It's the US central bank's largest single rate increase for 28 years

The Federal Reserve has made its most aggressive move on interest rates in 28 years, hiking its benchmark rate by 0.75% in a bid to tackle the mounting inflation crisis in the US.

That brings the short-term rate to a range of 1.5% to 1.75% and marks the first time the Fed has introduced a three-quarter-point increase since 1994, a sign that inflation is proving more difficult to control than anticipated.

Expectations of a supersized hike ramped up in the days before the Fed’s announcement as new government data showed prices rocketed at their fastest pace since 1981 in the US in May, rising by 8.6% on a year-over-year basis.

That grim news on inflation coincided with consumer confidence plummeting in early June to its lowest level on record, according to the University of Michigan, and appears to have prompted the Fed to up the ante on its plan for interest rates.

Last month, Fed Chairman Jerome Powell said a 0.75% increase was “not something the committee is actively considering” – but markets began to price in an aggressive hike because of the gloomier overall outlook on inflation and consumer sentiment.

Read next: How borrowers can manage the squeeze of rate increases

US mortgage rates have already surged during the past week ahead of the Fed decision with the average rate on a 30-year fixed mortgage climbing to 6.28%, up from 5.55% seven days prior.

That rate, which stood at 3.11% at the end of 2021, has been on an upward trajectory throughout the year to date following the record lows of the COVID-19 pandemic. It’s risen sharply as the Fed ends its support for mortgage-backed bonds, leading to a cooldown in the housing market with demand tailing off.

The US’s 30-year fixed mortgage rate up to 2020 (Source: Macrotrends)

A combination of inflation and rising rates appears to be causing many would-be-homebuyers to think again on entering the market, according to Freddie Mac’s chief economist Sam Khater – although the Mortgage Bankers Association’s latest survey showed that mortgage applications have rebounded quickly after recently hitting a 22-year low.

Read next: Cost-of-living crisis: What do mortgage holders need to keep in mind?

Consumer price index (CPI) inflation has swelled across the world in recent months due to supply chain snarls and upward pressure on energy prices caused by Russia’s invasion of Ukraine. However, the US’s May inflation data surprised those observers who believed it had already peaked in the country.

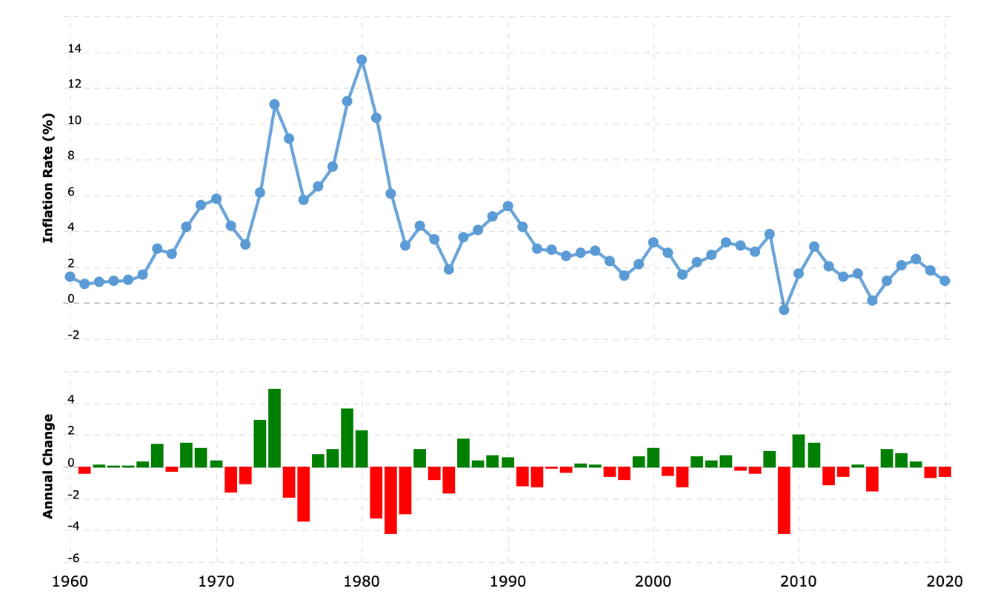

Annual inflation and yearly change in the US, 1960-2020 (Source: Macrotrends)

The central bank could follow up today’s decision with another supersized rate hike, according to Goldman Sachs, which expects a further 75-basis-point increase in July followed by a 0.5% hike in September.

That benchmark rate remained near zero throughout nearly two years of the COVID-19 pandemic before the Fed announced a 25-basis-point increase in March this year, following that up with a 0.5% hike in May.

The Fed is set to meet again on July 26-27, with further meetings scheduled for September, November and December.