But there were some spikes due to natural disasters

The overall US mortgage delinquency and foreclosure rates were the lowest in almost 20 years in November.

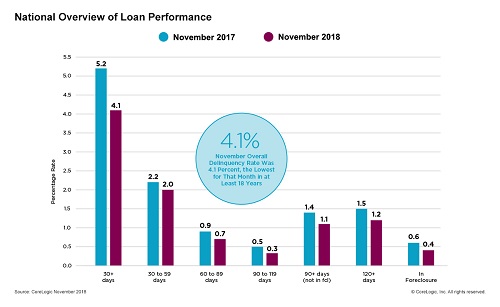

CoreLogic Data Solutions says that 4.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in November 2018, down 1.1 percentage points year-over-year.

The foreclosure inventory rate was 0.4%, down 0.2 percentage points year-over-year to its lowest for any month since at least January 2000.

“Solid income growth, a record amount of home equity and an absence of high-risk loan products put the US homeowner on solid ground,” said Dr. Frank Nothaft, chief economist for CoreLogic. “All of this has helped push delinquency and foreclosure rates to the lowest levels in almost two decades and will provide a cushion if the housing market should turn down.”

Hurricane Florence impact remains

While the national delinquency rate was lower, in North Carolina there are still some metros where loan vulnerability continues following the impact of Hurricane Florence.

“On a national basis, we continue to see strong loan performance,” said Frank Martell, president and CEO of CoreLogic. “Areas that were impacted by hurricanes or wildfires in 2018 are now seeing relatively large annual gains in the share of mortgages moving into 30-day delinquency. As with previous disasters, this is to be expected and we will see the impacts dissipate over time.”

The share of mortgages nationwide that transitioned from current to 30 days past due was 0.9% in November, down from 1% in November 2017.