Industry think-tanks call on policy makers should move quickly to address the disparity

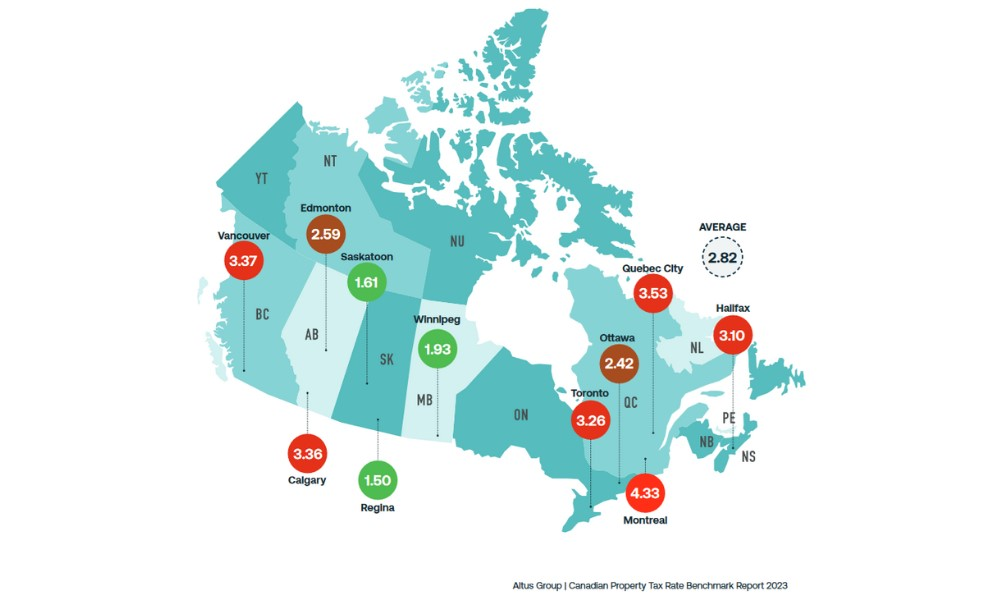

In the majority of Canada’s largest cities, commercial tax rates have been found to be more than three times as large as residential rates — a trend that could eventually prove to be disastrous for business stability and the country’s long-term economic health, according to a new analysis by Altus Group and REALPAC.

“As values of residential properties have skyrocketed and housing affordability has become a crisis in many communities, increased pressure has been placed on municipalities to reduce tax costs for homeowners,” Altus said.

“At the same time, values of commercial properties are beginning to stagnate or fall as interest rates continue to rise, and the cost of debt and operating expenses are becoming unmanageable.”

It is incumbent upon policy makers to balance these dynamics “to support business viability and community growth” – particularly since inflationary pressures are forcing many commercial asset owners and their tenants to labour under increasingly burdensome levies, Altus said.

“Property tax ratios of commercial-to-residential should not generally exceed a ratio of 2 to 1,” added Michael Brooks, CEO of REALPAC. “While we acknowledge the budgetary challenges faced by governments, this is not about the size of the pie; it is about the fairness between the slices of that pie.”

Michel Durand, Founder and CEO of MCommercial, said that while the commercial sector continued to labour under familiar struggles from 2022, there was room for optimism on the horizon.https://t.co/BDngGPTZL7#mortgagenews #commercialmarket #mortgageinsights #interestrates

— Canadian Mortgage Professional Magazine (@CMPmagazine) May 15, 2023

Local governments, in particular, are well placed to address these issues.

“We encourage municipalities to work with REALPAC to identify fair taxation solutions that support economic growth without unduly burdening commercial properties and their tenants,” Brooks said.