What is a commercial mortgage? What are its terms and who is eligible for it? Find out more in this article

You have been running a successful business for a couple years, but you need to either update your current commercial real estate property or buy a new one.

This is where a commercial mortgage comes in.

These types of mortgages are like traditional mortgages except you are securing land for commercial purposes rather than residential ones. Think offices, warehouses, apartment complexes or storefronts.

But what is the most common commercial mortgage? What are the typical loan terms? And who is eligible? Here are the answers to these commercial mortgage questions—and more.

To our audience of mortgage professionals, this article can serve as a valuable tool for any of your clients who are asking about commercial mortgages.

What is the most common commercial mortgage?

The most common commercial mortgage is the commercial real estate loan, which is often used to buy or refinance existing commercial properties. However, it is important to note that there are four main types of commercial real estate loans that businesses have open to them, which are as follows:

- Term loans

- Small business administration (SBA) loans

- Business line of a credit

- Bridge loans

These different types of loans are usually used when the money is needed more quickly or when there are bridge gaps in long-term financing. However, each of these commercial real estate loans differ in terms, funding time, and rates.

It is therefore critical to determine your business’s needs to decide which of these loans will work best for you. Here is a closer look at each:

1. Term loans

Term loans are the most popular form of commercial real estate loan and are what most people usually think of when they imagine a business loan. Term loans provide a lump sum of capital that you as the borrower will repay over regularly timed instalments.

These repayment periods are usually up to five years or more and feature an amortization period that can be longer than the loan term. Depending on the property you want to finance, your own financial criteria, and the amount of money you have to make a down payment, interest rates and funding amounts can vary.

Term loans are offered by commercial real estate lenders, online lenders, and traditional banks, with banks providing the most difficulty to qualify. When it comes to credit scores, business history, down payment amounts, etc., online lenders can provide more leniency.

2. Small business administration (SBA) loans

Small business administration loans, or SBA loans, are government-backed, meaning the government will pay for a portion of your outstanding balance if you default. This arrangement provides the lender with an added layer of security and means lower interest rates for you.

Since they feature longer terms and lower interest rates, SBA loans are great for refinancing real estate and cover pretty much every kind of business expense. However, real estate investors are ineligible for SBA loans.

To qualify for an SBA loan, your business must meet these criteria:

- Meet SBA size standards

- Be a for-profit business

- Operate within the U.S.

- Have a need for financing

- Have invested equity by business owners

- Have no outstanding debt to the government

- Not have any business owners on parole

3. Business line of credit

A business line of credit is another common type of commercial real estate loan and is often compared to credit cards. One of the main differences is that business lines of credit usually offer lower interest rates and more funding amounts.

As a commercial real estate loan, a business line of credit is quite flexible, allowing you, in certain instances, to reuse capital that you have already borrowed. You are given a set credit limit that you will be able to borrow from if you need it.

Additionally, there is less pressure to use the money immediately since you only have to pay interest on the funds you have borrowed. Those funds will become available to you to use again after you repay your balance.

One of the negatives about using a business line of credit is that you do not have a set repayment schedule and interest rates may be higher than more traditional loan terms. While these are certainly drawbacks, the flexibility can help make up for it. This type of loan is best if you do not know the precise cost of renovations or projects and can be put toward operating costs and other business expenses.

4. Bridge loans

A shorter-term financing solution, bridge loans provide an influx of funds until you, the borrower, secure a more stable form of financing. Bridge loans are typically used by homeowners and businesses that require money to buy a property but are also awaiting the sale of an additional property.

In other words, these types of loan will help cover any cashflow gaps you may be experiencing between when the money is needed and when it is available. As mentioned, they’re usually used by companies who need to repay one loan and have yet to receive a new permanent loan.

Bridge loans have shorter terms for repayment, usually one year or less. Additionally, you can use it to smooth over the refinancing process while you await money from your newer loan to deposit.

What is the purpose of a commercial mortgage?

The purpose of a commercial mortgage is to buy or refinance any property or land for business reasons. Just like more traditional residential mortgages, the funds are borrowed and secured against the property.

A commercial mortgage may also be used to expand an already existing business, for either commercial or residential property development. And if you want to finance any sort of business development plan, commercial mortgages tend to be the principal resource.

The commercial mortgage market is smaller than the residential mortgage market, although the overall value of the commercial mortgage market is disproportionately high. Commercial mortgages, different from residential mortgages, extend finance in these different ways:

- Developing owner-occupied businesses

- Adding to buy-to-let portfolios

- Buying premises for businesses

- Securing ventures for land development

A commercial mortgage is also structured for borrowers as well as lenders. Compared to renting, the borrower hopes to benefit through reduced repayments. The lender, on the other hand, wants to see security in their loan.

Commercial property mortgages are typically long-term loans, usually as high as 25 years, and provide the funds to buy a business premises. Mortgage lenders often lend as much as 70% of the value of the property, which leaves the business to pay regular mortgage payments and use working capital, if there is any, to fund its growth.

Since commercial mortgages usually only offer up to 70% of the property’s total value, lenders rely on businesses to come up with the remainder before the purchase is complete—and it is usually a significant amount of money.

Who is eligible for a commercial mortgage?

Since you will be using the property for business reasons and repaying the mortgage with business revenue, lenders will want to ensure you can make the loan repayments.

Like traditional loans, lenders will determine your pre-qualifying potential before you fill out the application form, which involves evaluating your financial information. While traditional lenders usually look at your financial statements such as income tax returns and banking statements to determine business stability, most will also want to see your business plan projecting earnings.

Here is a look at some of those financial requirements:

- Security

- Income

- Credit

Let’s take a closer look at each:

1. Security

Lenders want to know for certain that the loan is secured properly by the property you are borrowing against before they approve a loan. Generally, that means you will have to have roughly 30% equity in the property, which means, if you are buying, you will need a down payment of roughly 30% to qualify.

Additionally, lenders want to ensure that you have the right property insurance to protect against property damage. Lenders also run title work on the property and review the deed to ensure there are no outstanding liens or additional property claims.

2. Income

Lenders want to ensure that you have enough income compared to your expenses to make the loan repayments every month. One way to calculate this is your debt-service coverage ratio, or DSCR. While the minimum varies depending on the property you are borrowing against, most lenders want to see a 1.25 DSCR or higher.

You will have to provide two years of tax returns to establish your income with your lender, often business tax returns and personal tax returns. You will also have to provide the organization documents and operating agreement of your business, as well as personal documentation like a W-9 and a copy of your passport and birth certificate.

3. Credit

Lenders tend to check business credit scores for loans for business properties. In many cases, lenders will also require that you provide a personal guarantee, meaning they will want to check your personal credit as well. While minimum credit scores differ between lenders, most conventional loans will require credit scores between 660 and 680.

And to assess your credit risk, lenders will also want to know how long you have been in business. If you are trying to qualify for a commercial loan, you typically have to be in business for one to two years. It is the lender’s way to ensure the revenue of your business. This is important to lenders since your business’s revenue will be the main source of repayment on your loan.

What are typical terms for a commercial mortgage?

Typical terms for a commercial mortgage are up to 85% loan-to-value (LTV). Commercial mortgages are perfect for businesses that are established and have been in business for two years minimum, with excellent credit.

Typical loan terms for commercial mortgages are between seven and 30 years, with traditional banks offering fixed and variable rates at usually 5% and 7%. If you want to qualify for terms of five and 10 years, you must have a credit score of at least 660 and a down payment of no less than 20%.

Are commercial mortgages the same as residential?

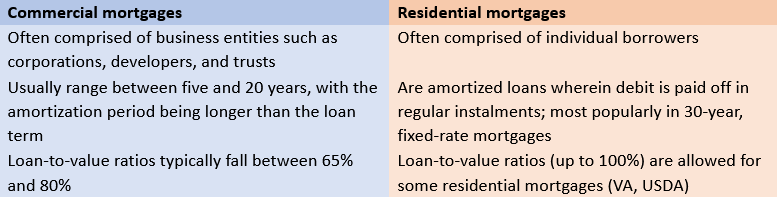

No. Commercial mortgages are not the same as residential mortgages. While there may be similarities, the differences are significant. For instance, residential mortgages are usually comprised of individual borrowers, while commercial mortgages are usually comprised of business entities such as developers, corporations, funds, trusts, and limited partnerships. Business entities are typically formed specifically to own commercial real estate.

Here is an example of the differences between a commercial mortgage and a residential mortgage:

If a business entity does not have a credit rating or a financial track record, the lender could ask the owners or the principals of the entity to guarantee the loan. This arrangement gives lenders an individual or group of individuals that have a credit history, meaning there will be someone they can recover the outstanding balance from in case of default.

Occasionally, lenders do not require this kind of guaranty and the property becomes a means of recovery in case of a loan default; the debit is termed a non-recourse loan, which means that the lender only has recourse with the property, not the business or the individual or group of individuals.

As we have seen, not only are commercial mortgages different from residential mortgages, but there are different options available to help you grow your business. It is important to know who is eligible for a commercial mortgage and the requirements when applying to these loans, as well as typical terms. Knowing the answers to these questions will provide you the tools to secure the best possible commercial mortgage for you and your business.

Have experience with a commercial mortgage? Let us know your challenges and successes in the comment section below.