Narrow niches are out and flexibility is in, as brokers look to non-banks with credit policy and products to suit all tastes

If you're going to talk about the ‘products’ of the non-banks, and why brokers prefer one over another, you first need to define what it is they’re selling. MPA’s Brokers on Non-banks survey took a multifaceted approach to this, asking brokers which non-banks they preferred; what they wanted from non-banks; and why they’d pick a non-bank over a bank.

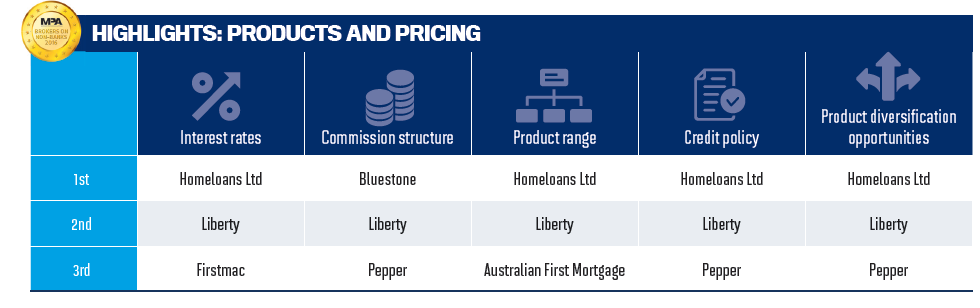

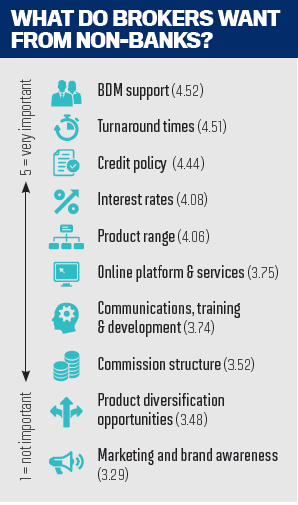

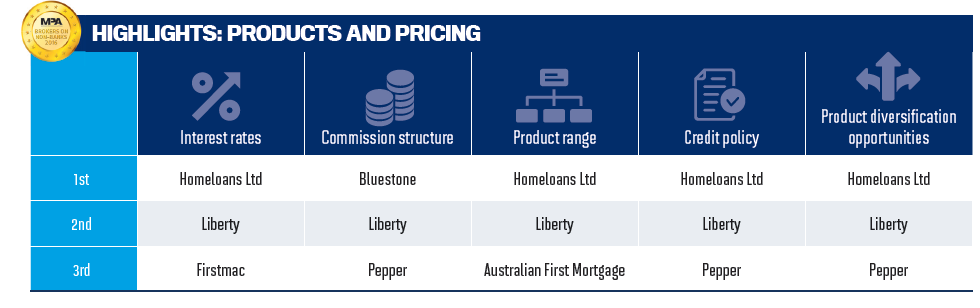

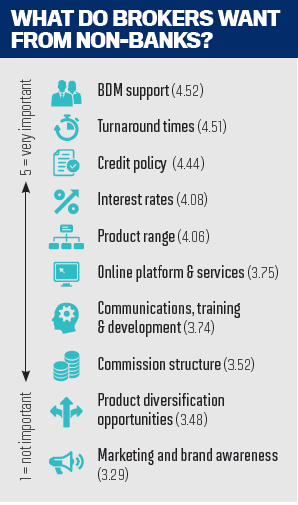

Homeloans Ltd dominated the product categories, with a strong showing overall from Liberty Financial, and Bluestone topping commission structure. While brokers prioritise BDM support and turnaround time – categories that will be discussed in the following section on service – it’s notable that credit policy, interest rates and product range occupy the third, fourth and fifth priority spots.

Credit policy is crucial here: not only can it lure customers over from other non-bank lenders but it can also attract customers who might otherwise have gone to a bank.

‘Taking a wider view than customer’s credit score’ was brokers’ biggest reason for taking a client to a non-bank lender. Having a wide range of products goes hand in hand with a wide credit appetite, and judging by its category wins Homeloans evidently has this, plus a broad range of funders that it has recently added to, as Homeloans Boss Ray Hair told MPA. Pepper, which came third in this category, seems to be benefiting from its ‘cascading’ application approach, where one form can be used to direct clients to three different products without having to resubmit, depending on their credit situation.

There are other ways to attract clients, as Liberty demonstrates. The option of ‘Recent regulatory changes have prevented client going to the bank (ie investors)’ was intended to draw out from brokers how they and their clients have reacted to investor lending changes over the past year. Eighteen per cent of brokers selected this option, and Liberty was one of the non-banks that marketed the fact that they were still open to business from investor clients and advertised more flexible serviceability requirements.

There are other ways to attract clients, as Liberty demonstrates. The option of ‘Recent regulatory changes have prevented client going to the bank (ie investors)’ was intended to draw out from brokers how they and their clients have reacted to investor lending changes over the past year. Eighteen per cent of brokers selected this option, and Liberty was one of the non-banks that marketed the fact that they were still open to business from investor clients and advertised more flexible serviceability requirements.

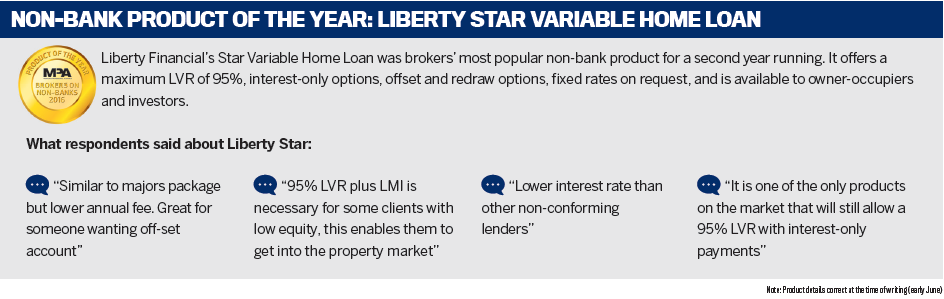

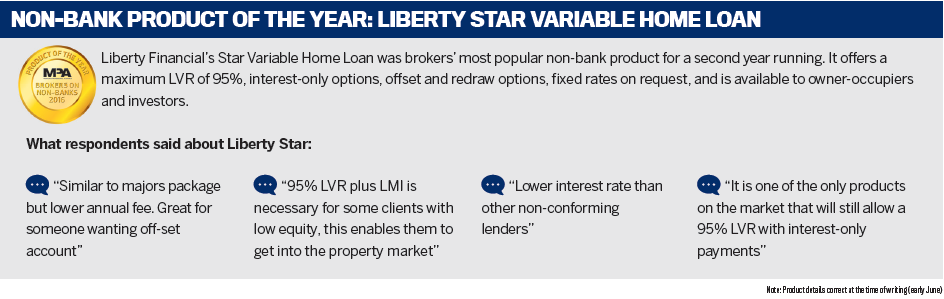

Another result that suggests Liberty is benefiting from ex-bank clients is its success in the Non-Bank Product of the Year category. Also the winner in 2015, the Liberty Star loan was available to owner-occupiers and the crucial investor segment, with variable and fixed rates. As the survey comments make clear, brokers liked the Liberty Star loan because it offered a similar package of services to the majors but catered to a wider range of clients, with a 95% maximum LVR, ticking the categories for credit policy and product range.

Another result that suggests Liberty is benefiting from ex-bank clients is its success in the Non-Bank Product of the Year category. Also the winner in 2015, the Liberty Star loan was available to owner-occupiers and the crucial investor segment, with variable and fixed rates. As the survey comments make clear, brokers liked the Liberty Star loan because it offered a similar package of services to the majors but catered to a wider range of clients, with a 95% maximum LVR, ticking the categories for credit policy and product range.

It appears that interest rates aren’t helping non-banks take customers from the banks – they are only a reason to place customers for 12% of brokers – but can help non-banks take customers from each other. Interest rates were brokers’ fourth priority when picking a lender, and it’s notable that Homeloans, Liberty and Firstmac took the top places in this category given that they also comprise three out of the top four nonbanks overall.

It’s also useful to note what brokers don’t prioritise when choosing lenders. Commission came low on the list of priorities, as it did in our Brokers on Banks survey, perhaps reflecting the combination of regulatory scrutiny and very similar commission levels across the industry. Seventy-nine per cent of brokers told us there was ‘no difference’ in the level of commissions this year, and 15% said they had improved.

It’s also useful to note what brokers don’t prioritise when choosing lenders. Commission came low on the list of priorities, as it did in our Brokers on Banks survey, perhaps reflecting the combination of regulatory scrutiny and very similar commission levels across the industry. Seventy-nine per cent of brokers told us there was ‘no difference’ in the level of commissions this year, and 15% said they had improved.

Interestingly, only 6% of brokers said a lack of documentation was the reason to take a client to a non-bank. In all our recent conversations with non-banks they’ve indicated that low-doc lending now effectively means self-employed lending. The number of other low-doc clients is very low indeed (or at least lenders just don’t want to deal with them). Evidently, non-banks need access to documentation of some sort to make the flexible and personalised lending decisions that attract brokers and clients in the first place.

Homeloans Ltd dominated the product categories, with a strong showing overall from Liberty Financial, and Bluestone topping commission structure. While brokers prioritise BDM support and turnaround time – categories that will be discussed in the following section on service – it’s notable that credit policy, interest rates and product range occupy the third, fourth and fifth priority spots.

Credit policy is crucial here: not only can it lure customers over from other non-bank lenders but it can also attract customers who might otherwise have gone to a bank.

‘Taking a wider view than customer’s credit score’ was brokers’ biggest reason for taking a client to a non-bank lender. Having a wide range of products goes hand in hand with a wide credit appetite, and judging by its category wins Homeloans evidently has this, plus a broad range of funders that it has recently added to, as Homeloans Boss Ray Hair told MPA. Pepper, which came third in this category, seems to be benefiting from its ‘cascading’ application approach, where one form can be used to direct clients to three different products without having to resubmit, depending on their credit situation.

There are other ways to attract clients, as Liberty demonstrates. The option of ‘Recent regulatory changes have prevented client going to the bank (ie investors)’ was intended to draw out from brokers how they and their clients have reacted to investor lending changes over the past year. Eighteen per cent of brokers selected this option, and Liberty was one of the non-banks that marketed the fact that they were still open to business from investor clients and advertised more flexible serviceability requirements.

There are other ways to attract clients, as Liberty demonstrates. The option of ‘Recent regulatory changes have prevented client going to the bank (ie investors)’ was intended to draw out from brokers how they and their clients have reacted to investor lending changes over the past year. Eighteen per cent of brokers selected this option, and Liberty was one of the non-banks that marketed the fact that they were still open to business from investor clients and advertised more flexible serviceability requirements. Another result that suggests Liberty is benefiting from ex-bank clients is its success in the Non-Bank Product of the Year category. Also the winner in 2015, the Liberty Star loan was available to owner-occupiers and the crucial investor segment, with variable and fixed rates. As the survey comments make clear, brokers liked the Liberty Star loan because it offered a similar package of services to the majors but catered to a wider range of clients, with a 95% maximum LVR, ticking the categories for credit policy and product range.

Another result that suggests Liberty is benefiting from ex-bank clients is its success in the Non-Bank Product of the Year category. Also the winner in 2015, the Liberty Star loan was available to owner-occupiers and the crucial investor segment, with variable and fixed rates. As the survey comments make clear, brokers liked the Liberty Star loan because it offered a similar package of services to the majors but catered to a wider range of clients, with a 95% maximum LVR, ticking the categories for credit policy and product range.It appears that interest rates aren’t helping non-banks take customers from the banks – they are only a reason to place customers for 12% of brokers – but can help non-banks take customers from each other. Interest rates were brokers’ fourth priority when picking a lender, and it’s notable that Homeloans, Liberty and Firstmac took the top places in this category given that they also comprise three out of the top four nonbanks overall.

It’s also useful to note what brokers don’t prioritise when choosing lenders. Commission came low on the list of priorities, as it did in our Brokers on Banks survey, perhaps reflecting the combination of regulatory scrutiny and very similar commission levels across the industry. Seventy-nine per cent of brokers told us there was ‘no difference’ in the level of commissions this year, and 15% said they had improved.

It’s also useful to note what brokers don’t prioritise when choosing lenders. Commission came low on the list of priorities, as it did in our Brokers on Banks survey, perhaps reflecting the combination of regulatory scrutiny and very similar commission levels across the industry. Seventy-nine per cent of brokers told us there was ‘no difference’ in the level of commissions this year, and 15% said they had improved.Interestingly, only 6% of brokers said a lack of documentation was the reason to take a client to a non-bank. In all our recent conversations with non-banks they’ve indicated that low-doc lending now effectively means self-employed lending. The number of other low-doc clients is very low indeed (or at least lenders just don’t want to deal with them). Evidently, non-banks need access to documentation of some sort to make the flexible and personalised lending decisions that attract brokers and clients in the first place.