said in a testimonial to NAB.

FAST

With more than two million small businesses now operating in Australia, the SME space is undergoing significant growth. According to the latest NAB quarterly survey, small business expectations of capital expenditure over the next few months are at their highest level in recent years. Despite the strong demand, access to capital for SMEs remains a challenge. However, FAST is taking steps to cater to the broader financing needs of clients operating businesses in industries such as health, retail, pubs, accommodation and transport.

“We are starting to onboard more specialist lenders to our 45-strong lending panel to make it easier for our brokers to find solutions for their SME clients,” Wright says.

OnDeck

Australia has been fortunate to have strong trends that support the growth of online SME lending, including growing fintech adoption and a favourable macro environment. Combined with positive self-regulatory e‑ orts, these have encouraged optimism around the SME sector.

However, there have still been challenges, particularly around cash flow.

“Industry data shows that one in five Australian small businesses were unable to take on new work because of cash flow restrictions,” says Burke.

“Additionally, nine out of 10 businesses said better cash flow could have improved revenue by an average of 11.7%. These statistics play no small part in why fintech in Australia is transitioning from alternative lending to mainstream lending.”

Bluestone

Traditionally, small businesses have found it extremely challenging to fund growth or expansion, as mainstream lenders need fully audited and lodged tax returns in order to lend to them, says D’Vaz. By contrast, non-banks like Bluestone have the flexibility to offer highly competitive, fully verified loans as well as alternative methods of verifying income.

“Unlike mainstream or major lenders, we take the time to get to know our customers’ individual circumstances by using personal bank statements, BAS and business bank statements if tax returns are not available,” D’Vaz says. “If brokers embrace the offering of the non-bank sector, these borrowers can be educated on some of the products available to them.”

Pepper

In the commercial real estate market, the banks still apply very rigid, old-fashioned, paper-based processes, which come with a whole slew of other challenges. In the past, the banks exercised strong controls over who had access to and who could write what commercial products, Rehayem says.

Pepper has designed its new product to be accessible, and its processes will be familiar to those brokers who already use the lender for residential mortgages. It will also apply its cascading credit model to the commercial fi le. That means that if the client doesn’t fi t into the prime category first, they will automatically be reassessed under the near prime criteria.

“This gives the broker and the customer a high probability of success in the application, which is not really the process that is adopted elsewhere.”

Q: How do you think the royal commission will affect small business lending going forward? Has it already affected loan flows?

Liberty

“The royal commission will affect all lending in some way,” Mohnacheff says. “What brokers need to remember is there are still lenders prepared to help good business customers, including the self-employed.”

Mohnacheff is adamant that Liberty will maintain its commitment to working with SMEs, even with future changes to legislation likely ahead.

“Small business owners are the backbone of the Australian economy,” he says. “These people take significant risks; they’re prepared to give it a go, and Liberty firmly believes we need to be there to help them achieve their business goals.”

Pepper

“My personal opinion is that loans should always be treated under the [NCCP Act] purely on the basis that, regardless of whether it’s commercial or SME or residential, there’s still a human at the other end of that loan, so it should be as transparent as possible,” Rehayem says.

At the same time, any new regulations have to be applied thoughtfully.

“In any market where you push harder regulation, there is going to be a compression of business flows,” Rehayem says.

“We’re already starting to witness that in residential, and that will happen in commercial. There has to be a balance, because if you go too far you’ll stifle people from getting loans, which means they will not be able to encourage entrepreneurs to try something new.”

Bluestone

The heightened spotlight on the industry with the various reports, forums and commissions has created a strong market dynamic for non-bank lenders, D’Vaz says. Indeed, the loan flows at Bluestone have more than doubled over the last few months, partly as a result of the mainstream lenders pushing further up the credit curve.

“As the mainstream lenders tighten their credit policy as a result of the focus on our industry, it has left a void that is easily filled by the non-banks,” D’Vaz says.

Equity-One

Despite the many unknowns on the horizon, the lender has been seeing enquiries for its products grow. “This has been a trend for a couple of years now as banks continue to tighten credit policies, and we certainly can’t see these policies being freed up at the conclusion of the royal commission – in fact, quite the opposite,” Koutsoumidis says.

“Broadly speaking, responsible lending obligations should always be taken into consideration with any lending to ensure that borrowers are getting the right product for their needs, with the ability to tailor it to their business to assist with growth and prosperity.”

On-Deck

Burke says OnDeck supports the objectives of the royal commission to ensure that the financial services sector acts with integrity. The final report will have some implications for small business lending.

“OnDeck demonstrated its commitment to responsible lending by proudly becoming one of six online lenders to set a new precedent for the protection of small business in Australia by signing an industryfirst Code of Lending Practice on 30 June,” Burke says.

“Signing the Code was an obvious choice for OnDeck in building a well-governed responsible lending environment for the protection of small business in Australia.”

NAB

Thomas is reluctant to “pre-empt” the commission’s work, but he is quick to point out that it was “necessary and justified” and the industry is likely to see some changes as a result.

“Brokers play an essential role in the lives of many Australians, across both residential and commercial lending, and NAB will continue to advocate for changes that support the best outcomes for consumers.

“We will continue to focus on lifting the bar in both the residential and commercial lending sectors, focusing on strong processes, data collection and customer service.”

Q: Many brokers have already diversified into SME lending, so what should they do now about servicing and retaining those clients? How is it different from working with home loan customers?

NAB

For brokers who have already expanded into commercial lending, Thomas says it’s important to understand the mindset of a small business owner in order to deliver personalised service. For example, small businesses need finance for a range of reasons – from managing cash flow because customers are slow to pay, to borrowing for expansion – and often require access to funds quickly.

“However, while there are these obvious differences between residential and commercial, there are also some similarities. Across the board, consumers are increasingly time-poor and seeking a seamless, hassle-free experience. That is why it is important for brokers to work with partners like NAB who can assist by investing in the latest tools and technology to enable a great customer experience.”

Equity-One

First of all, brokers need to ensure the product is right for their client, and then maintain ongoing contact with them during the term of the loan, which will help them retain the client going forward, Koutsoumidis says.

“Keeping abreast of trends and products and knowing the client’s future needs and goals is very important in the SME space. No client wants to enter into a loan agreement and be left out in the cold, and that is where the relationship between the lender and the broker becomes so important.”

FAST

“Knowing your customer is crucial for brokers expanding into the business lending space. Make sure you’re asking your clients the right questions, and finding out their short-term hurdles and longer-term goals,” Wright says.

FAST knows that in order for brokers to diversify successfully, they need wide-ranging support.

“One way we do this is by ensuring brokers are kept up to date and informed on the latest industry changes and policy through ongoing broker forums, partnership manager-run workshops and webinars, and our monthly publication, FAST Matters. Brokers can also subscribe to updates and publications from our panel of lenders for business insights relevant to clients’ specific industries.”

Liberty

The secret to customer retention is not complex, as it turns out – at least not to Liberty. “The key to retaining any customer is quite simple,” Mohnacheff says. “Keep the communication lines open and show the customer you appreciate their business and that you are there to help them achieve their financial goals.”

Pepper

Having come from a mortgage broking background, Rehayem says brokers should conduct a client review every 12 months to find out how the business is trading, whether pressures are mounting or changing, and what their plans are for future growth.

“It shouldn’t be a sales call. This is a ‘how are you, how is everything travelling?’ call. ‘How is the lender that I recommended treating you?’

“I believe that every loan should be administered or carried out in the same manner. What’s in the best interest of the customer, what’s the best possible product suited to the customer, how thorough is your questioning with regard to the customer’s understanding of the new debt they’re taking on board, and how it will impact their lives?”

Conclusion

There’s no doubt the coming years will bring change. It seems unlikely that any sector or subsector within financial services will remain untouched by the royal commission. Nonetheless, lenders and aggregators are still eager to work alongside brokers to help them provide the services and solutions SMEs so desperately need. With the right products and attitude, existing and new SMEs alike should be able to flourish well into the future.

.PNG)