The advantages and disadvantages of buy-to-let mortgages

A buy-to-let mortgage is when you purchase a residential property, such as a flat or a house, so that you can rent it out to tenants. This arrangement makes you the landlord.

The purpose of a buy-to-let mortgage, like most other kinds of investments, is to generate a regular monthly income. That income could come in handy to supplement your retirement income or other forms of income.

Here is everything you need to know about buy-to-let mortgages in the UK. For our usual audience of mortgage professionals, this article is part of our client education series, and we encourage you to pass this article along to any of your clients which have questions about buy-to-let mortgages in the UK.

How much deposit do you need for a buy-to-let mortgage UK?

A buy-to-let mortgage is usually aimed at landlords who want to purchase their property to rent it out to tenants. While the rules around buy-to-let mortgages can be similar to regular residential mortgages, there are some key differences.

One of those key differences is the deposit that you put down. The minimum deposit for a buy-to-let mortgage in the UK is 25% of the value of the property, which is higher than most regular mortgages. Occasionally, buy-to-let mortgages can be anywhere from 20% to 40%.

A buy-to-let mortgage could also provide you with capital growth. Essentially, this means that your house will likely appreciate over a longer period. Then, when you eventually sell the house, you will make an additional profit. While the basics of a buy-to-let mortgage may sound obvious, there are numerous variables to consider when entering this arrangement. Like most other types of investment, you could end up losing money if you are unlucky and careless.

Here is a look at some key differences about buy-to-let mortgages:

- Higher fees

- High interest rates

- Higher deposit, between 20-40%

- Interest only. (Note: If you have a buy-to-let mortgage, you only pay the interest every month and not the capital amount. At the end of the loan term, you pay off the original loan in full. However, buy-to-let mortgages are also available on a repayment basis.)

- Not regulated by Financial Conduct Authority (FCA). (Note: An exception to this is if you want to let the property to a close family member such as a child, a spouse, a parent, a sibling, or a civil partner. These are usually called consumer buy-to-let mortgages and are assessed the same way as a residential mortgage.)

Remember: the most you can borrow is directly connected to the amount of rental income you expect to get. Most lenders want to ensure that the rental income generated by your property will pay for the mortgage payments—and then some. Lenders often need the rental income to be about 25% to 30% more than your mortgage payment. You might also be on the hook for a bigger deposit if the rental valuation of your property is too low, which could impact the loan to value (LTV) the lender requires.

The reason the lending requirements for a buy-to-let mortgage are stricter than a regular mortgage is that most lenders consider buy-to-let a higher risk, meaning you have to meet certain conditions to be eligible. While they are different depending on the lender, they usually include:

- Own. You may need to already own the property, either outright or with an outstanding mortgage.

- Good credit. You must have a good credit history that is not being stretched too thin on other borrowings, like credit cards, for instance.

- Employment and earnings. You will have to prove that you have employment income or self-employment earnings that are separate from any rental earnings. This is usually £25,000 or more per year. If you earn less than that, you may have difficulty getting certain lenders to approve your loan.

- Maximum age. Your lender may require a maximum age of 75 years, though that age limit might be lower for some lenders.

- Loan-to-value. Most lenders will require an LTV limit of 75% minimum, meaning you will need a minimum of 25% deposit.

- Monthly rental. The amount of money you can usually borrow is based on the monthly rent you are getting or anticipate. That rental income should equal 125% of your mortgage payments.

Is buy-to-let in UK still worth it?

The answer to this question depends on various factors, such as the type of investment you are looking for and your long-term financial goals.

What is happening in the area that you are purchasing the property, as well as what is happening in the wider economy, are other key factors as to whether a buy-to-let mortgage is worth it. Since some properties are more popular in certain areas than others, it also depends on the kind of house you purchase and the rent you can charge.

While there are never any guarantees when it comes to investments, there are two things you can do to effectively assess whether a buy-to-let mortgage will generate income for you:

- Firstly, you will want to research the type of home and the local area in which you are planning to buy. Speaking to real estate agents, especially about house prices and rental data, will help.

- Secondly, you should invest over the long term. When deciding whether buy-to-let is worth it given your situation, you should weigh the costs against the benefits.

To help give you a better idea of what you should consider, let’s look at the advantages and disadvantages of a buy-to-let mortgage in the UK:

Advantages of buy-to-let mortgages

Potential house price growth. If you are thinking long term, property is a good investment, even if property prices continually fluctuate. If you own a home for 10 or more years, for instance, there is a greater chance that the value of the property will grow when you are ready to sell.

Income to cover your mortgage repayments. One key advantage of a buy-to-let mortgage is that renting out the home will pay for your mortgage—plus, give you extra money on the side. In order to get a buy-to-let mortgage, you will have to prove the rental income will pay your mortgage interest by at least 125%. Additionally, taking advantage of the special rate will make you more money because it lowers your monthly payments, therefore increasing your profit margin.

Costs can be offset against tax. You can offset some of the costs against the amount you are required to pay tax on. For residential properties, these include fees paid to letting agents; council tax and bills; the cost of advertising your rental property; and the money paid for repairs and maintenance.

Disadvantages of buy-to-let mortgages

Cost if property isn’t let. There is zero guarantee that you will be able to find tenants 100% of the time. During periods when the home is vacant, you will still need to make mortgage payments—from your own pocket. Plus, you will be on the hook for other maintenance costs and bills.

Responsibility for maintaining the property. In the likely event that your tenant has an issue, you will be required to be available 24 hours per day, seven days per week. It is your job to take care of the boiler or the washing machine, for instance, should they break down. Issues such as these can be expensive. None of which is to mention the standard wear and tear on the home.

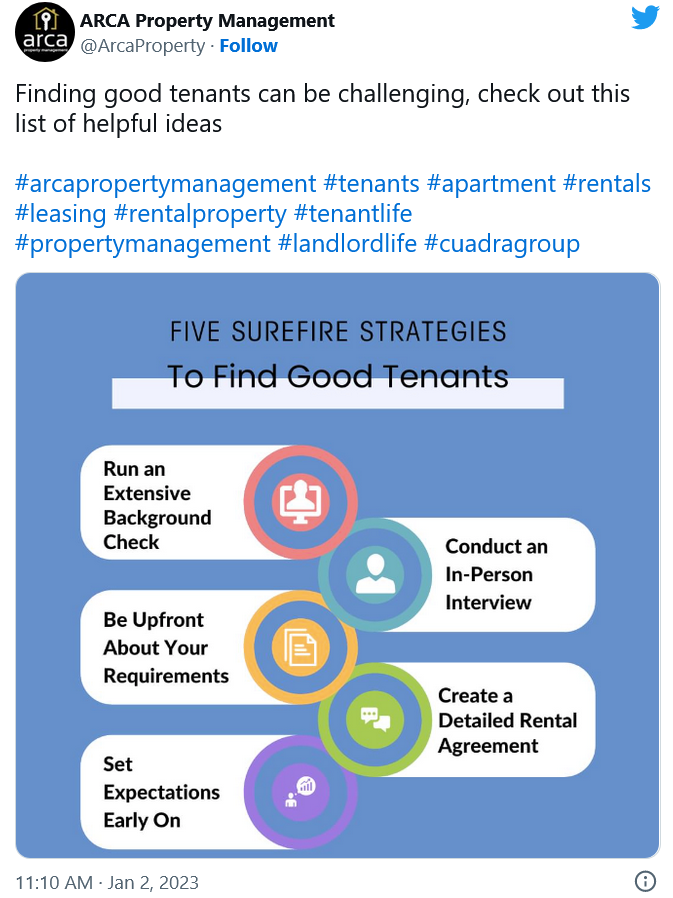

Hassle of finding tenants. You will save a lot of money and headache if you can find tenants quickly and easily, but to do so, you will have to advertise; check references; arrange the deposit; find the tenants; fully vet the tenants; and take care of the paperwork.

Do you need a minimum income for a buy-to-let mortgage?

It is entirely possible to get a buy-to-let mortgage if you have a low income or no regular income at all. In order to qualify, however, you will need to prove to the lender that you have savings, investments, or stocks.

While many lenders require that you have an income of at least £25,000 before approving you for a home loan, there are also lenders who do not. Buy-to-let mortgages that require low income or no income are aimed at potential property owners who have no regular salary, while still being able to produce the money necessary to buy a property to let out.

They are also designed for people who hope to make their income from the property investment, meaning lenders consider the potential rental income before approving the loan. If you want to go this route, you will need to find a specialist lender, since not all lenders will approve a buy-to-let mortgage under these circumstances. In this case, you will still have to meet other criteria, as well as having to provide a business plan to indicate how much you expect to earn from your buy-to-let investment.

Your potential rental income is not the only way that you can both get approval for and pay your mortgage. There are numerous income sources that you can use to make your buy-to-let mortgage repayments, including:

- Bridging loans

- Savings, existing, or gifted money

- Government benefits

- A pension

As mentioned, not all lenders in the UK will accept these income sources. It is therefore critical that you conduct your own research well in advance to ensure you are approaching a lender who works with clients in your financial situation. We recommend starting with our Special Reports where you will find quality mortgage professionals.

How much rent do I need for a buy-to-let mortgage?

For a buy-to-let mortgage, lenders typically require that you have a rental income that is 25% to 30% higher than your mortgage payment. If the rental valuation of your property is too loan-heavy, your loan-to-value (LTV) may be affected, and you would need to make a larger deposit.

While the rental income for a buy-to-let mortgage is important, there are other criteria that you will need to meet to be eligible. While it depends on the lender, you will likely have to meet the following criteria for most buy-to-let mortgages:

Age. You have to be over 21 years old and must be younger (in most cases) than 75 years old when the mortgage term ends.

Other properties. You usually must own your own property outright or have a mortgage on it. Depending on your lender, you may only be approved for a buy-to-let mortgage if it is of lower value than your residential property.

Credit history. You must have a good credit history and provide evidence that you are a reliable borrower. You should build up your credit history if, starting out, it is less than perfect. This will give you a better chance of being approved.

Minimum income. Lenders might require you to earn a minimum yearly income to ensure you can meet your mortgage repayments. At least £25,000 per year is common, especially for first-time buy-to-let borrowers.

Minimum deposit. Most lenders will require that you make a deposit of at least 25%, while other lenders require larger deposits in the 40% range.

What is the minimum salary for a buy-to-let mortgage?

The minimum salary for a buy-to-let mortgage in the UK is £25,000. This is the gross annual income that at least one applicant needs to borrow up to £1 million, according to Barclays. If you are the sole applicant, you will need a gross annual income of £75,000 to borrow more than £1 million. For a joint application to borrow more than £1 million, you can apply with a joint gross annual income of £100,000, if neither of you gross more than £75,000 annually.

While a minimum salary for a buy-to-let mortgage in the UK is £25,000, there are specialist lenders who will approve your loan with a low income or even no income. In that case, you need to prove to the lender that you can use the rental income to make your mortgage repayments, or that you have income sources that will more than cover those payments.

Because most lenders view buy-to-let mortgages as greater risks, the criterion for approval is stricter than with regular residential mortgages. If you can qualify, however, you may reap the rewards. Before deciding whether a buy-to-let mortgage is worth it, you should understand the type of investment you want and your long-term financial goals.

Do you have experience with a buy-to-let mortgage? Let us know in the comment section below.