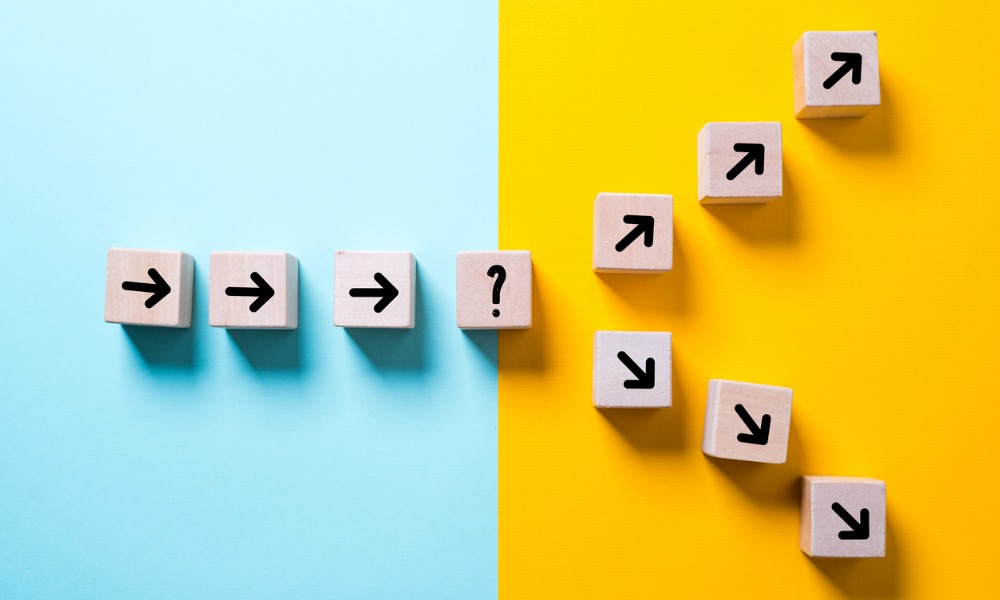

Here is what you need to consider when you are making a decision

When trying to decide between a mortgage broker and a direct lender to get the best mortgage loan, it is important to do your research. Securing a loan can be a complex process, but depending on your choice, it could be made simpler. Here are some things to consider when trying to decide what works best for you.

What is a mortgage broker?

A mortgage broker is someone who will help you find a mortgage that best suits your financial situation. Essentially, a mortgage broker is a financial professional whose job it is to bring borrowers and lenders together. Mortgage brokers themselves are not lenders, and therefore cannot use their own money to advance your mortgage loan. Rather, mortgage brokers will act as an intermediary for you, helping you compare mortgages and bringing you multiple quotes from different lenders at once.

To help you shop for mortgages more efficiently, mortgage brokers sit down with you to assess your financial situation and your needs, gathering crucial documents and overall information that lenders need from the borrower. This information usually includes tax returns, income, pay stubs, credit reports, and your investment and asset details. Brokers use this information to see how much you can afford to borrow.

Once compiled, brokers bring this information to the bank or other lender for loan approval. During the application and approval processes, mortgage brokers are additionally responsible for the communication between the lenders and the borrowers. Mortgage brokers will be able to bring valuable information to you like which lenders offer specific types of mortgages and which lenders loan funds in certain areas.

What is a direct lender?

A financial institution or a private entity, a direct lender is where you actually get the loan for your mortgage. Typically, a direct lender will be a bank or another financial institution. In other circumstances, a direct lender can be a private company that deals specifically with financing mortgage loans for the general public. Many of these types of direct lenders operate online.

It is a common practice that a borrower will select a lender that they have already done business with. So if you have a long-standing relationship with a lender, it could help you secure a better (higher) loan amount and a better interest rate. When you apply for a mortgage through a direct lender, the process is the same as when you apply with a mortgage broker: you will have to provide documents, fill out applications, and wait for approval.

When you go through a direct lender, you are essentially cutting out the middleman. It could also make the entire loan process quicker, because you can speak effectively with the lender instead of having to rely on a broker to relay the messages back and forth. This is because lenders deal directly with consumers.

Things to consider when choosing the best for your needs

When deciding between a mortgage broker and a direct lender, it is important to know what each offers and what will suit your needs best. The main advantage of a mortgage broker, for instance, is that they can help you navigate the complex landscape of lending institutions such as banks. A mortgage broker simply has more knowledge of the terrain than someone who is just shopping around.

Additionally, mortgage brokers usually work with multiple lenders—which also means they can find the best fit for you. This also means that you will have peace of mind that you have found the right mortgage. Two things to consider that may give you pause are that brokers come with fees and there are some lenders who do not work with brokers.

Learn why is it easier to get approved for a mortgage through a broker here.

Direct lenders, on the other hand, allow you to cut out the middleman and speak directly to your loan officer. It also allows you to skip mortgage broker fees. If you do your research, you will be able to suss out which financial institutions offer the best mortgage rates and which offer perks or rate discounts if you open more than one account with them.

Read next: What does a mortgage loan officer do?

It is important to know, however, that direct lenders offer options that are limited to their own products. Also know that if you aren’t approved by one lender and go to another, you will be subject to multiple credit inquiries, which can impact your credit score – in turn hindering your chance of getting the best interest rate.

Is it better to go through a mortgage broker or direct to a bank?

Short answer: it depends. Firstly, it depends on how much work (i.e., research) you want to put in, your personal situation, and your financial goals. However, time is not a luxury that is available to everyone. With their access to various lenders, a mortgage broker could be your best option, especially if you do not fit into the standard borrower profile. If you decide to go with a direct lender, you may be able to use that pre-existing relationship to get a discount you won’t be able to find elsewhere.