However, the coronavirus stimulus package may not be effective in easing consumer financial pain in the long term

Government efforts to provide relief for consumers and to stimulate the economy amid the COVID-19 pandemic have been paying off, according to data from LegalShield.

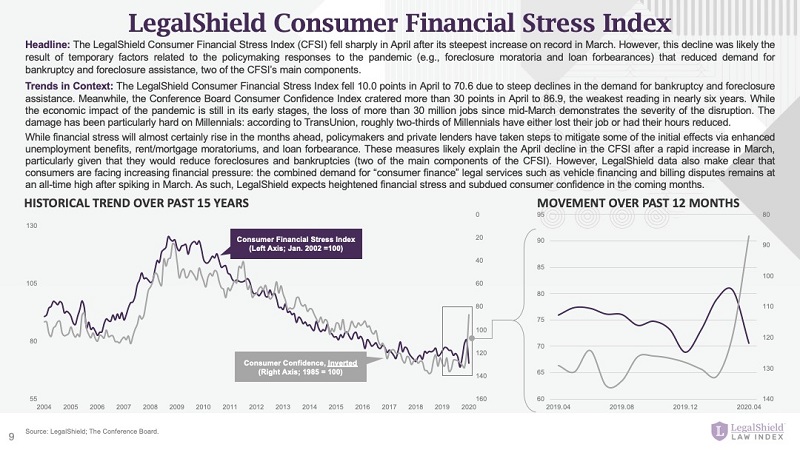

LegalShield's Consumer Financial Stress Index posted a steep month-over-month drop, down 10 points from 80.6 in March to 70.6 in April. The March results marked the highest reading in nearly four years and an all-time high in the 16-year history of the index, making the 10-point turnaround in April almost as significant.

“We have to admit to some initial surprise at the data because it is counterintuitive to what we see and know is happening during this horrible crisis,” said Scott Grissom, senior vice president and chief product officer of LegalShield.

However, the drop was likely a result of temporary factors tied to the government's responses to the pandemic, such as foreclosure moratoria and loan forbearances, that reduced demand for bankruptcy and foreclosure-related legal services.

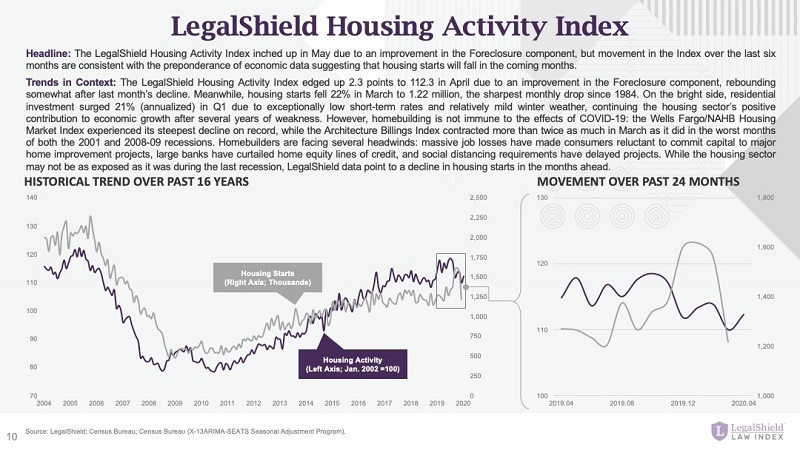

Additionally, its Housing Activity Index, an indicator of housing starts, bounced back from the 22-point decline in March, up 2.3 points to 113.3 in April.

“As we dug in further, it became clear that in the midst of potentially great financial challenges, consumers and small business did find some temporary relief, such as the federal Paycheck Protection Program for small business employees, economic stimulus payments of $1,200 to eligible adults, enhanced unemployment benefits, certain states instituting moratoria on evictions due to unpaid rent or mortgages, and even temporary mortgage relief by certain financial institutions," Grissom said.

But Grissom said that the temporary relief might not be enough to pull the economy out of a recession.

"Even so, we believe that this array of initiatives created to ‘bridge us to recovery’ in the near term may not have staying power in ultimately warding off consumer financial pain long-term," Grissom said. "In fact, we believe the opposite.”

The spike in COVID-19 layoffs and high mortgage forbearances suggest that bankruptcy and foreclosure activities might continue to increase in the coming months.