When learning how to become a mortgage broker in New York, follow these steps

If you want to become a mortgage broker in New York, you will first need to obtain a mortgage broker license.

In The Empire State, you need to go through the state-specific New York Department of Financial Services (DFS) to become licensed. You also need to create an account with the National Mortgage Licensing System (NMLS). Both have requirements that you will need to meet if you want to get a license.

In this article, we will break down the steps you must take to become a mortgage broker in New York, plus the licensing requirements. We will also outline the associated costs. Here is everything you need to know about how to become a mortgage broker in New York.

Steps to become a mortgage broker in New York

Are you interested in how to become a mortgage broker in New York? If so, you will need to complete a few steps—six in all. But don’t worry. They become straightforward once you know what you have to do. Here is how to become a mortgage broker in New York:

- Apply for NMLS account/ID number

- Complete NMLS pre-license education

- Pass NMLS mortgage licensing exam

- Apply for NMLS license

- Complete background checks/pay fees

- Associate NMLS account with employer

To help you on your way to become a mortgage broker in New York, here is a breakdown of each of these steps. But before we get started, take a look at our article on how to become a mortgage broker in the US for a quick overview.

1. Apply for NMLS account/ID number

NMLS stands for the National Mortgage Licensing System. The NMLS is used to process mortgage licensing requests across all 50 US states, including New York. To become a mortgage broker, you must first create an account, which is simple—and necessary. This process should only take a couple of minutes to complete.

Here are the steps you need to take to creating an NMLS account:

- Request an NMLS account through the online registration portal

- Choose the individual option

- Provide the information required and submit the application

- Prepare for pre-license courses

2. Complete NMLS pre-license education

To become a mortgage broker in New York, you must complete the required 20-hour NMLS SAFE pre-licensing course. This also includes three hours of New York-specific content, plus additional course work required by the New York Department of Financial Services, or DFS.

Remember: all 50 states require 20 hours of mortgage education from an NMLS-approved mortgage school. If you want to get a new mortgage license, ensure you enroll in the 20-hour SAFE course. This should be in addition to any state-specific educational requirements.

3. Pass NMLS mortgage licensing exam

After you have successfully completed your pre-licensing education, you must schedule an appointment to take the National Test Component with Uniform State Content. You can do this through your NMLS account.

Let’s break down the different components:

SAFE MLO National Test Component

The SAFE MLO exam covers federal mortgage-related laws, general mortgage knowledge, and ethics, among others. Here is a look at the test details:

- 190 minutes

- Cost $110

- 120 questions, 115 scored

Uniform State Content

The Uniform State Content (UST) portion of the exam covers the following:

- Compliance

- Definitions and documents

- License law and regulation

- Regulatory authority, limitations, and responsibilities

New York Department of Financial Services

New York requires at least 20 hours of pre-license education. You must meet at least one of these conditions:

- Pass on both the National and New York State components of the SAFE exam;

- Pass on both the National and stand-alone UST components of the SAFE exam; or

- Pass on the National Test Component with Uniform State Content.

4. Apply for NMLS license

Next, you can apply for your NMLS license. In New York, you can apply for your NMLS license by taking these steps:

- Log in to NMLS account

- Select the filing tab (top of the screen)

- If applying as an individual, select “individual”

- Click request new/update. If you are paying the filing fees, click “continue”. (If you are already employed by a mortgage company, your employer might handle this step for you.)

- Click “add” to apply for your New York license

- Select appropriate NY license and click “next”

- Verify info

- Before proceeding, read the final page carefully. Click “finish” if the info is correct

5. Complete background checks/pay fees

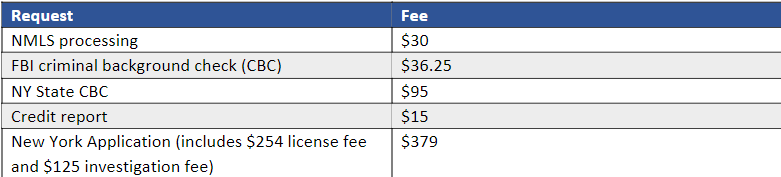

The SAFE Act established registration and licensing standards for mortgage professionals. To receive your New York mortgage license, you must provide the following information and pay the fees that come with them:

6. Associate NMLS account with employer

If you worked for a federal bank or are moving from another state, you can now apply for your NMLS license before being hired by a New York-regulated entity. After the DFS is satisfied that you have met all the requirements to become a mortgage broker, other than affiliation with a NY-regulated entity, you will receive a sponsorship notification. This will require that you become affiliated with a NY-regulated entity within 30 days of the date of the notification.

Licensing requirements for New York-based mortgage brokers

In New York State, there are three major license types: company, individual, and branch. In this section, we will be focusing on the most common company and individual mortgage broker licenses in New York.

Company licenses

The most common company mortgage licenses in New York are as follows:

- Mortgage bank license: Enables sole proprietorships and companies advance money and/or issue commitments to make mortgage loans. This license is required for companies that make three or more mortgage loans within a year. It is also required if the company makes five or more mortgage loans in two years on residential properties in New York state.

- Mortgage broker registration: Enables sole proprietorships and companies to negotiate mortgage loans on residential New York properties. It also allows sole proprietorships/companies to accept, process, or solicit with lenders on behalf of third parties.

- Mortgage loan servicer registration: Allows sole proprietorships and companies to get payments from borrowers. It also allows for payment to borrowers for conversion mortgages.

Individual licenses

The most common individual license in New York is as follows:

- Mortgage loan originator license: Enables individuals to negotiate the terms of the mortgage loans for residential properties. It also allows individuals to take mortgage loan applications.

Costs to become a mortgage broker in New York

To become a mortgage broker in New York comes with costs. When beginning the process, you must apply through the NMLS licensing portal. To ensure you are ready to apply, review the new application checklist beforehand.

You must pay $379 for the New York application fee. This covers the $254 licensing fee and the $125 investigation fee. You must also submit a credit report at the time of the application, which costs $15.

Being a mortgage broker in New York is an exciting journey

Mortgage brokers are essential to the mortgage industry, in New York as elsewhere. They help families and business owners along their way to purchasing the property that will make their dreams come true.

When determining how to become a mortgage broker in New York, you may run into challenges in the application process. However, there are also many perks and benefits once you are licensed.

Remember: the more knowledge you have, the better off you will be.

If you're truly interested in becoming a mortgage broker in New York or anywhere, take the time to look at the mortgage professionals we highlight in our Best of Mortgage section. Here you will find the top performing mortgage professionals, including mortgage brokers, across the USA.

Did you find these tips on how to become a mortgage broker in New York useful? Have you recently earned your mortgage broker license in New York? Let us know in the comment section below.