But pricing is flatlining quarterly report reveals

There was a slowdown in US commercial real estate sales in the first quarter of 2019, but things picked up in the second quarter.

Data from CRE platform Ten-X Commercial shows that deals in the second half of 2018 totaled $30 billion, but as industry M&A declined in the first half of 2019, CRE deals slumped to just $2.2 billion; slower in Q1 and slightly better in Q2.

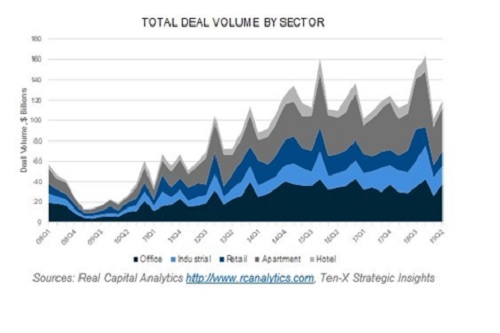

According to RCA, total second quarter deal volume rose 10% year-over-year and saw an increase of 24% from Q1, bringing Q2 CRE deal volume to $136.8 billion.

Of the five main CRE sectors, only apartments (up 19% year-over-year) and offices (29%) saw a gain in deal volume and together made up more than 15% of the overall $80.7 billion in CRE deals.

The industrial and retail sectors each saw a decline in deal volume, but the hotel sector hit a 6-year low after decreasing 38.5% from last year.

"A slowdown in the previously thriving M&A market prompted cooling in total Q1 2019 CRE transaction volume," said Ten-X Chief Economist Peter Muoio. "However, there was a resurgence in the second quarter of the year with the apartment sector leading the way in overall deal volume, totaling more than $43 billion in the second quarter."

Pricing has plateaued

Although pricing for all five CRE sectors remains at its highest levels since 2017, the report says that growth has plateaued.

Overall CRE pricing in August saw its first decline since mid-2018 with a 0.1% decline year-over-year according to the Ten-X Commercial Nowcast which uses several factors to determine values.

Hotel pricing increased just 0.2% from July, its weakest long-term trajectory and a 1.8% year-over-year decline. Retail property pricing also declined 0.3% year-over-year amid a 0.5% increase from the month prior.

There were some gains for offices, but the report says the sector will struggle from the growth of remote working and other work trends. Industrial property pricing has seen some improvements as the sector showed a 0.6% year-over-year increase. Though this is the strongest annual gain since 2017, pricing did fall 0.3% from the month prior.

There was a 0.3% decline from July to August for the apartment sector, but pricing has increased 0.9% year-over-year.

"Property pricing among all CRE segments is at a virtual standstill," Muoio continued. "This is for a variety of reasons, with the trade war with China and escalating tariffs that affect the industrial sector and the recent yield curve inversion sparking fears of a recession and spooking investor sentiment across all CRE segments, key factors."