Help your clients learn what interest-only mortgages are. Find out the benefits, risks, and key factors of this property loan form

- What is an interest-only mortgage?

- How an interest-only mortgage works

- How do you qualify for an interest-only mortgage?

- Is it a good idea to get an interest-only mortgage?

- What are the downsides of an interest-only mortgage?

- How do you pay off an interest-only mortgage?

- Why get an interest-only mortgage?

Not all mortgages work the same way. Some let you pay just the interest for a few years before you start paying down the property loan itself. This is called an interest-only mortgage. It can help lower your payments early on, but it’s not the right fit for everyone.

Interested about this mortgage? In this article, Mortgage Professional America will shed light on interest-only mortgages. We will talk about what it is, how it works, as well as the qualifications. We will also help you understand its advantages and disadvantages.

To our usual readers who are mortgage professionals, this article is another one of our client education pieces. If you have clients who are interested to learn about interest-only mortgages, this guide can be a great tool. Feel free to share this with them!

What is an interest-only mortgage?

For an interest-only mortgage, you make repayments only on the interest on the principal amount borrowed. This arrangement is made for a set term, such as five to ten years. During that period, you pay nothing off the principal. This means that the principal does not reduce until that set term ends.

When the interest-only period ends, your home loan will change from an interest-only mortgage to a principal and interest loan. When this happens, you start making payments for the principal amount and the interest on that amount. As such, your payments will increase.

How an interest-only mortgage works

Most interest-only mortgages are structured as adjustable-rate mortgages (ARMs). Your ability to make interest-only payments typically lasts no longer than 10 years. After this, you'll start repaying on both the principal and the interest on the principal. The principal is repaid either as a lump sum or through payment plans.

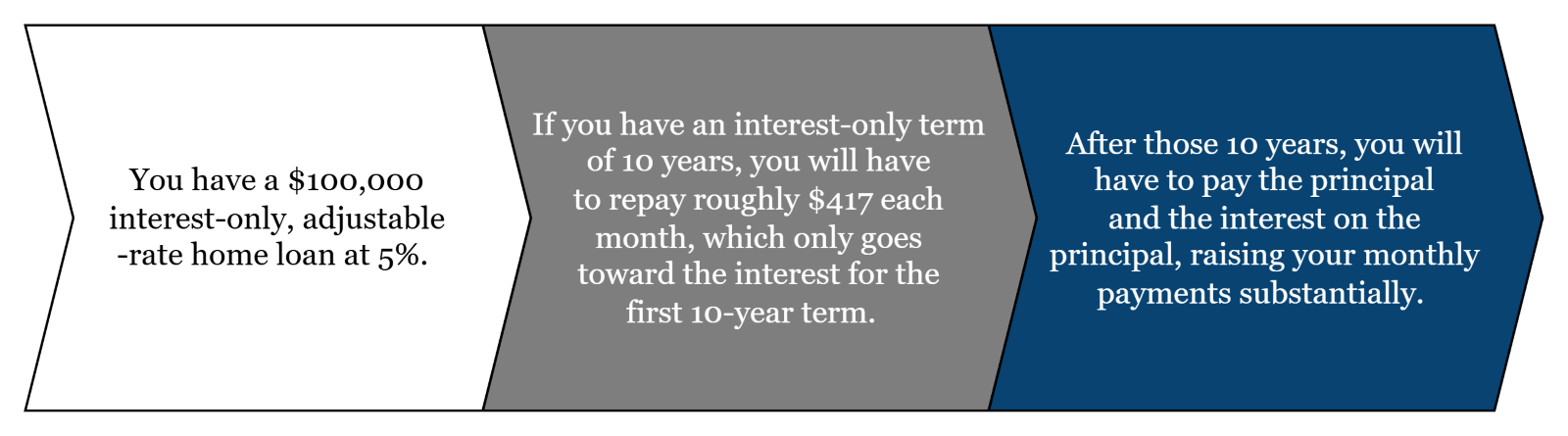

Here is a sample scenario of how an interest-only mortgage would work:

How do you qualify for an interest-only mortgage?

To qualify for an interest-only mortgage, you’ll need:

- a credit score of 700 or higher

- a debt-to-income ratio under 43%

- at least 20% for a down payment

- clear proof that your income will grow

- good savings or other assets

Do banks still offer interest-only mortgages?

Not many banks and mortgage lenders offer interest-only mortgages anymore, and the ones that do have tighter rules. Usually, mortgage providers will only give these property loans to people who are in strong financial standing.

Is it a good idea to get an interest-only mortgage?

It depends on your financial capacity and goals. There are numerous benefits of an interest-only mortgage. This is especially true for homebuyers who expect higher income later but need to save in the short term.

Here is a quick look at some situations where getting an interest-only property loan can help:

- your income will increase

- you want to qualify for a larger property

- you’re trying to buy a home in an uncertain market

- you'll use it as an investment strategy

Let’s take a closer look at each:

Your income will increase

An interest-only mortgage can be a good choice if your income is low right now but will likely go up soon. For example, if you’re in graduate school and want to buy a home, most of your money is probably going toward tuition.

With an interest-only home loan, your monthly payments stay lower in the beginning. This can be beneficial if you’re having financial struggles. Later—maybe five to ten years from now—when you're earning more, you should be able to handle the higher payments without a problem.

You want to qualify for a larger property

This will work best if you have a large lump sum coming to you in the future, such as an inheritance. However, be cautious. Securing a loan based on anticipated future funds can be difficult.

It is also important to make sure that the expected funds are guaranteed. This is because your mortgage payments will grow when your interest-only period ends. You need to be prepared financially for this.

You’re trying to buy a home in an uncertain market

If the housing market is going up and down, it can be hard to know when to buy. An interest-only mortgage might help you get into a home even if prices are unpredictable. With lower monthly payments at the start, you might be able to afford a property you plan to sell or flip later.

But this strategy isn’t without risk. If the market drops after you buy, the home could lose value. If that happens, you might owe more than it's worth. That’s why it’s important to understand how these property loans work and be prepared if things don’t go as planned.

To help you avoid such pitfalls, try talking to any of these experts listed on our Best in Mortgage page.

You'll use it as an investment strategy

An interest-only mortgage might work for you if you have strong investments but don’t want to sell them to cover mortgage payments. It’s also a good option if you’d rather keep putting money into stocks or a retirement account instead of paying off your home loan right away.

What are the downsides of an interest-only mortgage?

On the other hand, if you are unable to pay a higher monthly mortgage payment when the principal is introduced, interest-only mortgages can be risky.

Here are some examples of when interest-only mortgages might be too risky to pursue:

- there is no growth in home equity

- home values are decreasing

- the riskier the loan, the higher the interest rate

- variable interest rates jump

Let's further discuss them below:

There is no growth in home equity

To protect themselves, mortgage lenders often require a large down payment for interest-only mortgages. This helps reduce their risk if you stop making payments. But even with a big down payment, you won’t build equity during the interest-only period.

This is usually during the first 10 years, unless you choose to pay extra. If your goal is to reduce your mortgage balance over time, this type of mortgage might not be the best fit.

Home values are decreasing

The risks of interest-only mortgages became clear during the 2008 housing crash. Many people used these home loans to buy property, pushing the prices higher. But when the market collapsed, home values dropped fast.

Homeowners with interest-only property loans were stuck making large payments on houses that had lost value. They had little or no equity, which made it hard to sell or refinance.

The riskier the loan, the higher the interest rate

Interest-only mortgages used to be easy for banks to resell to other financial institutions. That’s no longer the case.

Today, this loan type is seen as higher risk. As a result, mortgage lenders often charge higher interest rates than they do for fixed-rate mortgages. They might also ask for a larger down payment to reduce their risk.

Variable interest rates jump

Most interest-only loans have variable interest rates. These rates can go up or down based on a benchmark rate, like the federal funds rate. If that rate rises, your monthly interest payments will climb as well.

The same applies to home equity lines of credit (HELOCs). To avoid surprises, you might want a mortgage that gives you the option to lock in a fixed rate. That way, you can have more control and predictability over your future payments.

How do you pay off an interest-only mortgage?

You'll still be on the hook for the original loan amount when the term of your interest-only mortgage comes to an end. Here are three payment options:

-

Remortgage: You can take out another mortgage to repay your first interest-only mortgage. You still need to make sure that you meet the criteria of your chosen bank or mortgage lender. This is good to remember since you will have grown older, and your life circumstances could be different.

-

Sell the home: To repay your interest-only mortgage, you could simply sell your home. This makes perfect sense if you go for Buy to Rent options. Hopefully, your property price will pay for the entire loan amount with some remaining. On the other hand, if you’re unfortunate, you might run into negative equity and be forced to pay for the shortfall.

-

Pay with investments or savings: You might be able to use funds you have earned from investments and/or savings to pay off your interest-only mortgage.

Why get an interest-only mortgage?

Interest-only mortgages are good for anyone who wants to keep their month-to-month housing costs low. It is also a viable option especially if you're buying a second home that will become your primary residence in the future. If you are not permanently residing in the house yet, making payments toward the interest only will be financially beneficial.

Have you tried applying for an interest-only mortgage? How was it? Feel free to share in the comments below.