Solution is being developed with Home Point Financial

A comprehensive suite of fully-integrated cloud-based digital mortgage applications has been beta launched by Capsilon.

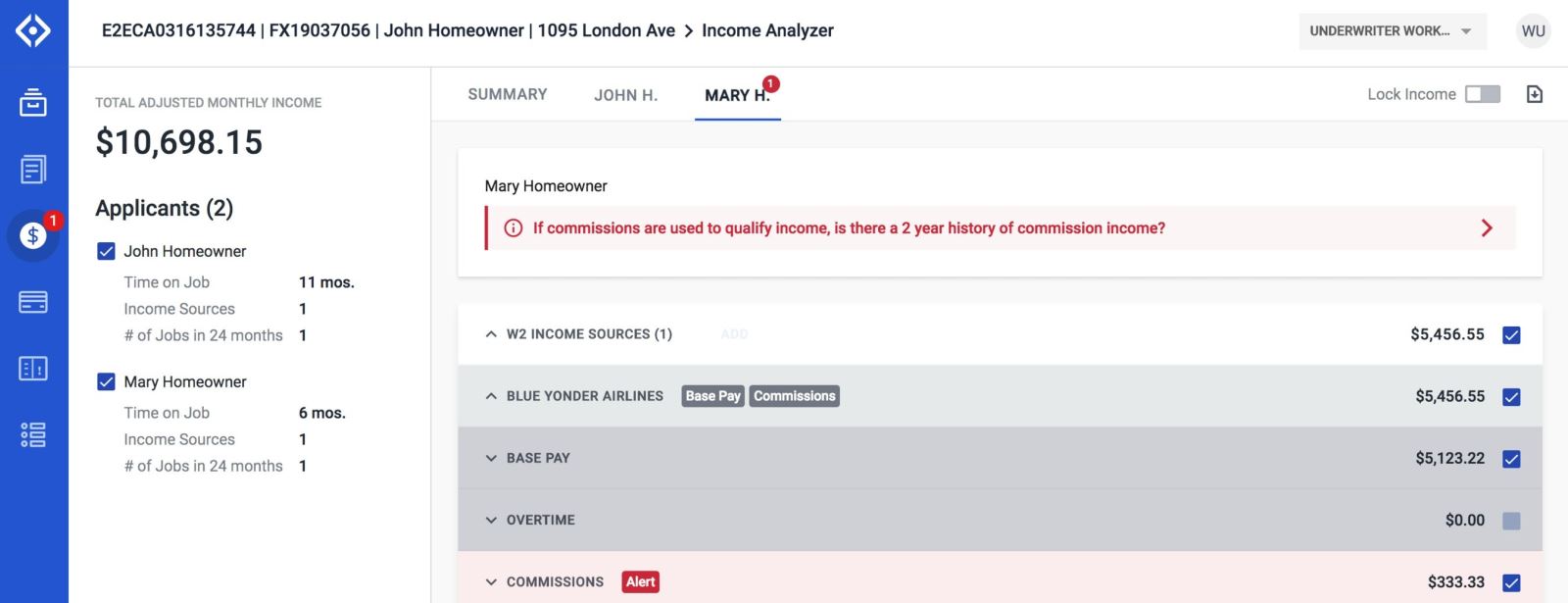

Capsilon Digital Underwriter will help lenders and investors make rapid, informed loan eligibility decisions with perfected data.

"Mortgage underwriting velocity has declined more than 85% over the last decade due to increased compliance and regulatory guidelines," said Steve Viarengo, SVP of Digital Mortgage Solutions. "We're delighted to collaborate with Home Point Financial to build a solution that will radically speed up mortgage underwriting and enable lenders and investors to make smarter decisions with accurate data."

The new product runs on the firm’s digital mortgage platform Capsilon IQ and is being launched as part of a broader company initiative to develop solutions that solve key points across the mortgage life cycle.

Source: Capsilon

Collaboration with lenders, servicers

To achieve its initiative, the firm is partnering with leading mortgage lenders, investors, and servicers, and the Digital Underwriter suite is being created in collaboration with mortgage lender Home Point Financial.

"Capsilon is uniquely positioned to solve the underwriting problem with advanced technologies," said Bill Shuler, Chief Information Officer of Home Point Financial. "You can't automate underwriting without trusted data. Capsilon elegantly combines the ability to capture and perfect mortgage data with robust automation capabilities. Capsilon has been a great partner to Home Point and we're excited to collaborate with them on this strategic initiative to digitize the underwriting process."