While the headlines about private landlords exiting the sector can sometimes be exaggerated, it is clear that the growth trajectory for private rental has flattened considerably.

Bob Pannell (pictured) is economic adviser to the Intermediary Mortgage Lenders Association

While the headlines about private landlords exiting the sector can sometimes be exaggerated, it is clear that the growth trajectory for private rental has flattened considerably.

The number of households renting privately has stagnated in recent years, according to the latest English Housing Survey. Meanwhile, the English Private Landlords Survey (EPLS) and more recent BVA BDRC research demonstrate clearly that the prevailing sentiment amongst landlords leans more toward maintaining or shrinking investment rather than portfolio expansion.

A welter of tax and regulatory changes over recent years has driven this sea-change in sentiment.

And it is worth remembering the full impact of some of the changes has yet to be felt. This is most obvious in the case of mortgage tax relief, with the final phased reduction to a standard 20% rate of relief only taking effect from April 2020. The discomfort that landlords who are higher-rate taxpayers had when completing their self-assessment claims for the 2017-18 tax year this January will continue for several more years!

An excellent House of Commons Library publication, Comparing private rented sector policies in England, Scotland, Wales and Northern Ireland, sets out the extensive and growing burden of regulation, with the most recent addition being the recent decision by government to consult on abolishing Section 21 “no fault” evictions. Recommended reading for insomniacs!

Landlords are responding to the more challenging environment in a myriad of ways. Searching out higher yields, for example by diversifying portfolios beyond London and the South East, scaling back future investment plans and reliance on mortgage debt, and switching to limited company status, to name but a few.

With product availability at its best since the global financial crisis, according to MoneyFacts, competitive deals from mortgage lenders are supporting record levels of remortgaging activity - £27bn last year, according to UK Finance. Such refinancing has helped landlord finances.

Whichever strategy, or combination of strategies, landlords are adopting, surveys suggest that continuing landlords remain profitable for the most part, albeit less so than in the past.

Where landlords are choosing to exit the sector, regulation and finances play a part, but some actions will reflect personal reasons such as retirement. There are no signs yet of a mass exodus.

Rents

Given the pressure on landlords, it is surprising that there has not been more evidence of landlords pushing rents higher.

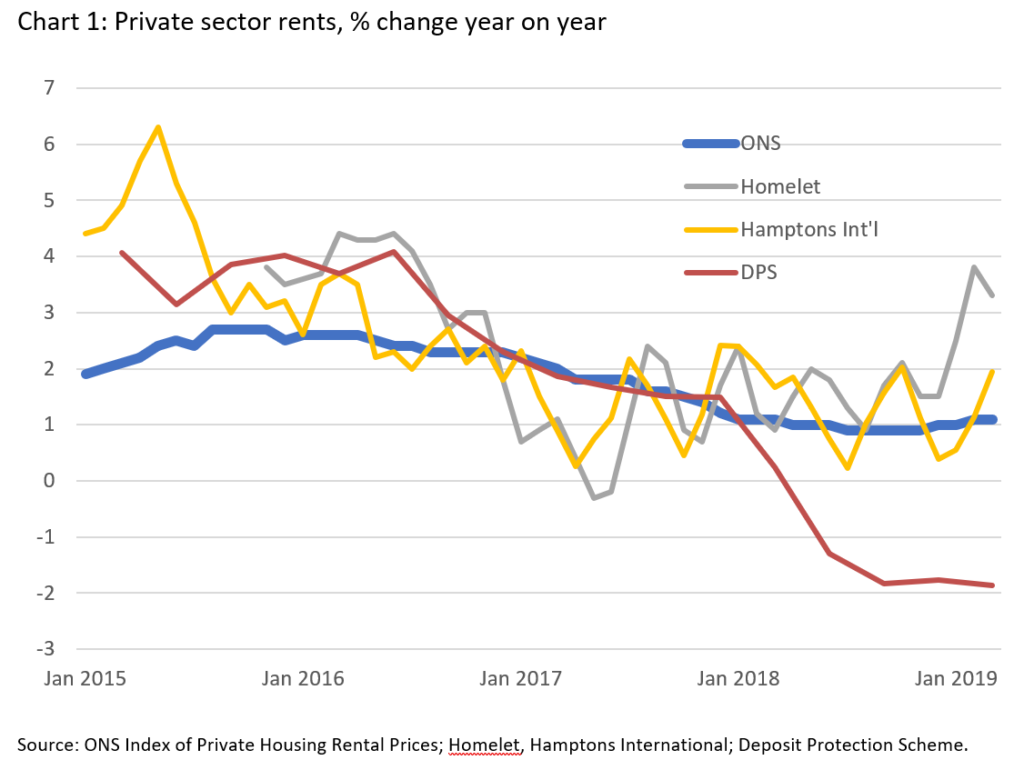

Yet, rent increases across most of the UK have been less than consumer price inflation for the past two years, according to the Office for National Statistics.

While the ONS reports rents nudging higher since late last year, it continues to show a largely benign situation and may continue to do so for some time.

The reason is that the ONS measure looks at continuing tenancies as well as new ones, and we know from EPLS that rent increases are less likely for existing tenants and typically less than for new tenancies.

If we want to focus on new lettings only, we face a truly baffling array of sources – Valuation Office, Rightmove, Zoopla, HomeLet, LSL, Hamptons International, Landbay, Your Move, the Deposit Protection Service, and no doubt several others too.

There is a very real danger of not seeing the wood for the trees here, given that these metrics can and do paint contrasting pictures as to rent levels and trends. For example, recent figures depict rents nationally as anywhere between 2% lower and 3% higher than a year ago.

At the risk of being unscientific, let me pick out one or two developments that might become more evident over the coming months.

Several surveys report that, following a protracted period of softness, average rents in London are once again increasing and have hit new records. Rightmove, which measures asking rents, and so may be ahead of many of its peers, recently reported that average rents in London were more than 8% higher than a year ago. As well as the capital, above-inflation increases in Scotland, the South West and the East Midlands have been noted by more than one data source. Homelet has recently reported UK-wide rents for new tenancies increasing at their highest rate for 3 years.

IMLA has been warning for some time that weaker investment by landlords will affect rental availability and eventually feed through into higher rental costs. If financial pressures on landlords have started to show through more explicitly in new rental contracts, then calls for rent controls are likely to grow stronger. A case of out of the frying pan into the fire …?