Jump to winners | Jump to methodology

The mortgage market saw one of its biggest boosts in years during the second quarter of 2024, with 1.62 million mortgages ($533 billion in loans) issued for residential properties, a significant 23.2 percent jump from the previous quarter.

The data marked the first gain in a year, as recorded in the US Residential Property Mortgage Origination report by ATTOM, the curator of land, property, and real estate data. This boom has been partly driven by the best mortgage companies in the USA who have finetuned their operations and enabled their employees to deliver for clients.

“Employers should be cognizant of their employees wants and needs,” says Valerie J. Saunders, president of the National Association of Mortgage Brokers. “They should be communicative with employees as well as borrowers and recognize the stressful aspects of lending and do everything they can to make it enjoyable to come to work.”

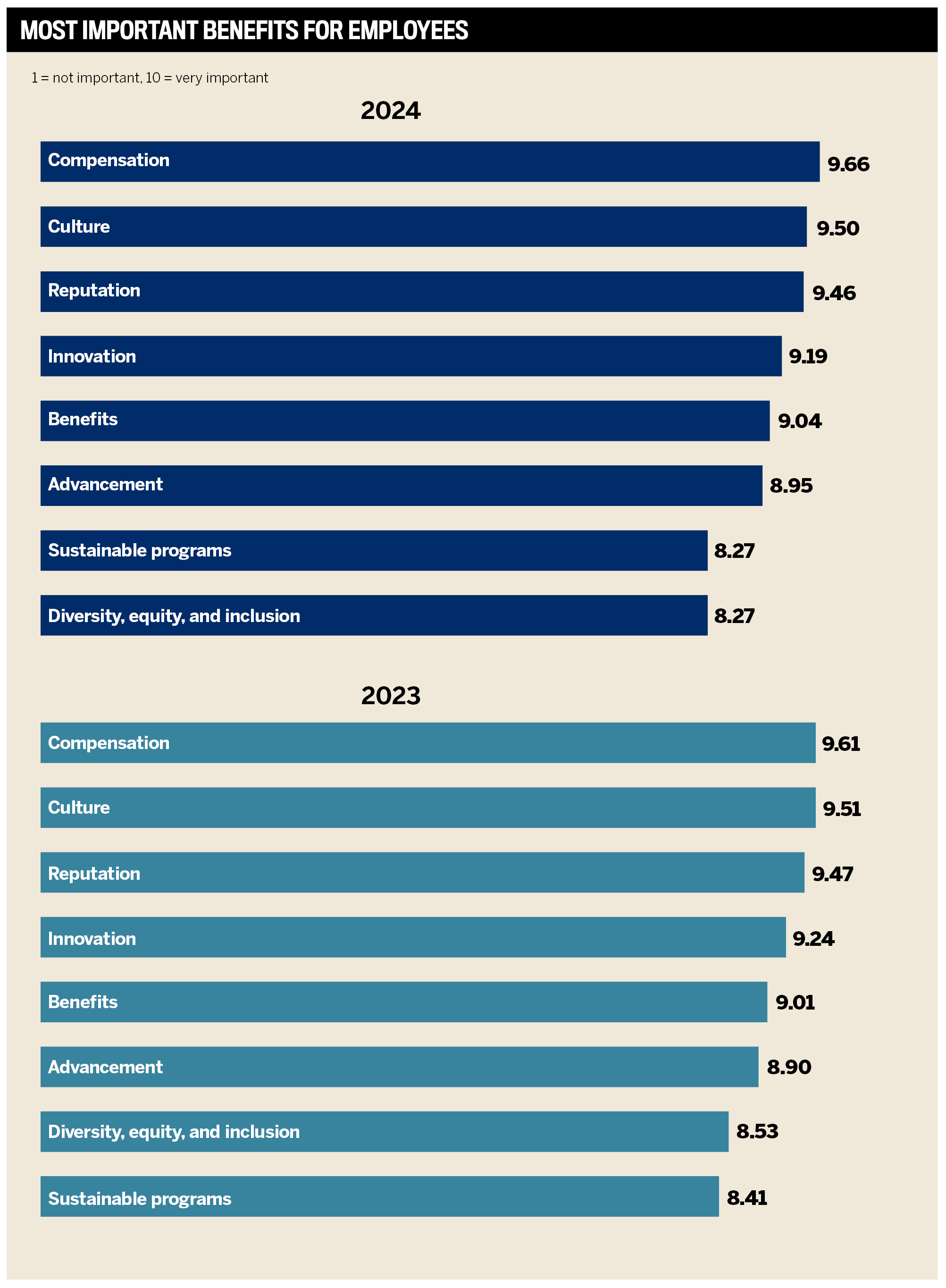

Creating a positive work environment is the calling card of Mortgage Professional America’s Top Mortgage Employers of 2024. Employees completed anonymous surveys for MPA evaluating their workplace based on several factors, including:

advancement

diversity, equity, and inclusion (DE&I)

sustainable programs

reputation

Implementing leading DE&I initiatives are important as highlighted by Saunders.

“Having an openness to hire the best person, regardless of their race, sex, or ethnicity is always the best policy. People are more mindful to treat everyone with respect and equally. It’s no different from basic human kindness,” she says.

A total of nine companies are recognized depending on their size, receiving gold, silver, and bronze. MPA’s Top Mortgage Employers also had to deliver as industry-wide job cuts meant they battled to retain their top talent while competing with other firms to ensure they had the best staff.

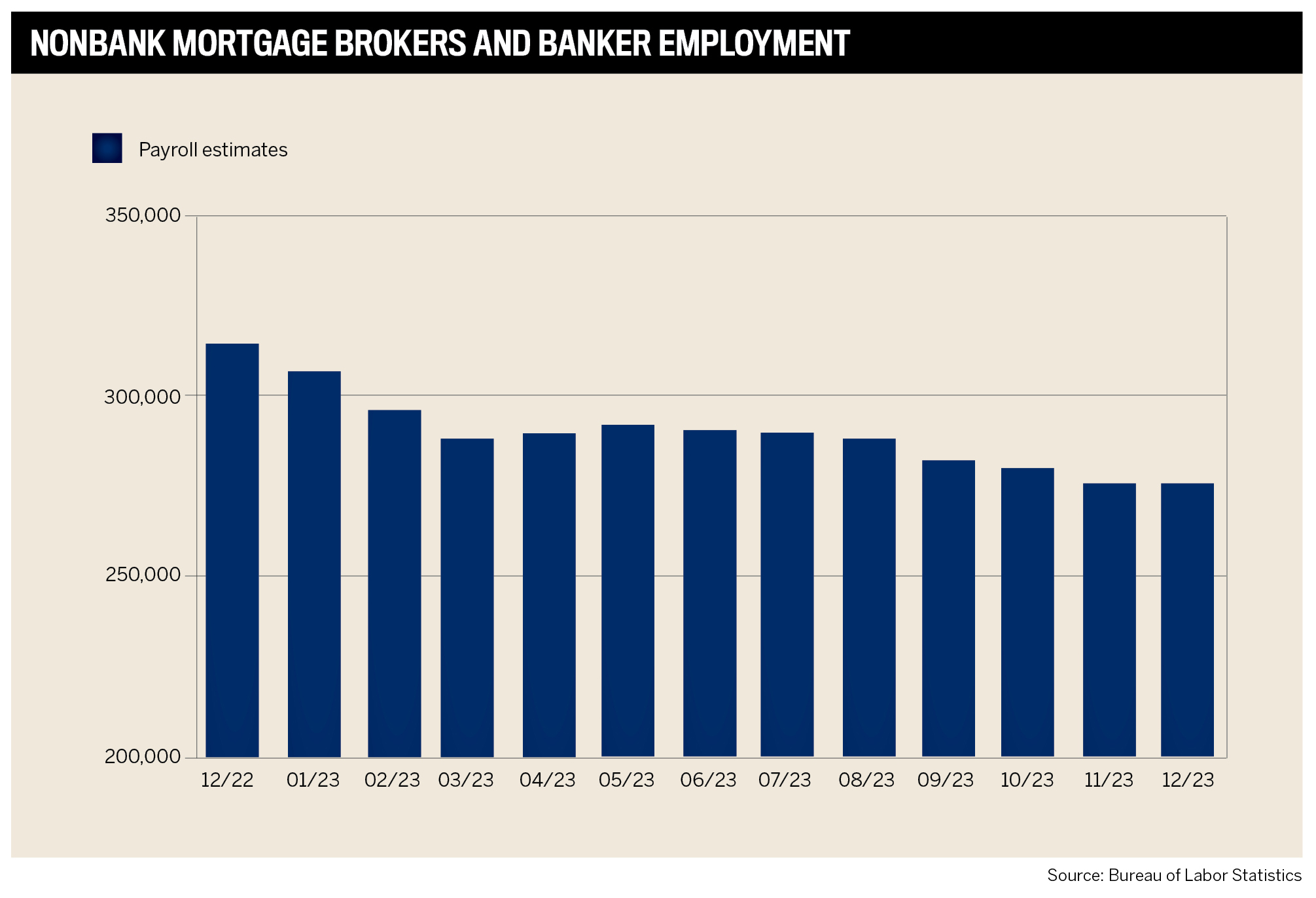

According to the Bureau of Labor Statistics (BLS), there were 343,000 mortgage employees in May 2023, down 15 percent year over year and down 18 percent from the peak of 420,000 in July 2021.

However, BLS stats project that employment of loan officers will grow 3 percent annually from 2022 to 2032, with 25,300 openings per year for the decade. Many of these will be the result of replacing workers who transfer occupations or exit the labor force. Similarly, the mortgage underwriter growth rate will be 4 percent between 2018 and 2028.

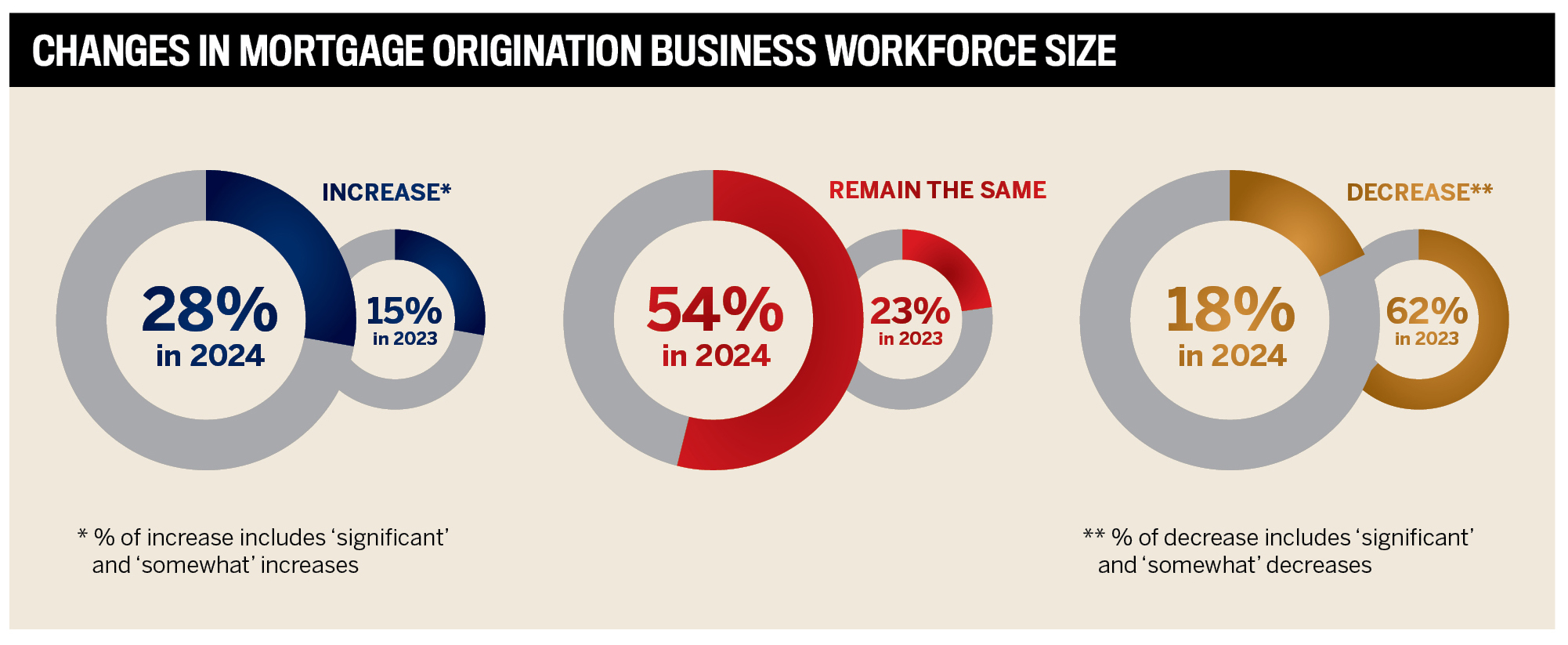

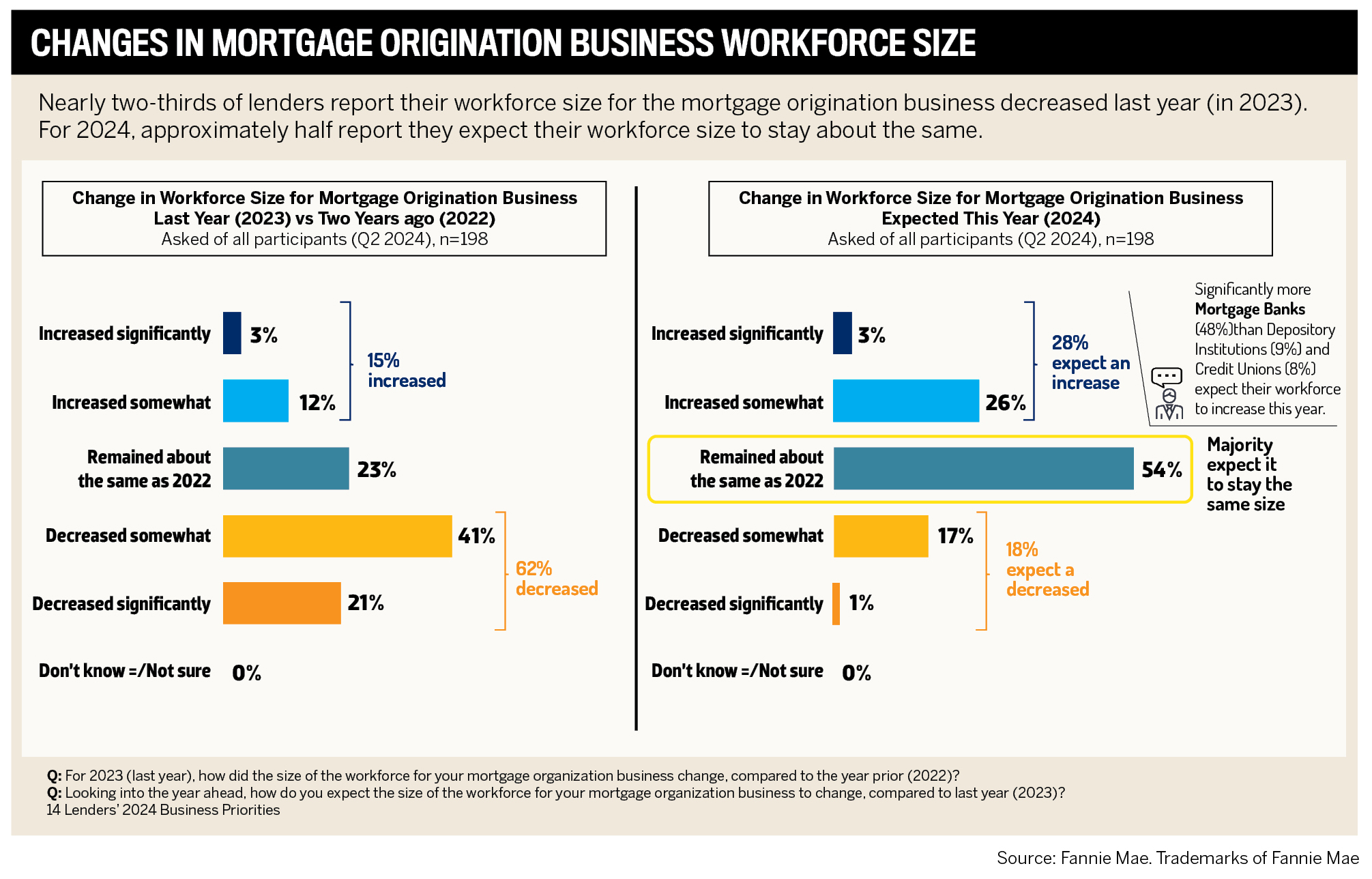

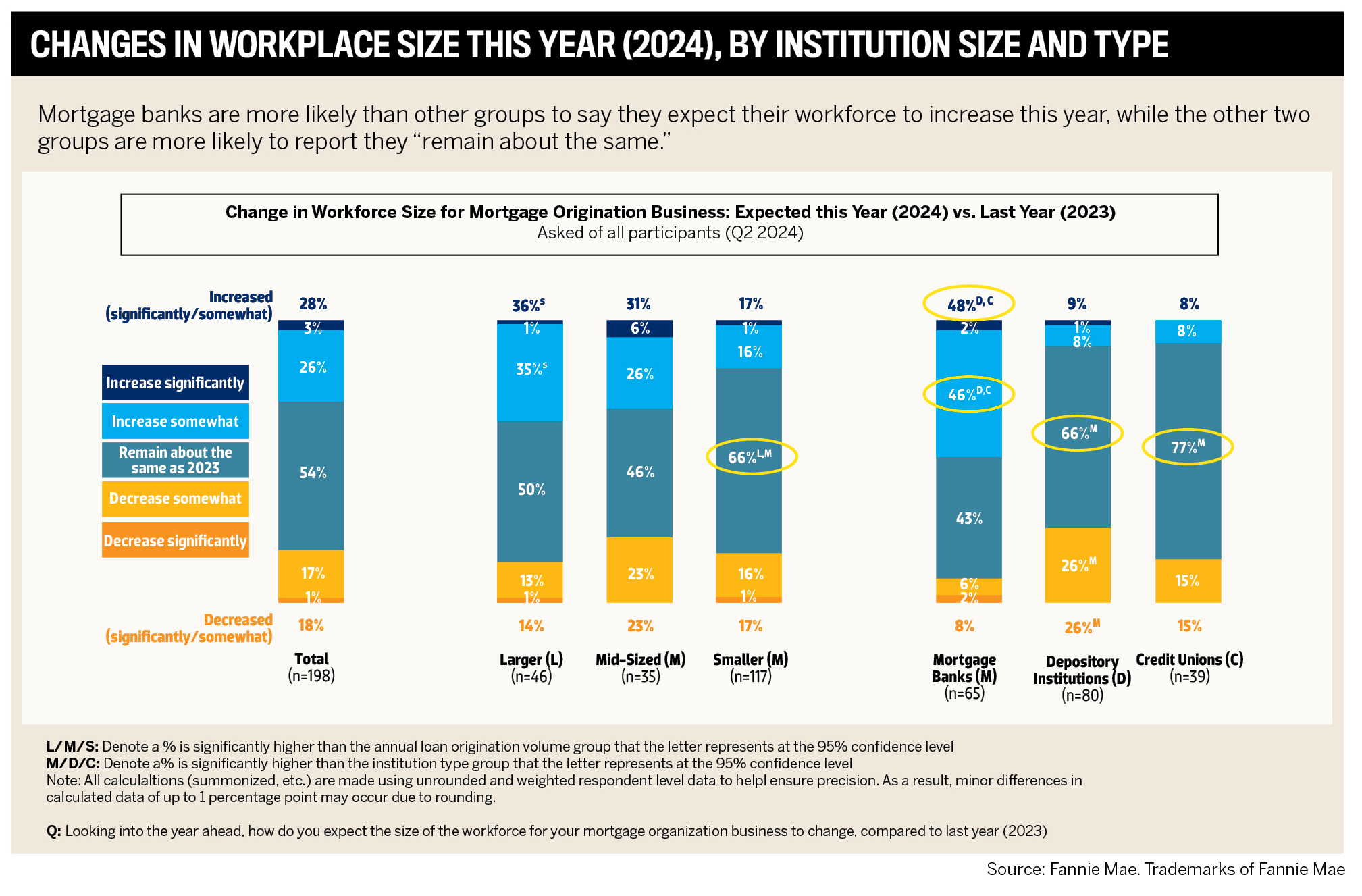

This dovetails with Fannie Mae stats showing that 82 percent of mortgage employers anticipate either an increase or have kept their workforce size the same from 2023 to 2024. This combined uncertainty in the market makes the standing of MPA’s Top Employers even more impressive for the way they have empowered employees.

NEO Home Loans

Firm type: Lender

Number of employees: 100–500

Employee satisfaction rating: 9.48

“Neo” is the Greek word for “new,” and NEO Home Loans believes the mortgage industry needs a new beginning. Established in late 2020, the Minneapolis-headquartered firm is a collection of top mortgage professionals cognizant of the industry and its inherent challenges. The firm has relied on that mindset through its history.

“Logistically, it was challenging because of Covid and travel restrictions, but mortgage rates were at the lowest they have really ever been, so we started with the wind on our backs,” says co-creator, Ryan Grant. “We hit a rough patch in the mortgage industry in 2022 and 2023, but we still found ways to be profitable and do great business through that time, and 2024 has been foundational for us.”

There are approximately 350 employees with their culture influenced by Simon Sinek’s book The Infinite Game. Employee respondents to MPA’s Top Employer 2024 survey rated culture as the second most important factor after compensation.

“We want our teammates to wake up inspired about the work they’re doing,” explains Grant. “To feel safe and confident and secure when they’re at work and go home fulfilled with the work that they’ve done, not just monetarily or for personal reasons, but [knowing] that they’re doing something meaningful.”

He adds, “We’re proactively helping clients become successful homeowners, and that permeates through the entire organization.”

NEO focuses on leadership training to empower employees, believing it’s a scarce commodity.

“You’re not born a good leader, it takes skill,” Grant says. “We conduct training for our production teams every week, which is a rare thing in the mortgage industry as most people work 99 percent of the time. Our team has found value in it, as they have become better professionals and more confident in their work.”

NEO offers employees a strong benefits scheme that enriches their personal and professional lives and includes:

unlimited PTO

discretionary remote work

full health, medical, and dental cover

401(k) matching

opportunity to make investments through NEO Capital

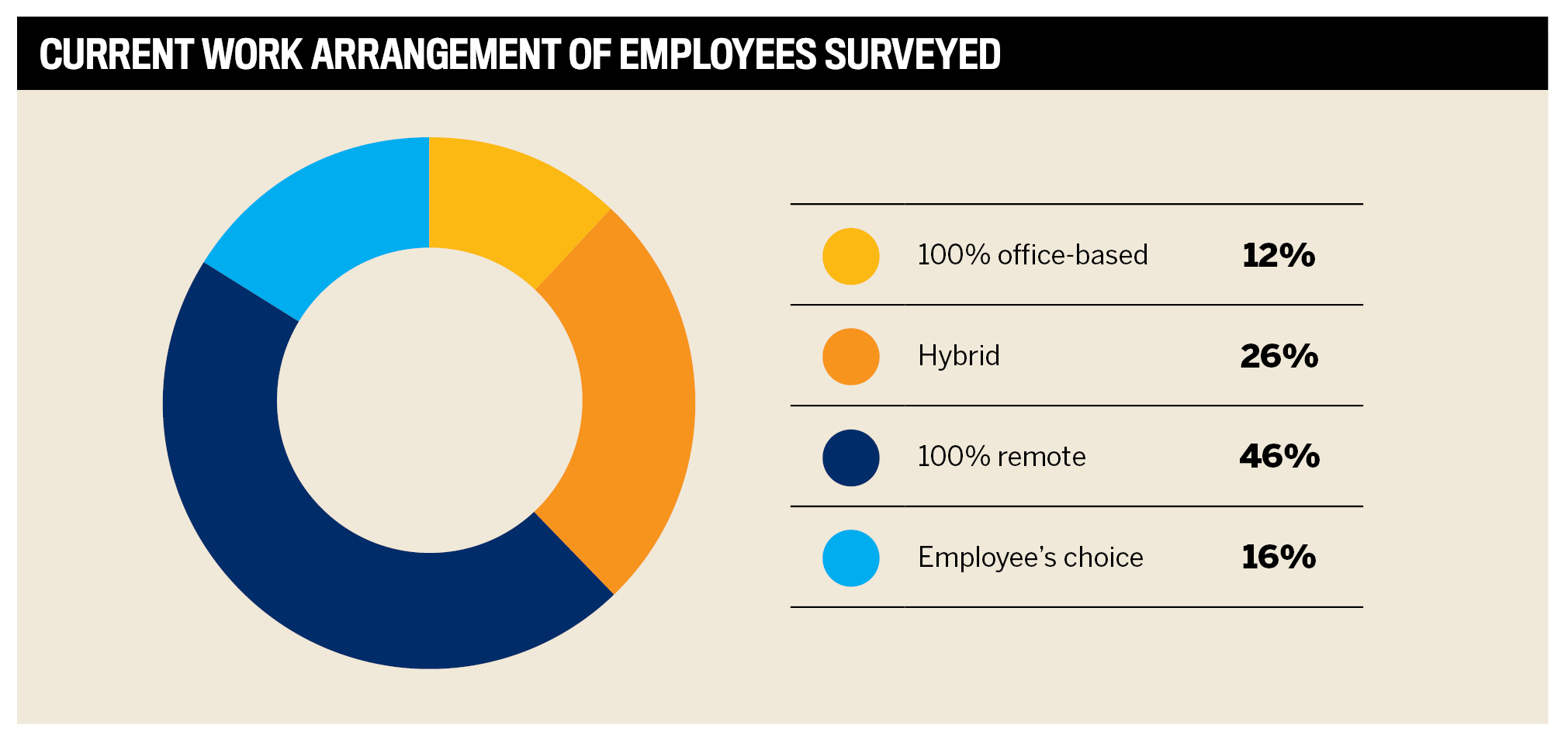

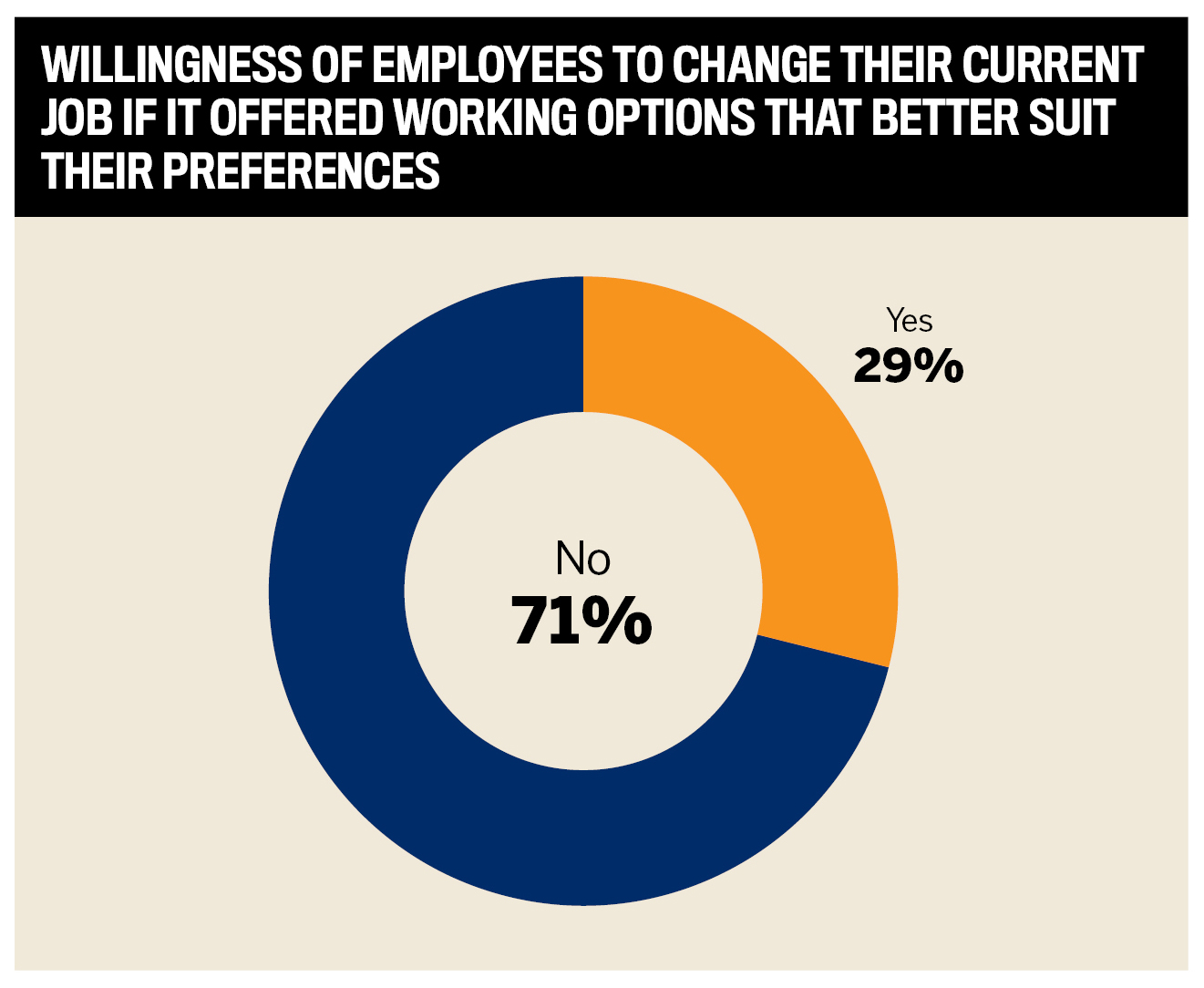

These initiatives were all mentioned by respondent employees to MPA from firms all over the US. Matching of 401(k) was a common policy that many workers would like to see introduced, along with numerous requests for more flexible working.

MPA’s data showed that 12 percent of respondents are mandated to be in the office 100 percent of the time, while 26 percent are in a hybrid arrangement and expected to attend on nominated days.

“If employees want to be fully remote, we welcome that,” says Grant. “We care less about where someone sits, but more about how comfortable they are sitting there and being their best self.”

The unlimited PTO scheme is a progressive measure, guarding against burnout.

“We want everyone to be productive. We don’t want metrics like, ‘If you take two weeks off, you have to work X number of hours by this time’. It feels like a very antiquated way of doing business,” comments Grant. “We would much rather have somebody work the hours that are appropriate for them and take the time off that they want. We find people are twice as productive and motivated.”

NEO Capital was launched in 2024 and ensures that employees are financially literate, to impart knowledge to clients.

“We want to help families become generationally wealthy and ultimately reach financial freedom, but we cannot do that unless we start from within,” he says.

NEO hosts classes monthly for all employees, enhancing their knowledge base in relation to:

budgeting

saving for a home

buying investment properties

retirement planning

holistic wealth

“It’s an opportunity for employees to invest in opportunities alongside us, which is not something that most companies have done,” says Grant. “We source investment opportunities that are going to change the financial profile of their teammates’ lives. Our organization’s goal is helping clients beyond the mortgage, and foundationally start by doing that with all our employees.”

The Top Mortgage Employers strive to create an environment where individuals from all backgrounds feel welcome. Grant believes having a diverse workforce at NEO helps provide superior service to clients.

“Our mission is to impact all the communities we serve in a way they are not expecting, and in a way that no one has done before,” he says. “The only way for us to do that is by being one of the most diverse organizations in the country, because we need that diversity of thought, demographic, and geographic.”

He adds, “The makeup of our leadership team is diverse compared to most. We have a great mix of both men and women, and ethnicities.”

In terms of gender composition, NEO’s employees are 59.75 percent female, 39.32 percent male, and 0.93 percent unspecified. The firm’s DE&I outlook goes beyond ethnicity and gender concerns, and also focuses on socioeconomic factors.

“We can take a younger person who’s coming out of an underprivileged community and give them an opportunity to help us,” Grant shares. “We’re in an early phase of growth mode, but we’re trying to put the message out that if you want to change the economic outlook in the country, we want you, regardless of your race, age, or gender.”

With the industry-wide reduction in workforces, employers faced a balancing act of remaining commercially viable while maintaining a positive working environment. NEO was not immune to this and learned valuable lessons by:

improving efficiency

reducing bulk hiring

creating scalability across the company

“The mortgage industry, unfortunately, is known for people operating independently,” Grant says. “A mortgage professional could operate a team that has certain roles and responsibilities, but everybody does it differently. The problem is that it doesn’t scale right, because as soon as you get more business as a production team, you need to hire another person, and as soon as your business drops a little bit, then you need to let go of that person.”

Grant insists that mortgage companies should spread workflow around the organization rather than hiring to meet the demand.

“It means less dealing with the market as a measure of who we hire and who we let go. It creates the ability for teams to operate at scale and grow.”

He continues, “It’s not going to make us completely immune to market shifts, but we’ll be much better suited moving forward. Otherwise, it creates massive inefficiencies, and that’s where you get the hiring and firing waves.”

Thousands of employees across the US shared with MPA what they would like to see offered by their employer that are currently not. Some of the feedback included:

“Better training opportunity and support could be really helpful, also some incentive bonuses or company paid trips.”

“Offer matching in retirement accounts and lower prices for family insurance.”

“Employee and leadership development programs. Soft skill improvement. Currently, many individuals at the leadership level have poor communication skills and talk to people like they’re beneath them.”

“More team-building activities. Many work remotely and we barely get to see each other and enjoy each other’s company.”

“Have a fair and consistent WFH/hybrid practice with local employees. Have the leadership team create an inclusive culture and lead by example, take our feedback seriously when given and not make us feel bad for being honest.”

“The workplace is different for everyone now that most of our employees work from home. It comes down to communicating a team atmosphere even though we are located all over.”

“Better collaboration to get a step up on the technology changes in the industry.”

“As we are continuing to grow at such a face pace, we’ve done a great job implementing the proper systems to improve efficiency. What my organization can improve on is communicating to departments what their game plan is.”

“Sponsor a fun, monthly team-building event so we can become better friends.”

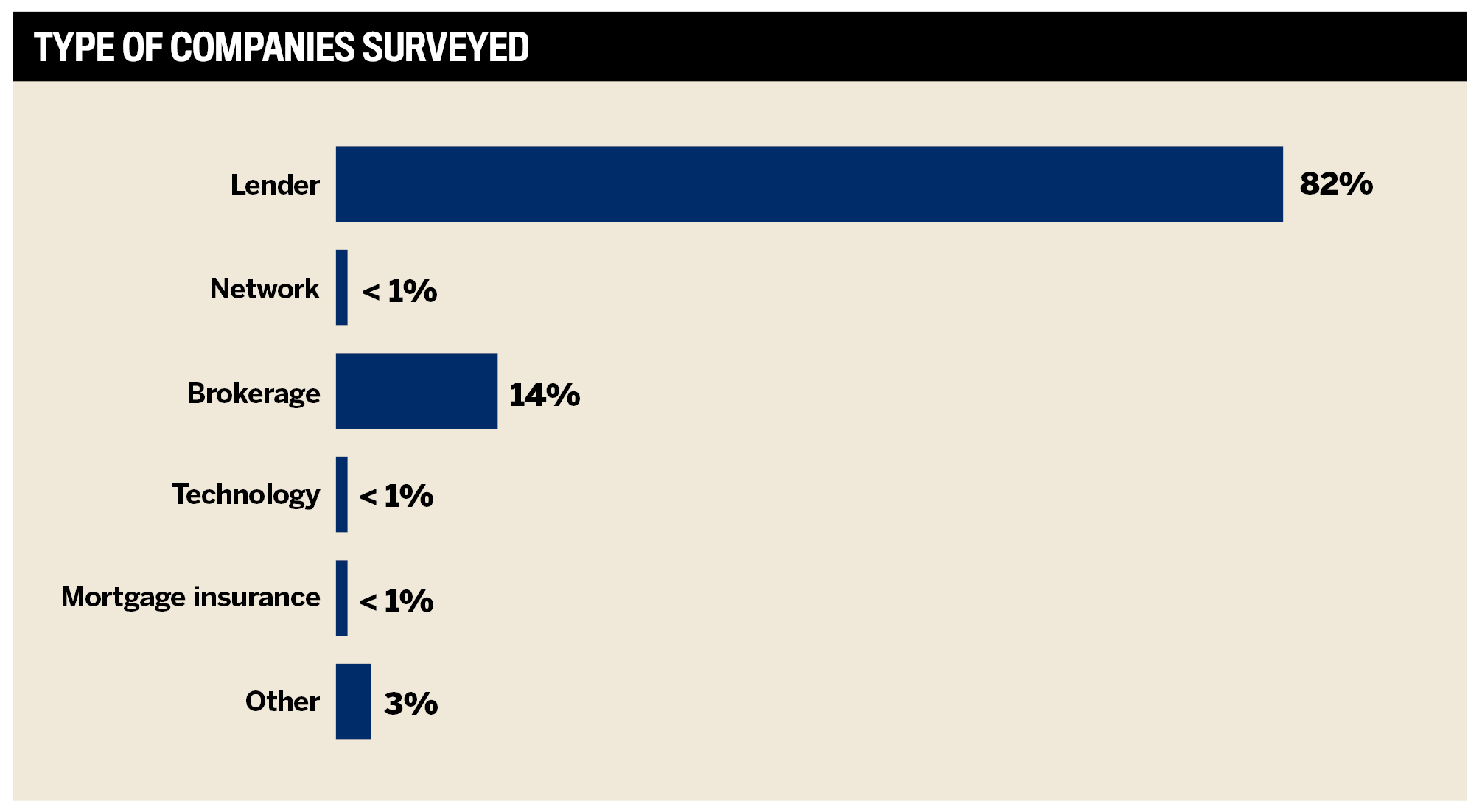

To help recognize and narrow down the nominations for the Top Mortgage Employers 2024 in the United States, MPA invited organizations to fill out an employer form highlighting their various offerings and practices. Employees of the nominated companies were then asked to take an anonymous survey evaluating their workplace based on eight key factors: compensation, benefits, reputation, culture, advancement, innovation, sustainable programs, and DE&I.

To qualify, each nominee had to meet a minimum number of employee responses based on the overall size of the organization: employers with 10–100 employees must provide a minimum of 10 responses; employers with 101–500 employees must provide a minimum of 20 responses; and employers with 500+ employees must provide a minimum of 50 responses.

Gold, silver, and bronze medals are awarded to the top three companies in each category based on overall employee satisfaction.