MPA explores with FAST how brokers can excel in both commercial and residential lending.

Diversification has typically been seen as a one-way street: experienced residential brokers ‘future-proofing’ their businesses with other revenue streams.

Yet increasingly, top commercial writers are also looking to diversify and they’re looking at residential lending – including MPA’s 2016 No. 1 Commercial Broker George Karam of BF Money and Top 10 Independent Brokerage Right Angle Group.

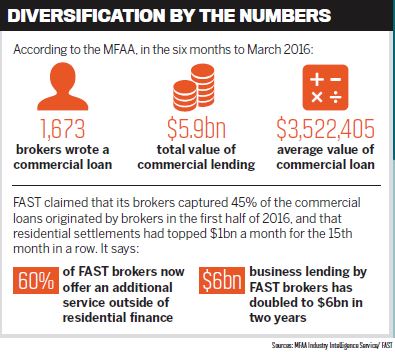

They’re not alone, says FAST’s head of the northern region, Rob Ryan. “We see it growing more and more.” While FAST has been vocal about getting residential brokers to try commercial lending, it is also finding that its experienced commercial broking members aren’t content to rest on their laurels.

The reason for this has little to do with market strength; indeed after years of lagging behind residential, commercial lending has emerged as a seriously profitable space for brokers to play in. MPA and FAST have teamed up to answer those big questions: why would commercial specialists want to move into an increasingly crowded residential lending market, and how can they do it?

Having written $278,920,637 worth of commercial loans in 2015/16, BF Money boss Karam seems to have the least reason to move into residential lending. But the brokerage has always had a white label residential lending operation, and Karam is looking to open the panel to other lenders as part of a broader expansion. “There’s been a shift to be more of a holistic property finance provider rather than a transaction broker; we don’t want to exclude any of the property finance needs our clients have.”

BF Money is the result of a rebranding (the brokerage was previously called Byblos Finance) accompanied by a move to a new office in Sydney’s west. Brand matters, explains Karam, as does being honest about that brand. “We don’t promote ourselves as a purely commercial broker; and we don’t promote ourselves as just a mortgage manager … we’re a specialist property finance broker, and if you want to be fair dinkum about that, you have to offer a range of finance solutions. You cannot ignore residential as a commercial mortgage broker.”

Read more: How to become a commercial mortgage broker in Australia

A commercial broker’s existing client base provides an easy and less risky way to move into residential broking, according to Ryan. However, fraudsters and financial crime are a concern, he warns. “My tip would be they need to stick to known referral sources and be wary of customers that approach them from out of their home state and out of the country, because new players in residential lending can be targeted sometimes.”

A common solution to this problem is to bring an experienced residential broker or loan writer into the office. This was the route taken by Brisbane-based Right Angle Group, director Guy Hewartson told MPA when interviewed for our Top 10 Independent Brokerages feature. “We probably weren’t very good at residential lending … we made the decision that we had to get someone in our business who knew what they were doing, which we did, and it has been hugely successful.”

Alternatively, you need to upskill yourself and your team, as Karam has found. “Just because you do commercial doesn’t mean that you can do residential well, and vice versa. While the skill set is complementary, it’s not quite the same.” Knowledge of NCCP regulation, responsible lending and application software is essential, Ryan says, especially as the latter is now the only way to apply for residential loans in many cases.

Brokers shouldn’t feel they’re alone, Ryan observes. “We’ve got very skilled partnership managers that can help brokers identify the right structure and help resource it.” FAST facilitates meetings between top commercial brokers and suitable residential lenders that suit its value proposition. It can also introduce brokers to compliance companies to help them make the transition to the more regulated residential sphere; FAST uses QED Risk Services.

Whether you’re a commercial broker looking at residential, or a residential broker looking to diversify, it’s vital to recognise how additional services can aid your core business. As Karam sees it, “[residential] is not an add-on; it’s one of the significant pillars of the business”. Offering additional services helps protect what you do best, Ryan concludes. “If a commercial broker isn’t offering residential lending into their stream of business, the chances are that another commercial broker may be, so the customer may go to another broker for this solution, and they may lose the customer from their core business.”

FAST has been supporting businessminded brokers through commercial and asset finance as well as residential lending for the past 16 years. Through this time the industry has evolved, and continues to present exciting opportunities along the way.

We aim to provide the best possible products and support to help our brokers grow their businesses across multiple revenue streams, whether that’s from residential into commercial or vice versa. To cut a long story short, commercial and residential loans needn’t be mutually exclusive.

As an advocate of diversification, FAST is proud to partner with MPA to bring you this dedicated report. I hope you find it valuable and useful to your business.

Rob Ryan,

Head of northern region,

FAST