CoreLogic report shows no state posted increases in foreclosure, overall or serious delinquency rate

The quality of US home loans remained strong in May according to the latest data from CoreLogic.

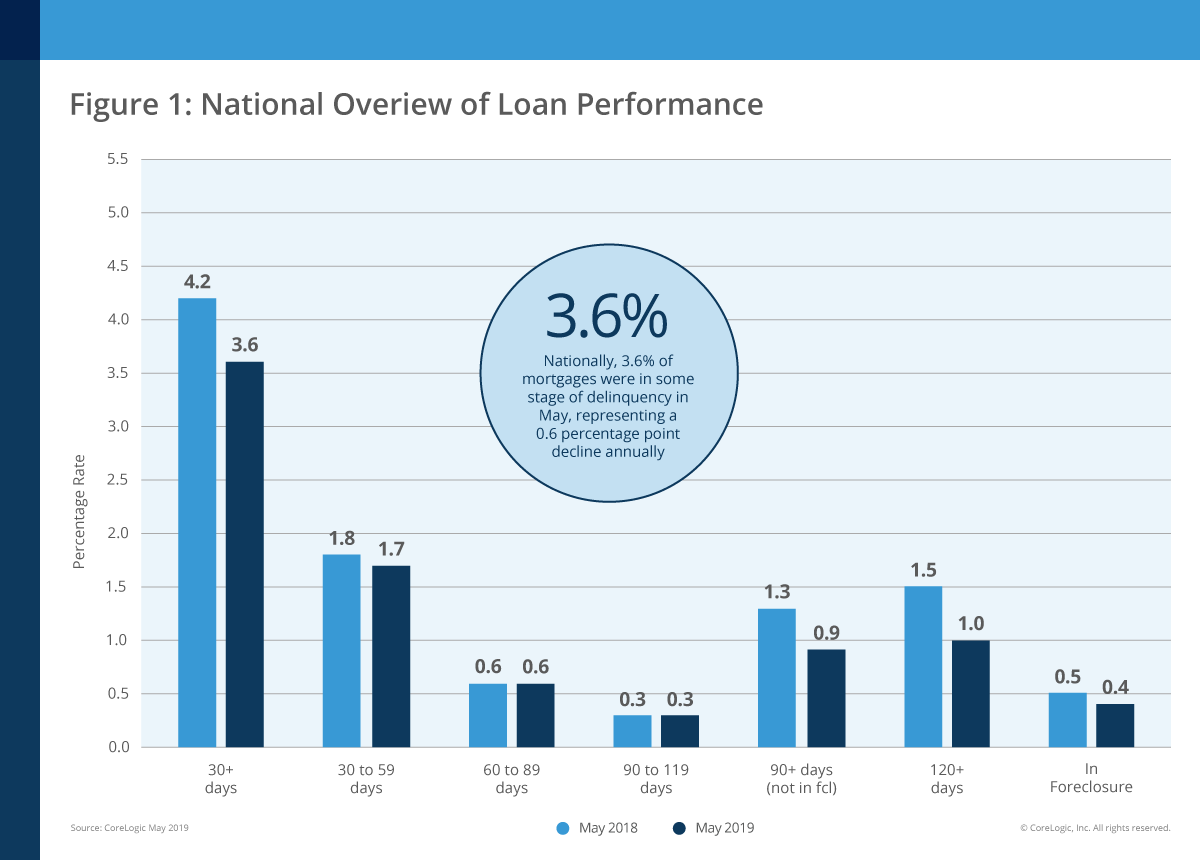

Its Loan Performance Insights Report reveals a 0.6 percentage point year-over-year decline nationally in mortgages that were in some stage of delinquency (30 days or more past due, including those in foreclosure) in May 2019.

The 3.6% rate marks the second consecutive month that the rate has been at its lowest point in more than 20 years.

There was also a decline in the foreclosure rate (of 0.1 percentage points year-over-year) to 0.4%. That means that, along with the previous 6 months, May had the lowest foreclosure rate of any month since at least January 1999.

“Growth in family income and home prices continues to support low delinquency rates,” said Dr. Frank Nothaft, chief economist at CoreLogic. “Communities that experienced a rise in delinquencies are generally those that also suffered from natural disasters. Last year’s hurricanes and wildfires, and this spring’s severe flooding from heavy rainstorms and snowmelt have pushed delinquency rates higher in these impacted communities.”

Some metros posted increases

The share of mortgages that transitioned from current to 30 days past due was 0.8% in May 2019, unchanged from May 2018.

While no states posted increases in overall or serious delinquencies, or foreclosures, there were at least small increases in overall delinquency in 20 of the country’s metropolitan areas.

“While the rest of the country experienced record-low mortgage delinquency rates again in May, the Midwest and parts of the Southeast are still experiencing higher rates as they recover from extreme weather,” said Frank Martell, president and CEO of CoreLogic. “Areas in Kentucky and Ohio, which were hit particularly hard this spring with historic flooding, experienced some of the largest annual gains in the country.”