Jump to winners | Jump to methodology | View PDF

Starting out in the mortgage industry can be daunting for young professionals at the best of times. While potentially hugely rewarding, the industry can also be intense and demanding, with an often-heavy work-load and a plethora of complex concepts to grasp within a short period of time. Those finding their feet in the industry right now have also had to overcome the hurdle of COVID-19, which has upended the conventional workplace and introduced a host of new difficulties into the mortgage space.

Against that backdrop, the young professionals who made CMP’s annual Rising Stars list went above and beyond, adapting to the changing landscape and serving as a knowledgeable source of advice for their clients. Indeed, among this year’s cadre of Rising Stars, the ability to provide detailed counsel to customers was commonly listed as one of the most important skills a young mortgage professional must have.

Maya Kaaki, a mortgage agent at DLC The Mortgage Source and one of last year’s Rising Stars, says that during the pandemic, mortgage professionals of all stripes realized that their clients were counting on them to provide reassurance and guidance during an unprecedented period of uncertainty.

“I think the first issue we were seeing was that so many people were worried,” she says. “With all of the issues of mortgage deferrals, we really had to educate as many people as possible about those ... and all about taking CERB: how that’s going to affect you, are you eligible, things like that. It’s been interesting to navigate those changes and try to keep our clients educated at the same time so that they’re making the best decisions they can.”

More than just a job

Those looking in from outside the mortgage industry often don’t grasp just how time-consuming it can be for agents and brokers, whose workday doesn’t necessarily end when they leave the office. Kaaki says her profession is a “different world” than that of many of her friends.

“It’s a nonstop job – it’s not a 9-to-5 or an 8-to-4,” she says. “I work all day, every day, weekends. If a client needs me, I’m available. It’s much more intensive than my non-industry friends’ jobs. It gets exhausting, but luckily we are a good strong team [at the brokerage], and we’re able to pick up for each other if you need some time or a break. But for the most part, we’re all available 24/7.”

The intensity of the mortgage industry makes it essential to seek out meaningful work-life balance, particularly during the challenges posed by COVID-19, says Stefan McMillan, a mortgage agent with Mortgage Alliance and another 2020 Rising Star.

“You’re dealing with a lot of clients, and on top of a global pandemic, it can be very consuming,” he says. “You have to balance your day; you can’t spend endless hours in work. You’ve got to include some type of life balance – walking, cycling or whatever you like to do – to kind of balance that so you don’t burn out.”

Among this year’s Rising Stars, another indispensable asset was the ability to listen attentively – whether to borrowers or lenders – to make sure clients are matched with the right mortgage solution.

“I am responsible for helping borrowers to find suitable products according to their needs and budget, and helping lenders to find the right borrower for their type of products and service,” says 2021 Rising Star Hasty Kiamehr, a broker at The Mortgage Coach.

McMillan stresses that meeting clients’ expectations is a key part of the role, which means demonstrating empathy and establishing a rapport with clients, rather than simply treating the relationship as a transactional one.

“A new skill [I] had to learn [was] dealing with clients – reassuring them and just listening,” he says. “All clients are different and have different types of personality traits. That was one of the things that I found I had to develop a skill on – human behavior, psychology and balancing the sales and the psychology.”

He adds that another crucial component of the job is to avoid “focusing on making a dollar and not really caring about the individual themselves.”

Developing expertise

One of the most challenging tasks when starting out in the mortgage industry can be absorbing relevant information and learning quickly on the job – but it’s a challenge this year’s Rising Stars have mastered. Kiamehr emphasizes the value of presenting an expert opinion to clients so they know they’re in safe hands.

“My goal is to make sure that I educate my clients and help them understand how they can achieve financial freedom through real estate,” she says. “I take the time to educate myself with lenders’ products and guidelines.”

Fellow 2021 Rising Star Natasha Ali, an account manager at First National Financial, was similarly described by a peer as being “extremely knowledgeable about products, as well as what the competition offers” and someone who “works well in finding solutions to challenges.”

Kaaki acknowledges that the abundance of information mortgage professionals are required to master from the outset can prove “potentially overwhelming,” but she says a strong guiding figure – in her case, her father, an industry veteran – can be a particularly valuable asset.

“It’s so important to have a good mentor who can really help and guide you,” she says. “There’s so much to know in this industry that sometimes you need someone to help you out a little bit and guide you in the right direction.”

It’s also perfectly fine, Kaaki adds, for young mortgage professionals to be open about the fact that they’re still learning on the job; after all, everybody has to start somewhere.

“One of the most important things to do is to ask a lot of questions and be open to learning,” she says. “It’s always super important to have that transparency – but also be willing to learn and ask for help from people around you. Being able to ask for help, listening and taking that advice is super important.”

Many of this year’s Rising Stars were singled out for their ability to innovate and find new ways to increase their volume or all-round efficiency as a mortgage professional. McMillan advises newcomers to set out a clear strategy for how to succeed in the industry from the beginning.

“One piece of advice I would give a young agent is definitely to create a business plan that gives you an idea of how much you want to earn, whether you want to build a team and things like that,” he says. “Do your due diligence and research behind the whole industry, speaking to principal brokers and brokers. Take 15 minutes of your time, and you can acquire a bit of insight and information into how this industry operates and how you can be successful.

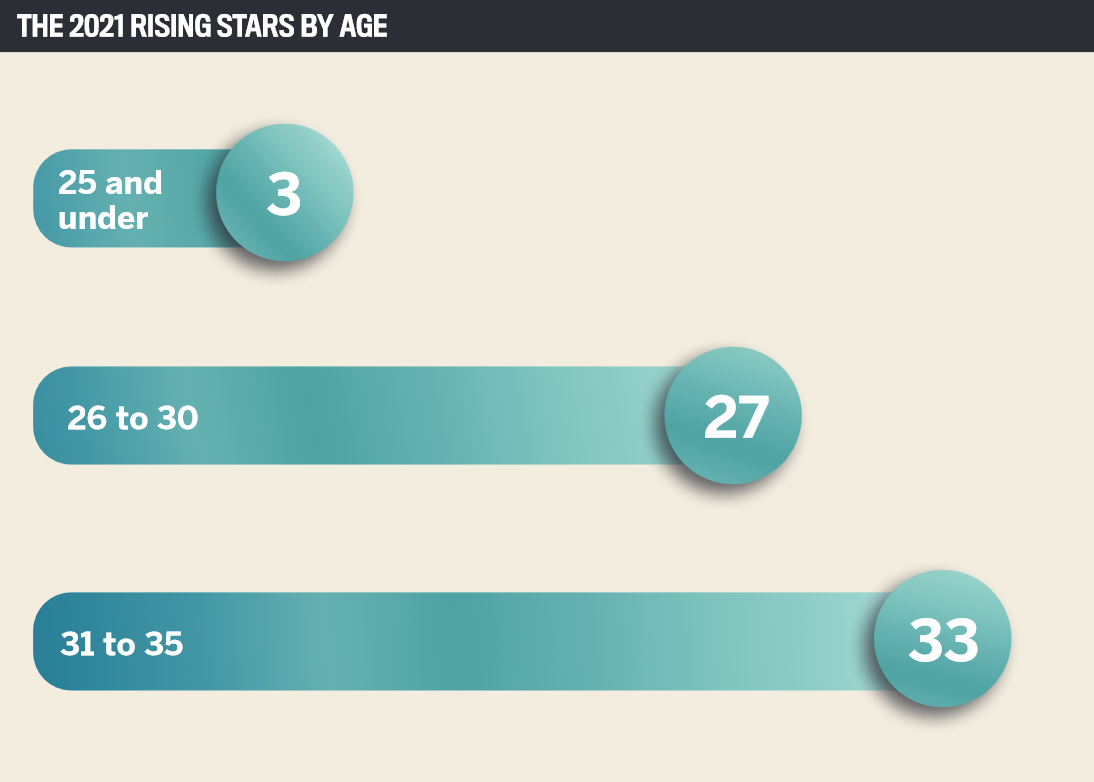

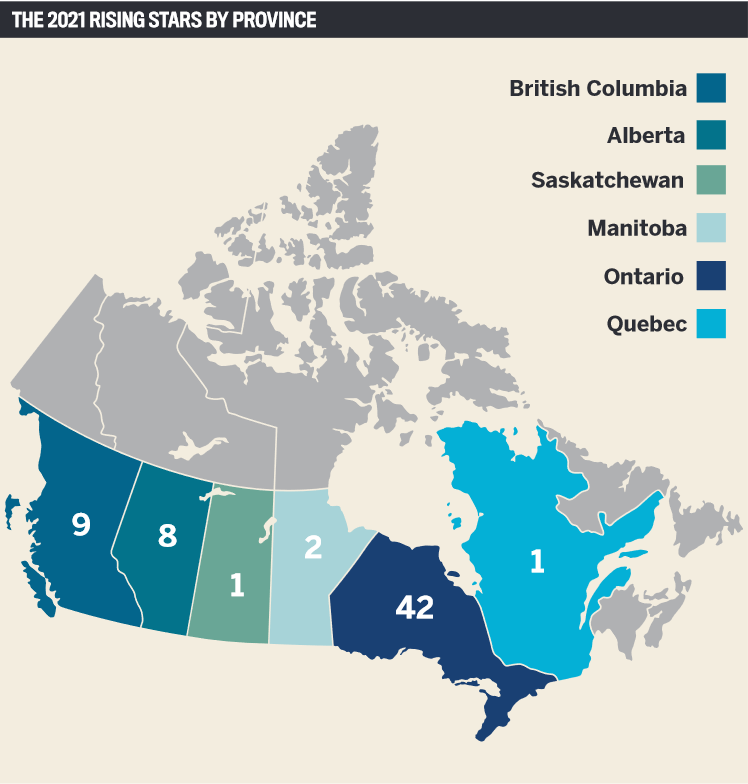

Starting in March, CMP invited professionals from across the Canadian mortgage industry to nominate their most exceptional young talent for the annual Rising Stars list. Nominees had to be age 35 or under (as of March 31, 2021) and have committed to a career in mortgages with a clear passion for the industry. To maintain a focus on new talent, only nominees who hadn’t previously been recognized as a CMP Rising Star were considered.

Nominees were asked about their current role and responsibilities and their key achievements over the past 12 months. Recommendations from managers and senior industry professionals were also considered.

The CMP team reviewed all nominations, narrowing the list down to 63 of the industry’s most outstanding young professionals.