Merging broker expertise and comparison sites' lead-generating potential is the way of future, says pioneer Julian Mattatia

The managing director of moneyQuest and founder of RatesOnline.com.au talks about why technology is making brokers more important than ever.

Can you remember a time before technology spelled the end of broking?

Can you remember a time before technology spelled the end of broking?

For years lenders have been warning brokers that they’ll soon be bypassed by clients on websites and, more recently, mobiles, or made irrelevant by comparison sites. Yet, all the while, the percentage of home loans going through brokers has risen – to 51.5% in September 2014. Evidently, the banking futurists were wrong, and to explain why they were wrong you need to turn to the tech pioneers within the broking community – pioneers like Julian Mattatia.

Mattatia has been based at moneyQuest’s Melbourne headquarters for five years now, as managing director, but his association with the city goes much further back. In fact he was born and bred in Melbourne, and stayed there throughout his time at RatesOnline.com.au as founder and managing director.

And he had an entrepreneurial streak that many brokers will recognise: he started working after school when he was 14 years and nine months, the legal minimum age for door-to-door sales, and continued working while pursuing a degree in Business Marketing at Monash University. The creativity of the course enthralled him: “I just love idea generation and looking for ways to grow, and marketing appealed to me.”

Melbourne might have made Mattatia an avid businessman, but his interest in technology was formed 10,500 miles away, in the excitement of London’s dot-com-bubble era. There he spent two years at the London office of US advertising agency Organic Inc.

“I had a few roles,” he says. “I started off in media buying and moved into media strategy, and from there … there were opportunities to pitch new business, and that was a lot of fun, especially the opportunity to pitch in Paris to Hennessy and other large brands.”

Rates Online wasn’t founded until 2007, five years after Mattatia returned to Melbourne, but the intervening years were vital in introducing Mattatia to the broking community. Working for RealEstate.com.au, he was meeting a large number of expanding brokerage firms. “The common theme amongst all the businesses were leads, leads, leads, so I guess after a few lunches … [we thought] ‘we’ve got this idea, so let’s see how we can monetise it’.”

Mattatia was also looking for his own first home at the time, and wasn’t impressed by the then main comparison sites, Rate City and InfoChoice. “I didn’t feel they gave the client enough information at the time – that, combined with the one thing that brokers always want, which is new business.”

Leads are the core of Rates Online’s business; customers compare loans and then their enquiries and details are sold to brokers. In comparison, the normal business model of comparison sites is based on lenders paying per click or per conversion.

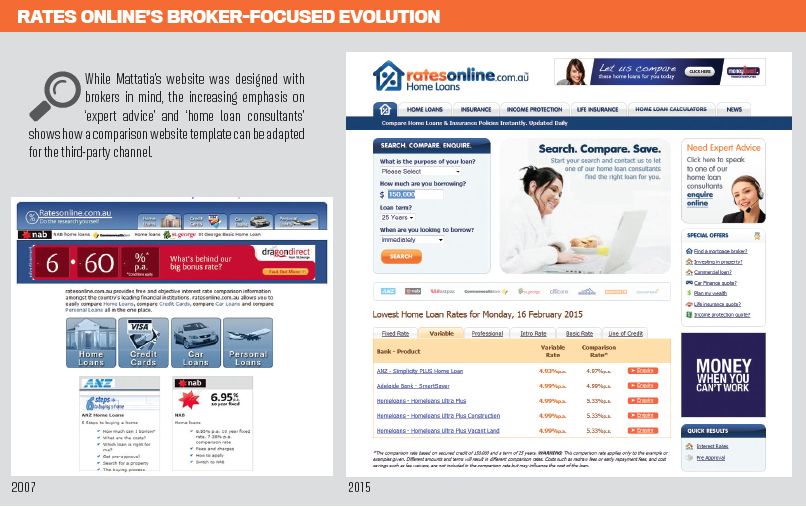

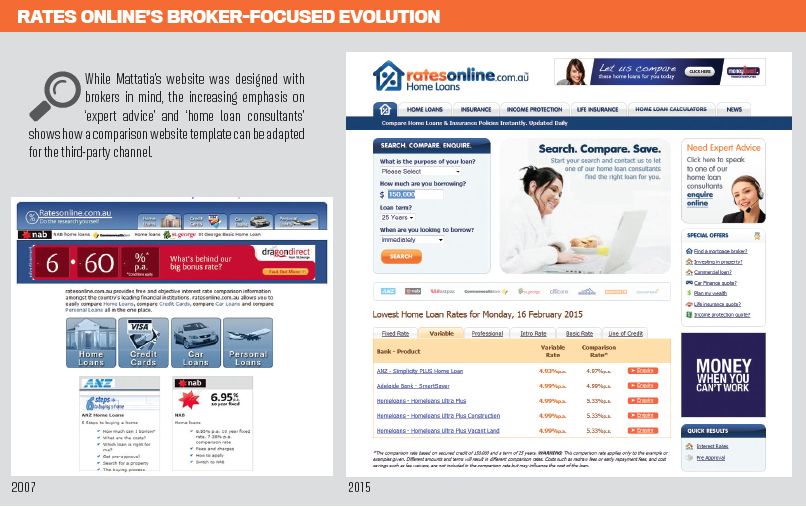

While the business case for Rates Online seemed simple to Mattatia, the process of building the website certainly wasn’t, he recalls: “To be honest, I didn’t know a lot about web development, and when we launched the first version of Rates Online it was quite an experience. We spent, in my eyes, a lot of money and found that the website itself really didn’t do what we needed. We had the site rebuilt by someone who specialised in data-driven websites.”

You can find the never-to-be first incarnation of Rates Online preserved on their current platform. Interestingly, their original slogan (now removed) was ‘Ratesonline.com.au [:] Do the research yourself’.

So did Mattatia think his website changed – or even threatened – the value proposition of the brokers it worked with? He doesn’t believe so. “Over the last few years, of all the leads we’ve generated, the comparison website is a conduit to generate a lead,” he says. “At the end of the day the broker is still there to facilitate and give the right advice on the right product. That’s it in a nutshell.”

In fact, comparison sites, he argues, make the role of the broker even more important. “We see it all the time: the consumer will come and ask about a particular bank product, and when they sit down with the broker, in many instances, once the broker asks and delves into that person’s personal situation they realise that may not be the right product.”

Rates Online, like other comparison sites, ranks mortgages primarily on the cheapest available. Furthermore, Mattatia reckons those enquiring through Rates Online are exactly the sort of “time-poor people” who most need a broker’s services.

“It’s a general mix … [ranging from] doctors, who are busy and they want a broker to facilitate and do everything for them, to first home buyers, who are not experienced and need their hand held for them. I will say, typically though, that those who come through the comparison site are more price sensitive, so rates are generally the initial conversation the client wants to have, but as a broker you can quickly make the client understand that rates don’t necessarily make the right product.”

Evidently, for Mattatia, brokers still come first. Rates Online is now part of branded-aggregator moneyQuest, which was founded by Ross Begley, also the co-founder of Choice Aggregation. In fact, moneyQuest was originally one of Mattatia’s clients,then in 2009 the brokerage acquired Rates Online and Mattatia became co-owner and managing director. moneyQuest-affiliated brokers get leads from the website, although with 1,350 leads a month some are still sold to other brokers. Mattatia’s role has shifted from simply providing leads to promoting best practice across the whole broking process.

That doesn’t mean he’s lost faith in the impact of technology. Far from it. moneyQuest’s diversification strategy heavily utilises its members’ databases. To grow asset finance “databases are part of a broker’s assets,” Mattatia says. “We spend time dissecting their databases to ensure they maximise opportunities and income. For example, if a database has 15 doctors we then look at how to diversify product from just the home loans into asset finance; for example, financing medical equipment, X-ray machines, etc.”

Mattatia is also enthusiastic about moneyQuest’s new ‘dashboard’ that provides brokers with real-time information about their own businesses, which is a huge improvement on a rarely updated spreadsheet, he adds.

Mattatia is still pushing the limits of technology and its possibilities for changing brokers’ businesses for the better. But he’s adamant that the broker and the face-to-face discussion remain core to the broker proposition:

“I don’t think Australians are quite ready to deal [just] over the phone. We’ve trialled it; we’ve trialled generating leads centrally and trying to facilitate a transaction through a call centre, and it has nowhere near the same conversion rates as going face-to-face and building a rapport with a client … it’s one of the largest decisions a consumer makes and Australians are still largely face-to-face.”

Can you remember a time before technology spelled the end of broking?

Can you remember a time before technology spelled the end of broking?For years lenders have been warning brokers that they’ll soon be bypassed by clients on websites and, more recently, mobiles, or made irrelevant by comparison sites. Yet, all the while, the percentage of home loans going through brokers has risen – to 51.5% in September 2014. Evidently, the banking futurists were wrong, and to explain why they were wrong you need to turn to the tech pioneers within the broking community – pioneers like Julian Mattatia.

Mattatia has been based at moneyQuest’s Melbourne headquarters for five years now, as managing director, but his association with the city goes much further back. In fact he was born and bred in Melbourne, and stayed there throughout his time at RatesOnline.com.au as founder and managing director.

And he had an entrepreneurial streak that many brokers will recognise: he started working after school when he was 14 years and nine months, the legal minimum age for door-to-door sales, and continued working while pursuing a degree in Business Marketing at Monash University. The creativity of the course enthralled him: “I just love idea generation and looking for ways to grow, and marketing appealed to me.”

Melbourne might have made Mattatia an avid businessman, but his interest in technology was formed 10,500 miles away, in the excitement of London’s dot-com-bubble era. There he spent two years at the London office of US advertising agency Organic Inc.

“I had a few roles,” he says. “I started off in media buying and moved into media strategy, and from there … there were opportunities to pitch new business, and that was a lot of fun, especially the opportunity to pitch in Paris to Hennessy and other large brands.”

Rates Online wasn’t founded until 2007, five years after Mattatia returned to Melbourne, but the intervening years were vital in introducing Mattatia to the broking community. Working for RealEstate.com.au, he was meeting a large number of expanding brokerage firms. “The common theme amongst all the businesses were leads, leads, leads, so I guess after a few lunches … [we thought] ‘we’ve got this idea, so let’s see how we can monetise it’.”

Mattatia was also looking for his own first home at the time, and wasn’t impressed by the then main comparison sites, Rate City and InfoChoice. “I didn’t feel they gave the client enough information at the time – that, combined with the one thing that brokers always want, which is new business.”

Digital marketing: What you could do, and what you should do

Mattatia might have built his career through a website, but he warns brokers it may not be the best use of their time.

"What makes a successful broker? The answer is activity; they need to be active seeing their clients; active getting referral partners. They don't need to be spending time writing content for their website, writing content for their email, designing email templates. That's where we as a nationally branded aggregator come in. We do many things that, yes, you could be doing but you're not necessarily a professional at. You're a professional at giving home loan advice, seeing referral partners and building relationships.

Mattatia might have built his career through a website, but he warns brokers it may not be the best use of their time.

"What makes a successful broker? The answer is activity; they need to be active seeing their clients; active getting referral partners. They don't need to be spending time writing content for their website, writing content for their email, designing email templates. That's where we as a nationally branded aggregator come in. We do many things that, yes, you could be doing but you're not necessarily a professional at. You're a professional at giving home loan advice, seeing referral partners and building relationships.

Leads are the core of Rates Online’s business; customers compare loans and then their enquiries and details are sold to brokers. In comparison, the normal business model of comparison sites is based on lenders paying per click or per conversion.

While the business case for Rates Online seemed simple to Mattatia, the process of building the website certainly wasn’t, he recalls: “To be honest, I didn’t know a lot about web development, and when we launched the first version of Rates Online it was quite an experience. We spent, in my eyes, a lot of money and found that the website itself really didn’t do what we needed. We had the site rebuilt by someone who specialised in data-driven websites.”

You can find the never-to-be first incarnation of Rates Online preserved on their current platform. Interestingly, their original slogan (now removed) was ‘Ratesonline.com.au [:] Do the research yourself’.

So did Mattatia think his website changed – or even threatened – the value proposition of the brokers it worked with? He doesn’t believe so. “Over the last few years, of all the leads we’ve generated, the comparison website is a conduit to generate a lead,” he says. “At the end of the day the broker is still there to facilitate and give the right advice on the right product. That’s it in a nutshell.”

In fact, comparison sites, he argues, make the role of the broker even more important. “We see it all the time: the consumer will come and ask about a particular bank product, and when they sit down with the broker, in many instances, once the broker asks and delves into that person’s personal situation they realise that may not be the right product.”

Rates Online, like other comparison sites, ranks mortgages primarily on the cheapest available. Furthermore, Mattatia reckons those enquiring through Rates Online are exactly the sort of “time-poor people” who most need a broker’s services.

“It’s a general mix … [ranging from] doctors, who are busy and they want a broker to facilitate and do everything for them, to first home buyers, who are not experienced and need their hand held for them. I will say, typically though, that those who come through the comparison site are more price sensitive, so rates are generally the initial conversation the client wants to have, but as a broker you can quickly make the client understand that rates don’t necessarily make the right product.”

Evidently, for Mattatia, brokers still come first. Rates Online is now part of branded-aggregator moneyQuest, which was founded by Ross Begley, also the co-founder of Choice Aggregation. In fact, moneyQuest was originally one of Mattatia’s clients,then in 2009 the brokerage acquired Rates Online and Mattatia became co-owner and managing director. moneyQuest-affiliated brokers get leads from the website, although with 1,350 leads a month some are still sold to other brokers. Mattatia’s role has shifted from simply providing leads to promoting best practice across the whole broking process.

That doesn’t mean he’s lost faith in the impact of technology. Far from it. moneyQuest’s diversification strategy heavily utilises its members’ databases. To grow asset finance “databases are part of a broker’s assets,” Mattatia says. “We spend time dissecting their databases to ensure they maximise opportunities and income. For example, if a database has 15 doctors we then look at how to diversify product from just the home loans into asset finance; for example, financing medical equipment, X-ray machines, etc.”

Mattatia is also enthusiastic about moneyQuest’s new ‘dashboard’ that provides brokers with real-time information about their own businesses, which is a huge improvement on a rarely updated spreadsheet, he adds.

Mattatia is still pushing the limits of technology and its possibilities for changing brokers’ businesses for the better. But he’s adamant that the broker and the face-to-face discussion remain core to the broker proposition:

“I don’t think Australians are quite ready to deal [just] over the phone. We’ve trialled it; we’ve trialled generating leads centrally and trying to facilitate a transaction through a call centre, and it has nowhere near the same conversion rates as going face-to-face and building a rapport with a client … it’s one of the largest decisions a consumer makes and Australians are still largely face-to-face.”