Familiar woes for housing and mortgage markets show no sign of easing

A shocking lack of inventory remains one of the top contributors to Canada’s housing crisis – and that picture doesn’t look like changing anytime soon with homebuilder sentiment at an all-time low, according to a new report.

Concern is growing among builders about the national residential construction industry’s health, the Canadian Home Builders’ Association’s (CHBA’s) latest Housing Market Index showed, with plunging optimism amid a slower pace of building and a slew of cancelled projects in 2023.

Fully 36% of builders expect fewer housing starts in the year ahead compared to the 12 months prior, CHBA said – grim news for a national outlook that already shows the speed of home construction is lagging far behind what’s required to maintain affordability.

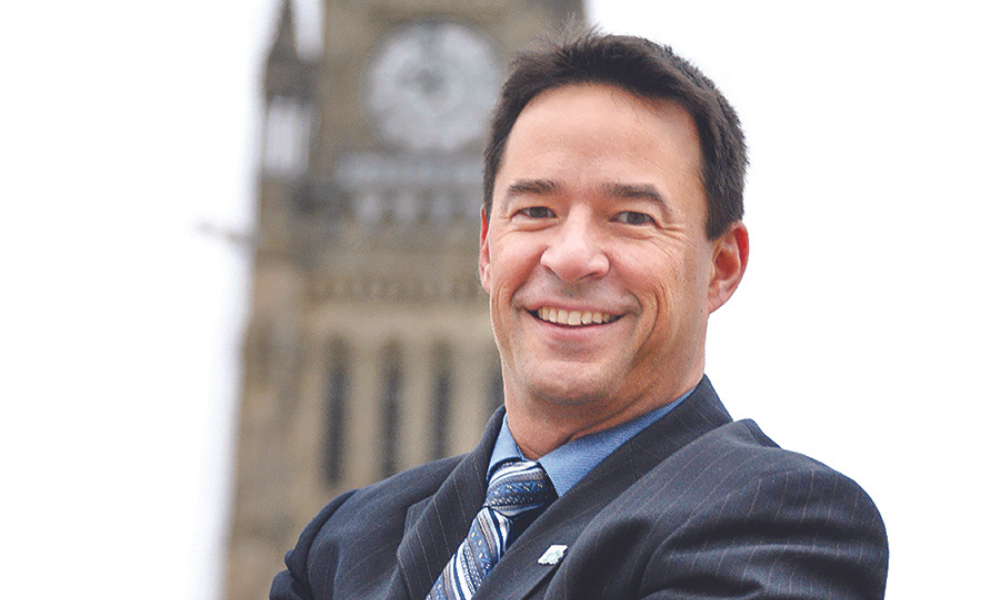

Kevin Lee (pictured top), CHBA’s chief executive officer, told Canadian Mortgage Professional that the news homebuilder sentiment had slid to 24.6 on the association’s scale of 0 to 100 – its lowest since the index began – came as little surprise in the context of the industry’s recent challenges.

“Unfortunately, it’s pretty much exactly what we’ve been hearing from our members,” he said. “There’s no question that the high-interest-rate environment continues to have a huge impact on sales… We expect it’ll still be a pretty slow start to 2024, to say the least.”

Why is the pace of building so slow – and what can be done about it?

A perfect storm of rising interest rates and steep construction costs have weighed upon homebuilding prospects in recent times, with a decline in lumber prices offset by spiking costs of other materials.

Rates are projected to fall at some point in 2024 – but they may not drop quickly enough, according to Lee. “Hopefully [lower rates] will be the case, and that will provide a little bit of relief. The expectation, of course, is that that’s not going to be until later in the year,” he said.

“So it’s not going to hit the most important time of year, which is springtime. And of course, the slow descent will probably result in a slow pickup in starts well into the future.”

Now is the time for the government to step in with decisive action to spur building and get Canadians into homes, Lee said, with the target set by Canada Mortgage and Housing Corporation (CMHC) of 3.5 million additional housing units by 2030 currently nowhere close to being realized.

RBC's Robert Hogue suggests that despite a potential repeat of last year's spring housing market surge, the main uptick in 2024 might occur in the second half of the year.https://t.co/EFEhH0fXEd#mortgageindustry #industrytrends #housingmarket #economicoutlook

— Canadian Mortgage Professional Magazine (@CMPmagazine) February 5, 2024

“We do have to overcome a bunch of policy and regulatory barriers, especially at the local level, that are hindering development. We’re seeing some movement there – so that’ll need to continue to head in that direction,” Lee said.

“But I think when we look at right now and into the future, we’ve had such a tightening of mortgage rules over the past decade and it has really come at the cost of homeownership.”

Among CHBA’s recommendations for the federal government: increasing the amortization period on insured mortgages to 30 years, a measure Lee said could potentially be limited solely to new construction to help incentivize homebuilding and avoid overheating things on the existing-homes side.

“Increasing to 30-year [amortizations] would really give that first-time buyer a leg up in being able to get into the market,” he said, “because with high interest rates and the stress test and everything else, it’s just so hard to qualify for a mortgage that we’re seeing it really hit housing starts and putting pressure on the rental market as well.”

Stress test, excessive bureaucracy key concerns amid current crisis

Also up for discussion should be ratcheting the stress test down slightly, Lee said, and encouraging longer-term mortgages of seven to 10 years. Red tape and bureaucracy, meanwhile, also remains a familiar hurdle in the homebuilding process.

“It really is a big concern and has been quite a concern for a while,” he said. “We’re pleased with the Housing Accelerator Fund that the federal government has put forward to really incent municipalities to look hard at their processes and permitting systems and everything to really get more supply moving.

“Everybody needs to be cognizant [that] if we’re going to build more houses, we really need to cut through the existing red tape.”

Make sure to get all the latest news to your inbox on Canada’s mortgage and housing markets by signing up for our free daily newsletter here.