Use our free mortgage calculator to estimate monthly mortgage payments and help clients understand affordability and long-term loan costs

Acting as a bridge between future homeowners in the United States and various property loan providers, mortgage brokers help clients secure the best possible deals. To do this effectively, they need access to tools that support their clients through every step of the mortgage process. That’s where mortgage calculators come in.

In this article, Mortgage Professional America will shed light on what a mortgage calculator does and how you can use it to your advantage. We’ll also explore some of its limitations and key components. Want to find out how reliable mortgage calculators are? Keep reading for more.

What is a mortgage calculator?

A mortgage calculator is an online tool or software feature that helps users estimate their monthly mortgage payments and total interest costs. You can also find out your clients’ amortization schedules based on various components that often include the following:

- loan amount

- loan term

- down payment

- homeowner's insurance

- interest rate

Let’s take a closer look at each one:

1. Loan amount

This is the amount your client borrows from their chosen bank or mortgage lender. It’s the purchase price of the home minus the down payment. In many cases, the higher your client’s income and the lower their existing debt, the larger the home loan they might qualify for.

2. Loan term

The loan term refers to how long your client will take to repay the mortgage. Common options include 30, 20, or 15 years. Most borrowers choose a 30-year fixed-rate mortgage, but shorter terms can offer lower interest rates and result in less interest paid overall.

However, shorter terms also mean higher monthly payments. Mortgage calculators allow you to compare different term lengths to show your clients how their payments will change.

3. Down payment

This is the portion of the home’s purchase price that your client pays upfront. A 20 percent down payment is often ideal because it helps avoid private mortgage insurance (PMI).

A mortgage calculator takes this component into account when estimating monthly costs and determining PMI applicability. In general, the higher the down payment, the better your client’s chances of getting a favorable interest rate.

4. Homeowner’s insurance

Homeowner’s insurance is required by most banks and mortgage lenders to protect the property against damage, loss, or disasters. This cost is usually included in the monthly mortgage payment. The amount depends on factors like the property’s value and location.

5. Interest rate

The interest rate is the cost of borrowing money. It’s expressed as a percentage and directly affects how much the borrower pays over the life of the mortgage. As such, this is an important variable to review with your clients.

Interest rates change frequently, and a mortgage calculator might not always reflect the most current rates available. This means that even a small difference in the rate used by the mortgage calculator could affect your clients’ monthly payment and total home loan cost.

To further understand how mortgage calculators work, watch this video:

In short, a mortgage calculator is a financial planning tool that gives you a projection of how much a mortgage could cost your clients over time.

How reliable are mortgage calculators?

Generally, mortgage calculators are reliable for giving estimates of monthly payments and amortization schedules. They use standard mathematical formulas based on the listed inputs above to provide you with a breakdown of the potential long-term cost of a mortgage. Still, mortgage brokers should keep in mind that mortgage calculators have their limits.

Let's first go over some of the tasks that these tools can do well:

-

Quick calculations: Mortgage calculators are excellent for getting fast ballpark estimates. They can help you visualize your clients’ payment scenarios and compare property loan options on the spot

-

Budget planning: They support financial planning by helping your clients understand what they can afford before committing to a mortgage lender

-

Breakdown of costs: Most mortgage calculators include detailed monthly payment breakdowns. This can help your clients grasp the true cost of homeownership

Mortgage calculators are widely used by those who are planning to buy a home or refinance an existing mortgage. They are designed to give your clients an idea of what their monthly payments might look like.

Using mortgage calculators can be very useful in the early stages of planning, but one should know that these tools have limitations. Let’s look at some of them:

-

No credit-based adjustments: Most mortgage calculators don’t factor in credit scores or other borrower-specific risk factors, which can heavily impact actual interest rates and home loan approval

-

Taxes and insurance may vary: Property taxes and insurance premiums are often estimated based on averages. The actual costs can differ depending on the home’s location and condition

-

PMI calculations may not be included or accurate: Some mortgage calculators don’t account for PMI or use rough estimates. This can be especially true when down payments are below 20 percent

-

No mortgage lender-specific fees: Origination fees and other mortgage lender-related costs are usually not included, unless added manually. Discount points are also often left out

Mortgage calculators are trustworthy tools for estimates, but they’re not a substitute for formal loan disclosures or a full pre-approval process. As a mortgage broker, you can use them to guide early-stage discussions with your clients. However, make sure that they understand that the actual figures will depend on various things like property details and credit evaluations.

What mortgage calculators can leave out

Mortgage calculators are simple tools and don’t always include all the costs involved in homeownership. For example, they might not account for:

- PMI

- property taxes

- homeowners association (HOA) fees

These costs can add to your clients’ monthly payments. Because of this, the mortgage calculator’s result might be lower than their actual expenses. Another point to consider is that mortgage calculators don’t take your clients’ personal financial situations into account.

All in all, the numbers shown in a mortgage calculator should be viewed as estimates, not exact figures. The good news: the mortgage calculator we feature here includes PMI, property taxes, and HOA fees! Feel free to play around with it to get a feel for it before using it for a client.

How much can your clients borrow?

Using a mortgage calculator, you can calculate how much your clients can borrow. Most homebuyers can usually qualify for a mortgage that’s 2 to 2.5 times their annual gross income. Let’s say your client earns $100,000 a year. With that income, they might be able to afford a mortgage between $200,000 and $250,000. But keep in mind that this is just a general guideline, not a fixed rule.

As a mortgage broker, you should assess your clients' full financial profile to set realistic expectations. Affordability depends on factors such as:

- gross income

- front-end ratio (monthly housing costs vs. gross income)

- back-end ratio (total monthly debt vs. gross income)

- credit score you need to buy a house

Aside from what the mortgage lender will approve, your clients will also need to consider their personal goals. Ask them what type of home they’re seeking and how long they plan to stay there. Guide them by letting them determine what expenses they’re willing to adjust to afford the mortgage.

Calculating your clients’ monthly mortgage payment

It's vital to calculate your clients’ mortgage to help them learn how each factor affects their monthly payment. Some of these factors are:

- the total amount they’re borrowing from their chosen bank or mortgage lender

- the amount of time they have to repay their mortgage in full

- the interest rate for their home loan

Before we provide you with the formula, we’ll first go over the variables used to calculate your clients’ mortgage:

- P: the principal amount

- i: monthly interest rate

Mortgage lenders usually list the interest rate as an annual figure. This means that you must divide it by 12 months. For instance, if the interest rate is 5%, the monthly rate would be:

.png)

-

n: the number of payments you will have to make throughout the entire loan term

Here’s how to calculate this variable for a 30-year fixed-rate mortgage:

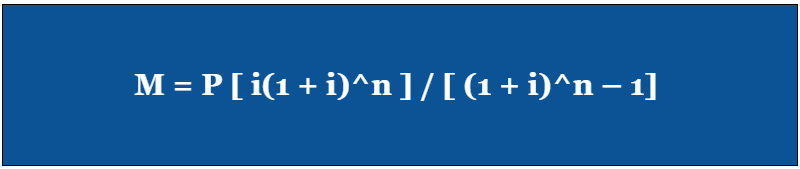

Using all these variables, this is the formula on how to calculate the monthly mortgage payment (M):

This equation is the simplest calculation that uses only your clients’ timeline as well as their interest rate and loan amount.

How can your clients pay off a 30-year mortgage in 15 years?

Have you used a mortgage calculator and realized that your clients might be able to pay off their mortgage sooner than expected? That can be a great chance to talk about smart ways to cut years off their mortgage and save money in the long run.

As a mortgage broker, you can guide them in exploring ways to shorten their mortgage term. Here are some options to consider:

Extra payments

If your clients have money left over each month from cutting expenses or increasing income, they can apply it directly to the mortgage principal. Paying down the principal faster reduces the total interest paid over time. Even small, regular extra payments can make a big impact.

As their mortgage broker, check if the bank or mortgage lender allows extra payments toward the principal without charging penalties.

Bi-weekly payments

This method involves making half of the monthly mortgage payment every two weeks. That adds up to 26 half-payments or 13 full payments each year instead of 12.

That extra payment each year can help shorten the loan term and save on interest. Confirm with the bank or mortgage lender if they allow bi-weekly payment plans or require setup through a third party.

One extra monthly payment

Encourage your clients to use any lump sum as an additional payment toward the principal. The earlier in the mortgage term that they do this, the more they save. This is especially true because most of the interest gets paid in the first 10 years of a 30-year mortgage.

Refinance to a shorter term

Refinancing to a 15-year mortgage is a more structured way to shorten the home loan. It can lower the interest rate and reduce the time to pay off the mortgage. However, monthly payments will be much higher, so this option is best for clients with steady income and minimal debt.

You can help assess whether their income supports the higher payments and guide them through closing costs and break-even timelines.

Modify the mortgage

If a client has fallen behind on payments due to job loss, medical issues, or other financial setbacks, loan modification might be an option. This could involve adjusting the interest rate or extending the mortgage term. While not intended to shorten the home loan, modifications can provide relief to make payments more manageable for your clients.

How mortgage calculators help mortgage brokers

A mortgage calculator may seem like a simple tool, but it can be a powerful asset. From doing quick payment estimates to helping clients understand their options, it can give value to every stage of the homebuying journey.

In today’s competitive market, mortgage brokers need every advantage they can get. Our free mortgage calculator is one of the most effective tools you can adopt right now. Try it and see how easy it is to guide your clients through their homebuying journey.

Whether you use our free mortgage calculator during consultations or link it on your website, it’s a simple way to make your job easier. Using this tool will add value to your service and keep your clients satisfied.

Have you tried our free mortgage calculator? Give it a shot and tell us how it helped you in the comments section below.