J.D. Power finds improvement in customer satisfaction but warns of future issues

Mortgage servicers have managed to improve overall customer satisfaction despite economic challenges, but underlying issues could spell trouble, according to a new J.D. Power study.

While borrowers are generally happier with their mortgage servicers this year, their financial health is deteriorating, and rising escrow costs are adding to their burdens, the study found.

“On the surface, mortgage servicers’ efforts to elevate their digital tools and customer service are offsetting challenging market conditions,” said Bruce Gehrke, senior director of lending intelligence at J.D. Power. “But digging a little deeper, the data shows early signs of potentially serious challenges for servicers in the future. A proverbial ‘canary in the coal mine’ is the financial health of borrowers, which has materially declined in the past few years.”

The study showed just 41% of borrowers are financially healthy, down from 46% last year and 52% in 2022. Meanwhile, the number of borrowers struggling financially has climbed to 19%.

“At the same time, most borrowers are facing rising escrow costs that result in their total monthly mortgage payment increasing,” Gehrke said. “This means the industry has a growing number of at-risk customers facing higher costs, a group that tends to be a lot more expensive to service.”

“At the same time, most borrowers are facing rising escrow costs that result in their total monthly mortgage payment increasing,” Gehrke said. “This means the industry has a growing number of at-risk customers facing higher costs, a group that tends to be a lot more expensive to service.”

Read next: New home sales slip as buyers wait for lower rates

Escrow costs – money set aside for property taxes and homeowners’ insurance – are on the rise, with 56% of borrowers paying more this year, leading to higher total monthly mortgage payments. Satisfaction scores were 62 points lower among those who faced escrow cost increases compared to those who did not.

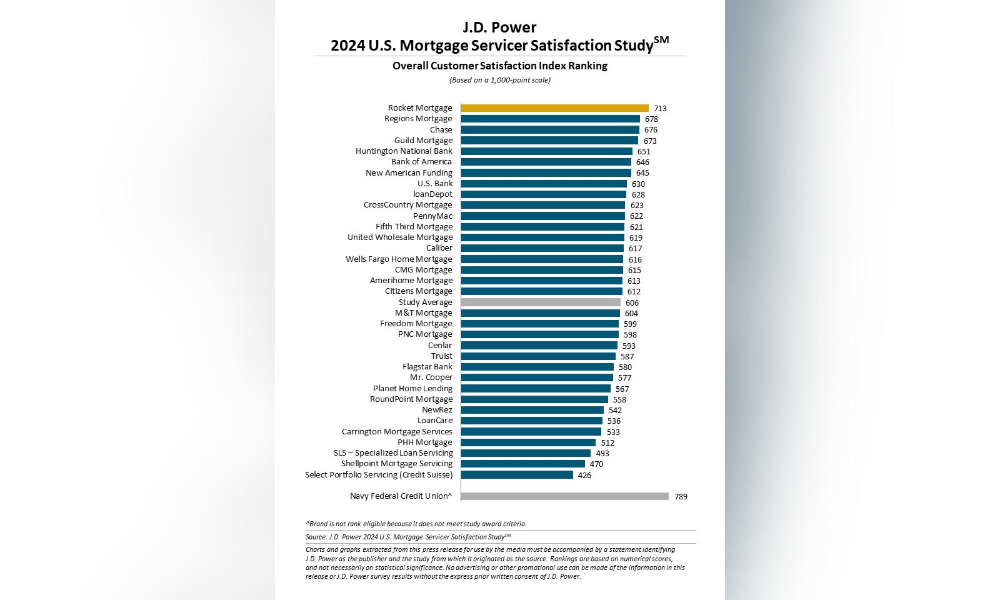

However, the overall customer satisfaction score for mortgage servicers did increase five points this year to 606, driven by improvements in problem resolution and digital channels.

The J.D. Power study is based on responses from 15,020 customers who have been with their current mortgage loan servicer for at least one year, and was conducted from May 2023 through May 2024. It measured satisfaction across six factors: level of trust, ease of doing business, information and education, people, problem resolution, and digital channels.

Rocket Mortgage topped the rankings for the 10th consecutive year with a score of 713, followed by Regions Mortgage (678) and Chase (676).

“At Rocket, we view mortgage servicing as an opportunity to forge lifelong relationships with our clients by delivering exceptional, hassle-free experiences,” said LaQuanda Sain, executive vice president of servicing at Rocket Mortgage.

The mortgage giant has expanded its use of artificial intelligence (AI) in the past year.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.