Big surge could indicate more business for intermediaries

A new report shows that the UK construction sector has experienced a notable surge in growth as the second half of the year commenced, with July witnessing a significant rise in both activity and new orders. This increase prompted companies in the sector to boost their purchasing and hiring efforts for the third consecutive month. The heightened demand for materials exerted some pressure on supply chains, resulting in a faster increase in input costs.

The S&P Global UK Construction Purchasing Managers’ Index (PMI) – a seasonally adjusted indicator of total industry activity – climbed sharply to 55.3 in July, up from 52.2 in June. This figure indicates a robust monthly expansion in the construction sector, extending the growth streak to five months and marking the fastest rate of expansion since May 2022.

Activity increased across all three construction categories in July, with housing projects returning to growth. Commercial activity saw solid gains, but the most rapid expansion was observed in civil engineering, which experienced the sharpest growth in nearly two and a half years.

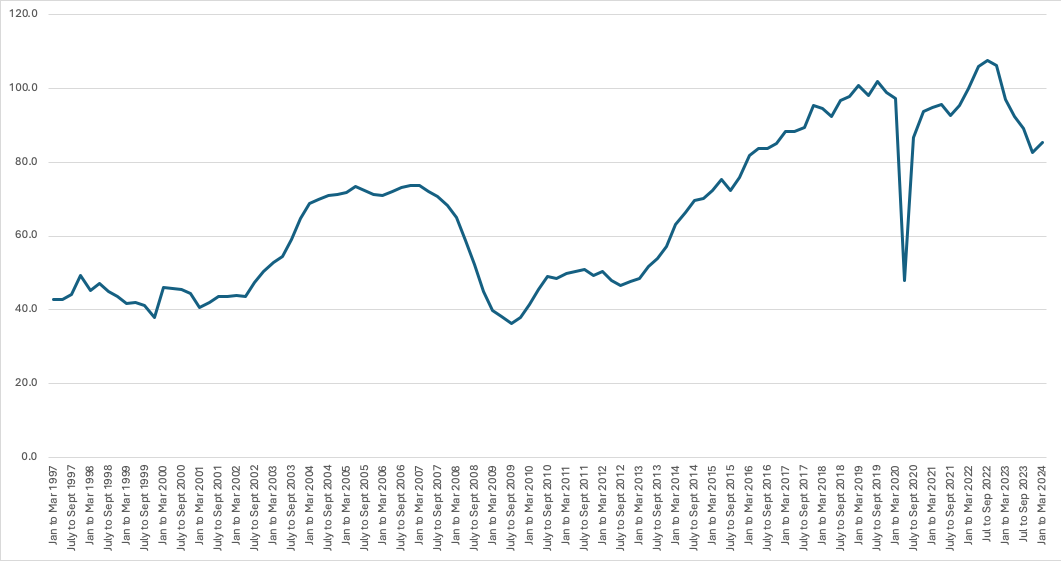

Construction output in Great Britain, volume, seasonally adjusted

Survey respondents attributed the rise in construction activity to success in securing new orders at the start of the third quarter. New business has now expanded for six consecutive months, achieving the strongest pace since April 2022. Improved market demand and strengthened customer confidence have led to the release of previously paused projects.

In response to rising workloads, construction firms increased their purchasing and hiring activities more quickly in July. Employment levels rose for the third month in a row, at a pace not seen in a year. Additionally, a significant rise in purchasing activity was recorded, the most pronounced in almost two years.

The increased demand for materials exerted some pressure on suppliers in July, ending a 16-month period of improving vendor performance. While some suppliers managed to maintain adequate stock levels, others faced challenges due to issues in manufacturing and transportation. Input cost inflation showed signs of accelerating as suppliers raised prices to match stronger demand, with the increase in input costs being the joint-fastest in 14 months.

Sub-contractor usage also rose for the fourth month running, although the availability of sub-contractors increased at a slower pace. Sub-contractor rates continued to rise modestly.

Despite a dip in sentiment to a three-month low in July, construction firms remain optimistic about future activity. Nearly 53% of respondents expect an increase in activity over the next 12 months, driven by improved client confidence and new product developments.

Andrew Harker, economics director at S&P Global Market Intelligence, commented: “The election-related slowdown in growth seen in June proved to be temporary, with the pace of expansion roaring ahead in July. Firms saw the strongest increases in new orders and activity since 2022 as paused projects were released amid reports of improved customer confidence. The strength of demand moved the sector closer to capacity, bringing a recent period of improving supplier performance to an end. There were also signs of inflationary pressures picking up, something that will need to be watched closely if demand strength continues in the months ahead.”

This upswing in the construction sector is a positive indicator for mortgage intermediaries – new houses mean new sales and the ability to help new customers finance a new home.