(TheNicheReport) -- Okay, it is time to say, unequivocally, that the real estate markets have stabilized; it is time to tell borrowers, confidently, that this is the time to buy a home (or two). There a difference between selling and speaking to the facts. For months, many of us in the housing market have talked to a recovery of home sales, but this was based more on hope and optimism than economic data. This has now changed. We have the data, economists are less shy about talking about the ‘bottom of the market’; property values are now projected to improve and, quite honestly, the forecast for the bottom was the 3rd or 4th quarter of 2012. To have these declarations in the 2nd quarter, nearly 3-6 months before economists thought it would happen, is a very good sign of things to come. It is worth noting, this has been an ongoing theme in this publication for several months. So the data below is not new to the religious reader of our beloved publication, but the difference month over month as the story continues to unfold – this is important. It is like the news cycle where you need to cover the same story as more information is released to the public.

(TheNicheReport) -- Okay, it is time to say, unequivocally, that the real estate markets have stabilized; it is time to tell borrowers, confidently, that this is the time to buy a home (or two). There a difference between selling and speaking to the facts. For months, many of us in the housing market have talked to a recovery of home sales, but this was based more on hope and optimism than economic data. This has now changed. We have the data, economists are less shy about talking about the ‘bottom of the market’; property values are now projected to improve and, quite honestly, the forecast for the bottom was the 3rd or 4th quarter of 2012. To have these declarations in the 2nd quarter, nearly 3-6 months before economists thought it would happen, is a very good sign of things to come. It is worth noting, this has been an ongoing theme in this publication for several months. So the data below is not new to the religious reader of our beloved publication, but the difference month over month as the story continues to unfold – this is important. It is like the news cycle where you need to cover the same story as more information is released to the public.Economic data is like a puzzle where each piece is released one at a time while economists attempt to forecast which pieces come next, and where they will fall in the end picture. This makes economic or industry forecasting difficult. The housing market is truly complex, with many economic, financial and industry-related factors. Let’s face it, there are thousands of companies that are directly involved in the purchase or sale of a home – mortgage, title, appraisal or real estate firms to name a few. And there are many more who are associated with the preparation for a sale or purchase or that follow the transaction, such as carpenters, contractors, plumbers, electrical utility companies, NETFLIX, Comcast, landscape companies, Home Goods, Target, COSTCO, Home Depot, and a host of other companies. With so many workers, markets, companies and factors, this leads to the challenges. When you build assumptions and one economic assumption is predicated upon another, it is easy for the economic model to fall apart when one vital assumption proves to be false – understated, overstated or just plainly incorrect.

April by the Numbers

Sales of existing homes rose 4.6% in April to annualized rate of 3.4 million units, following decline in February and March. Purchase of single-family existing homes rose 3.0% to an annual rate of 4 million units. The April sales tally of existing homes represents the strongest reflection of a housing recovery and consumer confidence in light of historic lows in mortgage rates. Sales of existing homes rose across all regions across the United States, with the Northeast (5.1%), West (4.4%) and the South (3.5%) recording larger gains as compared to the Midwest (1.0%). Distressed properties made up 28% of existing home sales in April, the lowest since October of 2008 just shortly after the market crash. This reflects a gradual reduction in distressed inventory, and all of us Real Estate Professionals, we say AMEN to that! Let that inventory dwindle! Where Is Real Estate and

What Should We Expect for 2012 and Beyond?

Economic and mortgage finance forecasts from The Mortgage Bankers Association (MBA) based in Washington, DC, estimate a projected $1.1 trillion in residential mortgage origination volume in 2012, and roughly the same projection for 2013. This is important because as mortgage lenders anticipate demand and the corresponding volume, the mortgage rates and street costs for a mortgage are constructed to establish a profitable business model. The industry that supports the qualification of borrowers for a mortgage is no different than any other business. You establish a budget to cover your costs, make money, and of course mitigate your risk by avoiding higher-risk investments – in this case, lending money to risky borrowers. If overall demand is soft, then there are fewer ‘quality’ borrowers to compete for, and as a result, lending standards remain tight. If demand is high and production volumes are expanding, then this loosens the pipeline leaving more mortgage deals to go around. As a result, companies have a greater appetite for risk and can experiment with various mortgage promotions. This is a function of business psychology in any market. Banking and mortgage professionals are people too. In these prejudices of today’s market, it is too easy to overlook a consumer psychology inherent in every business; the last I knew, all companies are owned by a single or collection of consumers.

The stable mortgage forecast is a function of lower mortgage rates that have brought higher-than-expected refinance volumes, while new purchase volume has been relatively flat with expected growth across the total percentage of originations in 2013. Previous projections by the MBA in the 4th Quarter 20111 were set at $990B. These are strong recovery signs within the housing sectors as key support services are set to support the sale and purchase of homes, and both legacy and new construction display signs of growth, albeit modest. Mike Fratantonia, MBA’s senior vice president of Research and Education, said, “We have lived through a series of unprecedented events over the past month: the debt ceiling crisis in the United States, S&P’s downgrade of the treasury debt, the ongoing sovereign debt crisis in Europe, a commitment by the Fed to keep rates near zero for the next two years, and a stock market volatility that has reached levels not seen since the fall of 2008.” Favorable to mortgage origination growth and market share adoption for existing firms are a few other key market indicators to both note and keep watch:

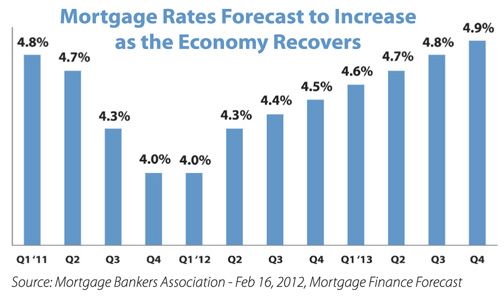

- Historic Low Mortgage Rates: Rate Forecasts by the MBA’s chief economists remain unchanged and at historic lows at or below 4.5% through 2013. See chart below:

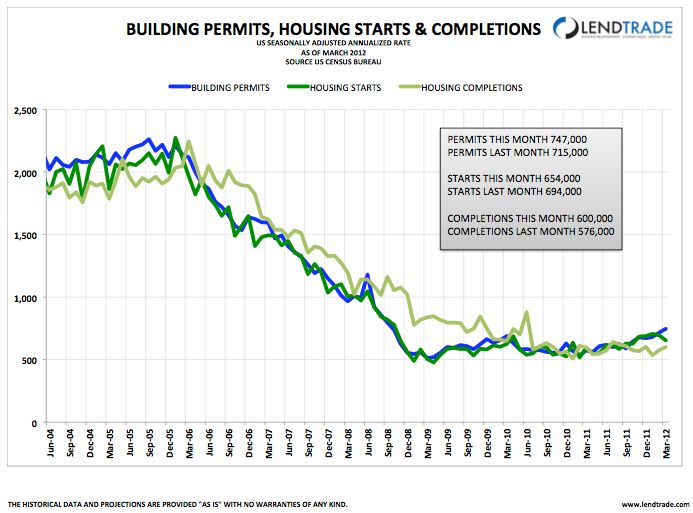

- New Home Construction on the Rise: Building permits have stabilized and are gradually on the rise, beginning to reflect a measurable rise in the first two quarters of 2012, which reflected the highest post-housing “bust” increase in permits issued. According to the U.S. Commerce Department, the seasonal adjusted 747,000 new residential housing permits issued in March of 2012 was the highest since September 2008. Coincidentally, reflecting a parallel trend, new apartment community permits issued were down 20%. These two market trends reflect confidence in the future of the purchase market, a slow but recovering jobs market, improving credit and lending conditions, improving consumer confidence forecasts and the depletion of existing housing inventory that has anchored economic growth since 2008. From a market supply side, these are the strongest indicators that the market, albeit fragile, has hit bottom, reflecting an opportune moment in the history of the U.S. housing market to invest and grow market share in mortgage origination. See Figure below.

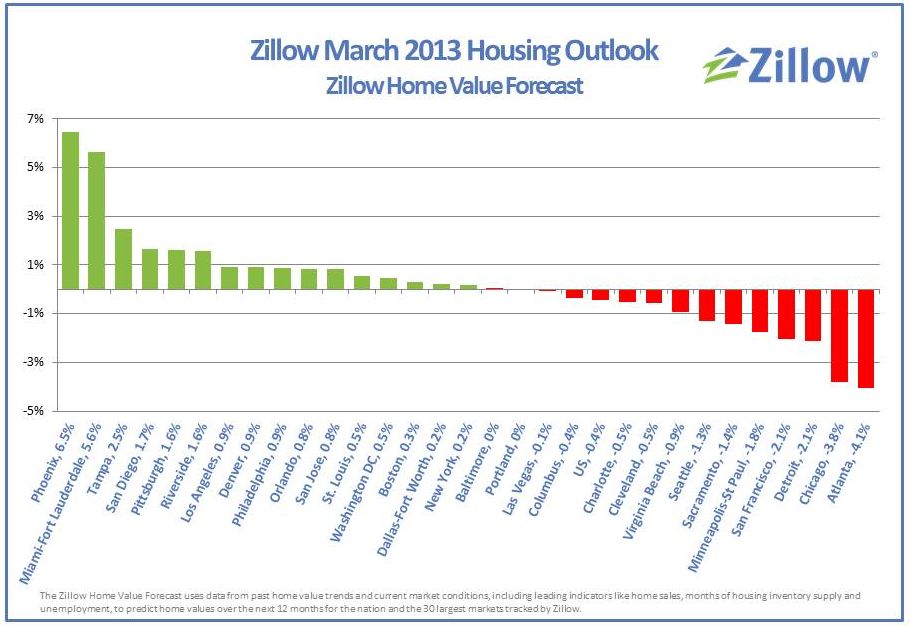

- Stable and Improving Property Values: Property values are expected to be “modestly’ positive through 2012 and continue appreciating trends through 2013 and beyond; this is a parallel indicator reflecting demand and purchase pressures causing the stabilization and growth in home valuations. According to Zillow’s Home Value Forecast released in the 2nd Quarter of 2012, property values across 19 of the 30 metro areas analyzed by Zillow are to hit bottom in 2012, with anticipated gains across the U.S. of approximately 6.5% in 2013 and forecasted gains of 4% per year thereafter. The gain through the first two quarters in 2012 reflects the largest gains in property values since 2006.

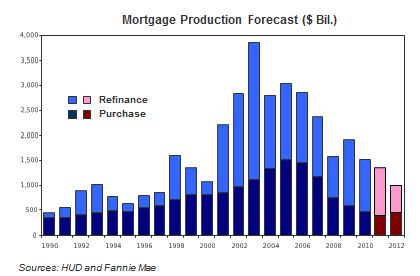

- Leveling Off of U.S. Mortgage Production Volume: Industry origination trends remain heavily refinance focused however. More mature and regionalized firms whose business models are more relationship driven will reflect greater percentages of new purchase transactions. The chart below reflects this composition: nearly 2/3 of the market is refinance and 1/3 (or more) is made up of new purchase transactions. MBA states, “Nothing in the housing market data suggests significant change from previous expectations of a frustratingly slow period with low but steady sales volumes. Purchase application volumes will remain in their present levels and will grow in 2013 and 2014 while the percentage of refinance volume across the total national production makeup will taper off as various government programs (Harp 2.0, Harp 3.0 etc.) legislatively are put into place to assist in keeping the flow of capital in the hands of consumers moving.” The figure below reflects purchase volume increasing in 2012 relative to the 2011 volume of $412 billion, with a total picture of $1.1 trillion in origination volume in 2012 and 2013.

- The Role of Housing in the U.S. Economy: While there is some uncertainty about how these events will impact consumer and business behavior moving forward, it is clear the housing market is not experiencing the same type of risks as reflected between 2008-2010. Broader economic metrics reflect gradually improving factors for investments in real estate and other industry support services. Housing and support services is a non-partisan market whose national contribution makes up over 17% of the U.S. gross domestic product (GDP). Such a substantial part of the U.S. economy is dependent on the successful origination, closing and funding of mortgage loans through its lending conduits. This activity supports tens of thousands of businesses in a variety of support industries – landscaping companies, building suppliers, home construction and key home service providers for home utility services and appliances, to name a few,. These facts support an end assumption that regardless of specific policy differences, the careful management of mortgage rates and the movement of mortgage volume for consumers is vital toward economic recovery, stability and growth.

Rick Roque

Any questions or feedback on this article, email Rick Roque, Managing Editor of The NicheReport Real Estate Edition, at rroque@thenichereport.com or call him at 408.914.5895.