HELOC demand has hit a five-year high. Learn how to market your HELOC program

HELOCs are gaining traction among homeowners. In fact, lenders increased their origination of home equity lines of credit by 21% in the 12 months ending in June, according to new data from real estate information firm RealtyTrac. The 797,865 HELOCs represent the highest level since 2009

Nearly 10 million homeowners nationwide, representing 19% of all homeowners with a mortgage, now have at least 50% equity in their homes. Daren Blomquist, vice president of RealtyTrac, said the rise in HELOCs reflects a natural evolution for a lending industry looking for products they can offer to homeowners who have already refinanced their first-position loan into a low fixed rate.

Is your company getting a piece of the HELOC pie? In the next few pages, we’ll provide the information you need to give you the competitive edge.

#pb#

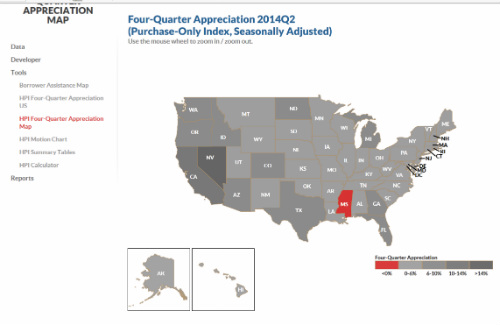

Not all markets are alike. That’s why before you begin marketing your company’s HELOC program, you need to know where. The FHFA provides an interactive home appreciation map of the U.S. that includes state data on how much homes have appreciated during the last four quarters. For example, based on the map, Mississippi may not be the best place to promote HELOCs.

Zillow and Trulia also provide up-to-date information on regional home values and prices and can help you narrow down your target areas. On Zillow, San Francisco is a city where home values have gone up 15.6% during the past year and Zillow predicts they will rise 4.8% within the next year.

Click to see ideas about how you should market HELOCs.

#pb#

Okay, you’ve figured out where you want to market, but now you’ve got to come up with a way to reach your audience. That’s where direct mail campaigns come into play. These campaigns can get information directly to homeowners that appear to have equity. Feel free to include a loan application in the promotional piece to help facilitate the process for the homeowner.

Check out MDG Advertising’s direct mail campaign for IBM Southeast Employees’ Federal Credit Union.

How can you market HELOCs for free?

#pb#

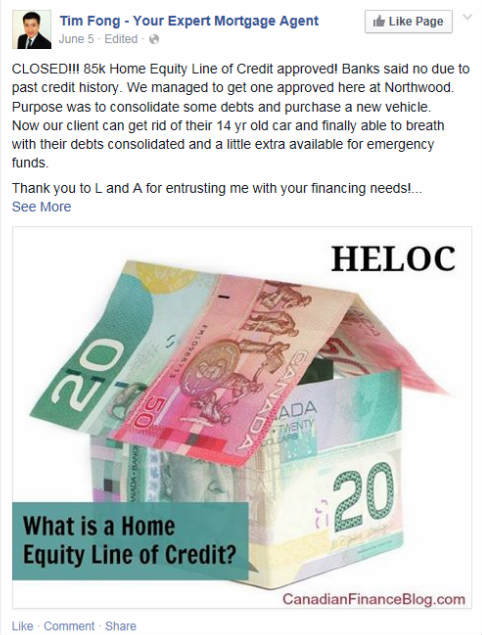

Promoting HELOCs through social media platforms like Facebook, Instagram and Twitter is quite possibly the easiest and quickest way to reach homeowners. To make your post stand out among the rest, you’ve got to grab readers’ attention quickly.

Simply writing “Apply for a HELOC today,” won’t’ cut it. Instead, connect with interested borrowers by posting interesting photos and providing examples of how you previously helped other clients.

Tim Fong’s Facebook post is the perfect example.

How to get the competitive edge

#pb#

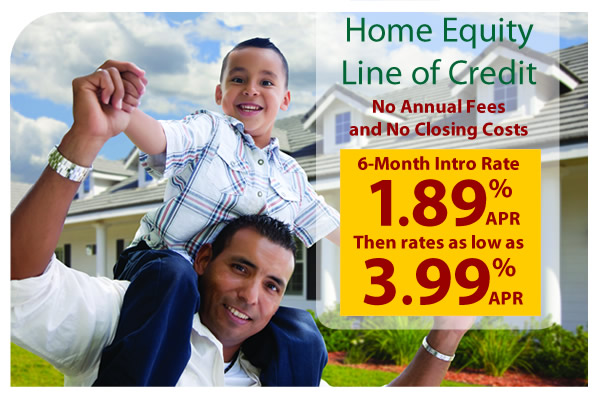

A lot of lenders are offering HELOCs, so how do you get potential HELOC borrowers in your door? Incentives can help pique a borrower’s interest. Commercial banks may offer free checking or discounted bank service to entice homeowners. Lenders can also advertise low- or no-closing cost HELOCs.

First US Community Credit Union is one of many that are currently offering no closing costs on HELOCs.

Also, become an expert

Reach even more potential HELOC borrowers by establishing yourself as an HELOC expert. Write columns for local news sources or use a blog to publish your own articles. Then, use social media sites to promote your articles.