To find the best REITs to invest in, you will need to know your risk tolerance and your financial goals

When determining the best REITs to invest in, you should understand your risk tolerance as well as your financial goals. You should also be aware of which REITs are performing well, meaning it helps to remain informed.

There are also downsides to REITs that you should be aware of.

In this article, we will look at the top-performing REITs right now, the downsides to REIT investing, and tips for picking the best REITs to invest in.

What are the best REITs to invest in?

Real estate investment trusts, or REITs, return value to shareholders in a couple of ways. One way is through share price appreciation, and the other is dividend yield.

Dividend yield is the cumulative annual dividend payment divided by the share price. For instance, a REIT that pays dividends of $10 annually and trades for $100 yields 10%. In 2022, the dividend yield on the benchmark FTSE Nareit All REIT Index was between 3.1% and 4.3%.

6 best REITs to invest in

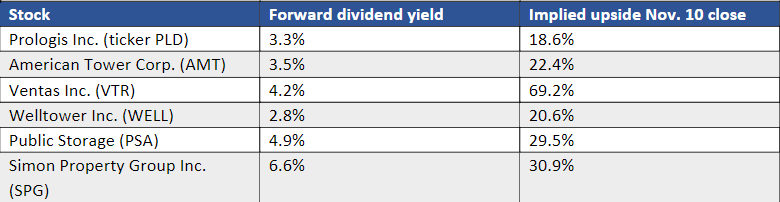

Here are the best REITs to invest in in 2023, according to analysts from Morningstar:

Here is a breakdown of the best REITs to invest in.

Prologis Inc. (PLD)

Prologis Inc. Is an industrial REIT specializing in logistics real estate. Prologis Inc. generated 20% year-over-year funds from operations (FFO) growth in the third quarter. Morningstar has a buy rating and $124 fair value estimate for Prologis Inc. stock. On Nov. 10, PLD stock closed at $104.55.

American Tower Corp. (AMT)

American Tower Corp. is specialty REIT operating the world’s largest independent portfolio of broadcast and communications towers. Morningstar has a buy rating and $225 fair value estimate for American Tower Corp. stock. On Nov. 10, AMT stock closed at $183.79.

Ventas Inc. (VTR)

Ventas Inc. is a healthcare REIT specializing in healthcare facilities. These include housing for seniors, specialty care facilities, hospitals, and medical office buildings. Senior housing rental rates increased 6.2% year-over-year in the third quarter, while same-store revenue growth was 7.5%. Morningstar has a buy rating and $72 fair value estimate for its stock. VTR stock closed at $42.56 on Nov. 10.

Welltower Inc. (WELL)

Another healthcare REIT, Welltower Inc. invests in healthcare facilities such as specialty care facilities, senior housing, and medical office buildings. The best performing stock on this list, Welltower inc. was up 31.2% year-to-date through Nov. 10.

In the third quarter, Welltower closed $1.4 billion in acquisitions and $922 million in acquisitions before its earnings call. Morningstar had a buy rating and $103 fair value estimate in its stock, which closed on Nov. 10 at $85.37.

Public Storage (PSA)

Public Storage is a specialty REIT that is the largest owner of self-storage facilities in the US. Public Storage grew same-store revenue by 2.5 annually in the third quarter. Morningstar has a buy rating and $317 fair value estimate for Public Storage stock. On Nov. 10, PSA stock closed at $244.78.

Simon Property Group Inc. (SPG)

This is a retail REIT specializing in regional malls, lifestyle and community centers, and outlet centers. SPG stock pays a 6.6% dividend. Morningstar has a buy rating and $151 fair value estimate for Simon’s stock, which closed on Nov. 10 at $115.33.

How to pick the best REITs to invest in

Investing in REITs is a good strategy for investing in real estate. The smartest way to pick the best REITs to invest in is to go with the ones that suit your risk tolerance and your financial goals. Most REIT investors choose by REIT type, dividend track record, business model, leverage, and cashflow and revenue production.

Let’s take a look at the best ways to pick REITs to invest in.

Know your options

The primary REIT types include:

- Equity REITs own property

- Mortgage REITs finance property

- Hybrid REITs own/finance property

When investing in real estate, the simplest option for you is usually the best way to go. For instance, you might want to start with an equity REIT that specializes in retail or residential spaces. That would likely be the most relatable option than a mortgage REIT.

Understand the business model

First, you should know how the REIT makes money. Second, you should know how revenue growth will continue in the future. To help you better understand the business model, you can review the REIT’s tenant profile, occupancy trends, and average length of lease.

Additional material includes annual reports and other documentation that will help you better understand the REIT’s acquisition and growth strategy.

Learn about the dividend history

The best REITs to invest in have a good history of dividend increases and dividend payments. Increases improve the efficiency of your portfolio and your net worth. Beyond that, dividend increases indicate that the REIT is active. To support it, sustainable dividend growth requires business growth.

Research revenue/cashflow trends

Where there is dividend growth, there is rising revenue and cashflow—trends that you can analyze. How much revenue growth has there been? For how long? And how does the growth compare to the REIT’s competitors?

Remember: funds from operations (FFO) are a good metric to keep an eye on for cashflow.

Review the balance sheet

Because REITs can be heavily leveraged, you will need to review the balance sheet. When doing this, you will want to focus on the debt ratio and the debt-to-equity ratio.

Debt ratio

The debt ratio measures solvency. To get the debt ratio, you divide total assets into total liabilities. Debt ratios above 60%, which are considered high, limit the REIT’s ability to borrow funds in the future.

Debt-to-equity ratio

The debt-to-equity ratio tells you how much debt the REIT uses compared to equity in funding the business. You calculate it by dividing the total liabilities by the total equity. A 3:1 ratio indicates that the business is financed with 25% equity and 75% debt.

What is the 90% rule for REITs?

The 90% rule for REITs stipulates that a company must distribute at least 90% of its taxable income to shareholders each year in the form of dividends. Additionally, a company must have the bulk of its assets and income connected to real estate investment to qualify as a REIT.

A company that qualifies as a REIT can deduct all the dividends it pays out to its shareholders from its corporate taxable income. Due to this special tax treatment, many REITs pay out a minimum of 100% of their taxable income to their shareholders. This means they owe no corporate tax.

What is the downside of REITs?

There are obvious benefits to investing in REITs. You can diversify your portfolio, generate passive income, and increase your liquidity, to name a few. There are, however, some considerations you need to make.

There are risks and disadvantages to investing in REITs. This is especially true if you do not diversify your portfolio well.

One of the major downsides of REITs is the interest rate risk. The value of REITs is based on the real estate market. If interest rates rise, and the demand for property drops as a result, it may lead to decreased property values. That will negatively affect the value of your investment.

The risk to interest rates is not the only downside. Let’s look at three other points you should consider before investing in REITs.

Dividend taxes

REITs dividends are usually a good source of passive income. The money you get from it, however, is subject to your standard income tax rate. That depends on your tax bracket. And since dividends are paid out regularly, you have to pay taxes on the income every year. You are obligated to do that even if you reinvest your dividends.

When selling a stock after holding it for more than a year, you will be subject to the long-term capital gains tax rate on any gains you receive. That is lower than your ordinary income tax rate.

Market volatility

The real estate market is less volatile than the stock market, especially over the short term. However, the real estate market is still subject to numerous influences, some of which do not impact the stock market. You will still likely experience market volatility when investing in REITs.

Less control

REITs are like buying exchange-traded funds or mutual funds – you do not have any say in how a REIT invests its money. Not only that, but you also have no control over the properties themselves. The result is that some REITs are less diversified than others. Instead, they focus on a specific niche, like apartment complexes or office buildings.

Higher fees

Another downside here is that some REITs charge high fees. If you invest in a private REIT, your upfront costs may be as high as 11%—or more—of your investment. (By contrast, publicly traded REITs usually do not have many fees beyond trading commissions, which most online brokers do not even charge anymore.) Private REITs might also charge a management fee of 2% every year.

Finding the best REITs to invest in takes research

Deciding on the best REITs to invest in requires research. You must understand your risk tolerance as well as your financial goals. You should also keep your research up to date – it helps to keep an eye on which REITs are performing well.

While there are many benefits to investing in REITs, there are also some risks that must be considered.

If you're truly interested in finding the best REITs to invest in, take the time to look at the mortgage professionals we highlight in our Best of Mortgage section. Here you will find the top performing mortgage professionals, including mortgage brokers, across the USA.

Did you find these tips on the best REITs to invest in useful? Have you recently begun your own journey into REITs? Let us know in the comment section below.