Just 57% of those who take the mortgage loan originator test pass on their first attempt. Here is your guide on the MLO test

Prior to 2008, mortgage loan officers in the US were not required to undergo educational training or pass an exam to become licensed. That changed in 2008, however, with the passing of the SAFE Act (the Secure and Fair Enforcement for Mortgage Licensing Act of 2008). The act pushed the mortgage industry to create regulations that protect consumers and reduce fraud.

Anyone who wants to become a mortgage loan originator in the US must become licensed, which you can do by passing the SAFE MLO test. But what does the test entail? What are the steps to taking the test? And how do you prepare?

In this article, we will answer these questions and more. Here is everything you need to know about the MLO test.

What is MLO for?

MLO stands for mortgage loan originator, which is a person or institution that helps prospective borrowers navigate the mortgage process before purchasing a property. The MLO is the initial lender for the home loan and works with the borrower throughout the entire mortgage process, from application approval to closing. An MLO can be a loan officer, a mortgage broker, or a lending company.

MLO test: What does a loan originator do?

MLOs guide borrowers through the different steps of getting a mortgage. This can include answering questions, collecting documents, and verifying information. If the borrower buys a property, MLOs also give an estimate of the home loan amount and interest rate based on the borrower’s credit report, income, and other assets. The initial approval of the mortgage can help borrowers determine a home-buying budget, as well as show real estate sellers and agents that the buyer is willing and able to purchase the property.

MLOs continue to work with borrowers throughout the mortgage application process into underwriting, helping to ensure the borrower is ready for closing. As mentioned, an MLO can be a person or a lending institution which initially funds the loan. It can be a bank or non-bank organization. A loan officer, meanwhile, is the person who works with the borrower.

MLO test: What is a mortgage loan officer?

A mortgage loan officer is a professional acting as an MLO and might work directly for a lender. A loan officer can also work as a mortgage broker who partners with multiple lenders to find prospective borrowers the loan option that best aligns with their financial situation, goals, and preferred loan terms.

If you’re curious about this career path, read our article on how to be a mortgage loan officer in 10 steps.

What are the steps to taking the MLO test?

As an aspiring MLO, you will have to take certain steps to obtain your MLO license—which includes taking, and passing, the SAFE MLO test. But what does the test itself involve and how do you prepare?

Firstly, you will be given 190 minutes (about 3 hours) to finish the 120-question exam. Each component of the test consists of four-part multiple-choice questions. Only 115 of the questions will be counted toward your score, which must be 75% or higher to pass the MLO test. If you fail to get 75%, you can retake the test.

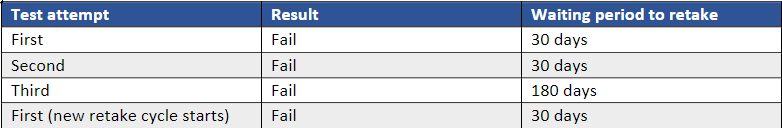

Here’s what you should know if you have to retake the MLO test:

Now that you have the basic information, let’s look at the steps you must follow to take the MLO test:

- Sign up for NMLS account

- Create test enrolment window

- Schedule test appointment

- Study, study, study

- Take the MLO test

Let’s look at each of these steps:

1. Sign up for NMLS account

The first step to taking the MLO test is to create your individual account in the Nationwide Multi-state Licensing System (NMLS). You will have to submit your fingerprints, authorize a criminal background check, and provide NMLS access to your credit report.

2. Create test enrolment window

After creating your NMLS account, you will have to create a test enrolment window and pay a $110 testing fee. You will have to create the test enrolment window before you can schedule your MLO test appointment.

3. Schedule test appointment

You can either take the MLO test in-person or online. The in-person test takes place in a Prometric Testing Center. The online test, on the other hand, is taken through the Prometric ProProctor system. You can reschedule or cancel your MLO test as long as you follow the policy.

4. Study, study, study

Some quick tips on studying for the MLO test:

- Start studying as soon as possible

- Make time each day to study, even if it is just 10 or 15 minutes at a time

- Use study methods that suit your learning style best such as taking practice tests, making flash cards, or reading core concepts out loud. These can help you absorb the most information

- Ensure you are well rested

- Ensure you have had enough to eat before taking the MLO test

So that you know which areas of study to focus on, here is the percentage of questions that correspond to the various facets of mortgages:

- Mortgage loan origination activities: 27%

- Federal mortgage-related law: 24%

- General mortgage knowledge: 20%

- Ethics: 18%

- Uniform state content: 11%

5. Take the MLO test

Prior to taking the test, you have to review the NMLS candidate agreement and rules of conduct. If you are taking the in-person MLO test, you should arrive 30 minutes early with your photo identification.

Remember: it is never too early to start preparing, whether you are looking into pre-licensure education to become an MLO or want to take the SAFE MLO test. While the test can be difficult, it is important to remain positive.

What percentage of people pass the MLO test?

To become an MLO, you must take and pass the SAFE MLO test. If you fail the test, however, you should not feel so down—it is surprisingly common. Just 57% of test takers pass on their first attempt.

MLO test: Why is it so difficult?

There are three reasons why the MLO test is so difficult:

- MLO test developers designed it to be challenging, to ensure compliance with the SAFE Act

- Many test takers fail to fully understand—or apply—the key concepts needed to pass

- MLO test takes do not always take enough time to study for the exam

With the proper preparation, however, you should be able to overcome these challenges.

Is the MLO test all multiple choice?

Yes. The MLO test contains 120 multiple-choice questions. Five of those multiple-choice questions are unscored. Why? These five questions are used by administrators to evaluate questions for future versions of the MLO test. Remember: the 120 multiple-choice questions must be completed within the 190-minute time limit.

What happens if you fail the MLO exam 3 times?

If you fail the MLO test on your third attempt, you have to wait at least 180 days (six months) before you can retake it. After the 180 days have elapsed, a new retake cycle begins. At the beginning of this retake cycle, you only have to wait 30 days after your fourth and fifth attempts.

As per the cycle, if you fail the MLO test on your sixth attempt, you have to wait 180 days again until you start a new test-taking cycle. This cycle can be repeated as many times as is necessary to pass.

MLOs are essential to the mortgage industry, helping families and business owners along their way to purchasing the property that will make their dreams come true. While there are stresses to taking the MLO test, there are ways to prepare that should make the process run smoothly, helping you to start this exciting new part of your career.

If you're truly interested in becoming an MLO, take the time to look at the mortgage professionals we highlight in our Best of Mortgage section. Here you will find the top performing mortgage professionals, including MLOs, across the USA.

Have experience taking the MLO test? How did you prepare? Did you pass on the first attempt? Let us know in the comment section below.