The study sheds light on Canada’s most attractive markets right now

A Royal LePage report on Canadian condo prices by the square foot reveals Montreal and Ottawa remain among the country’s most attractive real estate markets.

“We’ve seen a continuous slowing in the rate of appreciation. Prices have continued to rise in Montreal, but right through 2019 we’ve seen the rate at which prices are going up begin to slow,” said Phil Soper, Royal LePage’s president and CEO. “Pent up opportunity that existed in Montreal has been taken advantage of, and as a city it sat on the sidelines for a good six years while the other big cities in the country had expanding real estate markets. It didn’t get in on the party until the latter half of this decade.”

According to the Royal LePage report, the median price per square foot for a Montreal condo through the first seven months of the year rose 7.9% year-over-year to $433. The price per square foot of a single-family detached home in Montreal increased 6.9% during that same span to reach $313. The aggregate price per square foot in Montreal proper and the Greater Montreal Area jumped 8.3% and 5.9% to $357 and $286, respectively.

In Ottawa, the median price per square foot of a condo surged a whopping 17.9% year-over-year to $395, while the median price per square foot of a single-family Ottawa home increased 8.5% to reach $265.

“Ottawa, for the most part, missed the market correction driven by the B-20 regulations, so they slowed but they never backed up the way Toronto and Vancouver did, and I think the base reasons are affordability—people found they could continue meeting the new stress test regulations given the lower entry price of property,” continued Soper.

“It’s a goldilocks market that doesn’t have the peaks and valleys you see in bigger cities, so there was no overshooting of price like there was in Toronto and Vancouver between 2014 and 2016.”

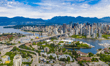

Through the end of July, Greater Vancouver condos saw the steepest year-over-year decline of any major Canadian market, as the price per square foot fell 8.3% to $764. In the City of Vancouver, the median price per square foot also fell, but only 6.3% to a still-exorbitant $1,044.

“The Vancouver issue was a perfect storm of regulatory intervention, meaning municipal, provincial and federal regulations were all raining down on an already twitching market,” said Soper. “It weighed heavily on consumers, developers and foreign investors. Everybody was pushed to the sidelines. It’s the most expensive market, which saw the highest appreciation in the run up to the middle of the decade.”

British Columbia is an interesting case study, added Soper. Economic prospects are auspicious with low unemployment and high business investment relative to GDP percentage—Soper points to the money flowing into LNG development in Kitimat, as an example. However, the homeownership rate in Vancouver is the lowest in Canada.

“It’s affordability-driven. It’s still much higher than in cities like San Francisco and New York, but low by Canadian standards. It’s an expensive city to live in; it has really expensive real property. The place is improving with development of new commercial and residential projects.”