Commercial property finance activity is ramping up

The commercial property market is enjoying a renaissance after a tough period.

The pandemic resulted in office workers retreating to their homes en masse, while SMEs hunkered down, many relying on JobKeeper and JobSeeker to survive. But government support and stimulus packages helped keep businesses afloat and ready to pivot when economic conditions improved.

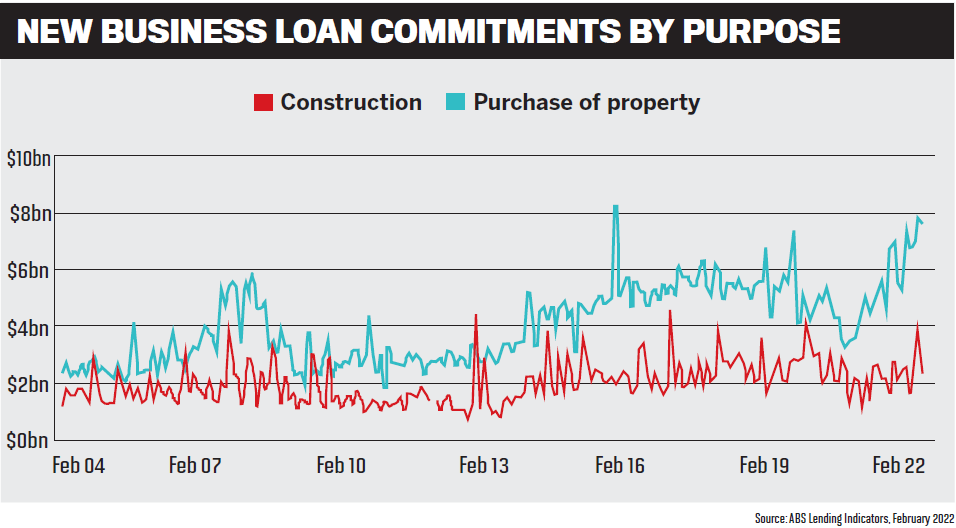

That time is now. ABS lending indicators show the value of new business loan commitments for construction rose 136% from $1.62bn in November 2021 to $3.84bn in January 2022. New business loans to buy property increased 11% from $6.75bn to $7.79bn over the same period.

As the economy recovers, so does the appetite for commercial property finance. Commercial real estate services giant JLL reported in March that strong tenant demand in the Sydney CBD showed that businesses were looking to occupy more office space.

MPA talks to Liberty’s group sales manager, John Mohnacheff (pictured above right); ANZ’s associate director, property, Daniel Gradwell (pictured above centre), and its Commercial Broker leadership team; and Pepper Money’s head of commercial, Malcolm Withers (pictured above left), about their outlook for the sector and the opportunities they see for brokers.

An appetite for commercial property

Mohnacheff says the last 12 months have caused serious concern for the Australian economy due to the impacts of COVID-19, natural disasters and international conflict.

“Nevertheless, the commercial property market has proven itself remarkably resilient, and demand for commercial lending has remained strong. And, as the residential market becomes increasingly competitive, more investors are setting their sights on the commercial arena to help build their passive income and grow their property portfolio.”

Mohnacheff says savvy investors under-stand that investing in commercial property is a long game – “it can be up to 10 years before they see significant growth in the value of their asset”.

“However, there is a particularly strong appetite for properties likely to appeal to tenants, which can often provide stronger rental yields as well as fewer vacancy periods.”

For retail and hospitality properties, location is key, says Mohnacheff. Properties on main streets where there is ample foot traffic have an advantage over those tucked away on side streets.

“Similarly, offices and warehouses in central and convenient locations are always in high demand. As increased migration from capital cities to regional areas continues, there’s also been a recent boost in the regional market,” he says.

ANZ’s Commercial Broker leadership team explain that initially banks approached the COVID crisis with caution, with speculation in the market focusing on economic outcomes and stress on property valuations.

“There was short-term volatility, but as government stimulus, including commercial rent regulations, was confirmed and businesses adapted to different approaches, volatility stabilised and then we saw valuations strengthen,” the team say.

“Now, commercial property appetite among the banks is as strong as it’s ever been, and more finance offerings are coming to market with simplified approaches to lending less than $3m. There remain some pockets of weakness for retail and office given post-pandemic uncertainty in some sectors of the economy, but brokers should be approaching their clients with confidence.”

Gradwell says the property development segment has been strong throughout COVID, although with mixed results across the sectors. Residential developments have boomed, while approvals and development finance for higher-density housing close to the CBD have been weak until recently.

“The other major winner through COVID has been industrial property, with storage, warehousing and logistics requirements rising strongly as online shopping has taken off,” he says. “This increased demand has under-pinned a strong expansion in the development of industrial property across the country.”

Withers from Pepper Money says that while the pandemic continues to affect the economy, the commercial property market is making a comeback, and opportunities to support SMEs are increasing.

“No other sector has been quite as impacted economically by COVID as SMEs,” he says. “But despite supply chain disruptions, increasing expenses, staff shortages and wage pressure, SMEs are confident to pivot their businesses and find new opportunities to thrive.”

With many SMEs owners looking to invest more in their businesses post-pandemic, Withers says the opportunities for brokers are there, especially with an estimated two million SMEs in Australia wanting to use the services of a trusted business adviser.

“Brokers are increasingly sought after to help [SMEs] achieve their short- and long-term business goals,” he says.

Momentum for brokers eager to diversify into commercial property lending continues to build, Withers says. Brokers can diversify their revenue streams and build stronger relationships with clients, and Pepper Money provides the tools and support brokers need to increase their confidence.

“There’s never been a better time for mort-gage brokers to expand their knowledge, develop new skills and diversify to include commercial property loans,” Withers says.

Mohnacheff says brokers operating in the commercial lending space have an excellent advantage “quite simply because there is less competition in terms of the service they provide”.

“When compared to the residential market, in which brokers hold more than 60% of the market share, commercial lending is vastly under-represented,” he says.

“There is ample opportunity for brokers to step in and provide the kind of personalised support that only a broker can provide. Whether you’re in the early stages of your career or looking to expand an already successful business, the commercial space offers endless opportunity to get ahead.”

The ANZ Commercial Broker leadership team say many clients have taken the opportunity to review their current arrangements for the properties that house their businesses.

“Given the lower interest rate environment, many have chosen to purchase their own premises rather than lease,” they say. “This provides the client with significantly greater flexibility and also control over their business’s future.”

There is a fantastic opportunity for brokers to assist their clients when it comes to financing these purchases. ANZ says brokers should be talking to their clients about their growth and investment plans – and property often plays a big part in this discussion.

There is a fantastic opportunity for brokers to assist their clients when it comes to financing these purchases. ANZ says brokers should be talking to their clients about their growth and investment plans – and property often plays a big part in this discussion.

Questions to ask include whether the client is looking to expand their business, and do they need a new warehouse facility? If the client is leasing, the broker should discuss how purchasing could work in terms of cash flow and tax considerations. Finally, is the client looking to invest in property?

“Knowing what banks can offer around different lending products and structures will help the brokers have better conversations with their clients,” say the ANZ broker team.

Clients may not be aware that they can purchase their operating premises and potentially structure the lending over a 30-year term when secured against that commercial property.

New solutions for business clients

The ANZ Commercial Broker team say the bank is simplifying its property lending appetite and wants to make it easier for business clients to invest or grow via lending for commercial property purchases.

At Liberty, Mohnacheff says the non-bank lender has more than 15 years’ experience, so it understands the challenges that commercial customers face.

“Recognising the need for more flexible lending solutions, our free-thinking product range has been designed to fill a gap in the market and provide tailored solutions with competitive LVRs,” he says. “Our Low-Doc and Boost products focus specifically on supporting SMEs, and provide options for customers in all kinds of circumstances to invest in commercial property.”

Mohnacheff says Liberty is constantly exploring ways to better meet customers’ evolving needs – and it assesses each application on a case-by-case basis.

For brokers wanting to take the next step and diversify into commercial finance, Liberty offers comprehensive guidance and support to help them hit the ground running.

Its ‘Do More’ training program helps brokers explore new possibilities and work closely with business partners to provide personalised support.

“Led by our award-winning team of BDMs, the program provides insights on how to source new customers from within your local area and identify opportunities within your existing database,” says Mohnacheff.

Withers says Pepper Money’s combination of tools, such as the Pepper Product Selector, the lender’s more than 20 years of specialist and SME knowledge, dedicated BDMs around Australia and a “real-life approach to making deals happen” create a game changer for business owners and brokers.

Pepper Money has a range of prime and near prime commercial property loans – including full-doc and alt-doc options – providing lending solutions of up to $3m in loan size. Whether customers want to buy an investment property or a commercial property to operate their business out of, or access equity and cash flow to support them in growing their businesses, the non-bank lender has solutions.

Pepper Money’s customers can get greater access to equity through higher LVRs and cash flow flexibility with longer loan terms. Unique features include a 100% offset sub-account, free redraw at no charge, and online banking tools.

“We’re very excited to be supporting both existing and new customers with real-life commercial real estate loan options,” says Withers. “We’ve seen industrial asset values perform very well over the past 12 months, whilst office space still lags in growth and there’s higher vacancy rates in major capital cities.”

ANZ’s Commercial Broker leadership team says the bank has a commercial property finance option for clients looking to borrow less than $3m, and it’s more flexible than ever. For investors, the property needs to be leased to an unrelated third party, but the loan term will not be restricted to the lease term, as long as the lease has at least one year to run.

“At ANZ we can also look at releveraging commercial property for customers who want to use that equity up to 70% of valuation – albeit we will be looking for loan amortisation if we extend the loan-to-value ratio up to 70%,” say the broker team.

As the post-COVID recovery progresses, Mohnacheff expects to see continued growth in demand for commercial property. He says for brokers to take advantage of this, it’s essential that they stay at the top of their game, maintaining a comprehensive knowledge of market-leading products. “At Liberty we make this easy with regular email communications containing all the need-to-know information and latest product updates.”

Boasting the largest BDM team of any non-bank lender, Liberty makes sure brokers always have someone to answer their questions, says Mohnacheff.