But there is some good news on serious delinquencies

Two key factors conspired to push overall mortgage delinquencies higher last month.

With typical seasonal increases and the month ending on a Sunday, it was perhaps inevitable that the delinquency rate would spike.

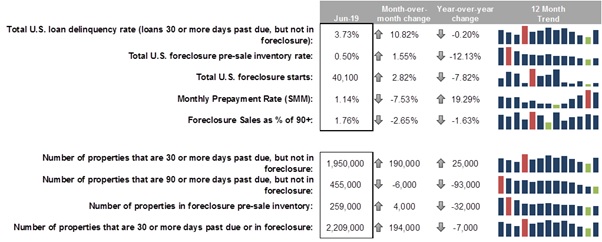

And a first look at mortgage data from Black Knight reveals a 10.82% increase in overall delinquencies to 3.73% (0.20% below June 2018). That meant a 190,000 more mortgages that were 30+ days past due but not in active foreclosure, bringing the total to 1,950,000 loans.

However, serious delinquencies (90+ days past due but not in active foreclosure) fell to their lowest level in 12 years; 455,000, down 6,000 month-over-month and 93,000 below June 2018.

The number of homes with mortgages that were in the foreclosure pre-sale inventory was up 4,000 to 259,000.

Prepayment takes a pause

There was a surprising pause in rising levels of prepayments following 5 monthly increases. Despite the downward trend for mortgage rates prepayment activity fell 7.5%, although is up almost 20% from a year earlier.

Mississippi, Louisiana, and Alabama led the states with the highest non-current percentages while Colorado, Oregon, and Washington were the states with the lowest non-current percentages.

Image credit: Black Knight, Inc.