Weaker jobs report leads to rate decline

Mortgage rates fell this week after a five-week streak of increases, driven by a weaker-than-expected jobs report that eased inflation concerns, according to Freddie Mac’s latest Primary Mortgage Market Survey.

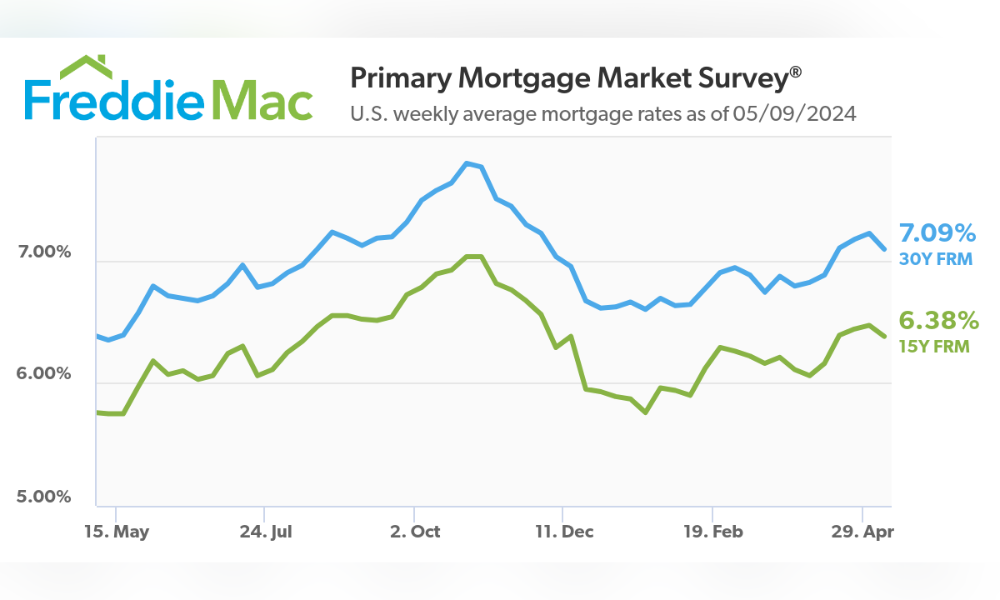

The 30-year fixed-rate mortgage averaged 7.09% for the week ending May 9, down from 7.22% the previous week. A year ago, the 30-year rate averaged 6.35%.

“Mortgage rates have fallen for the first time since March because of the news that job growth slowed in April,” said Holden Lewis, home and mortgage expert at NerdWallet. “When the economy creates fewer jobs, the inflation rate is likely to fall. Mortgage rates fell in anticipation that we will see progress on inflation in coming months.”

Elevated mortgage rates are dissuading many potential home sellers from listing properties and parting with lower rates obtained years ago, according to Freddie Mac chief economist Sam Khater.

Read next: Encouraging American homebuyers to ‘go local’

“An environment where rates continue to hover above 7% impacts both sellers and buyers. Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated,” Khater said in the PMMS report. “These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.”

The 15-year fixed-rate mortgage also decreased to 6.38% from 6.47% the prior week. A year ago, the 15-year rate was 5.75%.

In response to lower rates, mortgage applications rebounded for the week ending May 3, the Mortgage Bankers Association reported.

“Treasury rates and mortgage rates fell last week on the news of a slowing job market, with wage growth at the slowest pace since 2021, and the Federal Reserve’s announced plans to ease quantitative tightening in June and to maintain its view that another rate hike is unlikely,” said MBA chief economist Mike Fratantoni. “The conventional 30-year rate dropped 11 basis points, and the FHA rate fell 17 basis points to 6.92%, back below 7% for the first time in three weeks.

“Mortgage applications increased for the first time in three weeks, with refinances up 5%.”

However, Fratantoni noted that refinance volume remains about 6% below last year’s already depressed levels despite the increase.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.