"It's a privilege to help people navigate this journey"

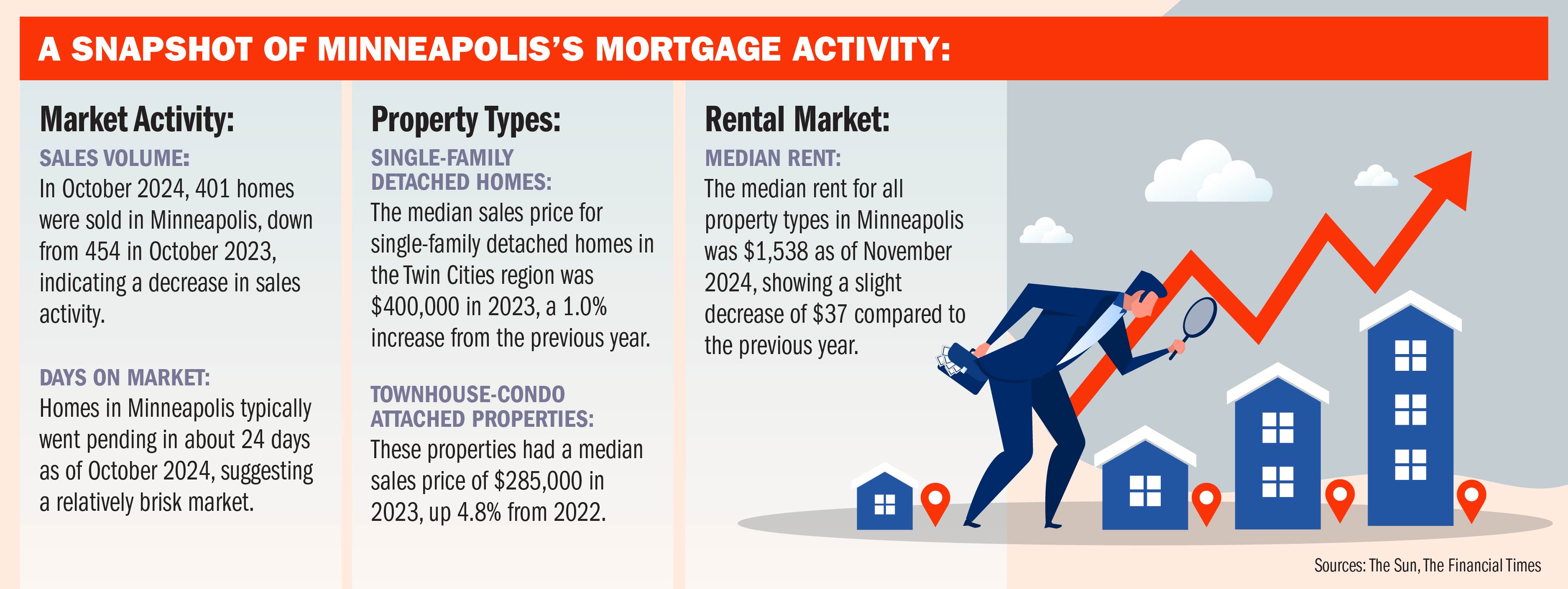

As of October 2024, the average price for homes in Minneapolis was $340,000 – showing a marked 3.8% increase compared to the same month in the previous year. However, just 401 homes were sold there – a decrease from 454 year on year.

Speaking to MPA, Andy Burton, of Waterstone Mortgage Corporation, said that the housing market in his location is brimming with changes and challenges.

“My area is the Eastern metropolitan area of the Twin Cities, and this is a booming new construction area,” he said. And yet, behind the boom lies a tale of disparity, particularly for first-time homebuyers. Burton doesn’t hesitate to call out the glaring gap in affordable housing there.

“Builders aren’t really building affordable housing right now,” he told MPA. This leaves many first-time buyers, who now average 38 years old, with limited options.

“They have to wait longer to save for a larger down payment, and they end up buying a more expensive home as their first home.”

This dynamic forces many buyers to look outside the most aggressively growing communities, venturing into surrounding areas like Saint Paul, Minneapolis, and their suburbs.

“The first-time homebuyer demand is there,” Burton added, “we’re just not necessarily seeing the inventory available for them to buy. We’re entering the winter with the same inventory as we had in the spring. This is the first one in probably five years that some of these first-time homebuyers have a chance to get into a home.”

When discussing market trends, Burton reveals a surprising nuance.

“Traditionally, higher-end homes would be closer to the city,” he said. “But in the Twin Cities, that’s not the case. The higher-priced homes are in the suburbs, or located on lakes, or acreage.”

The eastern suburbs near Saint Paul have seen an explosive transformation. “It was farm fields five years ago,” Burton said. “Now, there are quite literally thousands of homes. It’s pretty cool.”

Government-backed mortgage products are also seeing a revival. “During the COVID boom, buyers couldn’t win with government financing offers,” he said. “But now, with less competition, sellers are more willing to consider FHA, VA, and USDA loans.” For many, this shift is a long-awaited lifeline.

One strategy gaining traction is the temporary buy-down, which Burton describes as a practical solution in a high-interest-rate environment.

“A two-one buy-down lets the buyer have a 2% lower rate for the first year and 1% lower for the second,” he explained. Sellers often cover the cost, which can make a significant difference. “It’s saving buyers anywhere from $250 to $900 a month in the first year,” Burton said, emphasizing the impact.

Refinancing, once a booming sector, has slowed considerably. Burton recalls a brief resurgence when rates dipped last summer.

“We had a short period of time where people refinanced, but once rates climbed back up, the demand just wasn’t there,” he said. Instead, he sees more clients turning to home equity lines of credit. “People are looking at home equity lines instead of refinancing their entire mortgage at 7%.”

Burton also highlights the struggles of investors in today’s market.

“Investment properties just aren’t as attractive now,” he explained. With rates for investment properties often higher than market rates, and high home prices, many investors are pulling back. “The cash flow just doesn’t look good anymore.”

Throughout the conversation, Burton returns to the issue of education—or the lack of it—for first-time homebuyers.

“A lot of first-time buyers are held back simply because they don’t know what they don’t know,” he said. He sees misinformation as a common barrier, whether from outdated advice from parents or incomplete information online.

Burton recounts how many clients walk into pre-approval meetings expecting they’ll need far more savings than required.

“Once we look at their income, credit, and assets, many realize they can buy a home way sooner than they thought,” he shared. Some even abandon recently signed leases to jump at the chance. “It’s rewarding to help someone achieve that dream sooner than they ever imagined.”

This local market keeps evolving, and Burton remains both realistic and optimistic.

“It’s a shifting market,” he said, reflecting on how opportunities and challenges intersect. While gaps persist, he sees progress in areas where first-time buyers, often sidelined for years, are finally finding their way in.

Burton’s perspective is rooted in a deep understanding of his clients’ struggles and the broader forces shaping the Twin Cities housing market.

“It’s a privilege to help people navigate this journey,” he told MPA.