Customer-owned banks shine despite market challenges

Australians are starting to feel the pinch of the Reserve Bank of Australia’s campaign to bring inflation back down to an acceptable level.

With consecutive monthly increases to the official cash rate since May 2022, borrowers are struggling to cope with much higher mortgage repayments as interest rates have jumped from sub-2% to beyond 6% in some cases. There are also thousands of fixed rate loan customers set to roll off very low rates onto higher variable rates over the next 12 to 18 months.

Meanwhile, homeowners are dealing with cost-of-living increases, wages growth not keeping pace with inflation, and declining property values. Those in the market to buy a house can’t borrow as much as previously due to reduced borrowing capacity.

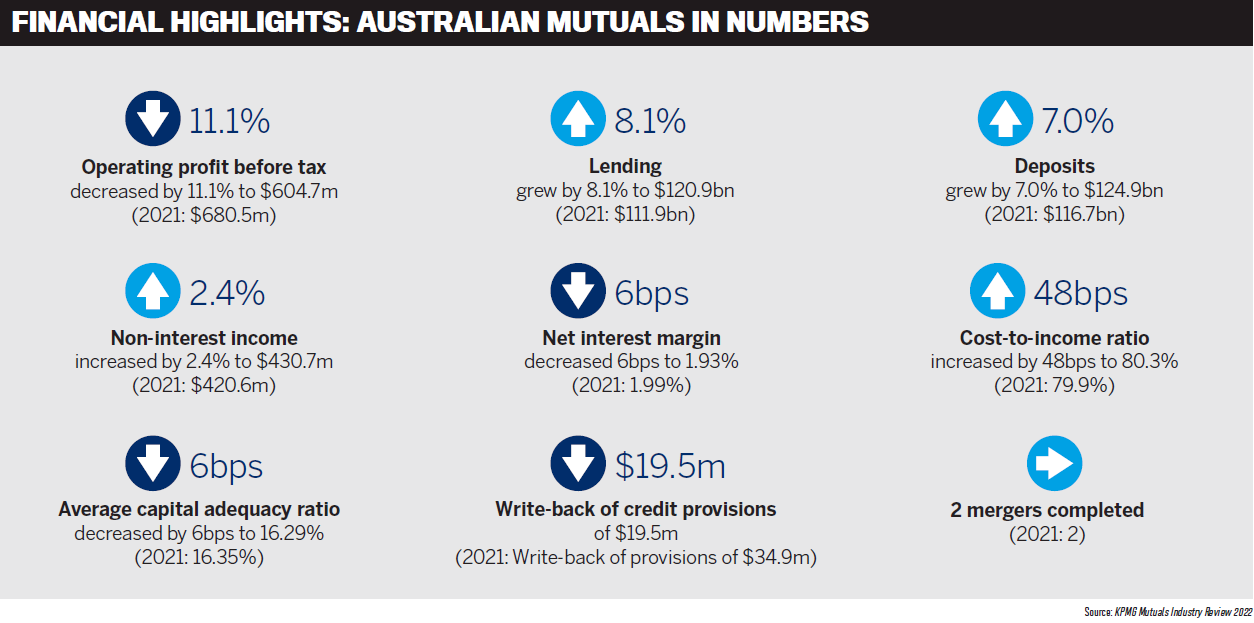

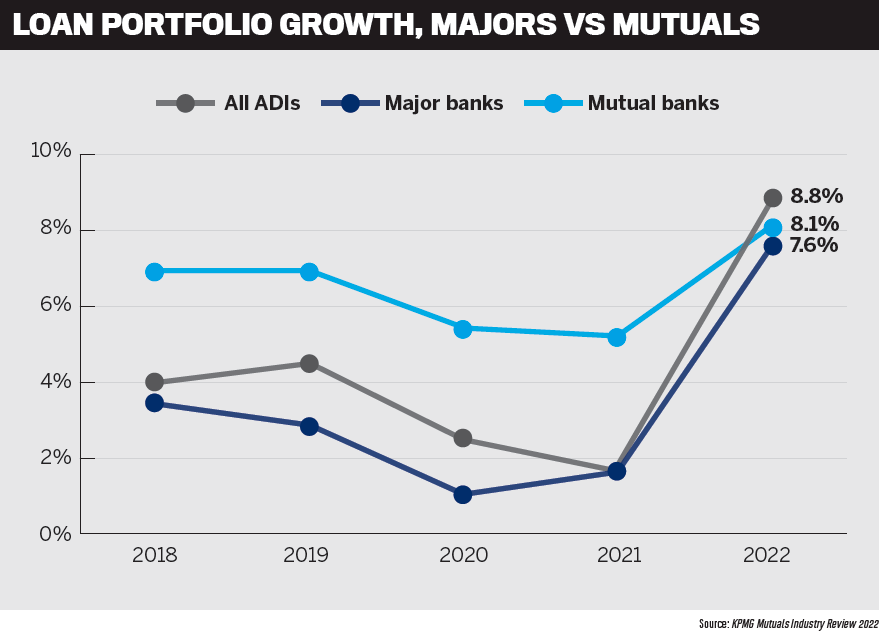

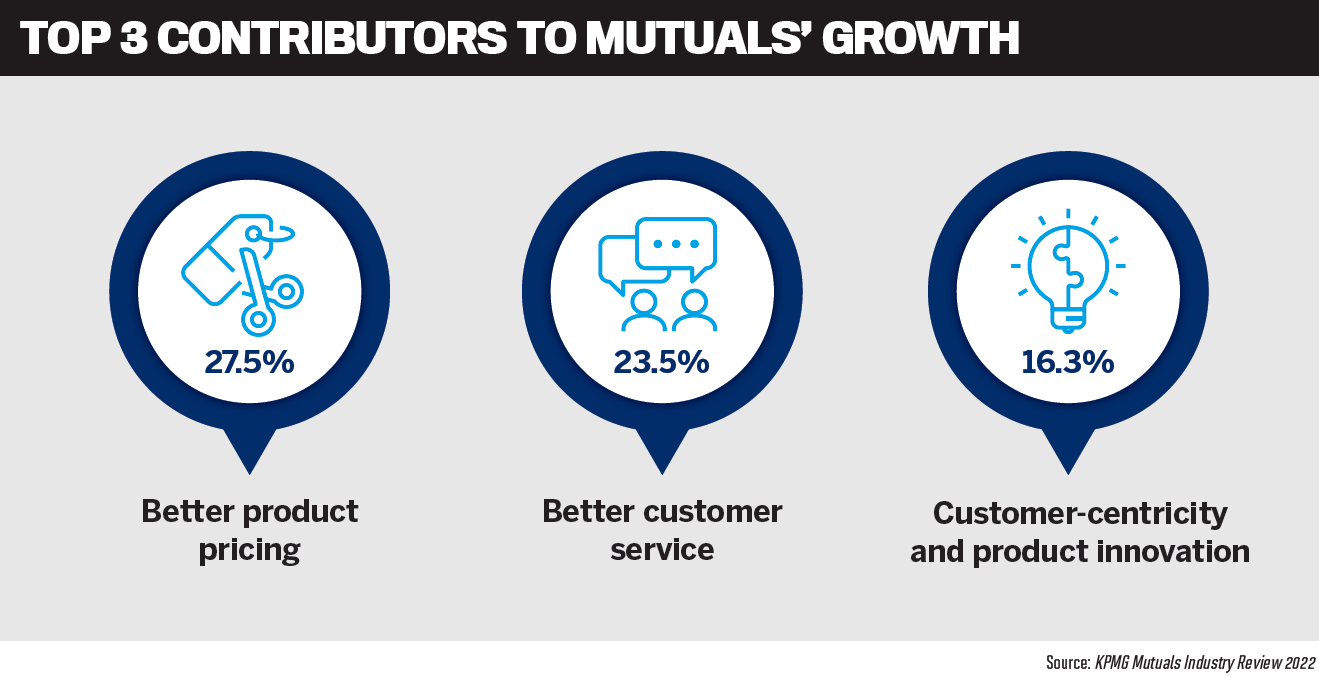

But amid all the doom and gloom, customer-owned banks have risen to the challenge, posting a combined 8.1% boost in lending growth in 2022 compared to the major banks’ 7.6% growth, according to KPMG’s Mutuals Industry Review 2022 report.

Such growth in an increasingly competitive market is testament to customer-owned banks’ strong relationships with brokers and their investment in that channel, their dedication to customer service and their ongoing efforts to employ digital tools and technology to improve end-to-end loan processes.

MPA once again invited key third party representatives from leading customer-owned banks Great Southern Bank, Heritage Bank, Newcastle Permanent, Teachers Mutual Bank Limited, Bank Australia, Beyond Bank, Gateway Bank and P&N Bank (including bcu) to take part in its annual roundtable, held at Cafe Sydney, to discuss the lending environment and broker networks.

Sydney brokers Leslie Smith (pictured below) of Dollars and Sense Finance and Jodie Cullen of Mortgage Choice Penshurst also joined the conversation to share their perspectives.

Q: As we embark on a new year in a changing economic environment, what stands out as the major successes and challenges for customer-owned banks over the last 12 months?

Newcastle Permanent head of digital customer experience and innovation Simon Burt said the big challenge for customer-owned banks had been navigating the changing interest rate environment.

Newcastle Permanent had been able to grow its loan books during a period when fixed rates became the norm, he said. “We were writing more than half of our loans as fixed rates, and we did that competitively and successfully over the last two years. Of course that creates a new challenge for this year as those fixed periods start to roll off.”

The bank also had to focus on competing in a sector that became more refinance focused as the property market started to soften.

“To continue to grow our loan books in that environment is a big win and a great achieve-ment for all of us,” Burt said. “As mutuals, what we really do is try and win business not off each other but from the major banks. So this year, with so many customers rolling off fixed rates in the market, it’s a big opportunity for us to win in that refinance game as people are coming off and looking for something else.”

Mathew Patterson (pictured below), head of broker partner-ships at Great Southern Bank, said one of its major successes was staying focused on “our purpose of helping more Australians own their own home”.

While consecutive increases in the RBA cash rate made it more challenging for first home buyers, Patterson said the bank’s focus on its purpose continued to support more Australians with homeownership, whether they were first home buyers, investors or just looking to refinance. “Our home loan propo-sition has been consistently competitive in the market, and we support around 2% of all Australian first home buyers to purchase a home, which is significantly higher than our overall market share.”

Challenges remained on the regulatory side: the high and rising cost of regulation made it increasingly difficult for the smaller mutuals to operate and invest in themselves.

“There is a risk that we will lose some of the smaller mutuals and customer-owned banks that local communities benefit from by not having scale to absorb some of the regulatory costs and not being able to take advantage of some of the cheaper funding sources,” said Patterson.

Customer-owned banks are an important community asset as they reinvest into local communities through employment and provide an invaluable service, he said.

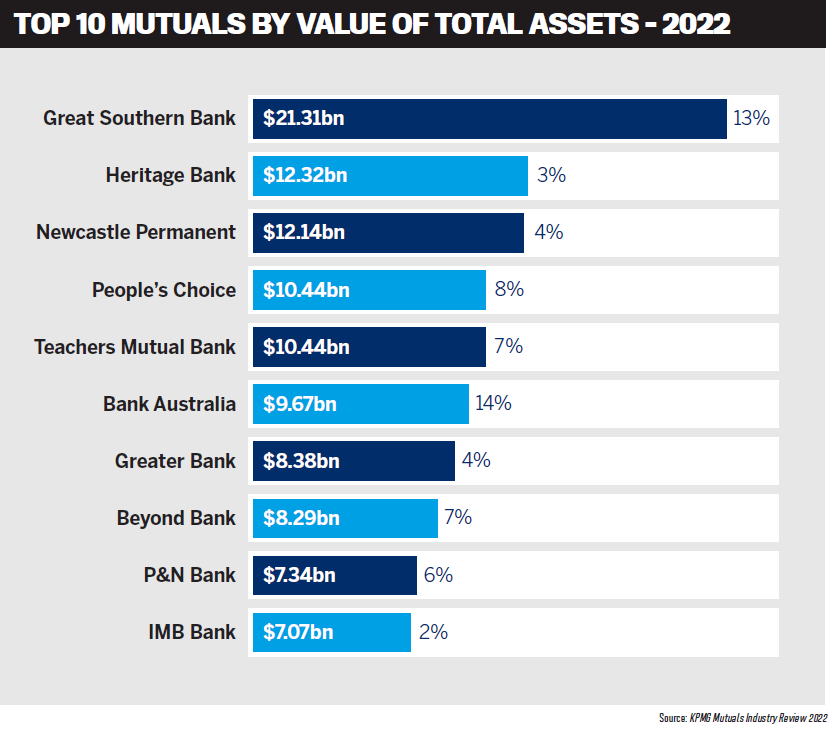

“Collectively, customer-owned banks are the fifth-largest retail bank in Australia with assets of over $150bn. We control more than 10% of retail deposits, and more than four and a half million customers bank with us.”

Teachers Mutual Bank Limited (TMBL) head of third party distribution Mark Middleton (pictured below) said it had been a successful year for all customer-owned banks, especially those participating in the First Home Buyers Guarantee scheme.

“The First Home Buyers Guarantee assists not only brokers but their clients and brings new clients for us into the market,” he said. “That’s been a big winner, but not all financial institutions, including mutuals, participate in that particular program.”

Thirty-eight lenders are currently participating, including two of the big four banks; he said the other two big banks would be included in June 2023. “It’s been a major contributor for us as an organisation, whilst also lifting our profile as a sector.”

Middleton said the other success for TMBL was gaining B Corp Certification after a review of the bank’s organisational values with respect to sustainability, ethical behaviour and accountability.

“To my understanding, there are nine banks in Australia that have gained certification as a B Corp. This certification is extremely difficult to initially attain and is reviewed for renewal on a regular basis to ensure the bank’s adherence to their stringent requirements,” Middleton said. “I know that we have it [B Corp], and so does Beyond Bank.”

He added that TMBL had also been rated by Ethisphere as one of the world’s most ethical banks for the last 10 years.

In terms of challenges, RBA Governor Philip Lowe’s past statement outlining that interest rates wouldn’t rise until 2024 has had impacts on consumers and financial markets.

“We’ve seen 10 interest rate increases during that time,” said Middleton. “In addition to natural disasters across the country, there have been economic outcomes that have impacted the cost of living for all Australians. The next 12 months are going to be difficult.

“Families’ weekly shopping baskets are going from $200 a week to $300 a week, and yet employees are struggling to get a 3% pay rise. From this perspective, it’s going to be difficult for many families to cover the interest rate increases, in addition to increasing day-to-day living costs.”

Middleton said that fortunately, most banks at the roundtable could say their arrears and hardships hadn’t increased dramatically yet.

Adam Norman (pictured below), chief marketing officer at Gateway Bank, said it had been a challenging market, but Gateway had maintained high levels of customer satisfaction – over 84%.

“Those are levels you see across the customer-owned sector,” he said. “I think that’s in part how we, as a sector, stay close to our customers and stay close to our broker partners. For us, that’s been a big success.”

The first home buyers sector had really helped Gateway, Norman said, and the bank was “delighted to really outperform our share” in that segment.

He said it was important for customer-owned banks to focus on finding those niches in the market that were underserviced or not serviced by the bigger banks. “We’ve had an environmental focus at Gateway, and we’re seeing some really good promising growth with customers looking for home loans that recognise energy-efficient properties. We have been recognised by Mozo for this.”

Norman said the rate environment was challenging, and it was also increasingly complex for consumers, given the enhanced competition due to cashbacks. “The question is, how does that flow to brokers with best interests duty? A couple of thousand dollars is that better than 25 points? This is the complexity that we try and work through with our broker partners.”

Beyond Bank head of third party Darren McLeod (pictured below) said the sector had a lot to be proud of. “When Forbes released their annual World’s Best Bank awards for 2022, the top four spots were all occupied by customer-owned banks,” he said. “Beyond Bank was named in the top spot, and it was closely followed by Heritage Bank, Greater Bank and Newcastle Permanent, so that’s a great reflection of how the sector’s going.”

Customer-owned banks also fared pretty well in the Roy Morgan customer satisfaction awards, McLeod said. Most of the top positions in each sector overall had a 91.6 customer satisfaction rate as of June 2022, while the majors were at 77.4.

Beyond Bank recertified as a B Corp with a 50% improvement on its certification in 2017, McLeod said, adding that this was only possible because of the work it did for its customers and local communities and the funding it put back into these communities.

“That speaks for itself on why we’re doing do so well,” McLeod said, “because customers are happy with what we’re doing, compared to who we’re trying to complete with.”

He agreed that the customer-owned banks shared the same challenges: “I think competing on interest rates, we don’t do cash-back, so that’s something we’ve got to try and combat as well – to get into that refinance market and keep up with technology.”

McLeod said cost of living was also a huge issue, and Beyond Bank was assisting customers coming off low fixed rates, setting up a special unit to educate clients. “Customers go to that unit, and we go through the options for customers – some might be in hardship, some might not be; it’s about giving them an option.”

Gerald Allan (pictured below), state manager for NSW/ACT/Tas/SA at Heritage Bank, believed the biggest challenge was uncertainty over the future economic environment. “We’ve already discussed rising interest rates and inflation, but I think the impacts of that are yet to be seen,” he said.

“But as mutuals start to play a big part in the industry, especially with us at Heritage Bank merging with PCCU [People’s Choice Credit Union], we’ll be looking to shed a lot more light on that for customers.”

Allan said Heritage Bank wanted to educate customers about the advantages of banking with a mutual, especially when one became a larger entity through a merger.

P&N Bank and bcu general manager broker Kaine Adamson (pictured below) noted that the latest MFAA Industry Intelligence Service report showed that the share of broker-originated loans to customer-owned banks was at an all-time high.

“Roy Morgan’s consumer banking report shows that the sector continues to surpass the major banks in terms of customer satisfaction, which suggests that brokers who refer their clients to customer-owned banks are going to be a lot happier in the long run,” Adamson said. “MFAA data also indicates that major banks are losing market share in broker loans.” He added that “brokers play a vital role in promoting consumer choice and fostering competition”.

Adamson said the mutuals weren’t on all aggregator panels, and brokers should add them to their list as a genuine alternative to major banks. “At the end of the day, we aren’t trying to maximise profits to benefit third party shareholders, and we act in our brokers’ best interests for the long term.”

Giving a broker’s point of view, Jodie Cullen (pictured below), franchisee at Mortgage Choice Penshurst, said brokers didn’t have the same channel conflict with customer-owned banks as with the bigger banks. “So that is something I take into consideration when I’m discussing options with a customer.”

Vincent Lewis (pictured below), national manager partnerships at Bank Australia, said a lot of the business coming to the mutuals had been due to the hard work they had done. “We’ve been industrious, and we’ve been the beneficiary of significant growth,” he said. “We do have a unique position collectively and individually. We emphasise in every conversation about our credentials and in particular about our Clean Energy Home Loans and our B-Corp Certification. The reputation that the mutual sectors have built is significant, and it’s something we’re all very proud of.”

Lewis said one of the biggest challenges at Bank Australia was its treasury department becoming much more involved in the business. “They are driving a lot of our decision-making now and controlling interest rate movements, which they haven’t historically done. That’s I guess fundamentally a consequence of the fixed rate proposition. It does add another level of complexity that we’ve got to battle with, and sometimes the explanations aren’t as clear as I’d like when I’m trying to explain decisions that have affected brokers.”

Bank Australia had offered a fixed rate with 100% offset, which created $1.8bn in fixed rate lending over the last two years, but the bank has now had to reduce that offset level.

Lewis said he was a great proponent of the mutuals sector. “I always promote us as collective rather than us as an individual because I think we’re stronger collectively than we are individually, and we all get the benefits as a consequence.”

Burt (pictured below) agreed, saying it was an important point that none of the mutuals were competing against each other. “That’s why we’re all happy to sit here and talk, because we’re all competing against the big guys.”

Middleton added that 10 years ago, many of the mutuals at the roundtable weren’t in the broker channel. “Each of us has collabo-rated with others to assist in expanding mutual banks’ capabilities via this distribution channel, whilst also providing new alter-natives for brokers and aggregators.”

He agreed with Cullen that the mutuals weren’t a source of channel conflict. “Brokers are an integral part of the mutual bank sector and our individual businesses,” he said.

“Brokers enable us to lift awareness of our offerings, and none of the mutuals would have achieved the level of growth we have experienced without the involvement of the broker marketplace.”

Burt said brokers’ market share had grown significantly, and the mutual banks had helped support that growth, expanding the broker proposition of being able to find the right loan and bank for the customer – “that customer may not have found us without their broker”, he said.

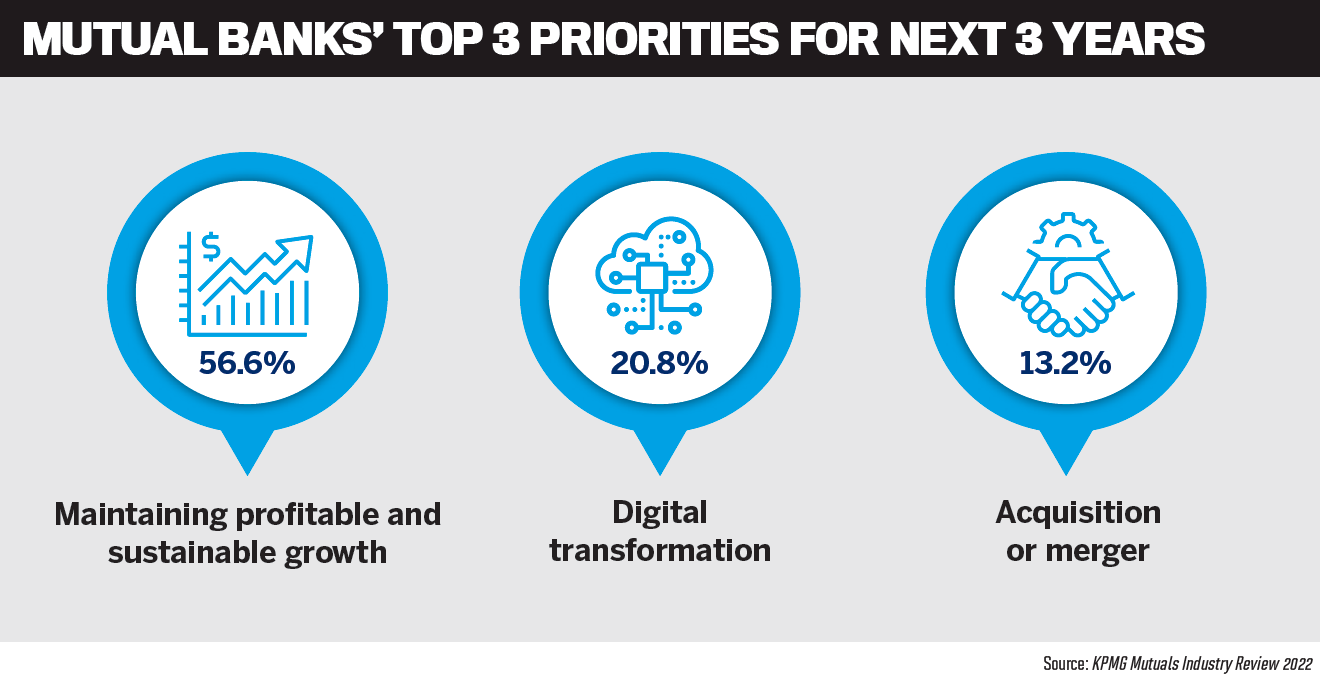

Q: Customer-owned banks enjoyed loan portfolio growth of 8.1% in 2022 (compared to 5.2% in 2021). What’s driving this growth? How are you competing with major banks during a surge in refinancing?

While the KPMG Mutuals Industry Review 2022 revealed loan portfolio growth of 8.1%, a number of the mutuals exceeded that, with APRA statistics showing growth over the 12 months to December 2022 of 11% for Bank Australia, 8.4% for Newcastle Permanent, 9.7% for TMBL, 15% for P&N Bank and 15.8% for Beyond Bank.

McLeod said Beyond Bank had enjoyed really good loan growth, with its broker-originated loans growing by 14%.

He said one of his comments at a previous roundtable was that customer-owned banks were the best-kept secret. “Well, the secret’s out now – that’s why we’ve got more share and we’re growing, because we’re all investing in it and putting more resources behind it.”

Brokers and aggregators knew that mutuals were active in the channel and that had helped these banks grow, McLeod said. “We started our broker business, we wrote our first loan in 2016, and now last month we were over 60% of the bank’s new mortgage business. You can see what Beyond Bank’s done but what everyone’s done over the last five years to be where we are now.”

Patterson challenged the notion that mutuals were a best-kept secret. “As I said before, four and a half million customers bank with the sector. From a broker perspective, customers know who we are,” he said. “Everyone knows who the major banks are; that’s an easy sell. I think people underplay how relevant the customer-owned sector is in the market.”

When he joined Great Southern Bank, Patterson said what struck him was the love for the brand shown by customers and brokers and even brokers not on its panel. “Someone has always had a good interaction with the brand at a point in time, and that’s just carried over in terms of what their brand perception is.”

As a sector, the mutuals started from a stronger position because “we put the customer at the centre of all of our decision-making, not shareholders”, Patterson said. “When you put the customer at the centre of your decision-making, you do get better outcomes.”

Agreeing with earlier comments about customer satisfaction scores, he said “we outperform the major banks quite significantly and have done for a while”.

“We are more well known than certainly what a lot of people realise,” Patterson said.

Burt said Newcastle Permanent had been in the broker channel for over 15 years, and originally “we competed largely on price”.

“We had a better price as mutuals, but our processes were sometimes more difficult to navigate for brokers,” he said. “The reality now is you can’t just have one string to your bow; we’ve invested significantly in our broker offerings. You’ve got to have a competitive price, and you’ve got to have the right product and policies. You’ve also got to be in the right place with that product, such as the first home buyer panels.”

Having the right process was also important. Burt said Newcastle Permanent had invested significantly in technology, and focused on both broker and customer experiences, from application through to settlement and beyond. Last year the bank launched Digital Signatures for its end-to-end home loan process – one of the first in market to do so.

“This has been a real game changer, taking days out of the process and essentially removing paper,” Burt said. “We also enabled Digital ID solutions and continued to develop our ApplyOnline offering, focused on helping brokers to get their application right the first time, minimising rework.”

Burt said that Newcastle Permanent had focused on personalised service and providing a good broker experience, which meant having excellent BDMs assisting all the way through to settlement and post-settlement, with welcome calls from customer support teams to customers, “supporting them to get set up on our app”.

The bank was also working on its digital connections “because most of our broker customers aren’t in Newcastle”.

“They’ll never see a branch, so the branch is [mobile] in your pocket,” Burt said. “We’ve invested in a new mobile app that’s simple to use and our customers love it, evidenced by our iOS App Store rating of 4.7, which is equal to or ahead of the major banks and the leader in the mutual sector.

“For us, digital is about retention – if a customer transacts with you digitally, daily, weekly, they feel like they’re part of the bank. And where required our people are always there to support them virtually, and it’s easy, using technology, including leveraging AI, to find help when you need it. If you do that well, you’ve got a better chance of retaining them when the time comes to review their loan, such as when a fixed rate rolls.”

Norman echoed Burt’s comments, saying Gateway Bank had experienced third party growth over the last 18 months to two years. “We’ve made a concerted effort to really engage with brokers to understand what was wrong with the process, or what we could improve,” he said.

While the big banks normally did customer research and journey mapping, Gateway did something similar “from end to end with our broker partners to understand where the pain points were”.

“Then we utilised our workplace and IT teams to get rid of those pain points and provide a seamless process that is up to market.”

Norman referred to McLeod’s earlier point that “we’re all sitting here today because we’re investing in promoting ourselves to the broker market, and we’re supporters of the broker market”.

“I’ve been here for four years,” he said. “We have taken that journey of investing in the brand in the broker channel. My perception going back five or six years, there was an expectation to just chuck the price out there and hope they come.”

Gateway and the rest of the sector were close to their members, Norman said. “I think we’ve taken that ethos and tried to engage with brokers in that way. That’s really the key to what we’re seeing in the last couple of years, blending that personal touch with good-quality technology and process.”

One element of Bank Australia’s success was how it managed its aggregator relationships and kept them to a minimum – at present just four panels, said Lewis. “That’s served us well because we’ve never overstretched the boundaries.”

He said Bank Australia focused on its relationship managers – there were 11 of them, but each had just 150 brokers to worry about. The bank had 7,500 brokers on its books, with about 1,500 brokers who it dealt with on a regular basis.

“Last year there was 17% growth; the previous two years we were over 20% growth per annum. We weren’t out there searching for business; it was coming through.”

As the market changed over the year, it brought new stresses and strains, but Lewis said it was all about “how we manage relationships on an individual basis, and that’s where our success is coming from – it’s that one-on-one”.

Bank Australia prided itself on returning brokers’ calls. “Our industry does it better than most – that just drives that reliability piece, that confidence that we’re there to help,” Lewis said.

Similarly, Patterson said Great Southern Bank did not have or want a huge panel. “The brokers who we have on board, we want to commit to and make sure that we can service,” he said. “We could go and bring other aggregators on panels if we wanted to, but then we risk compromising our overall service proposition.”

Patterson said every bank had a limited capacity – “it could be a thousand deals a day; it could be a hundred deals a day”.

“It’s a bit inauthentic just signing up, throwing out the rate and blowing it up, annoying brokers,” Patterson said. “Sticking to what you can consistently deliver to is one of the real strengths of what we do.”

Middleton described 2022 as a year of two halves: the first six months the banks were all out there writing new business before the increase in interest rates. “The four Ps came into play: people, place, price, promotion. The second half, when rates started moving, that’s been about moving to retention and refinancing.”

Mutuals then had to approach business activity from different angle and ask questions such as: How do we work with our customer bases to ensure that we’re able to provide effective and well-placed products and services? How do we ensure effective retention strategies, which includes working with brokers to achieve the right outcomes for their clients?

Q: Thousands of people are set to roll off low fixed rates over the next 12 to 18 months. How is your bank preparing for the fixed rate cliff, and what conversations should brokers be having with customers?

Adamson said that when it came to competing with the majors, “mortgage brokers and customer-owned banks were founded on the same principles, which was increased competition and acting in a customer’s best interest.”

“When we talk to brokers about our customer value proposition, it’s something that resonates well as our purpose is the same,” he said.

P&N Bank grew its broker book by 31% last year, but Adamson said you couldn’t just be good at acquiring new customers, you had to be good at looking after them too.

“It’s widely reported that some banks charge their customers a loyalty tax whereby they offer less favourable rates to existing customers compared to new customers. We don’t think that’s fair value, so we offer the same rates to both new and existing borrowers. Our aim is to retain customers in the long term by providing consistent value.” Adamson pointed out that historically, fixed rate mortgages had often rolled onto uncompetitive standard variable rates, resulting in repayment shock for customers and significant work for brokers. “After speaking with a lot of brokers, it’s clear that many of them are dedicating significant resources towards repricing. So we thought, how can we solve that problem?” he said.

About half of the loans P&N Bank wrote last year were fixed rate mortgages. The bank looked at the entire portfolio and decided to reprice all existing and new loans onto competitively priced acquisition products once they matured.

“This reduces the burden on brokers, mini-mises repayment shock for customers and maintains customer loyalty in the long term,” Adamson said.

Allan agreed that the refinancing market was huge. “Customers are looking for value, whether that be repricing with their current financial institution or going with someone else.”

He said mutuals were a genuine alternative, and there would be more opportunities as major banks moved away from personalised lending. “This is where Heritage and other mutuals come into their own. To handle all that volume, we’ve invested quite heavily last year in our back end, which has seen our capacity grow by 30%. We’re in a good position to handle the additional volume.”

For Gateway Bank, it’s important to get communications right, Norman said. “If [brokers] know that someone’s facing repayment shock, we want you to talk to us earlier. The sooner you have a chat to us, the sooner we’ll be able to help restructure the loan. It’s about being upfront, being proactive and engaging with our customers.”

Norman anticipated no major increase in loan roll-offs until nine to 12 months’ time. “We’ve got time, but we can’t just sit on our hands,” he said. “We’ve got to make sure when fixed rates roll off, customers are in the best position they can possibly be.”

Middleton debated the definition of a fixed rate cliff. “From an examination of our past loan fundings, we can establish that loan maturity rates will most likely occur over the next 12 to 18 months, rather than the perception that all loans are maturing in the same month. From my perspective, there is a lack of understanding about the fixed rate cliff. It’s not a cliff; it’s a slope or a hill, as it’s not immediate but rather over the next 12 to 18 months as fixed rates mature,” he said.

“It’s all about educating and assisting borrowers on what the potential end repayments will be and their available options that match their individual circumstances.”

He added, “Once the RBA are confident with inflation being under control in the next 12 to 18 months, interest rates will come back to a more affordable repayment level, potentially at what we’ve experienced pre-COVID.”

Burt said Newcastle Permanent was trying to make the fixed rate roll-off process easy for brokers and customers. “Fixed rate rolls shouldn’t be a complex or time-consuming process for a broker and a customer. And at present we’re trying to make sure we’re delivering a really simple process, with both a variable and fixed rate offer,” he said.

“We’re focused on ensuring that the offers are very clear, that they are both competitive offers. That’s taken some significant focus to enhance both our products and process, but the experience will make it worthwhile.”

As a broker, Smith said that when it came to fixed rates she told clients, “These are the party rates, and all parties come to an end”. She advised clients to dial back their spending and focus on paying down the variable portion.

“I share with clients that my first mortgage in 1999 was approximately 6%, and in subsequent years I recall the highest rate being close to 9%, then reducing again. Therefore, rates now aren’t that bad. It’s the economic pressure of inflation increasing the cost of living. Hopefully soon, inflation will be resolved, and things will return to being somewhat normal and affordable.”

Cullen said that in 2020 she was offering her customers five years fixed with Newcastle Permanent at 1.99%. “I had two people take that up; everyone else said, ‘No way; rates are going to go down further’.

“I rang those two customers in January to say, ‘Oh my God – 1.99% for five years! How lucky!’ But after the latest interest rate rise, I have had at least seven phone calls with customers saying, ‘I’m not going to be able to afford my mortgage’. At the time I couldn’t sell the 1.99%.”

Q: Broker question from Leslie Smith: Gateway offers monthly LMI, which I’ve found very helpful for my first home buyers. Is anyone else offering monthly LMI payments or intend to in the future?

Middleton said LMI provider Helia had approached a number of banks, including mutuals, offering monthly LMI. “I think you’ll find there’s a number of mutuals who are reviewing the opportunity. This is evident by Gateway’s early adoption of the opportunity.”

Bank Australia hadn’t been approached by QBE about monthly LMI, Lewis said, but it would certainly look at it. “You would think it’s a very favourable proposition,” he said.

Patterson said there were a number of things happening across the industry. “From a Great Southern Bank perspective, we’ve got a strong focus on first-time buyers and how we support them in the market. Last year, we increased our lending schemes by 6% from the year before, so it’s a core component of our business and talks to our purpose. I think governments are also trying through stamp duty changes. So there’s a lot of options in the market for first home buyers aside from LMI.”

Q: Broker question from Jodie Cullen: What are customer-owned banks doing about retention? Cullen said that with most big banks now, brokers couldn’t get customers to sign a discharge; “they actually have to fill out a discharge online so the bank is alerted that they are refinancing”.

“I got to the day of settlement, and I lost the deal because on the day of settlement the discharging bank rang my customer and offered him the same rate and a cashback to stay with them,” she said.

Adamson said the first question P&N Bank asked brokers was: how can we work together on this? “We’ll work with our brokers and try and match the rate wherever possible, but if we can’t, we know that the broker has to act in their customer’s best interest, which means they might need to help them refinance. We’re not in the space of competing with brokers, because at the end of the day they’re our customers too.”

Customer-owned banks did not have the same distribution as the big four, Adamson said. “It’s pointless that some banks are offering customers three grand to stay, because all they do is take that $3,000 and they’ll refinance again,” he said. “For us, we’re not going play that game. We do offer cash back for new business, but again, that’s why we try to maintain fair and consistent pricing for both new and existing customers.”

This had helped P&N Bank grow its book by 31%.

“We’re in a partnership with mortgage brokers,” Adamson said. “We don’t play games by offering last-minute incentives or better rates to undercut a broker; we will put out best foot forward up front and keep things transparent.”

Beyond Bank encouraged brokers to contact it for retention, McLeod said. “Number one, we want to keep the customer, so we say, give us the opportunity first, and we’re very aggressive on potentially matching whatever’s out in the market. So we encourage brokers to come to us first, and we’ll try and match it. We have a very good success rate there,” he said.

“It’s all about have an early, quality conversation with the customer to fully explain all their options.”

Cullen said she did not want to rewrite her book. “I’m happy to get the customer the lowest rate they could possibly get. I want new customers – I don’t want to rewrite my book; I want to grow my book,” she said.

“I’m not into refinancing customers every two years. I go back to their lender every time, send an email. But if they see a bank advertised on TV and their new clients are getting a lower rate than they will get, they’ll say ‘I’m ready to go’. So you really do need to give the customer what a new customer gets.”

McLeod said it was a lot more cost-effective to keep that customer in the current market than to go and get a new one.

In Middleton’s view, it came back to Cullen’s earlier comment about channel conflict, “We’re not here to compete against yourselves; we’re actually a partnership,” he said. “We’re here to work with you. If you’ve got a client and you want the best rate, ring us.”

Allan said all the mutuals understood how important their relationships with brokers were. “For Heritage and the other customer-owned banks it’s all about creating partnerships with our brokers.”

At Gateway Bank, Norman said its process meant that if a broker’s client came to the bank directly for a refinance, “we’ll get in touch with the broker to make they are across that”.

“We will always encourage brokers to ring us up. We don’t want to see a customer go and both of us lose that relationship.”

Patterson said every lender in the market would be hypercompetitive around retention over the next period. “It’s good to see brokers talking about book growth rather than just churn,” he added. “If you think about the cost in brokers’ businesses at the moment – you’ve got admin, you’ve got compliance to rewrite the same loan, but you’re losing money. You pay for all those costs only to get gazumped at the last minute. So I think lenders will work with brokers a lot more collaboratively than they did in the past.”

Patterson said no broker could afford to rewrite their whole book, because they’d go backwards. “No bank can afford to keep churning customers, because we all lose money.”

Middleton asked the two brokers how they addressed cashback with clients who saw attractive offerings on TV, given the need to comply with the best interests duty and the fact that those cashbacks came at a cost.

Cullen responded by saying she had put four loans through to a lender at 4.59% with a $3,288 cashback, and two of the loans submitted on 23 December had only been approved in the second week of February. “It took 20 days for it to be initially picked up and assessed, and then they asked for more information,” she explained. “SLAs have blown out and banks cannot handle the workflow.”

Cullen said she told her customer there was no point going for a cashback and the lowest rate: “You need customer service as well, and they’re not going to be able to provide it with all the new business they’re getting”.

Smith said he tried to deter clients from cashback with explanations of policy, as some clients who were keen on cashback “wouldn’t have fit the [credit] policy anyway”.

“So then I’ll go into Brokerpedia, and I’ll say, ‘Well, you’re casual; it’s not going to work’. But sometimes I have lost a client … it’s not that you want to dictate to your client, but you want your client to trust you in what you’re saying.

“Most of my clients know that I’ve got their best interests at heart anyways, because I do tax as well.”

Q: Tell us about your relationship with brokers. What are you doing to boost third party growth, especially in terms of improving loan systems and processes, technology and BDM support?

Burt said Newcastle Permanent’s focus had always been on having close relationships with brokers. “We’ll now be on five panels; we’re just going onto Aussie’s,” he said. “We take that on very carefully, ensuring that we have the processing capacity to take on new brokers, so that their first experience is a good one with us.”

All mutuals were trying to improve consistency of service levels and processes, Burt said. It was important to boost relationships with brokers by listening to them about how banks could be better.

“Broker feedback is really important,” he said. During this retention period it was vital to work with broker partners to retain customers “for us and you”.

“That’s what will win us new business from a broker in the future,” Burt said.

Beyond Bank was in the middle of a “massive transformation project”, McLeod said. “We’ve partnered with NextGen for a new loan origination system. This will not only improve our turnaround times but streamline the whole upfront process the broker has with us.

“This also positions us in the box seat to thrive in the digital space going forward. Everything will be e-signed – that’s all the upfront documents, all the post-settlement documents, even up to the mortgage documents in the jurisdictions that allow that.”

McLeod said loans that ticked a certain box would be approved in minutes, with documents issued as quickly as the next day. Beyond Bank was also partnering with FMS to speed up the refinance process.

“We’re spending millions on technology, systems and processes to be really slick – e-signing, instant decisioning, brand-new broker interface, brand-new broker website,” McLeod said.

“We’re also going to be offering free CCR reports to brokers so they get the opportunity to look at those customers’ files before they submit us deals.”

Allan said Heritage Bank had also invested significantly in technology to increase its loan capacity by 30%. This meant that the bank could take on more business and retain its service proposition.

“We’ll continue to do that with our platforms as well as we move into the merger, so you’ll see a lot more automation in our processes,” he said.

Heritage had also boosted the staff who support BDMs to help streamline processes and be a touchpoint for brokers.

Adamson said P&N Bank and bcu had also embarked on a transformation project, with broker being identified as a key invesment priority.

“Last year we conducted over 400 customer and broker surveys along with 40 deep-dive interviews with brokers to hear what they wanted and what was important to them,” he said. “It’s one thing to assume what brokers want; it’s another to actually sit down and hear brokers saying, this is what you need to improve on; this is what we expect; these are the moments that matter for us.”

Adamson said one of the best insights from the surveys was just “how hard it is to be a mortgage broker”. “By the time the deal gets to us, there’s been many hours of work put into that transaction. So we have to treat that with care.”

As a result, the bank had built a new case management process, which Adamson said had vastly improved broker satisfaction. “So when the file comes in, there’s a dedicated assessor who the broker can speak to that will case-manage that application from submission all the way through to formal approval. Our brokers have been a lot happier, and we’re seeing satisfaction levels increasing month-on-month.”

Norman said Gateway Bank was focusing on getting close to brokers and technology to enable a better experience. “We’ve done research and journey mapping. We want to keep SLAs at good levels.”

Great Southern Bank completed its trans-formation project last year, which included a new loan origination system. “We launched DocuSign last year, and we’re about to launch e-sign this year,” Patterson said. “So that home loan process will be digital. What that meant in terms of time to yes – almost half of our applications are unconditionally approved in two days now … it’s about four and a half days to unconditional on average. So we’re realising some huge improvements there.”

Middleton said many of the banks at the roundtable had adopted e-sign, upfront valuations, DocuSign and Digital ID. “But I think the most important thing is not what we do but listening to brokers on what they want in order to improve our processes. The only way all financial institutions are going to improve is by engaging with our brokers.”