Experts explain the broader implications of the tax cuts

For many Australians, the Stage 3 tax cuts primarily meant an increase in net wages, providing financial relief amid ongoing cost-of-living pressures.

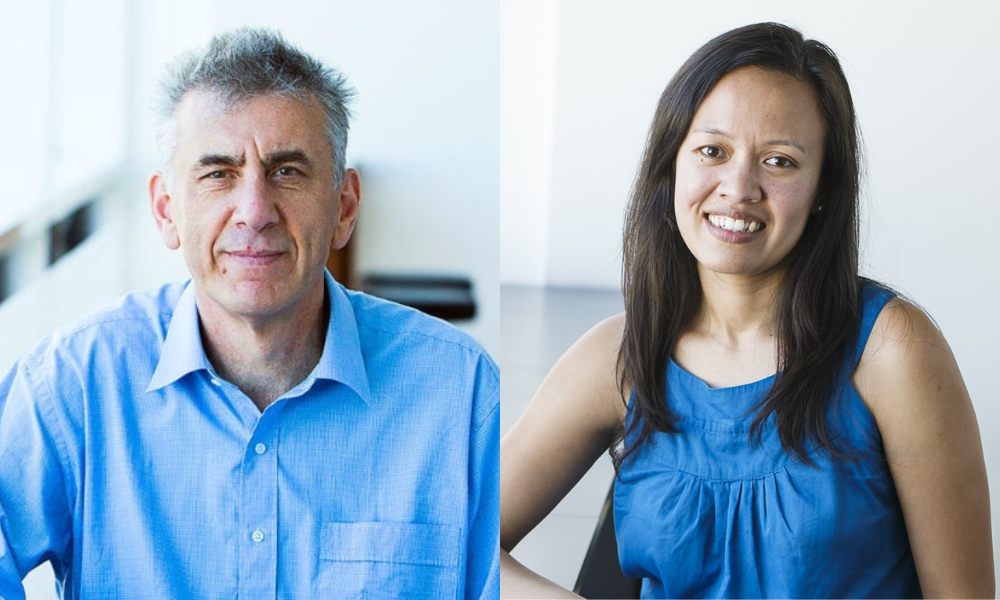

“Tax cut relief touches all taxpayers, providing them with more income to manage during this cost-of-living crisis,” said associate professor Dale Boccabella (pictured above left), a tax expert from UNSW Business School. “The critical elements of the Stage 3 tax cuts involve reducing tax rates for income brackets and adjusting the taxable income bands to which these rates apply.”

According to Boccabella, an individual with a taxable income of $100,000 will be $2,180 better off due to the Stage 3 tax cuts, which equates to about $42 per week.

However, the broader implications of these cuts extend beyond the immediate boost to take-home pay, raising questions about their long-term effects on the economy.

Nalini Prasad (pictured above right) from the School of Economics at UNSW Business School, explained that the impact on inflation and the cash rate largely depends on how taxpayers use their increased take-home pay.

“If individuals decide to spend most of the increase in their income from the tax cut, then this will be inflationary and put upward pressure on the cash rate,” Prasad said. “This option is concerning as the current period shows that the economy is struggling to produce as many goods as people demand.”

Alternatively, if most individuals decide to save money from tax cuts by increasing their mortgage repayments, then the effect on inflation will be muted.

If the economy experiences higher inflation due to increased spending from tax cut savings, Prasad expects small increases in economic growth. However, she expressed concern for the services sector, where higher inflation tends to lead to higher wages, significantly impacting businesses with high labour costs.

The Stage 3 tax cuts also offer several long-term benefits for taxpayers and the broader economy. Addressing bracket creep is a key advantage. Bracket creep occurs when inflation pushes people into higher tax brackets, causing them to pay more tax even though their real income has not increased.

“The cuts help taxpayers by adjusting for inflation, so they aren’t unfairly pushed into higher tax brackets just because their nominal income has gone up,” Boccabella said.

He suggested a better approach would be to use an objective method like indexing to adjust tax brackets automatically.

The tax cuts also aim to maintain the tax system’s progressivity, ensuring that higher earners continue to pay a greater percentage of their income in taxes compared to lower earners.

“Compared to the Coalition’s Stage 3 proposal, which had a 30% rate between $45,000 and $200,000, the current system maintains progressivity, with higher earners paying a higher percentage of their income in taxes,” Boccabella said. “A progressive tax system can be viewed as more effective for wealth redistribution and achieving social equity.”

Prasad noted that while tax cuts can stimulate investment and growth in the long term, their success depends on resolving current inflation issues and increasing the economy’s productive capacity.

“In the longer term, if the economy builds more productive capacity, then I’d expect more investment to occur from the tax cuts, but we need to resolve the inflationary problems in the short-term first,” she said.

“For the economy to benefit fully from these tax cuts, productive capacity needs to be increased. Otherwise, the immediate effect might be limited to higher inflation without significant gains in economic growth.”

From a tax perspective, Boccabella pointed out that the cuts invariably lead to reduced government revenue, which can affect the budget deficit or surplus.

“Without corresponding reductions in government spending or increases in other forms of revenue, the budget deficit may widen,” he said. “This impact could constrain the government’s ability to fund public services and social programs in the long run.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.