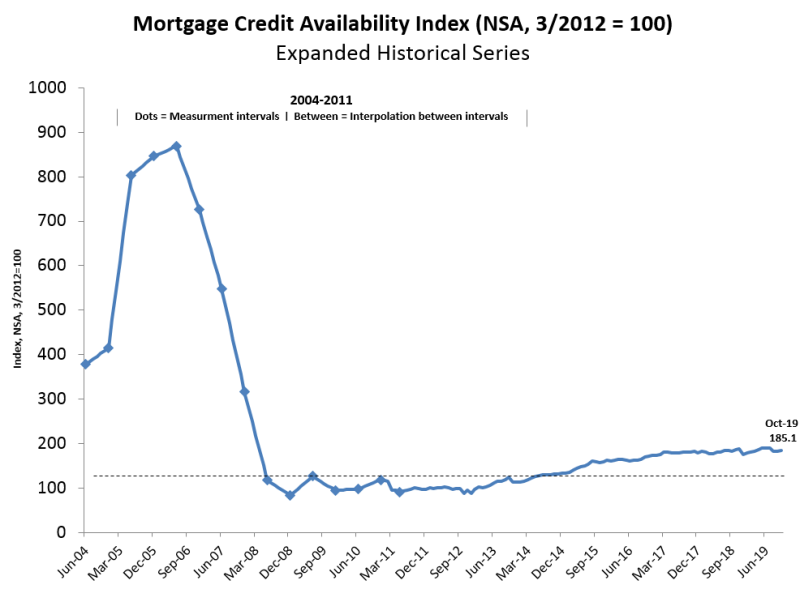

Programs for low-scorers and investors were among the factors boosting mortgage credit availability

Obtaining a mortgage should have been easier last month overall as lending standards eased and new programs enabled certain borrowers to secure loans.

The Mortgage Bankers Association’s Mortgage Credit Availability Index (MCAI) gained 0.9% to 185.1 in October driven by a 2.4% increase in the Conventional MCAI while the Government MCAI decreased 0.9%.

Of the Conventional MCAI’s components, the Jumbo index was up 3.1% while the Conforming index was up 1.3%.

"Mortgage credit availability expanded in October, driven mainly by an increase in conventional loan programs, including more for borrowers with lower credit scores, as well as for investors and second home loans," said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. "Credit supply for government mortgages continued to lag, declining for the sixth straight month. Meanwhile, the jumbo credit index increased 3% to another survey-high, as that segment of the market stays resilient despite signs of a slowing economy."

Source: Mortgage Bankers Association; Powered by Ellie Mae's AllRegs® Market Clarity®