Four in five of under-40s have not asked parents for financial support

Despite concerns over housing unaffordability, younger Australians are not relying on parental support, according to AMP’s latest research that has revealed key insights into Australians’ attitudes towards intergenerational wealth.

The study indicates that half of those under 40 expect to support their parents financially as they age, while only 20% are relying on financial assistance and inheritance from their parents for future financial security.

Four in five or 80% of under-40s have not asked their parents for financial support, while 60% have not discussed wealth transfer with their parents.

Majority or 60% believe their generation faces greater financial challenges than their parents, rising to 70% for those under 29.

The research findings also show that 80% of non-homeowners under 40 believe property ownership is out of reach and that not owning property will harm their long-term wealth in retirement. Furthermore, 80% would consider purchasing property with friends or family members, increasing to 90% for those under 29.

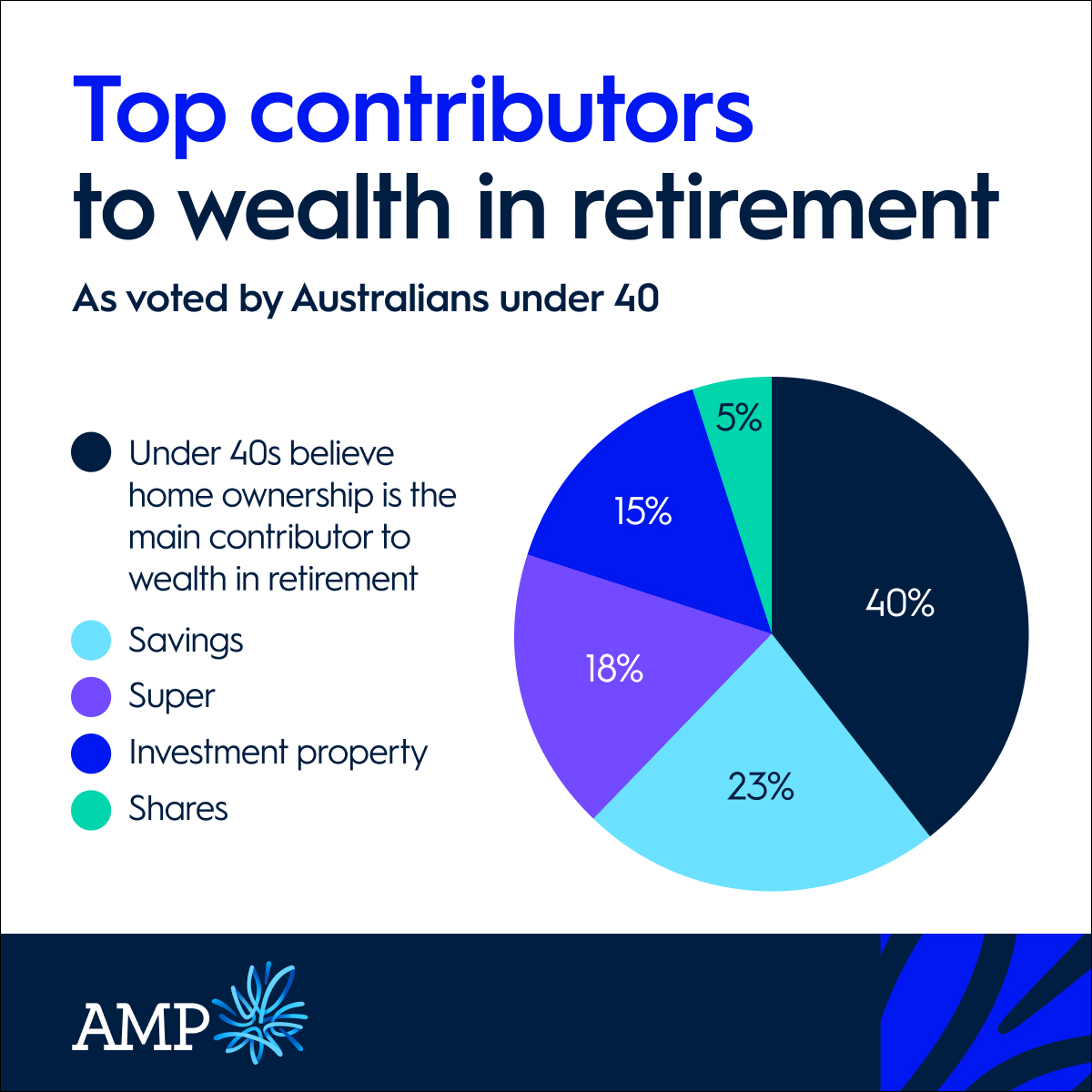

Home ownership is seen as the main contributor to wealth in retirement by 40% of under-40s, followed by savings (23%), superannuation (18%), investment property (15%), and shares (5%).

These findings come after the first phase of AMP’s research, which indicated that retirees want to support their children but are concerned about their own financial security. An estimated $3.5 trillion is expected to be transferred by Australians aged 60 and above in the next two decades, with 90% occurring through inheritance.

“Many under-40s are concerned about housing unaffordability but are reluctant to ask for financial support from their parents,” said Ben Hillier (pictured above left), director of retirement at AMP. “There’s a significant opportunity in Australia to help retirees build financial confidence, improve financial literacy, and simplify the retirement system.”

Sean O’Malley (pictured above right), group executive of AMP Bank, emphasised the importance of home ownership for long-term wealth.

“Younger Australians are justified in their concerns about housing unaffordability,” O’Malley said. “There are immediate options, such as joint property ownership with family and friends, which could help them enter the property market. Fractional lenders like Bricklet offer services that can make this feasible.”

Want to be regularly updated with mortgage news and features? Get exclusive interviews, breaking news, and industry events in your inbox – subscribe to our FREE daily newsletter. You can also follow us on Facebook, X (formerly Twitter), and LinkedIn.