Experts weigh in on the impact of rising rates and prices

Pending home sales fell sharply in April, according to new data from the National Association of Realtors (NAR). Industry experts cited the impact of elevated mortgage rates and eroding affordability on homebuyer sentiment.

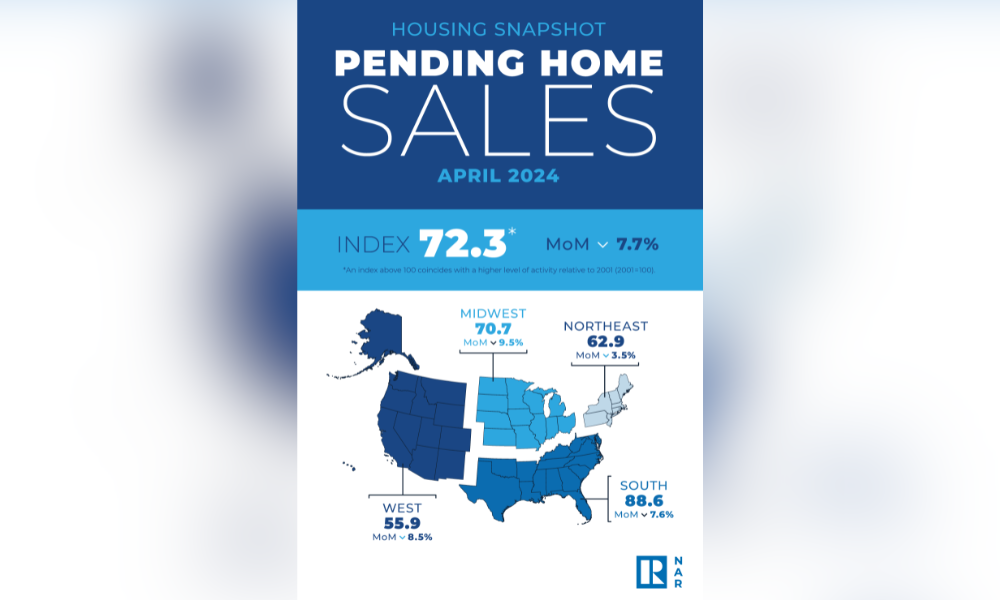

NAR’s Pending Home Sales Index (a forward-looking indicator of home sales based on contract signings) declined 7.7% from March to 72.3 in April. Compared to a year ago, pending transactions were down 7.4%.

“April saw pending home sales drop 7.4% year over year, and 7.7% month over month,” said Kate Wood, home and mortgage expert at NerdWallet. “That bit of improvement we saw in March did not prove to be a turning point. With mortgage interest rates remaining relatively high, the traditional spring homebuying season may be a bit of a nonstarter this year.”

“April saw pending home sales drop 7.4% year over year, and 7.7% month over month,” said Kate Wood, home and mortgage expert at NerdWallet. “That bit of improvement we saw in March did not prove to be a turning point. With mortgage interest rates remaining relatively high, the traditional spring homebuying season may be a bit of a nonstarter this year.”

NAR chief economist Lawrence Yun blamed escalating mortgage rates for dampening home purchases despite more available inventory.

CoreLogic’s chief economist Selma Hepp highlighted a shift in homebuyer sentiment from a year ago when demand was strong.

“This time last year, potential homebuyers had the mentality to get into home buying despite high rates and a lack of homes for sale,” Hepp said. “With little expectation of interest rates going down in the near term, the mindset today is to wait and see.”

She added that rising insurance costs and climate impacts are further weighing on affordability and souring sentiment.

Regional breakdowns showed the Northeast (-3.5%), Midwest (-9.5%), South (-7.6%), and West (-8.5%) all experienced year-over-year declines in their respective pending sales indexes.

Yun expects the pace of home price gains to moderate with increased supply.

“Home prices are hitting record highs, but the pace of gains should decelerate with more supply,” he said. “However, the prospect of measurable home price declines appears minimal. The few markets experiencing price declines will be viewed as second-chance opportunities for buyers to enter the market if those regions continue to add jobs.”

Read next: Have homebuyer affordability conditions improved?

First American’s Odeta Kushi agreed the price outlook hinges on supply and demand dynamics.

“The decision to buy a home comes down to a payment-to-paycheck calculation, which is influenced by income, mortgage rates, and house prices,” Kushi said. “While house prices continue to reach new heights, more supply amid a pullback in demand means the pace of price appreciation has decelerated, and will likely continue to do so if this supply-demand dynamic persists.

“Household income remains strong as the labor market continues to demonstrate resiliency, yet mortgage rates remain elevated in the Fed’s ‘higher-for-longer’ interest rate environment.”

She added that a potential Fed rate cut could boost affordability and “bring buyers off the sidelines” by lowering mortgage rates, provided incomes remain strong.

Stay updated with the freshest mortgage news. Get exclusive interviews, breaking news, and industry events in your inbox, and always be the first to know by subscribing to our FREE daily newsletter.