CMHC figures are in line with expectations… Royal LePage report shows a two-tier housing market in our cities… Even multimillionaires have mortgages but they’ll need a bigger down payment… And smart home tech giant links with developers…

CMHC stats ‘in line with soft landing’

New stats released by the Canada Mortgage and Housing Corporation show that were 185,939 new home starts in June compared to 184,019 in May. The trend is a six-month moving average of the monthly seasonally adjusted annual rates of housing starts. “This is in line with CMHC’s analysis indicating that the new home construction market in Canada is headed for a soft landing in 2014,” said Bob Dugan, CMHC’s Chief Economist. “Builders are expected to continue to manage their building activity to ensure that demand from buyers seeking a new unit is channeled toward unsold units, whether these are under construction or completed.” In June, the seasonally adjusted annual rate of urban starts increased in Atlantic Canada and the Prairies, and decreased in Quebec, Ontario, and British Columbia.

Canada’s two-tier housing market

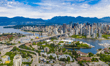

In our major cities the market is red hot, with demand outstripping supply and sending prices sky high. Elsewhere though it’s generally a different story. The latest Home Price Survey from Royal LePage shows the average price hike is around 5 per cent in a year, but that is largely driven by the hot markets. In smaller cities growth is small, assuming there is any at all. In Ottawa for example, prices of two-storey homes have risen by an average of 0.8 per cent and in Saint Prince there’s been a drop of 8.5 per cent. “Chronic supply shortages are driving price spikes in Canada’s major cities, masking otherwise moderate home price appreciation nationally,” said Phil Soper, president and chief executive of Royal LePage. “While a widening affordability gap in Canada’s largest urban centres is characterizing the national market Canadians read about daily, year-over-year house price increases in most regions of the country are presently tracking below the historical average.” Looking ahead at the remainder of 2014, Royal LePage is projecting that the national average house price will increase at 5.1% per cent for the full-year.

Millionaire mortgages

If you have the kind of money that buys you a multi-million dollar home many would be surprised to find you seeking a mortgage. However millionaires frequently do have a home loan as their wealth is tied up elsewhere. Lenders tend not offer loans of percentages a more modest purchaser could expect. A buyer of a $2 million home may have to make a 40 per cent down payment. That’s a sizeable deposit, especially for any potential purchaser of home once owned by Henry Ford. The Calgary property is in line to be the most expensive residence listed in the province at $37.9 million; in case you’re the broker approached for the mortgage, you’ll need to see a down payment of $15.1 million. Read the full story.

Smart-home tech firm links with developer

Samsung’s smart-home technology which links up all your home appliances to a smartphone or tablet is being rolled out in Canada via a condo developer. While most consumer electronics would typically go to market through retail outlets or online, Samsung’s strategy may prove to be a smart one; selling their product straight into new homes rather than relying on a secondary purchase. The firm’s first deal looks set to be with YC Condos but there will be others. With the speed at which technology grows, we can soon expect the practice of running a bath while still on our way home to be very much part of everyday life. Read the full story.

New stats released by the Canada Mortgage and Housing Corporation show that were 185,939 new home starts in June compared to 184,019 in May. The trend is a six-month moving average of the monthly seasonally adjusted annual rates of housing starts. “This is in line with CMHC’s analysis indicating that the new home construction market in Canada is headed for a soft landing in 2014,” said Bob Dugan, CMHC’s Chief Economist. “Builders are expected to continue to manage their building activity to ensure that demand from buyers seeking a new unit is channeled toward unsold units, whether these are under construction or completed.” In June, the seasonally adjusted annual rate of urban starts increased in Atlantic Canada and the Prairies, and decreased in Quebec, Ontario, and British Columbia.

Canada’s two-tier housing market

In our major cities the market is red hot, with demand outstripping supply and sending prices sky high. Elsewhere though it’s generally a different story. The latest Home Price Survey from Royal LePage shows the average price hike is around 5 per cent in a year, but that is largely driven by the hot markets. In smaller cities growth is small, assuming there is any at all. In Ottawa for example, prices of two-storey homes have risen by an average of 0.8 per cent and in Saint Prince there’s been a drop of 8.5 per cent. “Chronic supply shortages are driving price spikes in Canada’s major cities, masking otherwise moderate home price appreciation nationally,” said Phil Soper, president and chief executive of Royal LePage. “While a widening affordability gap in Canada’s largest urban centres is characterizing the national market Canadians read about daily, year-over-year house price increases in most regions of the country are presently tracking below the historical average.” Looking ahead at the remainder of 2014, Royal LePage is projecting that the national average house price will increase at 5.1% per cent for the full-year.

Millionaire mortgages

If you have the kind of money that buys you a multi-million dollar home many would be surprised to find you seeking a mortgage. However millionaires frequently do have a home loan as their wealth is tied up elsewhere. Lenders tend not offer loans of percentages a more modest purchaser could expect. A buyer of a $2 million home may have to make a 40 per cent down payment. That’s a sizeable deposit, especially for any potential purchaser of home once owned by Henry Ford. The Calgary property is in line to be the most expensive residence listed in the province at $37.9 million; in case you’re the broker approached for the mortgage, you’ll need to see a down payment of $15.1 million. Read the full story.

Smart-home tech firm links with developer

Samsung’s smart-home technology which links up all your home appliances to a smartphone or tablet is being rolled out in Canada via a condo developer. While most consumer electronics would typically go to market through retail outlets or online, Samsung’s strategy may prove to be a smart one; selling their product straight into new homes rather than relying on a secondary purchase. The firm’s first deal looks set to be with YC Condos but there will be others. With the speed at which technology grows, we can soon expect the practice of running a bath while still on our way home to be very much part of everyday life. Read the full story.