Non-major bank executives, brokers gather for roundtable

Pandemics can be good for mortgage brokers and non-major lenders – who would have thought it?

While all parts of the economy struggled with the panic and flux of 2020, as the dust settles two years later it’s clear that non-majors have enjoyed a ripsnorting run of business thanks to record-low interest rates, new and efficient ways of interacting with customers, the continued growth of the broker channel, and stronger third party partnerships.

The surge was not all driven by external factors, however. Non-major lending institutions were able to adjust faster than many majors due to their lack of cumbersome legacy systems and ability to implement decisions quickly. They pivoted earlier and faster because they could, setting an example of how to conduct business well during an unprecedented crisis.

But make no mistake – the lessons and methods employed by non-majors in 2020 and 2021 will not end when COVID becomes background noise. The changes in practice that occurred during these watershed years have set the pattern for the future, and nobody wants to turn back time and do things 2019-style.

Yes, in-person meetings are important, and top executives and brokers understand there is no tech that can replace the human connection. But the reality is that going back to 2019 methods would hurt the bottom line for lenders.

Many of the technologies and management practices that non-majors employed to super-charge their businesses during the pandemic were not new. Tools such as Zoom and digital signatures were not invented in response to the horror the world felt as the first lockdowns in Wuhan heralded what was to visit the rest of us in a few short months.

There was simply no compelling reason for everybody to embrace radical change – until there was.

The pandemic was a catalyst that sent financial services on a new trajectory that suits the capabilities of the modern world better. The dividends are many, including the rise of brokers, a healthy property market, richer information, less paperwork and more money.

The current year is already seeing new challenges arise, many of them stemming from the pandemic but not part of it. The tools that non-majors and brokers will use to overcome these newer problems will be among those that have come to the fore during the pandemic.

International relations scholars talk about something called ‘the peace dividend’, where all the inventions of necessity that arise during a terrible time of war continue to be used afterwards in peaceful applications – think computers, radar, canned food and plastic surgery.

In the finance industry at least, perhaps we are seeing a similar phenomenon.

Welcome to the pandemic dividend. MPA sat down with a group of non-major banks at Bel & Brio restaurant in Barangaroo, Sydney, recently to discuss how their businesses have fared, the factors behind their growth, and what lies ahead.

Representatives included Ian Rakhit, general manager third party at Bankwest; Troy Fedder, head of broker partnerships at Suncorp; Glenn Gibson, head of customer experience, service and distribution at ING; Simon Elwig, head of broker operations at Bank of Queensland and ME; Matt Wood, head of mortgage distribution at Citi; and Paul Herbert, head of intermediary distribution and governance at AMP Bank.

They were joined by two brokers to provide a different perspective – Suzanne O’Connor, director of Dominion Finance, and Fabio De Castro, mortgage broker at Oxygen Home Loans.

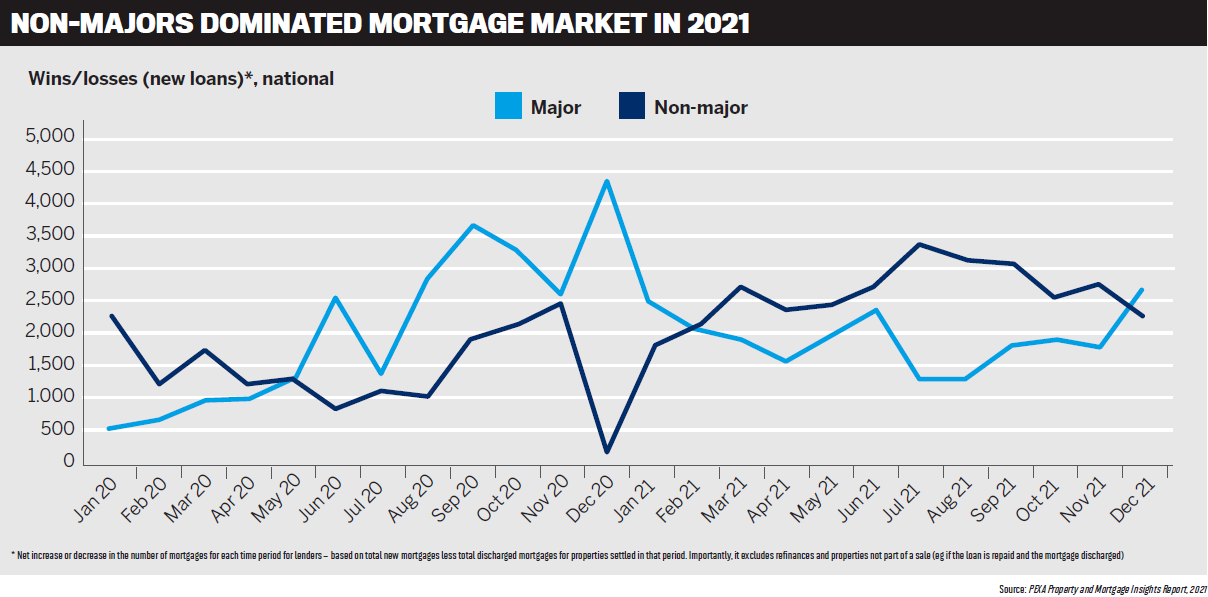

Q: The 2021 PEXA Property and Mortgage Insights Report shows that for most of 2021 the non-major banks dominated the residential mortgage market over the major banks. What’s behind the growth in your market share?

Bankwest’s Ian Rakhit called the period “unprecedented and very significant” for the financial institution, which he said had done two years’ worth of residential mortgages volume in 2021.

“‘Unprecedented’ is a well-worn descriptor in recent times, but it’s entirely appropriate for Bankwest, as purchases have been really strong. Refinances have also been incredibly strong,” Rakhit said.

He put the standout performance down to the broader choices available at non-major banks in terms of service levels, price and policy.

“For me, it’s simple. We offer choice, and we’re always focused on the needs of the broker and the customer.”

Another factor was the more even playing field for majors and non-majors.

“I think we’ve all sharpened our proposition and therefore given brokers the opportunity to use that choice that they’ve got in the market, and therefore that results in the bigger shares to us,” Rakhit said.

Troy Fedder (pictured) said Suncorp Bank had seen similar growth over the course of the pandemic for similar reasons.

“Non-majors really provide genuine choice,” he said, adding that players in the sector had upped their game to the point where brokers were significantly attracted to the offerings at non-majors.

Digitalisation was also a factor, with a lot of investments in better practices, he said.

But it was not all push; there was a bit of pull too as customers surveyed the choices available and became more savvy.

“Brokers are really desiring that genuine choice to use the non-majors significantly.”

ING’s Glenn Gibson talked about the “customer lens” and how the same clients kept coming back for products that they liked.

“They’re doing a little more research themselves. They’re actually finding out, and they’re going to brands that they like.

“We have a lot of ING customers that will go to a broker for a choice of products but will end up back at ING because they’re an ING customer,” Gibson said.

Simon Elwig from BOQ expanded on the brand theme, saying that BOQ had a multi-brand approach with a range of products targeting different types of borrowers, from first home buyers to refinancers, which gave the bank the ability to switch around.

BOQ had also expanded its accreditations with aggregators, which had helped momentum.

Representing AMP Bank, Paul Herbert said non-majors were seeing the fruits of their efforts to fill gaps in the market with various products that customers had asked for.

“I think, as a group, we’re listening to our customers and delivering the products that meet their needs,” he said.

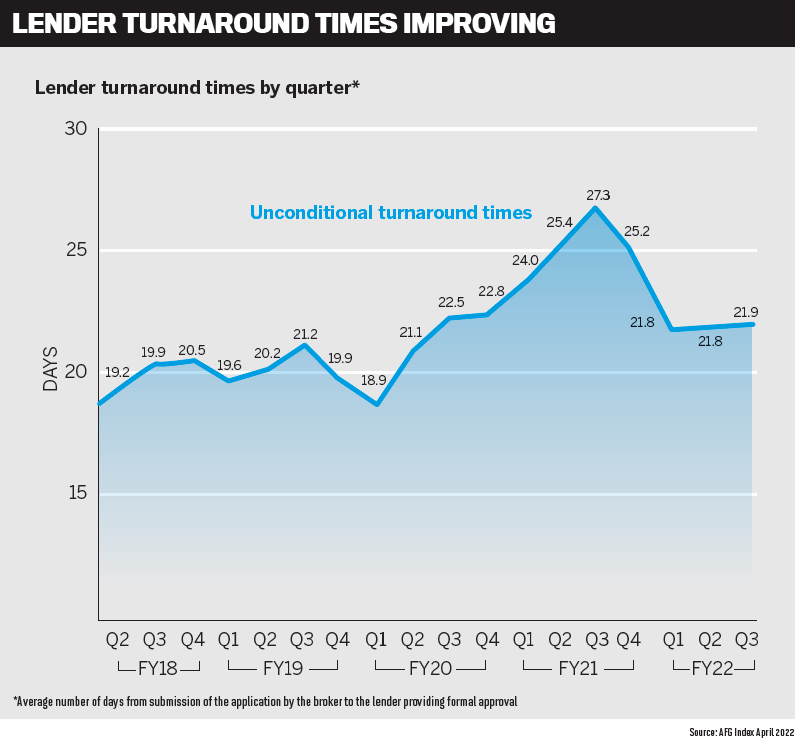

But technology was also an important factor behind the increase in business, as it had improved non-majors’ turnaround times when compared with those of the majors, despite the challenging conditions COVID had produced.

“As a non-major, we’re able to make iterative change and find creative ways of working with our broker and adviser partners to adapt to the changing environment,” Herbert said.

“Prior to COVID, how many of our brokers and our teams within our businesses were running off laptops and talking to our teams the way we are talking now? It significantly increased during COVID.”

Herbert saw parallels with the GFC in 2008, another period of accelerated growth for brokers who were quick to support their customers during such ‘black swan’ events. These significant events tended to highlight the nimbleness of the broker channel and smaller banks, as they were able to adapt quickly. This was reflected in the growth of brokers’ market share during the GFC and the pandemic, he said.

“What we saw was a large jump in customers choosing their brokers and advisers.”

Citi had a slightly different experience. Matt Wood said the bank had started well in 2020 but received a shock when in April that year its parent company, Citigroup, decided to exit its consumer business across 13 markets in the Middle East, Europe and Asia, including Australia.

Prior to the announced sale, Citi had already undertaken a rapid review of its operations in response to the COVID-19-induced economic downturn. The bank’s balance sheet was growing as people started to save more, and the mortgage business was considered a key avenue for growth to utilise those funds. In August 2020, NAB emerged as a potential buyer of the business and was apparently pleased with the growth Citi was experiencing.

Wood said the growth was not as spectacular as that of the other institutions at the roundtable in 2020, but it was still pleasing given the circumstances. However, last year, Citi’s mortgage business had a growth rate of 15%, the second-highest among non-majors, and its growth trajectory continues this year.

Q: How important is the broker channel to your success, and what are you doing to boost third party partnerships?

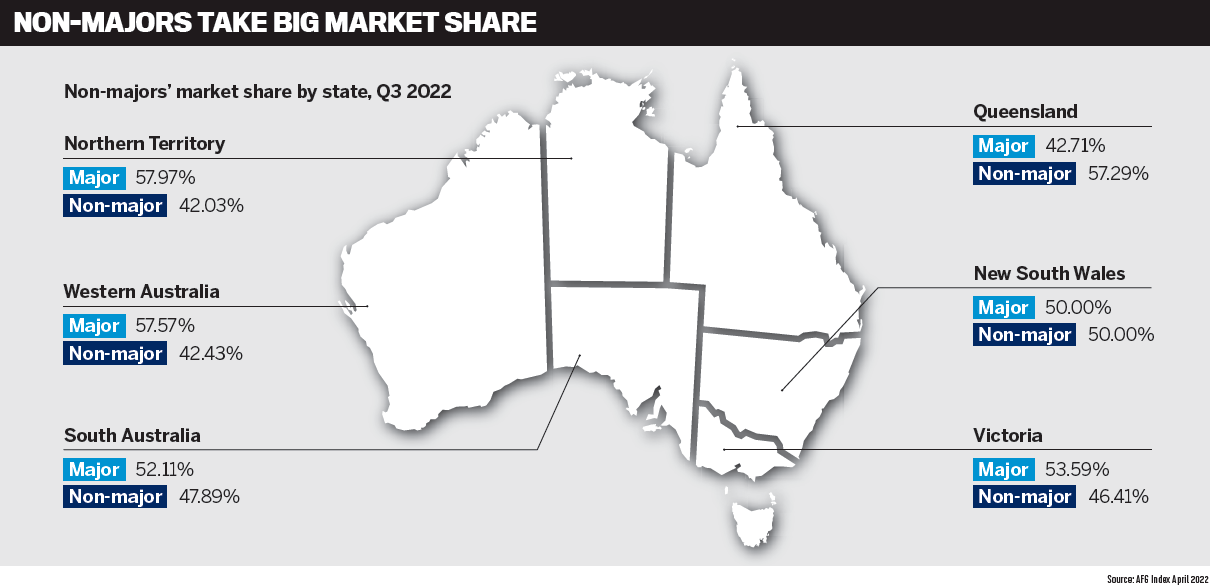

Fedder said the broker channel was only becoming more important to Suncorp’s business as time went on. At the beginning of 2021, brokers brought in around two thirds of loans to the bank, but by the end of March 2022 that had risen to over 75%, which had positive flow-on effects in terms of Suncorp being broker-oriented.

“I think what that does is that it really allows the organisation to get behind and be a real support to the investments we need to look after our brokers. It allows us to really get that better traction.”

Rakhit (pictured) said the only word that could describe the value of brokers was “critical”, given that 85% of Bankwest’s loan business came via that channel. Even in its home state of WA, only one third of business was derived from branches now, he said.

Bankwest had recently decided to focus 100% on retail, and the high reliance on brokers allowed it to pinpoint its investment better. “It makes it much cleaner for us,” Rakhit said.

Gibson said the broker channel had always been the “mainstay channel of bringing in loans” for ING. This meant that marketing efforts were focused on this area, but the fact that more consumers were using brokers was also a major factor in the uptrend.

“More people that use non-majors go through brokers, [so] you then, by default, have more people actually using brokers themselves,” he said.

“Our marketing and promotion efforts mean that Australian customers are actually going to brokers more and more.”

Suzanne O’Connor (pictured) is a mortgage broker and director of Canberra-based Dominion Finance. She said confirming a loan or equity-status situation for a customer at a major bank was cumbersome, but with the non-majors such details were often searchable for existing customers.

“You don’t have to sit on the phone like you do with some of the majors for two hours waiting,” O’Connor said. “Waiting on hold to the major banks for long periods of time is not a good use of our time. Some wait times have been well over an hour. Having access to clients’ existing information via a portal is ideal.”

Fabio De Castro (pictured), director of Sydney brokerage Simplify Finance, which has a partnership with Oxygen Home Loans, echoed these sentiments. He said the ability to see key events for clients on broker portals was a “major win” for brokers, as it saved a lot of traffic coming into the call centre.

Given all the repricings over the last few years, not having this functionality could have negatively affected the volume of business his team could handle, De Castro said.

“At the end of the day, as a broker we’re sort of in between the bank and the client … so we’ve got to earn their trust.”

He said the only way to do that was if he had confidence that the bank would deliver when it said it would.

“We don’t care if it’s five days, 20 days, just as long as it’s what you tell us it is, and credit is consistent and the service proposition is consistent.”

Herbert (pictured) said ÄMP Bank was “primarily an intermediary distribution bank, and this influences our approach and partnerships”.

“We’re a broker-first distribution channel. Our priority is always staying close to brokers and advisers, and improving the service and support we provide to ensure we make it as easy as possible for them and their customers.”

He said AMP Bank had spent a lot of time over the last six months becoming more familiar with the details of the process that brokers went through. It did this by having various AMP Bank representatives who would not normally be at the coalface sit in on client meetings and watch how the loan application process unfolded.

The aim was to map out the systems involved and understand the process from the ground up when changes were made.

“[When] we start bringing in updates for our systems to make it easy to do business with us, we’ve actually started with the broker and customer user in mind,” Herbert said.

Of the non-majors at the table, Citi was the most reliant on the broker channel, at 98%. Three of its staff had been doing direct loans nationally, but Wood said he had recently moved them to be desk-bound BDMs. “So that will tell you the way we’re heading.”

Simon Elwig (pictured) agreed that the broker channel was very important to BOQ and had become even more so since the bank purchased ME last year, as it derived over 75% of its business from brokers.

He said BOQ was upgrading and digitising the home loan process to make it easier to use, and the first cab off the rank was the broker channel.

“So you see the focus is definitely on the broker. We embrace brokers and value them to achieve our growth aspirations,” he said.

Q: How did you adapt to the challenges of COVID and cope with a big rise in home loan volumes? What steps were taken to keep turnaround times down to a minimum?

Citi coped by ensuring the inflow of loan applications was kept within its capacity, with a targeted number of applications that the bank wanted to achieve each day.

“We know what our capacity is; we try and manage to that,” Wood (pictured) said. “It’s difficult to do that with a third party, but I do it to protect relationships and not get as much as I can at all costs.”

As business boomed during the pandemic, Citi increased its handling capacity in terms of staff numbers.

“We went from 20 credit officers to 40,” Wood said.

ING also sought to limit volume in order to provide a consistent service. Gibson (pictured) said ING had plans to scale up over several years but wanted to control the flow while back systems were being built.

ING used credit policy to manage flows but still had an 80% increase in application volume last year compared to the year before, Gibson said.

Traditionally, non-majors would have deep relationships with a limited number of brokers, but ING began to move towards dealing with a broader range of brokers over the course of the pandemic.

“Invariably in the past, non-majors would have depth of relationships, not so breadth of relationships, so what that meant was we had fewer brokers that you would have very, very deep relationships with. Our focus for two years was, let’s go wider and deeper so that we could actually set ourselves up for the next couple of years,” Gibson said.

Bankwest found that utilising latent technology for which there were no legacy impediments had helped it increase the amount of work it could handle.

“A lot of the things we tried to do for many years and couldn’t, we got done in a matter of weeks at the start of the pandemic,” Rakhit said. He cited examples such as moving from a wet signature to a digital signature, or from a physical valuer to a desktop.

“Now, the minority [of valuations] are done by a physical valuer, and there’s all manner of third parties able to do identity, income checking, comprehensive reporting. For us, it’s been huge in terms of checking debt repayments.”

The move to more online solutions had become a permanent change that brought dividends by reducing the amount of paperwork required of brokers, Rakhit said. These changes were continuing to pay off during other crises, such as the flooding on the east coast, that necessitated remote solutions.

“One of the positive outcomes of COVID for Bankwest was the ability to move to an easier way of working and actually retain those ways of working and give us then the courage to start thinking what else could we do,” he said.

On the flip side, Rakhit said he wanted BDMs to combine these technological gains with getting back to more in-person meetings to increase mental stimulation.

“I think if we can just bring that personal element back to it, we’re in a good place.”

BOQ’s Elwig said that having people work from home increased productivity due to less time spent travelling and increased discretionary effort as staff worked around home and family commitments.

Fedder added that the pandemic revealed the true value of brokers to financial institutions. He cited the empathy brokers showed to customers going through challenging times, and the way brokers pivoted their business models and worked in partnership with lenders and non-majors.

“What we saw was just the incredible value of the broker proposition. I think that really came to life,” he said.

“We really saw the industry at its best … I’d probably see it as a new watermark.”

Suncorp had roughly doubled its business in the loan sector over the course of the pandemic and was forced to increase capacity in places where it did not traditionally focus, such as Sydney and Melbourne, Fedder said.

“We looked at what was right for the market and how we could look after our customers much better.”

Q: Channel conflict is a major issue for brokers. How do you ensure that first and third party channels are treated equally?

O’Connor at Dominion Finance said there had been some “heartbreaking” experiences that had made her want to give up using certain banks. She said she had lost clients to branches in the recent years apparently because of the difference in the service levels between going through a broker or direct to a branch.

“We’ve had to tell them to go to the branch because we want them to have the right experience and get the property that they want,” O’Connor said. “And if that’s the only way they’re going to do it, then we have to do it.”

De Castro said such incidents motivated him to take more business from branches. But he did not see much channel conflict, partly because he preferred dealing with non-majors.

“It reinforces the importance of [non-majors] being around and being focused on brokers, because if you’re 98%, why would you damage that channel?” he said.

ING took the position that it was up to the customer to choose.

“Obviously I want to grow both channels, but I don’t do it at the detriment of the other,” said Gibson. “We’re not going to try and grow our direct channel by making better offers only available through that particular channel – that’s not a customer-first strategy.”

BOQ had the same price across all channels and only one pricing tool.

“Both channels have access to the same pricing tool and team,” Elwig said.

It was the same at Bankwest. Rakhit said the top brokers were very adept at using the systems, including knowing what documents were needed. There was no difference in terms of levels of service, but broker expertise was strongly correlated with regularity, he said.

This could lead to brokers getting faster turnaround times than by going direct in some cases, while for those who used the system infrequently it would inevitably take longer.

“We have brokers who deal with us once every six months – that’s a challenge. You know, we get the wrong payslip, or we don’t get the right identification. And that’s some-thing we want to help them on,” Rakhit said.

Bankwest also had systems in place where broker loans could not be rewritten, and any “rogue” lender would not be able to benefit by trying to take a broker’s customer.

“The broker is protected,” Rakhit said. Fedder said brokers were very important to Suncorp, and there was no channel conflict. “A big part of that is we came out deliberately to say we don’t differentiate between service levels, and I think that has been for Suncorp very well received in the market.”

Q: How do you gather feedback from brokers and act on it?

Herbert said AMP Bank used broker round-table forums, interviews, questionnaires, surveys, as well as in-person feedback from those on the road (in person or virtually) all the time. He said it had taken a while for everyone to get used to working from home, but as it became the norm, the bank began working with brokers to find creative ways to make sure it was providing the service and support customers wanted.

AMP Bank made “changes based on what our customers tell us”, Herbert said.

“We take the feedback on board and use these as coaching opportunities; we use live calls with the calls recorded.

“We know great conversations more often than not resolve those problems, and we’re able to take on feedback to improve.”

At ING, Gibson said feedback from the coalface was invaluable, and he was constantly seeking primary evidence to stay abreast of issues. It was a feature of non-major banks that senior people would do this rather than just salespeople, which might be the case at larger players.

“I’m always out on the road, always catching up with brokers. I’m talking to customers on the phone and listening to retention calls,” Gibson said.

The other non-majors agreed that they cast a broader net for this type of information-gathering than the larger institutions.

“We’re across so much of the business that you just can’t help but actually understand customer impact,” Gibson said.

Wood said getting feedback was a crucial part of doing business for a non-major.

“We’re across every facet of the business, and we do fit into all those forums, [and] it’s critical that we do that.”

He said Citi tried to empower BDMs to make more decisions on their own so they could have more influence and be heard better than at a large firm.

“I think they should have the ability to tweak things if they can and build relation-ships, because that’s their job,” Wood said.

O’Connor agreed that having easy access to BDMs who were able to sort out a problem on the spot made a big difference. She said that while she had a few go-to people among the majors, “there does seem to be a bit more flexibility in the non-majors”.

Another way to empower brokers was to make information about processes clear so everyone knew where they stood, O’Connor said. This was particularly true over the last two years when new and unprecedented factors had frequently cropped up.

She said having clarity on process was “huge, because then you’re not trying to wait for someone to call you back. You’re not trying to work out how to do it, submit it wrong, get it back.”

Rakhit agreed that BDMs were key players and should have the ability to change things up if necessary when dealing with brokers.

“The BDMs [are] the king or queen. I think they’re the people that can make or break our relationship and our reputation with individual brokers.”

Of course, more formal instruments such as surveys were part of the process as well. Elwig said some of the most valuable nuggets of information came from the comments sections in which brokers outlined poor experiences that they’d had.

BOQ had a system called “service recovery feedback” that targeted brokers and customers with negative experiences and followed up with a phone call to find out more. This process allowed BOQ to some-times rectify situations and fix spots in the process that were less than optimal.

Q: What new technology platforms have been introduced for brokers and customers, and what’s still to come?

Technology improvements were of major importance to financial institutions as the shape and needs of the economy changed during the pandemic.

Broker portals, the ability to use such things as comprehensive credit reporting for verification, and an overall reduction in the use of physical documents were some of the enhancements introduced.

“We used to ask for multiple months’ statements. We largely now use [comprehensive credit reporting] for verification. Those types of things have hopefully a positive broker impact but secondly [result in] a better customer experience and a faster time to yes as well,” said Fedder.

But another factor was the huge amount of investment required for these systems.

Gibson said large amounts had been spent on technologies that made life easier for brokers, but they were often back-end fixes that a broker would be unaware of when they went through the application process.

“The amount of investment for an audience perspective in end-to-end processing behind the scenes in the non-sexy things is big,” he said.

The return on that investment was still mostly in the future, but Gibson said brokers would benefit in key ways from these systems over coming years.

Herbert said AMP Bank had made significant investments in technology to simplify and improve the lending experience.

“A leading example of what we’ve delivered recently is adding eSign functionality, making it easier and quicker to originate and approve loans. And we’re turning our attention to the broker portal too, which will be moving ahead this year as we integrate the vast amount of data that’s available.

“We’re working towards delivering all these integrations. But the real benefit is when the auto credit decisioning engine can approve a loan, and it consumes the data, raises the data, and makes the credit decision. This means faster and more consistent loan approvals.”

Citi also had its work cut out. Wood said prior to the business sale announcement Citi had struggled to put new digital systems ahead of other priorities within the business, but cut-through was achieved once the sale process began.

“We’ve made a lot of progress over the past 18 months but are still building out our full digital capability,” he said.

“I can say there’s been optimism and excitement about how NAB can further assist in building our capabilities once Citi formally came under the NAB umbrella after 31 May.”

Elwig said BOQ had introduced a middle-ware communication system for brokers and was releasing a digital transaction savings account for consumers.

The broker communication system placed all the information in one place, and the process was smoother for processing teams. It introduced uniformity in the way applications were handled, rather than having different teams tackle the same task in different ways.

The bank was also piloting an electronic lodgement system, Elwig said.

“We actually had a situation where the other day we had a deal, and it went unconditional in 25 hours.”

Elwig said ME Bank was also just about to launch its long-awaited broker portal.

Q: Where is the mortgage market heading in the next 12 months?

BOQ was seeing activity in the housing market start to slow, and Elwig noted that “a significant portion” of borrowers who had set fixed rates would be seeing these mature reasonably soon.

“There should be a lot more refinance activity in 12 to 18 months’ time, and obviously mortgage pricing is likely to remain competitive,” he said.

Fedder said the market dynamics on the horizon would be good for brokers as customers sought to find the best deals possible.

“I wouldn’t be surprised if we see the broker flows as a total percentage of new lines hit the 70 [per cent line] in the next 12 months. I think it’s good for non-majors, I think it’s great for brokers, and I think it’s brilliant for customers.”

At the same time, some players in the market were not yet seeing a slowdown.

“I think there’ll still be a really good purchase market. I think there’s a lot of customers sitting on a lot of savings at the moment,” said De Castro.

Rakhit was philosophical about factors that could not be controlled, such as interest rates or the impact of the situation in Ukraine.

“As long as I’m doing the right thing by prioritising the broker and the customer, I know we will manage any situation,” he said. “We’re going to be busier than ever.”

Another factor that Gibson said might help mitigate any slowdown was the jump in the number of new clients brokers had gained over the past two years.

“The number of customers that brokers have has gone through the roof. The more customers you’ve got, the more you can weather any downturn,” he said.

“From a broker perspective or buyer-broker, we actually don’t think [interest rates are] going to have a major impact at all.”

But education was going to be key, because many younger brokers had not experienced a rising interest rate environment before and were unaware of how to talk to customers about it.

“Hopefully, the RBA is going to do the right thing, and we’re going to see small increments over time,” said De Castro.

He pointed out that customers would need to prepare for when base rates went up, and communication was key to riding out any turbulence.

“As long as you’re communicating, you’re properly giving us the opportunity to deliver that message to your clients,” he said.

But brokers and lenders could get through it together if transparency could be maintained and institutional rate changes were signalled ahead of time.

“It’s not pretty to tell people that their rates are going up, but it’s our job to communicate that to our customers,” De Castro said.