What is a cash out refinance? Is a cash out refinance ever a good idea? Learn all of that, and more, in this article

Because mortgage debt is generally good debt, a cash-out refinance can be one of the cheapest ways to access money. And you can use it for pretty much anything: home improvements, college tuition, or high-interest debt consolidation. Plus, there are often tax benefits.

But it is not always a slam dunk. If taking a cash-out refinance will threaten your financial health in the long term, you may want to rethink your options.

In this article, Mortgage Professional America will explain how cash-out refinance works. We will also help you weigh the benefits against the risks to give you a better idea if this is the right move for you. To the mortgage professionals who typically visit our website, this article is part of our client education series and can be a good resource to send to your clients.

What does a cash-out refinance do?

A cash-out refinance replaces your current mortgage with a new, larger mortgage, allowing you to access the difference between both loans in cash. In other words, a cash-out refinance allows you to convert home equity into money. The amount is based on the equity you have built up in your property.

The funds that you get from a cash-out refinance can go toward pretty much anything, like home improvements or consolidating high-interest debt, among other financial needs.

A cash-out refinance is like a mortgage refinance, or a rate-and-term refinance. In these types of refinancing, you replace your current home loan with a new loan for a shorter loan term, a lower interest rate, or both. The major difference with a cash-out refinance is that you can take out some of your home equity as a lump sum.

Generally, refinancing is a popular option if you want to replace your current mortgage with a new one to extend more favorable terms, including:

- lower monthly mortgage payments

- lower interest rates

- remove or add borrowers from the loan obligation

- renegotiate the periodic loan terms

- access cash from the equity in your home

Find out if mortgage refinancing is a good move in this guide.

How cash-out refinance works

Essentially, cash-out refinancing lets you use your property as collateral for new home loans plus extra money. This is done by taking out a new mortgage for more money than you owe on your current mortgage. Using your home equity to gain access to your funds is an easy way to get money for emergencies, expenses, and even leisure. Check out this guide if you want to learn more about how home equity is calculated.

If you want to pursue a cash-out refinance, you will have to find a lender who is willing to work with you. Your lender will look at your current mortgage terms, your credit profile, and the balance needed to repay the home loan. Then, based on an underwriting analysis, the lender will make you an offer.

You would then get a new home loan that repays your previous loan and get locked into a new monthly installment plan. The amount of money that is more than the mortgage payoff would then be given to you in cash.

If you opted for a standard refinance, you would not see any of the money in hand – you would simply see a decrease in your monthly payments. While the money from a cash-out refinance can be used in any way you like, most use it for larger expenses like educational fees or medical bills, to consolidate debt, and emergency funds.

But remember, you have less equity in your home when you use a cash-out refinance. This means that your lender is taking more risk on you, resulting in interest rates, fees, and closing costs that are higher than for a standard refinance. If you have a specialty mortgage such as a VA loan (US Department of Veteran Affairs), for instance, you can refinance through better terms with lower rates and fees than non-VA loans.

Cash-out refinance eligibility requirements

Just like what you did when you took out your original mortgage, you need to meet certain requirements to qualify for a cash-out refi. If you choose a conventional loan – meaning you are borrowing from a private bank or lender – the general requirements are listed below. The eligibility criteria can vary between different lenders.

- Credit score: A credit score of at least 620 makes you eligible for a cash-out refinance. A higher credit rating could help you access more competitive interest rates. For government-backed loans, borrowers may qualify with a score as low as 580.

- Debt-to-income (DTI) ratio: DTI ratio measures your monthly repayments – including the refinanced mortgage – against your gross monthly income. The ideal ratio is less than 50%, but most lenders cap the figure at 43%.

- Equity: Most banks and lenders require at least 20% equity built in your home to qualify. In layman’s terms, this means that you have paid off at least 20% of the current appraised value of the property.

- Seasoning: You will need to own the home for at least six months before doing a cash-out refinance. This is regardless of how much equity you have. Some lenders may make an exception if you inherited the house, or it was legally awarded to you. If you have a VA loan, you must wait at least 210 days. The seasoning requirement for borrowers with government-backed loans is that they must have lived in the home for at least 12 months.

Here's a brief checklist of the eligibility requirements for a cash-out refinance. You can download the file for easy access:

How much money can you get with a cash-out refinance?

The amount you can cash out depends on several factors:

- your home’s value

- the LTV limit

- your mortgage balance

- closing costs

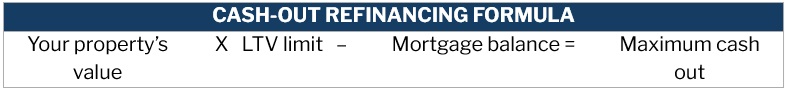

You can use this formula to calculate the maximum amount you can get in a cash-out refi:

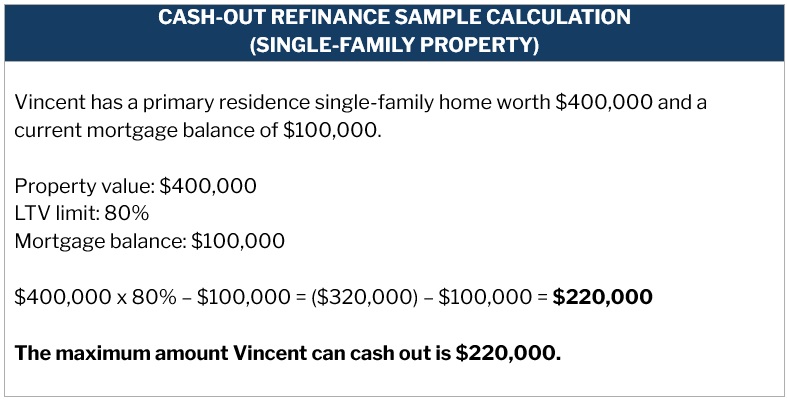

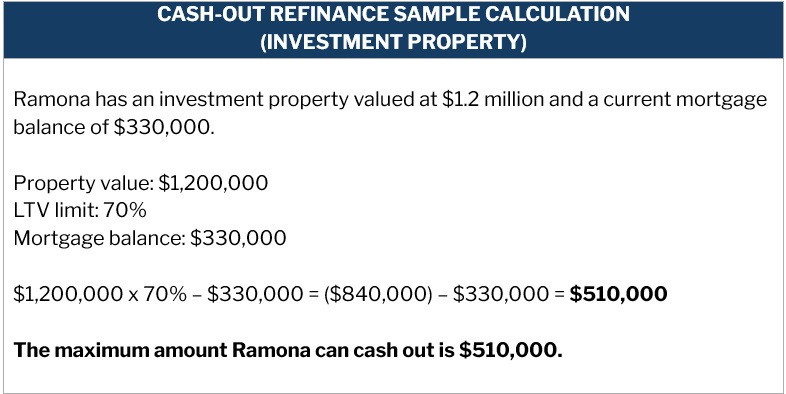

The LTV limit for a single-family property is 80 percent. This means that you need to keep at least 20 percent equity in your home when you do a cash-out refinance. But depending on the type of property, your LTV limit can go down to as low as 70 percent – for investment properties, for example. This can increase the amount of home equity you need to maintain while doing the cash out. There are also some VA loans that allow 100 percent financing, eliminating the need to retain home equity.

Here is a cash-out refinance example for a single-family property:

Here is another sample calculation, this time for a property investor:

Both calculations, however, do not include closing costs. Let’s keep it simple and say both Ramona and Vincent incurred $5,000 in closing costs. This amount will be subtracted from their cash out amounts, so they will be taking home $5,000 less.

Step-by-step guide to cash-out refinancing

If you are considering doing a cash-out refi and do not know where to start, this simple step-by-step guide may help you:

- Step 1: Determine your home equity. This involves a straightforward calculation. As mentioned, home equity is your home’s market value minus your mortgage balance. So, if your house is worth $400,000 and you have $100,000 remaining on your loan, you have built $300,000 in home equity.

- Step 2: Calculate the maximum amount you can cash out. Use the formula: Property Value X LTV Limit – Mortgage Balance = Maximum Cash Out. Given the numbers above and if you have a conventional loan, the LTV limit is 80 percent and your calculation goes like this:

$400,000 x 80% – $100,000 = ($320,000) – $100,000 = $220,000

The maximum cash out you can get is $220,000.

- Step 3: Shop around and compare rates. Shopping around and comparing rates from multiple lenders gives you more options and will help you get the best deal.

- Step 4: Consider your alternatives. Once you have researched and compared available rates, you can get an idea of how much your mortgage payments would be. If it makes sense and you can afford it, you can proceed with a cash-out refi. But if not, you might be better off pursuing other options.

- Step 5: Submit your application. As with your original mortgage, you will have to go through the appraisal and underwriting process again before closing the loan and getting your cash.

Is a cash-out refinance a good idea?

When you repay your mortgage, you build equity in your property, which, incidentally, is one of the main reasons mortgage debt is considered good debt. Using a cash-out refinance, you can access that equity in cash now rather than having to wait until you completely pay off your mortgage or sell your property.

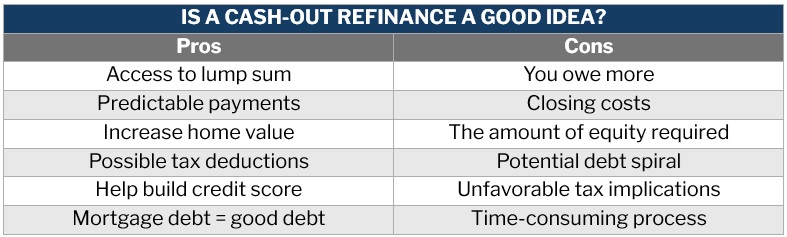

But the ability to access your equity in cash is not the only benefit. Here are some of the other pros of a cash-out refinance:

1. Access to lump sum

By unlocking the home equity you have already built, you get the funds you need to upgrade your home or pay down any debts you have. This access to a lump sum is one of the more significant benefits of a cash-out refinance.

2. Predictable payments

When you take a cash-out refinance, you will most likely go with a 30-year fixed-rate mortgage, meaning you will know when your monthly mortgage payments will be. This can be a major benefit, since you will be able to more easily get your finances in order.

With other options for accessing home equity, this is not always the case. If you went with a home equity line of credit, for instance, you would likely have to go with a variable rate instead of a fixed rate.

3. Increase home value

The home improvements that you make will likely increase your property’s value depending on the kind of renovation you fund with your cash-out refinance. Home updates can further build your home equity as well. Especially effective are bath and kitchen remodels.

4. Possible tax deductions

At tax time, renovations can also have a significant impact. Generally, you can deduct the interest you pay on your mortgage if you use the money for home improvements that boost the value of your property. Home improvements can also boost your tax basis in the property, reducing your capital gains tax liability if you sell the house.

5. Build credit score

Paying off your credit cards in full using the money from a cash-out refinance may build your credit score by reducing your credit utilization ratio. This is the amount of available credit you are using.

6. Mortgage debt = good debt

What is the cheapest form of money available? The answer, for many consumers, is mortgage debt. This is true especially when you compare mortgage debt to personal loans, credit cards, or other types of debt, since mortgages usually offer a combination of favorable terms and lower interest rates.

What is the downside of a cash-out refinance?

While there are many benefits, there are about as many downsides to a cash-out refinance. You may want to rethink your financial plans if you are worried about the impact that a cash-out refi will have on your long-term financial health.

For instance, if you want to sell your property soon, a cash-out refinance may not make financial sense, because you will be on the hook for the bigger balance at closing. Before you choose a cash-out refinance, it is critical to weigh the benefits as well as the downsides.

Here are a few of the downsides of a cash-out refinance:

1. You owe more

Your overall debt load increases when you use a cash-out refinance. In other words, the extra money you received will be a larger burden financially, regardless of how close you were to repaying your initial mortgage in full. If you were to sell, it would also reduce your proceeds.

2. Closing costs

When you take a cash-out refinance, you have to pay closing costs like you did when you took out your original mortgage—and they can be a significant cost. The credit check, appraisal, and other costs can be as high as 2% to 4% of the loan amount.

Learn more about how closing costs are calculated during the home-buying process in this guide.

3. The amount of equity required

After a cash-out refinance, most lenders typically need you to maintain 20 percent equity at minimum in your property (there are, however, exceptions). You may not qualify if you purchased your property with a low-down payment loan.

4. Potential debt spiral

While accessing home equity to fund home renovations can be a great move, it could also be a major downside if you cash out to pay off high-interest debt on credit cards. First, you should ensure that you have addressed the spending problems that led you to accumulate that high-interest debt in the first place. If you do not, you could find yourself in what is termed a debt spiral, where the same mistakes get you deeper and deeper in debt.

5. Unfavorable tax implications

Your tax liability may increase with a cash-out refinance, since it means you take on additional mortgage debt. It is therefore important to consult with your accountant or tax expert.

6. Time consuming process

Because a cash-out refi is treated as a new loan, you will have to go through the whole borrowing process again. This can take weeks. If you need money urgently, refinancing may not be your best option.

Here’s a summary of the pros and cons of a cash-out refinance:

Cash-out refi timeline

Though the whole cash-out refinancing process varies depending on the lender, the timeline generally ranges from four to six weeks. Here is a breakdown:

- Submitting basic requirements (around one to two weeks): This is when the application process begins. This can be done in person or online. You will need to submit the necessary documentation. The lender will review the submitted requirements and determine your eligibility.

- Processing your information (around four weeks): The lender will confirm your personal information, including the relevant details of your home. After this, your application will be forwarded to the underwriting team for the final decision.

- Closing the loan (around one to two weeks): The lender will contact you to schedule the loan closing and arrange for the funds to be transferred to your account.

Why is cash-out refinance riskier?

A cash-out refinance can be riskier for a few reasons. One of these reasons is if your life circumstances change after the refinance and you are unable to afford to pay off the new loan. This puts your home at risk. When the risk increases, either you or the lender must bear responsibility.

Another reason that may make a cash-out refinance riskier is if your home value decreases, which may be out of your control. In this case, a cash-out refinance may result in you owing more money than your property is worth. However, it is true that this is less of a risk given the 80 percent loan-to-value (LTV) ratio requirement that came into effect after the 2008 mortgage crisis. Once this requirement was implemented, lenders were more casual with aggressive borrowing.

Alternatives to cash-out refinance

If a cash-out refi is too risky for you, there are alternatives. Let’s take a closer look at each to better understand your options:

Home equity line of credit (HELOC)

A HELOC is a separate loan and creates a second lien on the home, while not actually functioning like a loan. Instead, it is a line of credit that you can access when necessary, plus it comes with minimal closing costs. Depending on the terms (five or 10 years, for instance) you only have to repay the interest on the amount you borrow. After that initial period, you must start repaying the principal plus interest.

Gain a deeper understanding of how a home equity line of credit works by checking out this guide.

Home equity loan

A home equity loan is essentially a second mortgage, by a different name. Because you take out a second loan against your home equity, you must make an extra payment every month. Home equity loans are attractive because you can choose a fixed interest rate. Just be sure not to borrow more than you can afford to pay back.

Here is everything you need to know about a home equity loan.

Personal loan

A personal loan is a quick way to get funds for almost any need. Interest rates may vary depending on your credit profile, and just like a mortgage, you will need to make monthly payments. But unlike in cash-out refinancing, personal loans generally require less documentation and can often be approved and disbursed on the same day.

Reverse mortgage

Reverse mortgages let homeowners aged 62 and older turn home equity into cash without selling. Unlike cash-out refinancing, there is no monthly repayment. Instead, the loan is paid off when the property is sold, vacated, or the borrower passes away. A reverse mortgage is a good option for those who need funds but don’t want to worry about monthly payments. Keep in mind that interest and fees add up over time, reducing the home’s remaining equity.

Find out more about how a reverse mortgage works in this guide.

Is it smart to use a cash-out refinance?

A cash-out refinance can be a smart choice for many homeowners. Even when mortgage rates are rising, the collateral involved in a cash-out refinance (your property) makes it less risky for lenders. These lenders are then able to keep refinance rates more affordable.

All of this means that a cash-out refinance is one of the best – i.e. cheapest – ways to pay for major expenses. Some of the reasons that make it smart to use a cash-out refinance include:

- Home improvement. If you use a cash-out refinance to pay for home improvements, you can deduct the mortgage interest from your taxes. First, make sure that these projects significantly increase the value of your home.

- Investments. If you want to buy an investment property or to build your retirement savings, a cash-out refinance would be a smart move. Learn the 5 ways to buy an investment property in this article.

- High-interest debt consolidation. Compared to other kinds of debt such as credit card debt, refinance interest rates are usually significantly lower. The money from a cash-out refinance will allow you to repay these debts and instead repay the loan with a single, low-cost monthly payment.

- College education. Accessing your home equity to pay for college education can make great financial sense if the refinance rate is less than the rate for a student loan.

As we have seen, there are many benefits to a cash-out refinance, from using the lump sum to increase the value of your home to predictable mortgage payments to potential tax deductions. But there are risks, especially if you find yourself debt spiraling because you have not gotten to the root of your financial woes. Whatever you decide, it is important to know what you’re getting into first.

As with any financial decision such as cash-out refinancing, consult with an industry expert so you know that you are making the right decision. If you are looking for a mortgage specialist to guide you on your homeownership journey, our Best in Mortgage Special Reports page is the place to go.

The mortgage professionals and companies featured in our special reports have been nominated by their peers and vetted by our panel of experts as respected and reliable market leaders. By partnering with these specialists, you know that you are getting the right guidance to make informed choices.

Do you have experience with doing a cash-out refinance? Let us know in the comment section below.