With thousands of options, choosing the right intermediaries can be challenging. We're making your search easier by listing the best ones

Updated: 27 Feb 2025

The UK’s lending sector is highly competitive; going through the process alone as a first timer can be overwhelming. If you’re ready to purchase a home but aren’t quite sure where to start, a mortgage intermediary can be of great help.

Intermediaries – also called mortgage brokers or advisers – scour the market for potential lenders that can provide you with the best deal and assist with special situations.

In this article, we will list the top mortgage intermediaries in the UK. We will give you a rundown of the benefits each offers, so you can pick the one that suits your needs. Read on and find out how these industry players can help you achieve your homeownership dreams.

What are the top mortgage intermediaries in the UK?

The UK is home to thousands of brokerage firms and intermediaries, that’s why finding the one that can assist with your unique needs can be tricky. Given that each home buyer’s profile and circumstances differ, it’s also hard to pick a clear-cut top choice for everyone.

Because of this, we decided to arrange this list of top mortgage intermediaries in the UK in no particular order. We also limited our picks to national brokers, although you can find independent local intermediaries that can cater to your needs. Here are our choices:

- Alexander Hall

- Better.co.uk

- First Mortgage

- Habito

- John Charcol

- L&C Mortgages

- Mojo Mortgages

- Mortgage Advice Bureau

- Simply Adverse

- Tembo

We have also created a list of mortgage lenders that the top mortgage intermediaries in the UK can work with. Here are 20 of them:

- NatWest for intermediaries

- Barclays for intermediaries

- HSBC for intermediaries

- Nationwide for intermediaries

- Accord for intermediaries

- Coventry for intermediaries

- Leeds for intermediaries

- Skipton for intermediaries

- Aldermore for intermediaries

- Platform (now The Co-op) for intermediaries

- Precise for intermediaries

- Principality for intermediaries

- BM Solutions for intermediaries

- Kent Reliance for intermediaries

- The Mortgage Works for intermediaries

- Virgin for intermediaries

- Bank of Ireland for intermediaries

- Paragon for intermediaries

- West Brom for intermediaries

- Kensington for intermediaries

Let's take a closer look at each mortgage lender that the UK’s top mortgage brokers can partner with:

1. NatWest for intermediaries

NatWest for Intermediaries offers a wide range of mortgage products. This includes residential, remortgage, and Buy to Let options. This mortgage lender provides a hassle-free experience for intermediaries who want to recommend tailored mortgage solutions to their clients.

2. Barclays for intermediaries

Through their intermediary-only platform, Barclays for Intermediaries provides mortgage brokers with flexible lending criteria and low deposit options. They support their partner-brokers by giving them access to the Intermediary Hub.

This tool allows a mortgage broker to see real-time case updates for their clients. It also has a live chat, and a ‘Knowledge’ help centre for further assistance. Barclays is known for having various property loans that cater to different types of clients. It’s one of the reasons why the top mortgage intermediaries in the UK should work with them.

3. HSBC for intermediaries

HSBC for Intermediaries delivers competitive mortgage products and exclusive broker-only deals through their exclusive website. This banking giant boasts a strong global presence, with proven and effective lending solutions for their clients.

They offer their High Value Mortgage Service for home loans that are priced at £1 million or above. This is perfect for property buyers who are looking for large mortgages.

4. Nationwide for intermediaries

Nationwide for Intermediaries, the mortgage arm of Nationwide Building Society, offers a broad range of mortgage solutions for these client types:

- first-time home buyers

- clients looking to remortgage

- clients who want to buy energy-efficient homes

- borrowers moving homes and transferring existing mortgage product to a new property

5. Accord for intermediaries

Accord Mortgages, a subsidiary of Yorkshire Building Society, is an intermediary-only mortgage provider. They specialise in providing flexible lending solutions for residential and Buy to Let clients. They also have a dedicated website for intermediaries where the latter can access helpful tools like Accord’s Product Finder and affordability calculators.

6. Coventry for intermediaries

Coventry for Intermediaries is the trading name of Coventry Building Society, the UK's second largest building society in 2023. They are a member of the Building Societies Association (BSA). Coventry adopts an intermediary-focused approach, providing mortgage brokers with high-quality service.

Coventry combines their offerings with competitive rates. Eligible borrowers can find the right home loan when they browse Coventry’s wide range of mortgage products.

7. Leeds for intermediaries

Next is another building society that can cater to first-time home buyers, portfolio managers, and more. Leeds Building Society, previously known as Leeds and Holbeck (Permanent) Building Society, has mortgage products with competitive interest rates.

Aside from the usual mortgage offerings, Leeds for intermediaries has green mortgages for clients who want to buy sustainable properties. It is beneficial for the top mortgage intermediaries in the UK to look for mortgage providers with various types of home loans like Leeds.

8. Skipton for intermediaries

As the intermediary-only platform of Skipton Building Society, Skipton for Intermediaries adopts a broker-focused approach. They are committed to providing award-winning service to mortgage brokers. They also have flexible lending criteria and a strong reputation for client support.

Skipton also boasts affordability calculators like their:

- monthly payments calculator

- flexible mortgage calculator

- buy to let calculator

9. Aldermore for intermediaries

The Aldermore Bank is an established retail banking institution that has mortgage products on top of the usual banking services. Some of these property loans include residential mortgages and product switching. Aldermore supports their partner-brokers with mortgages that fit clients’ unique financial circumstances.

10. Platform (now The Co-op) for intermediaries

Platform, the intermediary lender of The Co-operative Bank, offers a wide range of mortgage products, including residential and Buy to Let deals. Their requirements for eligibility can be easily found on their intermediary-only website. As a banking firm, the Co-op Bank is the first in the UK to introduce ethical bank accounts.

11. Precise for intermediaries

As the trading name of Charter Court Financial Services Limited, Precise Mortgages markets itself as a specialist mortgage lender. Their flagship mortgage offerings are residential and Buy to Let.

For clients who are looking for remortgage services, Precise for intermediaries will accept those who will apply for these three schemes:

- Help to Buy England

- Help to Buy Scotland

- Help to Buy Wales

12. Principality for intermediaries

For the 12th spot, this building society is another member of the BSA. Principality Building Society uses their broker-only platform to showcase competitive property loans such as their:

- First Time Buyers’ mortgage

- Buy to Let and Holiday Let mortgage

- Joint Borrower Sole Proprietor mortgage

- New Build Properties mortgage

With this, they help intermediaries secure the right mortgage options for their clients. Principality’s set of eligibility criteria is also concise and straightforward.

13. BM Solutions for intermediaries

BM Solutions for Intermediaries, part of Lloyds Banking Group, specialises in Buy to Let mortgages. With their user-friendly website, BM Solutions caters to portfolio landlords and property investors. They also give access to various tools like mortgage product finder and affordability calculators.

14. Kent Reliance for intermediaries

If you’re looking for a mortgage provider that takes on complicated residential and Buy to Let cases, Kent Reliance is the way to go. It is the trading name of the OSB Group, a specialist mortgage lender and savings provider that focuses on the overlooked sectors within the mortgage market.

15. The Mortgage Works for intermediaries

The Mortgage Works for Intermediaries, a subsidiary of the Nationwide Building Society, is another trusted mortgage lender in the UK. They focus on helping clients who are:

- first-time home buyers

- first-time landlords

- experienced landlords

- consumer Buy to Let applicants

16. Virgin for intermediaries

Virgin Money, the bank founded by the famous Sir Richard Branson, has a broad range of mortgage products for eligible borrowers. It has an entry page for mortgage brokers who are interested to work with Virgin Money.

17. Bank of Ireland for intermediaries

The Bank of Ireland is the oldest bank in continuous operation in Ireland. It is also one of the traditional Big Four Irish banks. They have the usual mortgage products like residential and Buy to Let.

For complex cases, they offer their Bespoke service. It is Bank of Ireland’s personalised and flexible service for clients in difficult situations.

18. Paragon for intermediaries

Paragon for Intermediaries is bent on providing Buy to Let and specialist mortgage lending. They have tailored property loans for clients who are:

- first-time landlords

- experienced portfolio landlords

- limited company landlords

19. West Brom for intermediaries

West Brom for Intermediaries is the trading name of the West Bromwich Building Society. Aside from residential home loans, West Brom offers mortgage products like:

- Shared Ownership

- Interest Only

- New Build

- Product Switch

20. Kensington for intermediaries

Kensington Mortgages helps intermediaries find the most suitable mortgage selections for their clients. In 2023, Barclays completely acquired Kensington. Still, it operates as a specialist mortgage lender while under Barclays.

What are intermediaries?

Intermediaries are vital industry players who help aspiring homeowners secure a mortgage that best fits their circumstances. These professionals or businesses are popularly known as mortgage brokers and mortgage advisers.

There are two general types of intermediaries:

- tied intermediaries, which are restricted to offering the products of their partner lenders

- independent intermediaries, like most companies on our list, can source products from the whole UK market

If you’re a first-time buyer with a limited knowledge of how the mortgage process works, an intermediary can help save you time and money and avoid a lot of stress. These experts will know which lenders are most likely to approve your application and how you can get the best deal.

Our mortgage rates database should be part of every intermediary’s toolkit. It shows what the top 10 mortgage providers offer and how they compare against each other. This database is updated weekly, so your intermediary should have the most updated rates to share with you.

Some of the top mortgage intermediaries in the UK don’t charge fees for their services, relying mostly on the commissions they receive from the lenders. You can access mortgage services by contacting these companies directly or visiting their branches. There is also an emerging breed of mortgage advisers that operate online only businesses.

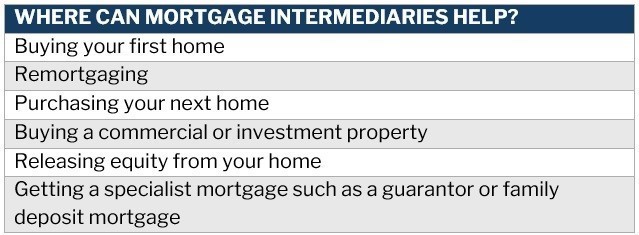

Here are some of the areas where intermediaries can help you:

What are the pros and cons of using a mortgage intermediary?

Using the services of an intermediary comes with its share of benefits and drawbacks, although the pros mostly outweigh the cons. Here are some of them:

Pros of using a mortgage intermediary

- Having the peace of mind in knowing that an industry expert is guiding you in the process

- Spares you from the time-consuming process of comparing lenders on your own

- Finds you a lender that best matches your personal and financial situation

- Lets you access products that may be available only through brokers

- Boosts your chances of getting approved for a loan the first time, protecting your credit score

- Some intermediaries don’t charge fees for their services

- Online-first mortgage brokers allow clients to access their services 24/7

Cons of using a mortgage broker

- Some intermediaries charge large fees for their services

- Some brokers don’t have access to the whole market

- Some may refuse to cover you if you have unusual circumstances like bad credit or a history of default or late mortgage payments

How can you find the right intermediary for your needs?

Because of the sheer number of intermediaries in the UK, finding one that caters to your unique needs can be challenging. National intermediaries can give you access to more lenders, but local brokers may be able to provide more personalised services.

One of the best ways to go about this is by shopping around and comparing companies. Be on the lookout for brokers and advisers that offer services that fit your situation. You can also check out review sites or ask family and friends for recommendations.

Our Best in Mortgage Special Reports page is another good place to start your search. Here, we feature individuals and businesses who have been nominated by their peers and vetted by our panel of industry experts as reliable and trusted market leaders. By choosing to go with these award-winners, you can be sure that you’re partnering with intermediaries that have your best interests in mind.

How important is the role of intermediaries in the mortgage-buying process? Would you like to share your experience with working with one? We’d love to see your story below.